/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR DISSEMINATION IN THE UNITED STATES./

TSX and OTC: MPVD

TORONTO and NEW YORK, Feb. 25, 2025 /PRNewswire/ -- Mountain Province Diamonds Inc. ("Mountain Province" or the "Company") (TSX: MPVD) and (OTC: MPVD) today announces that it entered into (i) a payment and security agreement (the "Payment Agreement") with De Beers Canada Inc. ("De Beers") and 2435386 Ontario Inc. (the "JV Company"), an indirect wholly-owned subsidiary of the Company, to recalibrate the obligations of De Beers and the Company for the decommissioning costs of the GK Mine (as defined below) and the grant of additional security to De Beers for the Company's obligations thereunder (the "Decommissioning Recalibration"); and (ii) a bridge credit facility agreement (the "Term Loan Agreement") with Dunebridge Worldwide Ltd. ("Dunebridge") as administrative agent, security trustee and lender, and the guarantors named therein, for a term loan of up to USD$40 million term loan (the "Term Loan").

The GK Mine is located in the Northwest Territories of Canada and is operated as a joint venture between the Company and De Beers. The Company, through JV Company, holds a 49% interest in the GK Mine. De Beers holds the remaining 51% interest and is the operator of the GK Mine.

The Payment Agreement and new Term Loan Agreement are part of a series of transactions (the "Refinancing Transactions") consisting of (i) the Decommissioning Recalibration; (ii) the Term Loan; and (iii) an amended and restated indenture to be entered into among the Company, the guarantors named therein and Computershare Trust Company N.A. (the "Note Trustee"), as trustee and collateral agent, in respect of the Company's 9.00% senior secured notes due December 15, 2025 (the "Second Lien Notes"), of which USD$177 million aggregate principal amount is outstanding (the "Amended and Restated Indenture"), extending the maturity of the Second Lien Notes to December 15, 2027 and amending certain terms of the Second Lien Notes, including an option to pay scheduled coupon payments on the Second Lien Notes in June and December of 2025 in kind at the PIK Interest Rate (as defined below) (the "Note Amendments").

The Company expects 2025 to be a particularly challenging year for the production and sale of rough diamonds from the Gahcho Kué diamond mine (the "GK Mine"). The Refinancing Transactions are designed to support the Company in meeting those challenges until mid Q2 2025, during which period the operating costs of the GK Mine are typically higher in the first half of the year due to the costs associated with the winter road. To manage its working capital requirements and cash flow fluctuations for the balance of 2025, the Company is seeking, and the definitive documentation for the Refinancing Transactions contemplates, a revolving capital facility of up to CAD$33 million. The Company has had preliminary discussions with a potential lender that it intends to pursue upon completion of the Refinancing Transactions.

As discussed in detail below, the completion of the Refinancing Transactions is subject to receipt of Noteholder Consent (as defined below) and regulatory approvals, including certain approvals and exemptions from the Toronto Stock Exchange ("TSX") under the TSX Company Manual. Each of the Decommissioning Recalibration, Note Amendments and Term Loan are cross conditional. The Refinancing Transactions are expected to close as soon as practicable upon satisfaction of all such conditions precedent.

Mark Wall, the Company's President and Chief Executive Officer, commented:

"The Refinancing Transactions conclude months of negotiations with De Beers and the Company's creditors. The primary objectives of these transactions are to address the reclamation liabilities owed to De Beers, find a solution to the 2025 near to medium term cash flow deficit, extend the term of the Second Lien Notes (that were due to expire at the end of this year), and most importantly, protect shareholder value. The Payment Agreement with De Beers addresses the parties' respective obligations under the existing joint venture agreement to fund the joint venture's obligations to decommission the GK Mine at the end of its life cycle. The injection of capital from the proceeds of the Term Loan combined with the reduction in the Company's debt service obligations in 2025 as a result of the proposed amendments to the Second Lien Notes is expected to allow the Company to continue to meet its immediate and near-term obligations under the joint venture agreement. While a complete financing solution for 2025 is expected to require additional working capital of approximately C$33 million, the Refinancing Transactions will stabilize matters in the near term while the Company's operating costs are especially high. As the Company has indicated in its interim and annual financial statements and other public disclosure, the Company is in serious financial difficulty and without the Refinancing Transactions and additional working capital facility, its ability to continue as a going concern is in doubt."

"With regard to shareholder value, there is limited potential shareholder dilution from the additional warrants and despite the financial situation of the Company, the coupon and true up payments on the Second Lien Notes remain unchanged, with only a modest increase on the deferred interest amount, should the company elect to defer the coupon payments on the Second Lien Notes in 2025."

