Provides Fiscal 2025 Guidance

Welcomes 30-Year Industry Veteran Jason Potter, President and CEO

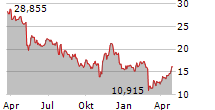

EMERYVILLE, Calif., Feb. 25, 2025 (GLOBE NEWSWIRE) -- Grocery Outlet Holding Corp. (NASDAQ: GO) ("Grocery Outlet" or the "Company") today announced financial results for the fourth quarter and full fiscal year ended December 28, 2024.

Highlights for Fourth Quarter Fiscal 2024 as compared to Fourth Quarter Fiscal 2023:

- Net sales increased by 10.9% to $1.10 billion.

- Comparable store sales increased by 2.9%.

- Gross margin was 29.5% compared to 30.2% last year.

- Net income was $2.3 million, or $0.02 per diluted share, compared to $14.1 million, or $0.14 per diluted share last year. Adjusted net income(1) was $14.5 million, or $0.15 per adjusted diluted share(1), compared to $18.2 million, or $0.18 per adjusted diluted share last year.

- Adjusted EBITDA(1) increased by 12.5% to $57.2 million, or 5.2% of net sales.

Highlights for Fiscal 2024 as compared to Fiscal 2023:

- Net sales increased by 10.1% to $4.37 billion.

- Comparable store sales increased by 2.7%.

- Gross margin was 30.2% compared to 31.3% last year.

- Net income was $39.5 million, or $0.40 per diluted share, compared to $79.4 million, or $0.79 per diluted share last year. Adjusted net income(1) was $76.3 million, or $0.77 per adjusted diluted share(1), compared to $108.1 million, or $1.07 per adjusted diluted share last year.

- Adjusted EBITDA(1) decreased by 6.3% to $236.8 million, or 5.4% of net sales.

__________________________________

(1) Adjusted EBITDA, adjusted net income and adjusted diluted earnings per share are non-GAAP financial measures, which exclude the impact of certain special items. Please note that the Company's non-GAAP financial measures should be considered as a supplement to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. See the "Non-GAAP Financial Information" section of this release as well as the respective reconciliations of the Company's non-GAAP financial measures below for additional information about these items.

"We delivered solid fourth quarter results, generating comps above expectations as customers responded to our improved value assortments," said Eric Lindberg, Chairman of the Board of Directors of Grocery Outlet. "We continue to make progress on multiple fronts, and we are keenly focused on key strategic initiatives that will strengthen our foundation and support future growth, while ensuring we deliver best in class execution for our customers and independent operators."

Mr. Lindberg continued, "We have filled key leadership positions to take us forward, including new President and CEO Jason Potter, who has over 30 years of industry experience, most recently leading The Fresh Market. I couldn't be more pleased to have Jason leading the business given his strong capabilities and track record of value creation. I remain very encouraged about the prospects of Grocery Outlet, with our highly differentiated model and significant runway for growth and long-term value creation for our shareholders."

"I am honored to lead this unique and differentiated company as we embark on the next stage of our strategic roadmap," said Jason Potter, President and CEO of Grocery Outlet. "In my first few weeks, Eric and I have been working closely together and are aligned on the company's strategic direction to drive disciplined, sustainable growth and improve returns on capital."

Fourth Quarter Fiscal 2024 Financial Summary

Net sales increased 10.9% to $1.10 billion during the fourth quarter due to new store sales and a 2.9% increase in comparable store sales. Transactions increased by 3.0% during the period while average transaction size was flat. The Company opened five new stores and closed one store, ending the quarter with 533 stores in 16 states.

Gross profit increased 8.4% versus the prior period to $323.9 million. Gross margin declined 70 basis points to 29.5% year-over-year. While an increase in value sales positively impacted margins for the quarter, this was more than offset by higher inventory shrinkage related primarily to issues with our systems conversion.

Selling, general and administrative expenses increased by 11.6% to $312.5 million, and increased 20 basis points to 28.5% of net sales. The increase in SG&A as a percentage of net sales was driven primarily by $15.9 million in charges related to the Restructuring Plan (described below) and increases in other store costs, partially offset by a decrease from elective commission support we provided to operators in the prior year period related to the systems conversion.

