LUND, SWEDEN / ACCESS Newswire / February 25, 2025 / Alligator Bioscience (STO:ATORX)

The English text is an unofficial translation. In case of any discrepancies between the Swedish text and the English translation, the Swedish text shall prevail.

The shareholders of Alligator Bioscience AB, Reg. No. 556597-8201, are invited to the extraordinary general meeting to be held on Thursday 27 March 2025 at 14.00 CET, at Medicon Village, conference room Bengt, Scheelevägen 4 in Lund, Sweden.

RIGHT TO PARTICIPATE AND NOTIFICATION

Shareholders that want to participate in the meeting must be recorded in the company's share register kept by Euroclear Sweden AB as of Wednesday 19 March 2025 and, further, have notified their participation to the company no later than Friday 21 March 2025, by mail to Alligator Bioscience AB, att. Greta Höög, Medicon Village, Scheeletorget 1, SE-223 81 Lund, Sweden. Notice can also be given by phone +46 (0)46-540 82 00 or by e-mail anmalan@alligatorbioscience.com. The notification should specify the shareholder's complete name, personal identity number or company registration number, the number of shares held by the shareholder, address, telephone number during work hours and, when applicable, information on the number of advisors (two at the most).

TRUSTEE-REGISTERED SHARES

Shareholders whose shares are trustee-registered in the name of a bank or other trustee must, to be able to exercise their voting rights at the meeting, request the trustee to register their shares in their own name with Euroclear Sweden AB (so called "voting rights registration"). Such voting rights registration must be implemented by the trustee no later than as of Friday 21 March 2025. Accordingly, shareholders must well in advance before this date notify their trustee of their request of such voting rights registration.

PROXIES ETC.

If the shareholder should be represented by a proxy, the proxy must bring a written power of attorney, which is dated and duly signed by the shareholder, to the meeting. The validity term of the power of attorney may not be more than one year, unless a longer validity term is specifically stated in the power of attorney (however at the longest five years). If the power of attorney is issued by a legal entity, the representing proxy must also present an up-to-date registration certificate or equivalent document for the legal entity. In order to facilitate the entrance at the meeting, a copy of the power of attorney and other authorization documents should preferably be attached to the shareholder's notification to participate in the meeting. A template power of attorney is available at the company's website (www.alligatorbioscience.com) and will be sent to shareholders who request it and state their address.

PROPOSED AGENDA

0. Opening of the meeting.

1. Election of Chairman of the meeting.

2. Preparation and approval of the register of voters.

3. Election of two persons to confirm the minutes.

4. Approval of the agenda.

5. Determination as to whether the meeting has been duly convened.

6. Resolution on guidelines for remuneration to senior executives.

7. Resolution on reduction of the share capital to cover loss.

8. Resolution on (A) amendment of the Articles of Association; and (B) reverse split of ordinary shares.

9. Closing of the meeting.

PROPOSED RESOLUTIONS

Item 1: Election of Chairman of the meeting

The board of directors proposes that lawyer Ola Grahn is elected as Chairman of the meeting.

Item 6: Resolution on guidelines for remuneration to senior executives

The board of directors proposes - with amendments to the guidelines adopted by the annual general meeting 2024 - that the meeting resolves on guidelines for remuneration to senior executives in accordance with the following terms.

Scope and applicability of the guidelines

These guidelines comprise the persons who are part of Alligator's group management (including the CEO). The guidelines also encompass any remuneration to members of the board of directors, in addition to board remuneration.

These guidelines are applicable to remuneration agreed, and amendments to remuneration already agreed, after adoption of the guidelines by the extraordinary general meeting. These guidelines do not apply to any remuneration resolved by the general meeting, such as e.g. board remuneration and share-based incentive programs.

The guidelines' promotion of the company's business strategy, long-term interests and sustainability

Alligator is a clinical-stage biotechnology company developing tumor-directed immuno-oncology antibody drugs focused on the CD40 receptor. Alligator's business strategy includes in brief proprietary drug development - from early-phase research and preclinical development up to the phase in the clinical development when the treatment is validated in patients (clinical Phase 2). The strategy is thereafter to subsequently out-license the drug candidate to a licensee for further development and market launch. For more information about the company's business strategy, see Alligator's latest Annual Report.