"We are grateful to our major stakeholder partners, Mr. Dermot Desmond in particular, the independent holders of the Second Lien Notes and De Beers, who have worked collaboratively and tirelessly with the Company on this key aspect of a part of the Company's 2025 financing plan."

Background to the Refinancing Transactions

The Company's current financial difficulties are a function of a number of factors, including a continuation of pressures negatively affecting the price of rough diamonds since 2022 as detailed in the Company's annual information form for the financial year ended December 31, 2023 and the Company's most recent annual and interim financial statements and related management discussion and analysis. These market conditions have been compounded by a delay in accessing the NEX orebody at the GK Mine, access to which would have resulted in an offsetting increase in production. As previously reported, access to the higher grade NEX orebody during 2025 has been delayed to the third quarter of 2025 due to geotechnical and operational constraints.

In addition, market conditions and production levels at the GK Mine caused management to reduce the proposed number of sales cycles from the typical nine cycles to seven cycles in 2025, and most significantly delaying the February 2025 sales cycle to March 2025 in order to optimize sales prices. Owing to the delay in the February sales cycle and a smaller than usual return from the January sales cycle, the Company did not have sufficient cash on hand to satisfy the immediate cash calls in February 2025 by De Beers, as operator of the GK Mine, under the joint venture agreement and is currently in arrears of such obligations.

The parties to the Refinancing Transactions worked through a complex and prolonged negotiation process where they executed a non-binding letter of intent on December 30, 2024. Since then, the parties have been diligently negotiating the terms of the definitive documentation.

In the immediate term, the Company requires access to the Term Loan to satisfy the February 2025 cash calls and further expected cash calls under the joint venture agreement. Due to the closely held nature of the Company's voting shares and related party aspects of the Refinancing Transactions, discussed below, the Company is unable to obtain a written consent of disinterested shareholders to the Refinancing Transactions and is unable to convene a meeting of shareholders in the time available to approve the Refinancing Transactions.

The Payment Agreement

Pursuant to the Payment Agreement, De Beers, the Company and the JV Company agreed to a schedule for payment of the estimated decommissioning costs to the decommissioning fund established under the existing joint venture agreement, which schedule will supersede previous schedules determined by the joint venture management committee (the "Remaining Reclamation Payments"). The Payment Agreement confirms the Remaining Reclamation Payments owing by each of the JV Company and De Beers as at December 31, 2023 as a gross C$60 million and C$63 million, respectively (excluding accrued interest on contributions). The first payment to the decommissioning fund, being approximately one third of the Remaining Reclamation Payments, is due on or prior to June 30, 2026 and then half of the balance estimated as owing at December 31, 2026, payable on or prior to June 30, 2027 and the balance of what is estimated as owing at December 31, 2027, on or prior to June 30, 2028.

As security for the Company's obligation to make the Remaining Reclamation Payments, the Company has agreed to grant De Beers additional security over its assets in priority to the Company's other secured creditors, being the holders of the Second Lien Notes (the "Noteholders") and Dunebridge, in connection with both the Company's existing junior secured credit facility with Dunebridge (the "Dunebridge JCF") and the Term Loan. Such grant of security is subject to settlement of an intercreditor agreement among the Company's creditors.

Concurrently, De Beers, the Company and the JV Company have agreed to amend and restate the existing joint venture agreement in order to make consequential changes arising from the terms of the Payment Agreement and to provide for an in-kind election (the "In-Kind Election") in favour of De Beers upon (a) a failure by the Company to pay a cash call when due or (b) upon a breach of the Payment Agreement resulting in an acceleration and non-payment of the Remaining Reclamation Payments. Pursuant to the In-Kind Election, De Beers is entitled to the proceeds from the sale of the JV Company's share of diamonds until the amount in default (including interest) is fully paid (with the costs of such sale being for the account of the JV Company). Any balance remaining after payment of the amounts owing to De Beers is payable to the JV Company.

The Term Loan

The Company, as borrower, the guarantors named therein and Dunebridge as administrative agent, security trustee and lender entered into the Term Loan Agreement for up to USD$40 million, USD$30 million of which will be readily available to the Company and the remaining USD$10 million of which will only be available to the Company at the discretion of Dunebridge, and upon terms and conditions to be agreed to.

The Term Loan has a one-year term and carries a rate of interest of 10.50% per annum, capitalized and compounded quarterly on the principal amount and payable on maturity, to be increased to 12.5%, if not repaid on maturity of the Term Loan. The Term Loan includes a facility fee of US$1 million (the "Facility Fee") which is to be paid in cash, on maturity of the Term Loan. The Facility Fee is subject to the same terms and rates of interest as the principal amount of the Term Loan.