Net income was $2.3 million, or $0.02 per diluted share compared to $14.1 million, or $0.14 per diluted share last year. The decrease was attributable to the lower gross margin and higher SG&A as a percentage of net sales noted above, as well as an increase in net interest expense driven by higher average principal debt outstanding during the fourth quarter of fiscal 2024. Adjusted net income(1) decreased by 20.1% to $14.5 million, or $0.15 per adjusted diluted share(1). Adjusted EBITDA(1) increased by 12.5% to $57.2 million, or 5.2% of net sales.

Fiscal 2024 Financial Summary

Net sales increased by 10.1% to $4.37 billion during fiscal 2024 due to new store sales and a 2.7% increase in comparable store sales, driven by a 4.2% increase in the number of transactions, partially offset by a 1.4% decrease in average transaction size. The Company added 67 new stores, including 40 stores from the acquisition of United Grocery Outlet, and closed two stores during the year.

Gross profit increased 6.5% versus the prior year to $1.32 billion. Gross margin declined 110 basis points to 30.2% year-over-year due to higher inventory shrinkage related primarily to issues with our systems conversion.

Selling, general and administrative expenses increased by 11.4% to $1.24 billion during fiscal 2024, and increased 30 basis points to 28.4% of net sales. The increase in SG&A as a percentage of net sales was driven primarily by $15.9 million in charges related to the Restructuring Plan and increases in other store costs, partially offset by a decrease from elective commission support we provided to operators in the prior year related to the systems conversion.

Net income was $39.5 million, or $0.40 per diluted share compared to $79.4 million, or $0.79 per diluted share in the prior year. The decrease was attributable to lower gross margin and higher SG&A as a percentage of net sales noted above, as well as an increase in net interest expense driven by higher average principal debt outstanding during fiscal 2024. Adjusted net income(1) decreased by 29.4% to $76.3 million, or $0.77 per adjusted diluted share(1). Adjusted EBITDA(1) decreased by 6.3% to $236.8 million, or 5.4% of net sales.

Balance Sheet and Cash Flow:

- Cash and cash equivalents totaled $62.8 million at the end of fiscal 2024.

- Total debt was $477.5 million at the end of fiscal 2024, net of unamortized debt issuance costs.

- Net cash provided by operating activities during fiscal 2024 was $112.0 million.

- Capital expenditures for fiscal 2024, before the impact of tenant improvement allowances, were $206.9 million, and, net of tenant improvement allowances, were $185.7 million.

Restructuring Plan:

During the fourth quarter of fiscal 2024, the Company began to initiate a restructuring plan that is intended to improve long-term profitability and cash flow generation, optimize the footprint of new store growth and lower the Company's cost base (the "Restructuring Plan"). The Restructuring Plan includes (i) the termination of leases for unopened stores in suboptimal locations, (ii) the cancellation of certain capital-intensive warehouse projects and (iii) the implementation of a workforce reduction, pursuant to which the Company notified affected employees on February 18, 2025. These actions under the Restructuring Plan are expected to be substantially completed by the first half of fiscal 2025. The Company currently estimates that it will incur total costs under the Restructuring Plan of between $52 million and $61 million, of which between $36 million and $45 million are expected to be cash expenditures.

Outlook:

The Company is providing the following outlook for fiscal 2025(2):

| New store openings, net | 33 to 35 |

| Net sales | $4.7 billion to $4.8 billion |

| Comparable store sales increase(3) | 2.0% to 3.0% |

| Gross margin | 30.0%-30.5% |

| Adjusted EBITDA(1) | $260 million to $270 million |

| Adjusted diluted earnings per share(1) | $0.70 to $0.75 |

| Capital expenditures (net of tenant improvement allowances) | $210 million |

__________________________________

(2) Includes 53rd week.

(3) Excludes net sales in the non-comparable week of a 53-week year from the same store sales calculation and compares the current and prior year weekly periods that are most closely aligned.

