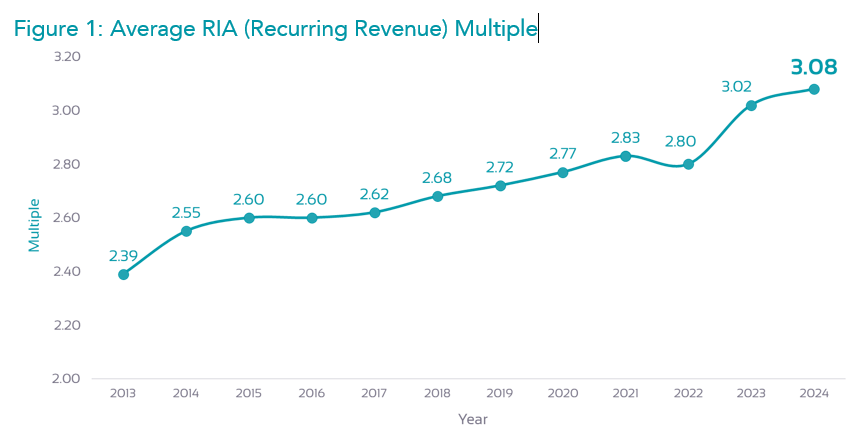

PORTLAND, OREGON / ACCESS Newswire / February 25, 2025 / Succession Resource Group, Inc. (SRG) published its ninth annual review of advisor acquisition activity, unveiling key trends for advisors interested in buying, selling, and succession planning. In this year's data release, SRG reported on one of its largest pools of transaction data, drawing on 176 transactions representing more than $13.3 billion in assets under management, all completed during the calendar year 2024. This data represents the largest and most comprehensive transaction data in the industry, pulling information from deals facilitated or listed by SRG, as well as transaction data not facilitated by SRG - from industry lenders including Oak Street Funding, PPC Loan, and Skyview Partners. Overall, M&A valuations appear to have returned to historical norms, increasing a modest 1.83% over 2023 valuations despite a variety of influential external factors including an improved, but still elevated, interest rate environment, a national election, and increased attention on the values paid by Private Equity (PE) and PE-back industry aggregators.

Average multiple of recurring revenue for 2025

M&A Highlights:

Based on current "rules of thumb" for benchmarking purposes, the average EBITDA multiple for advisory 'businesses' in 2024 remained steady at 9.20x, while the average topline recurring revenue multiple for 'books of business' climbed to 3.08x, up 1.83% over the prior year's RIA (recurring revenue) multiple of 3.02x [1].

Advisors with a sell-side advocate (in a competitive bidding scenario), as opposed to a one-on-one privately negotiated sale, continued to beat the "market." Advocated sales obtained 6.91% more value as compared to last year's average multiple (3.07x), while also receiving an average down payment of 75.00%, as compared to 61.00% for non-advocated/private deals. These results are likely driven by increased demand in 2024, as evidenced by the average number of offers SRG obtained per seller (an average of five offers per listing, up from an average of three offers in 2023) while the average time from listing to funding reached an all-time efficiency record of 129 days.

Out-of-state buyers continue to increase in frequency, with 33.00% of all 2024 deals involving a buyer in a different state.

Succession Survey:

In 2024, SRG conducted a succession planning survey with more than three hundred respondents. The results found:

Internal succession plans remain a top priority for advisory firms. Of more than three hundred firms polled, 28% indicated that succession planning was "a primary focus for 2025," with 48% indicating their "ideal buyer is/will be" their internal team.

When asked to "Rate your overall level of succession readiness" on a scale of 0-10, with zero indicating "Not ready at all" and a score of ten representing "Plan is communicated, written, and shared," only 1% of respondents indicated they had a plan that has been written and shared, with 56% scoring themselves a five or less.

Only 5% of respondents indicated that their ideal buyer is/will be a PE firm or industry aggregator, despite 11% of the respondents representing firms with more than $1 billion in AUM, and 4% with more than $5 billion.

Most noteworthy was the indication that 24% of advisors have no plans to retire, and that 43% plan to retire in less than ten years.

Market Trends:

Despite increased value expectations from advisors citing published deal activity and marketing collateral about/from PE firms, values paid for RIAs in 2024 were in line with SRG expectations based on historical deal data, remaining consistent and sustainable.

Down payments remained consistent in 2024, increasing slightly from an average of 63.00% cash down in 2023 to 65.00% cash down in 2024. SRG expects down payments to continue to rise in 2025 given the increased cash flow obtained by buyers using industry lenders' ten-year amortization schedules versus the shorter six (5.94) year amortization schedule with seller notes. In 2024, the amortization on seller notes ranged from as short as one year to as long as 24 years.

Just over half (52.60%) of the deals in 2024 included a retention clause designed to account for potential attrition post-sale, including deals with a clawback, contingent escrow payments, and bank holdbacks. The average target retention rate in 2024 was 88.00% of annual gross revenue, measured one year after closing.

As the market for advisory practices continues to evolve and mature, the range of values/multiples paid in the market continues to expand. Nearly two-thirds (62.8%) of deals were paid between 2.50x and 3.50x recurring revenue, but over 20% received a multiple of more than 3.50x. And for the first time on record, no deals received a multiple below 1.50x.