A successful implementation of Alligator's business strategy and safeguarding of Alligator's long-term interests, including its sustainability, require that the company is able to recruit and retain highly competent senior executives with a capacity to achieve set goals. In order to achieve this, Alligator must offer a competitive total remuneration on market terms, which these guidelines enable.

Long-term share-based incentive programs have been implemented in Alligator. For further information about these programs, see Alligator's latest Annual Report. The share-based incentive programs have been approved by the general meeting and are therefore not covered by these guidelines.

Types of remuneration, etc.

The remuneration shall be on market terms and be competitive, and may consist of the following components: fixed salary, variable cash remuneration, pension benefits and other benefits. For the individual senior executive, the level of remuneration shall be based on factors such as work tasks, expertise, experience, position and performance. Additionally, the general meeting may - irrespective of these guidelines - resolve on, e.g. share and share price-related remuneration. The remuneration shall not be discriminating on grounds of gender, ethnic background, national origin, age, disability or any other irrelevant factors.

For employments governed by rules other than Swedish, pension benefits and other benefits may be duly adjusted for compliance with mandatory rules or established local practice, taking into account, to the extent possible, the overall purpose of these guidelines.

Fixed salary

The CEO and other senior executives shall be offered a fixed annual cash salary. The fixed salary shall be based on the individual's responsibility, competence and performance. For the CEO, the fixed salary shall be determined annually on 1 January and refer to the following twelve months. For other senior executives, the fixed salary shall be determined annually on 1 April and refer to the following twelve months.

Variable cash remuneration

In addition to fixed salary, the CEO and other senior executives may, according to separate agreements, receive variable cash remuneration. Variable cash remuneration covered by these guidelines is intended to promote Alligator's business strategy and long-term interests, including its sustainability.

The satisfaction of criteria for awarding variable cash remuneration shall be measured over a period of one or several years. Any variable cash remuneration may amount to a maximum of 30 per cent of the fixed annual cash salary. Variable cash remuneration shall not qualify for pension benefits, save as required by mandatory collective bargaining agreements.

The variable cash remuneration shall be linked to one or several predetermined and measurable criteria, which can be financial, such as Alligator's revenues or achieved milestone payments, or non-financial, such as application of Clinical Trial Authorizations (CTA) for entering clinical studies. The variable cash remuneration may be entirely independent of non-financial criteria. By clearly and measurably linking the remuneration of the senior executives to the company's financial and operational development, the goals contribute to the implementation of Alligator's business strategy, long-term interests and sustainability.

To which extent the criteria for awarding variable cash remuneration has been satisfied shall be evaluated and determined when the measurement period has ended. The Remuneration Committee is responsible for the evaluation. For financial objectives, the evaluation shall be based on the latest financial information made public by Alligator.

In addition to the ordinary yearly variable cash remuneration as per the above, the CEO and other senior executives may also receive a separate transaction related bonus in case of a transaction involving the company's lead candidate Mitazalimab. The transaction bonus shall be payable in case of closing of a transaction related to Mitazalimab, irrespective of whether such transaction occurs directly as a sale or out-licensing of Mitazalimab or through an acquisition of the company. The aggregate transaction bonus payable to all participants in the bonus program (which, in addition to the CEO and other senior executives, will also include certain other employees) shall equal two per cent of the aggregate transaction value, however not more than SEK 22.5 million (excluding social charges), and furthermore, the transaction bonus for each participant shall not exceed 200 per cent of the fixed annual cash salary.

Additional variable cash remuneration may be awarded in extraordinary circumstances, provided that such extraordinary arrangements are only made on an individual basis, either for the purpose of recruiting or retaining senior executives, or as remuneration for extraordinary performance beyond the individual's ordinary tasks. Such remuneration may not exceed an amount corresponding to 30 per cent of the fixed annual cash salary and may not be paid more than once each year per individual. Any resolution on such remuneration shall be made by the board of directors based on a proposal from the Remuneration Committee.

Pension benefits

Pension benefits, including health insurance, shall be defined contribution, in so far as the senior executive is not covered by defined benefit pension under mandatory collective bargaining agreements. Pension premiums for defined contribution pensions may amount to a maximum of 30 per cent of the fixed annual cash salary.

Other benefits

Other benefits may include i.a. life insurance, medical insurance and a company car. Premiums and other costs relating to such benefits may amount to a total of not more than the lower of SEK 18,000 per month or 20 per cent of the fixed annual cash salary.