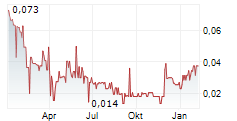

In connection with the Term Loan, Dunebridge will be issued 10 million common share purchase warrants with an exercise price of CAD$0.20 per share and an expiry date of December 15, 2029 (the "New Warrants"). The listing of the 10 million common shares of Mountain Province (the "Common Shares") underlying the New Warrants on the TSX is subject to the conditional approval of the TSX. The exercise price for the New Warrants represents a 208% premium to the 5 day volume weighted average price ("VWAP") of the Common Shares on the TSX prior to this news release.

The Noteholder Consent and Note Amendments

The Second Lien Notes were issued pursuant to, and are governed by, the indenture dated December 14, 2022 among the Company, the guarantors named therein and the Note Trustee (the "Existing Indenture"). The Refinancing Transactions, including the grant of a first ranking security interest to De Beers in respect of the Company's obligations to make the Remaining Reclamation Payments under the Payment Agreement, require the approval of the holders of 90% aggregate principal amount of the Second Lien Notes, to be provided in accordance with the terms of the Existing Indenture (the "Noteholder Consent").

Provided the Noteholder Consent is obtained, the Company and the Note Trustee will enter into the Amended and Restated Indenture pursuant to which the terms of the Second Lien Notes will be amended to, among other things, permit the first ranking security interest of De Beers and to extend the maturity date from December 15, 2025 to December 15, 2027. Further, Mountain Province, shall at its election, have the option of making the June 15, 2025 and December 15, 2025 coupon payments in cash at the existing interest rate of 9% plus a true up to 12% (the "Base Interest Rate"), or to make such payments in kind, at an interest rate not to exceed 13.50% per annum in aggregate, , on the principal amount outstanding (the "PIK Interest Rate"). The PIK Interest Rate option will only be available in respect of coupon payments to be made in 2025.

In addition, the Amended and Restated Indenture will amend certain covenants and events of default and impose new covenants and events of default, including: amending the debt incurrence, restricted payment, asset sale and affiliate transaction covenants; increasing the default interest penalty and change of control premium, adding new reporting obligations and adding a new cross-default for failure to make the Remaining Reclamation Payments when due.

In consideration for the amendments to the terms of the Second Lien Notes, the Noteholders will receive a USD$2 million fee to be distributed pro rata among them (the "Noteholder Fee").

The amendments to the Second Lien Notes were principally negotiated with Noteholders that are at arm's length to the Company.

The Company intends to seek Noteholder Consent by solicitation process upon settlement of the terms of the Amended and Restated Indenture and an amended and restated intercreditor agreement among De Beers, the Note Trustee, Dunebridge, the Company and the guarantors named therein, reflecting the terms of the Refinancing Transactions.

Amendments to the Existing Warrants

As set forth above, the Refinancing Transactions require the consent of the Company's junior lender, Dunebridge, as administrative agent, security trustee and lender under the Dunebridge JCF. As consideration for this consent, the Company has agreed that upon and subject to closing of the Refinancing Transactions, the 41 million share purchase warrants (the "Existing Warrants"), which we were initially granted to Dunebridge in connection with the Dunebridge JCF, will be amended to reduce the exercise price on the Existing Warrants to C$0.20 per share (from USD$0.60 per share) and to extend the expiry date of such warrants to December 15, 2029 (from December 15, 2027) (the "Warrant Repricing and Extension"). The amended exercise price for the Existing Warrants represents a 208% premium to the 5 day VWAP of the Common Shares on the TSX prior to this news release.

Insider Involvement in the Refinancing Transactions

As of the date hereof, Vertigol Unlimited Company ("Vertigol"), of which Mr. Dermot Desmond is ultimate beneficial owner, holds 75,446,071 Common Shares, or approximately 35.5% of the Company's issued and outstanding Common Shares. Mr. Dermot Desmond's ultimate beneficial ownership of Vertigol makes him a control person of the Company. Mr. Desmond is also the ultimate beneficial owner of Dunebridge and also of Noteholders holding USD$118 million of the aggregate principal amount of the Second Lien Notes outstanding (or 66% of the aggregate principal amount of Second Lien Notes outstanding).

