BEIJING (dpa-AFX) - iQIYI, Inc. (IQ), a Chinese entertainment company Monday announced that it has closed its $350 million offering of 4.625% convertible senior notes due 2030. The $350 million Notes bear 4.625% annual interest, payable quarterly starting June 15, 2025, and mature on March 15, 2030, unless repurchased, redeemed, or converted earlier. Net proceeds of approximately $344.8 million will be used for debt repayment and general corporate purposes.

The Notes rank junior to secured debt and cannot be converted until 40 days after issuance. Conversion is conditional until September 15, 2029, after which holders can convert anytime until maturity. Upon conversion, holders receive cash, ADSs, or both. The initial conversion rate is 64,819 ADSs per $200,000 principal, with a conversion price of $3.0855 per ADS-27.5% above the February 19 closing price. Holders can request repurchase at full principal plus interest on March 15, 2028, or during certain fundamental changes.

The Notes are offered offshore under Regulation S of the U.S. Securities Act and are not registered under U.S. or other securities laws. They cannot be sold or transferred without an exemption from registration. No public offering is being made in the U.S.

Following the Notes' pricing, iQIYI privately negotiated agreements to repurchase approximately $300 million of its existing convertible senior notes in cash.

The Repurchase Transactions and related market activities may influence the trading prices of iQIYI's ADSs, Notes, and existing debt securities. Holders of the Existing Notes using a convertible arbitrage strategy might hedge their exposure by buying ADSs or adjusting derivative positions, potentially affecting market prices. Similarly, investors in the new Notes may hedge by short-selling ADSs or taking short derivative positions, which could impact trading dynamics. The overall effect on market prices remains uncertain.

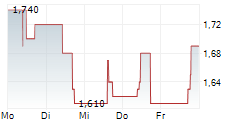

IQ is currently trading at $2.085 or 7.54% lower at the the Nasdaq Global Select Market.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News