Termination of employment and severance payment

Senior executives shall be employed until further notice or for a specified period of time. Upon termination of an employment, the notice period may not exceed six months. Severance pay, in addition to salary and other remuneration during the notice period, may not exceed an amount corresponding to six times the fixed monthly cash salary. Upon termination by the senior executive, the notice period may not exceed six months, without any right to severance pay. In addition to fixed cash salary during the period of notice and severance pay, additional remuneration may be paid for non-compete undertakings. Such remuneration shall compensate for loss of income and shall only be paid in so far as the previously employed senior executive is not entitled to severance pay for the period for which the non-compete undertaking applies. The remuneration shall be based on the fixed cash salary at the time of termination of employment and amount to not more than 60 per cent of the fixed annual cash salary at the time of termination of employment, save as otherwise provided by mandatory collective bargaining agreements, and shall be paid during the time as the non-compete undertaking applies, however not for more than 12 months following termination of employment.

Salary and employment conditions for employees

In the preparation of the board of directors' proposal for these remuneration guidelines, salary and employment conditions for employees of Alligator have been taken into consideration by including information on the employees' total income, the components of the remuneration and increase and growth rate over time, in the Remuneration Committee's and the board of directors' basis of decision when evaluating whether the guidelines and the limitations set out herein are reasonable.

Consultancy fees to the members of the board of directors

To the extent a member of the board of directors renders services for Alligator, in addition to his or her assignment as a member of the board of directors, consultancy fee on market terms may be paid to the member of the board of directors, or to a company controlled by such member of the board of directors, provided that such services contribute to the implementation of Alligator's business strategy and the safeguarding of Alligator's long-term interests, including its sustainability.

Preparation and decision-making progress

The board of directors has established a Remuneration Committee. The Remuneration Committee's duties include i.a. preparing the board of directors' resolution to propose guidelines for remuneration to senior executives. The board of directors shall prepare a proposal for new guidelines at least every fourth year and submit it to the general meeting. The guidelines shall be in force until new guidelines have been adopted by the general meeting. The Remuneration Committee shall also monitor and evaluate programs for variable remuneration for the senior executives, the application of the guidelines for remuneration to senior executives as well as the current remuneration structures and compensation levels in the company. The members of the Remuneration Committee are independent in relation to the company and its senior management. The CEO and other members of the senior management do not participate in the board of directors' processing of and resolutions regarding remuneration-related matters in so far as they are affected by such matters.

Deviation from these guidelines

The board of directors may temporarily resolve to deviate from these guidelines, in whole or in part, if in a specific case there is special cause for the deviation and a deviation is necessary to serve the company's long-term interests, including its sustainability, or to ensure the company's financial viability. As set out above, the Remuneration Committee's tasks include preparing the board of directors' resolutions in remuneration-related matters, which include any resolutions to deviate from these guidelines.

Review of the guidelines

The board of directors has not received any comments from the shareholders regarding the current guidelines for remuneration to senior executives. The board of directors' proposal for resolution on guidelines for remuneration to senior executives corresponds with the guidelines adopted by the annual general meeting 2024 with the addition of the new "transaction bonus" as outlined under "Variable cash remuneration".

Item 7: Resolution on reduction of the share capital to cover loss

The board of directors proposes that the meeting resolves to reduce the share capital to cover loss, partly by SEK 623.3352 by redemption of all 779,169 series C shares that are held by the company, partly by SEK 0.2672 without redemption of shares. In total, the share capital is thus proposed to be reduced by SEK 623.6024.

The resolution presupposes and is conditional upon that the meeting also approves the board of directors' proposal for resolution on (A) amendment of the Articles of Association; and (B) reverse split of ordinary shares in accordance with the board of directors' proposal to the meeting.

Item 8: Resolution on (A) amendment of the Articles of Association; and (B) reverse split of ordinary shares

The board of directors proposes that the meeting resolves on a consolidation of ordinary shares (so-called reversed share split) whereby one thousand (1,000) existing ordinary shares are consolidated into one (1) ordinary share (1:1,000) in accordance with B below. The purpose of the reverse share split is to achieve an appropriate number of shares for the company. In order to enable the reverse share split of ordinary shares, the board of directors further proposes that the meeting resolves to amend the company's Articles of Association in accordance with A below.