The Refinancing Transactions, however, will not materially affect control of Mountain Province. If the New Warrants and the Existing Warrants are exercised in full, Mr. Desmond would become the ultimate beneficial owner of 126,446,071 Common Shares, representing approximately 48% of the issued and outstanding Common Shares. The increase in shareholdings resulting from the exercise of the Existing Warrants and the New Warrants would not provide Mr. Desmond with the ability to influence the outcome of a vote of security holders or to block a significant transaction involving the Company beyond that which he already has given his current and already significant equity position in Mountain Province.

Value of the Consideration to Insiders

Dunebridge and those Noteholders of which Mr. Desmond is the ultimate beneficial owner are related parties of Mountain Province, on the basis that they are all affiliates of Vertigol, each such entity being controlled by Mr. Desmond. (collectively, the "Related Parties").

The aggregate value of the consideration to be received by the Related Parties is equal to 229.14% of Mountain's Province's market capitalization as of February 21, 2025. Such a percentage reflects the aggregate value of the cash consideration to be received by the Related Parties in connection with the Refinancing Transactions as a percentage of its market capitalization as of February 21, 2025, plus the percentage share dilution which would result from the exercise of the New Warrants and the Existing Warrants. The aggregate cash consideration to the Related Parties of C$30,472,111 includes: (a) interest on the Term Loan, calculated in accordance with the Term Loan and assuming the Term Loan is paid out at the end of its one year term; (b) the Facility Fee; (c) the difference between the Base Interest Rate and the PIK Interest Rate on the Second Lien Notes (such being the additional benefit to the Noteholders in the event Mountain Province defers the June 2025 coupon payment and the December 2025 coupon payments on the Second Lien Notes); (d) the Noteholder Fee; and (e) the additional interest payable on the Second Lien Notes during the term extension from December 15, 2025 to December 15, 2027. In all cases, amounts denominated in United States dollars were converted to Canadian dollars using the Bank of Canada exchange rate of 1.4207 as published on February 21, 2025.

Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions - Exemption for Financial Difficulty

The amendments to the terms of the Second Lien Notes, the Warrant Repricing and Extension, the Term Loan and the issue of the New Warrants constitute "related party transactions" within the meaning of Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101").

A special committee of independent directors of Mountain Province (the "Special Committee"), after determining that the Company is in serious financial difficulty and after giving due consideration to the best interests of the Company, current industry and market conditions and the impact of entering into the Refinancing Transactions on shareholders and the Company's other stakeholders, unanimously concluded that the Refinancing Transactions are in the best interests of the Company, are designed to improve the financial position of the Company and that the terms of the Refinancing Transactions are reasonable in the circumstances and unanimously recommended the Refinancing Transactions to the board of directors of the Company (the "Board").

The Board received the recommendations and findings of the Special Committee and unanimously approved the Refinancing Transactions. Two members of the Board, Mr. Jonathan Comerford and Mr. Brett Desmond, having declared conflicts of interest, abstained from voting on the Refinancing Transactions.

The Company is relying on the exemption from the formal valuation and minority shareholder approval requirements applicable to a related party transaction provided under section 5.5(g) and 5.7(1)(e) of MI 61-101 on the grounds that the Company is in serious financial difficulty, that the Refinancing Transactions are designed to improve the financial position of the Company and that the Board, acting in good faith, and all of the Company's independent directors, acting in good faith determined that, the terms of the Refinancing Transactions are reasonable given the difficulties that the Company is facing.

TSX Financial Hardship Exemption

Because the aggregate value of the consideration to be received by the Related Entities will exceed 10% of the market capitalization of Mountain Province, disinterested security holder approval is required pursuant to section 604(a)(ii) of the TSX Company Manual. Similarly, the Warrant Repricing and Extension also requires disinterested security holder approval under section 608(a)(i) of the TSX Company Manual as the Existing Warrants are held by an affiliate of Mr. Dermot Desmond, an insider.

The Company has applied for an exemption (the "604(e) Exemption") pursuant to section 604(e) of the TSX Company Manual from such disinterested security holder requirements of the TSX on the same basis as the exemptions from the minority shareholder approval requirements applicable under MI 61-101 - the Company is in serious financial difficulty and the time to convene a meeting of the Company's shareholders would be prejudicial to the ability of the Company to continue as a going concern.

There can be no assurance that the TSX will accept the application for the 604(e) Exemptions. The Company expects that as a consequence of its application and intention to rely on the 604(e) Exemptions, the TSX will place the Company's listing of its Common Shares under delisting review, which is a customary practice when a listed issuer makes an application under Section 604(e) for an exemption from the security holder approval requirements of the TSX. No assurance can be provided as to the outcome of such review and therefore continued qualification for listing of the Common Shares on the TSX is not guaranteed.