Recurring Revenue Multiples |

| % of 2024 Deals |

| |

< 1.50x |

|

| 0.0 | % |

1.5x to 2.0x |

|

| 1.7 | % |

2.0x to 2.5x |

|

| 14.9 | % |

2.5x to 3.0x |

|

| 28.1 | % |

3.0x to 3.5x |

|

| 34.7 | % |

3.50x to 4.0x |

|

| 12.4 | % |

> 4.0x |

|

| 8.3 | % |

Overall, buyer demand remained strong considering the higher-than-normal interest rate environment, with the 2024 average buyer-to-seller ratio at 66:1, with over half (51.8%) of the buyers having acquired an advisory firm previously. We anticipate that the buyer-to-seller ratio will stay steady as firms continue to focus on organic growth, team/ensemble development, and internal succession planning.

All cash deals represented 25.3% of transactions, down from prior years. However, deals with 100% of the funds paid within the first 12 months of closing represented 51.3% of all deals, which is more consistent with historical expectations.

Based on deals completed by SRG in 2024, third-party financing usage is down, likely due to higher interest rates than seen in previous years. 43.2% of the deals in 2024 used some form of outside capital. However, sellers prefer buyers who are working with a lender, as the average down payment when a lender is involved was 73.8%, while the average down payment without a lender was 48.5%.

When seller financing was used in 2024, 56.8% of all deals, the average amortization was 5.94 years at 4.9% interest, indicating the seller's confidence in the buyer's ability and overall fit given the below-market interest rate.

Internal succession planning continues to mature. The average tranche sold to internal successors reached 20.9% of the firm, up from the prior-year average of 18.4%. Overall, 36.0% of advisors' succession plans in 2024 leveraged external capital to assist next-gen advisors with the buy-in, down from 58.3% of succession plans in 2023. Relative to commercial industry financing, internal company-based succession financing terms had lower total borrowing costs due to a lower interest rate of 5.07%, however, cash flow for borrowers was more constrained due to a 7.5 year payback schedule. Although reduction of total borrowing costs is commonly emphasized in these scenarios, it is usually accompanied by less margin of error from a cash flow perspective due to a shortened repayment period.

Private Equity Firms & Aggregators:

PE and PE-backed aggregators remain active acquirers, though very selective, focused on specific markets and specific business sizes, and generally seeking to keep the seller involved and active for many years post-sale. Those RIAs that do attract PE attention are finding that the high valuations are combined with "creative" deal terms, with the majority of value paid in the acquirer's equity (with aggressive valuation assumptions) and performance-based payments. For RIAs that outgrew the resources of most buyers and industry lenders, and do not have an internal successor(s), PE provided a viable solution in 2024 and the demand for this group of RIAs is expected to remain or increase in 2025.

Private equity-backed aggregator offers and stories in the press about these deals continue to be part of the dialogue during negotiations amongst sellers and prospective non-PE buyers. Unrealistic sellers are being forced to reevaluate their expectations with non-PE buyers, due to cash flow constraints of buyers using less creative terms paired with a greater reliance on traditional financing to provide 70-100% cash at closing. Much like overpriced real estate, non-PE buyers in 2024 were forced to either bring additional cash to close or adjust the purchase price to a more realistic figure supportable by the acquired cash flow - with the overwhelming majority adjusting the price. This trend is expected to continue into 2025 regardless of rate or market conditions.

2025 Outlook

The 2024 advisor M&A market behaved as expected, and 2025 is expected to remain active given the general lack of succession readiness and aging advisor workforce. SRG predicts increased deal volume and leveraging of external capital to complete deals, bolstered if interest rates remain flat or decrease. SRG expects to see modest increases in advisor valuations as some sellers accept the creative deals offered by industry aggregators, with average RIA multiples likely reaching 3.1x on gross revenue or close to 9.3x EBITDA. Discussing the current M&A market, David Grau Jr., President of Succession Resource Group, shared his firm's perspective on where things are heading in 2025: "There's a lot of 'noise' around the value of an advisory practice and it is making it difficult for owners to determine what a fair value really is. Marketing letters offering 4x revenue or 10-14x earnings are commonplace now. Unfortunately, this 'noise' from buyers offering obscenely high multiples has caused some owners to reconsider their exit plans, chasing a higher valuation, only to find that the terms needed to support such a valuation aren't what any reasonable owner would accept." David went on to share, "Founders who focus on building a sustainable firm, optimizing their business, and remaining focused on the best fit for their clients at their exit will always get the best value. Period."

About Succession Resource Group

Succession Resource Group (SRG) is an award-winning consulting firm dedicated to supporting independent financial professionals across the country. We leverage decades of experience to provide a comprehensive suite of services, including valuation, M&A, succession planning, and practice management solutions. Our mission is to empower financial professionals at every stage of their business journey, helping them navigate complexities, maximize value, and achieve their long-term goals. For more information, visit SuccessionResource.com.

[1] Succession Resource Group, 2023 Advisor M&A Review. January 2024.

Contact Information

Guy Littlefield

Marketing Specialist

marketing@successionresoucegroup.com

(503) 427-9910

David Grau

President

david.graujr@successionresourcegroup.com

(503) 427-9910

Related Video

https://vimeo.com/1049482307/8848127c6b

SOURCE: Succession Resource Group

View the original press release on ACCESS Newswire