A. Amendment of the Articles of Association

In order to enable the reverse share split of ordinary shares proposed under B below, the board of directors proposes that the meeting resolves to amend the company's Articles of Association, by adopting new limits for the share capital and the number of shares as follows.

§ 4 Share capital

Current wording

The share capital of the company shall be no less than SEK 9,920,000 and no more than SEK 39,680,000.

Proposed wording

The share capital of the company shall be no less than SEK 13,200,000 and no more than SEK 52,800,000.

§ 5 Number of shares

Current wording

The number of shares shall not be less than 12,400,000,000 and shall not exceed 49,600,000,000.

Proposed wording

The number of shares shall not be less than 16,500,000 and shall not exceed 66,000,000.

B. Reverse share split of ordinary shares

The board of directors proposes that the meeting resolves to carry out a reverse share split of ordinary shares, in the ratio 1:1,000, resulting in one thousand (1,000) ordinary shares being consolidated into one (1) ordinary share.

The reason for the reverse share split is that the company wants to achieve a number of shares that is appropriate for the company.

If a shareholder's holding of ordinary shares does not correspond to a full number of new ordinary shares, the excess ordinary shares will become the property of the company on the record date for the reverse share split. Excess ordinary shares will then be sold at the company's expense by Vator Securities AB, whereby the shareholders concerned will receive their share of the sales proceeds.

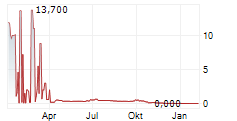

After completion of the reverse share split of ordinary shares, the number of ordinary shares in the company will decrease from 16,905,477,334 to 16,905,477. The proposed reverse share split also means that the quota value of the share increases from SEK 0.0008 to SEK 0.80.

The board of directors shall be authorized to determine the record date for the reverse share split, which may not, however, be earlier than the date on which the resolution on the reverse share split has been registered with the Swedish Companies Registration Office. Further information on the procedure for the reverse share split will be published in connection with the board of directors' decision regarding the record date.

The board of directors' proposals under A - B above constitute a combined proposal and shall be made as a joint resolution.

The resolution presupposes and is conditional upon that the meeting also approves the board of directors' proposal for resolution on reduction of the share capital to cover loss in accordance with the board of directors' proposal to the meeting.

PARTICULAR MAJORITY REQUIREMENTS

For valid resolutions on the proposals pursuant to items 7 and 8, the proposals have to be supported by shareholders representing at least two-thirds of the votes cast as well as of all shares represented at the meeting.

MEETING DOCUMENTS AND OTHER INFORMATION

The complete proposals for resolutions and ancillary documents pursuant to the Swedish Companies Act (Sw. aktiebolagslagen) will be kept available at the company's office at Medicon Village, Scheeletorget 1, SE-223 81 Lund, Sweden and at the company's website (www.alligatorbioscience.com) as from no later than three weeks prior to the meeting, and will also be sent to shareholders who request it and provide their address. Copies of the documents will also be available at the meeting.

Shareholders present at the meeting have the right to request information at the meeting pursuant to Chapter 7, Section 32 Paragraph 1 of the Swedish Companies Act (2005:551).

NUMBER OF SHARES AND VOTES IN THE COMPANY

The total number of shares in the company amounts to 16,906,256,503 shares, of which 16,905,477,334 are ordinary shares with one vote each and 779,169 are series C shares with one-tenth vote each. The total number of votes in the company amounts to 16,905,555,250.9 votes. The company holds all 779,169 outstanding series C shares, corresponding to 77,916.9 votes, which cannot be represented at the meeting.

PROCESSING OF PERSONAL DATA

For information on how your personal data is processed, see

https://www.euroclear.com/dam/ESw/Legal/Privacy-notice-bolagsstammor-engelska.pdf.

_____________________

Lund in February 2025

ALLIGATOR BIOSCIENCE AB (PUBL)

The Board of Directors

For further information, please contact:

Søren Bregenholt, CEO

E-mail: soren.bregenholt@alligatorbioscience.com

Phone: +46 (0) 46 540 82 00

The information was submitted for publication, through the agency of the contact person set out above, at 5:20 p.m. CET on February 25, 2025.

Attachments

Notice of extraordinary general meeting in Alligator Bioscience AB

SOURCE: Alligator Bioscience

View the original press release on ACCESS Newswire