About Mountain Province Diamonds Inc.

Mountain Province Diamonds is a 49% participant with De Beers in the GK Mine located in Canada's Northwest Territories. The Gahcho Kué joint venture property consists of several kimberlites that are actively being mined, developed, and explored for future development. The Company also controls more than 96,000 hectares of highly prospective mineral claims and leases surrounding the GK Mine that include an indicated mineral resource for the Kelvin kimberlite and inferred mineral resources for the Faraday kimberlites.

For further information on Mountain Province Diamonds and to receive news releases by email, visit the Company's website at www.mountainprovince.com.

Caution Regarding Forward Looking Information

This news release contains certain "forward-looking statements" and "forward-looking information" under applicable Canadian and United States securities laws concerning the business, operations and financial performance and condition of Mountain Province Diamonds Inc. Forward-looking statements and forward-looking information include, but are not limited to, the terms of the Refinancing Transactions; the anticipated benefits of the Refinancing Transactions to allow the Company to continue as a going concern and to meet its obligations under the joint venture and in respect of its existing indebtedness; statements with respect to estimated production, access to certain orebodies and mine life of the project of Mountain Province; the timing and amount of estimated future production; costs of production; the future price of diamonds; recovery in demand in the diamond market; dividend policy. Except for statements of historical fact relating to Mountain Province, certain information contained herein constitutes forward-looking statements. Forward-looking statements are frequently characterized by words such as "anticipates," "may," "can," "plans," "believes," "estimates," "expects," "projects," "targets," "intends," "likely," "will," "should," "to be", "potential" and other similar words, or statements that certain events or conditions "may", "should" or "will" occur. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made, and are based on a number of assumptions and subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. Many of these assumptions are based on factors and events that are not within the control of Mountain Province and there is no assurance they will prove to be correct.

Factors that could cause actual results to vary materially from results anticipated by such forward-looking statements include the negotiating stances taking by the parties with respect to the Refinancing Transactions; the ability to obtain approval of regulators, parties and shareholders, as may be required, on conditions acceptable to the parties; the ability to secure an additional working capital facility, the development of operation hazards; variations in ore grade or recovery rates; changes in market conditions; changes in project parameters; mine sequencing; production rates; cash flow; risks relating to the availability and timeliness of permitting and governmental approvals; supply of, and demand for, diamonds; competition within the mining industry; fluctuating commodity prices and currency exchange rates, the possibility of project cost overruns or unanticipated costs and expenses; labour disputes and other risks of the mining industry; and failure of plant, equipment or processes to operate as anticipated.

These factors are discussed in greater detail in Mountain Province's most recent Annual Information Form and in the most recent MD&A filed on SEDAR+, which also provide additional general assumptions in connection with these statements. Mountain Province cautions that the foregoing list of important factors is not exhaustive. Investors and others who base themselves on forward-looking statements should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. Mountain Province believes that the expectations reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release.

Although Mountain Province has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Mountain Province undertakes no obligation to update forward-looking statements if circumstances or management's estimates or opinions should change except as required by applicable securities laws. The reader is cautioned not to place undue reliance on forward-looking statements. Statements concerning mineral reserve and resource estimates may also be deemed to constitute forward-looking statements to the extent they involve estimates of the mineralization that will be encountered as the property is developed. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

Further, Mountain Province may make changes to its business plans that could affect its results. The principal assets of Mountain Province are administered pursuant to a joint venture under which Mountain Province is not the operator. Mountain Province is exposed to actions taken or omissions made by the operator within its prerogative and/or determinations made by the joint venture under its terms. Such actions or omissions may impact the future performance of Mountain Province. Under the Second Lien Notes, the Dunebridge JCF and the Term Loan, Mountain Province is subject to certain limitations on its ability to pay dividends on its Common Shares. The declaration of dividends is at the discretion of Mountain Province's Board of Directors, subject to the limitations under the Company's debt facilities, and will depend on Mountain Province's financial results, cash requirements, future prospects, and other factors deemed relevant by the Board.

FOR FURTHER INFORMATION, PLEASE CONTACT: Mark Wall, President and CEO 161 Bay Street, Suite 1410, Toronto, Ontario M5J 2S1 Phone: (416) 361-3562, E-mail: info@mountainprovince.com

![]() View original content:https://www.prnewswire.co.uk/news-releases/mountain-province-diamonds-announces-refinancing-transactions-302384426.html

View original content:https://www.prnewswire.co.uk/news-releases/mountain-province-diamonds-announces-refinancing-transactions-302384426.html