Conference Call Information:

A conference call to discuss the fourth quarter and full fiscal 2024 financial results is scheduled for today, February 25, 2025 at 4:30 p.m. Eastern Time. Investors and analysts interested in participating in the call are invited to dial (877) 407-9208 approximately 10 minutes prior to the start of the call. A live audio webcast of the conference call will be available online at https://investors.groceryoutlet.com.

A taped replay of the conference call will be available within two hours of the conclusion of the call and can be accessed both online and by dialing (844) 512-2921 and entering access code 13750098. The replay will be available for approximately two weeks after the call.

Non-GAAP Financial Information:

In addition to reporting financial results in accordance with accounting principles generally accepted in the United States ("GAAP"), management and the Board of Directors use EBITDA, adjusted EBITDA, adjusted net income and adjusted earnings per share as supplemental key metrics to assess the Company's financial performance. These non-GAAP financial measures are also frequently used by analysts, investors and other interested parties to evaluate the Company and other companies in the Company's industry. Management believes it is useful to investors and analysts to evaluate these non-GAAP measures on the same basis as management uses to evaluate the Company's operating results. Management uses these non-GAAP measures to supplement GAAP measures of performance to evaluate the effectiveness of the Company's business strategies, to make budgeting decisions and to compare the Company's performance against that of other peer companies using similar measures. In addition, the Company uses adjusted EBITDA to supplement GAAP measures of performance to evaluate performance in connection with compensation decisions. Management believes that excluding items from operating income, net income and net income per diluted share that may not be indicative of, or are unrelated to, the Company's core operating results, and that may vary in frequency or magnitude, enhances the comparability of the Company's results and provides additional information for analyzing trends in the Company's business.

Management defines EBITDA as net income before net interest expense, income taxes and depreciation and amortization expenses. Adjusted EBITDA represents EBITDA adjusted to exclude share-based compensation expense, loss on debt extinguishment and modification, asset impairment and gain or loss on disposition, acquisition and integration costs, costs related to the amortization of inventory purchase accounting asset step-ups, restructuring charges, and certain other expenses that may not be indicative of, or are unrelated to, the Company's core operating results, and that may vary in frequency or magnitude. Adjusted net income represents net income adjusted for the previously mentioned adjusted EBITDA adjustments, further adjusted for the amortization of property and equipment purchase accounting asset step-ups and deferred financing costs, tax adjustment to normalize the effective tax rate, and tax effect of total adjustments. Basic adjusted earnings per share is calculated using adjusted net income, as defined above, and basic weighted average shares outstanding. Diluted adjusted earnings per share is calculated using adjusted net income, as defined above, and diluted weighted average shares outstanding.

These non-GAAP measures may not be comparable to similar measures reported by other companies and have limitations as analytical tools, and you should not consider them in isolation or as a substitute for analysis of the Company's results as reported under GAAP. The Company addresses the limitations of the non-GAAP measures through the use of various GAAP measures. In the future the Company will incur expenses or charges such as those added back to calculate adjusted EBITDA or adjusted net income. The presentation of these non-GAAP measures should not be construed as an inference that future results will be unaffected by the adjustments used to derive such non-GAAP measures.

The Company has not reconciled the non-GAAP adjusted EBITDA and adjusted diluted earnings per share forward-looking guidance included in this release to the most directly comparable GAAP measures because this cannot be done without unreasonable effort due to the variability and low visibility with respect to taxes and non-recurring items, which are potential adjustments to future earnings. The Company expects the variability of these items to have a potentially unpredictable, and a potentially significant, impact on the Company's future GAAP financial results.

Forward-Looking Statements:

This news release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this release other than statements of historical fact, including statements regarding the Company's future operating results and financial position, the Company's business strategy and plans, the Restructuring Plan and its associated benefits, the Company's ability to drive long-term value and business and market trends may constitute forward-looking statements. Words such as "anticipate," "believe," "estimate," "expect," "intend," "may," "outlook," "plan," "project," "seek," "will," and similar expressions, are intended to identify such forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions that may cause actual results to differ materially from those expressed or implied by any forward-looking statements, including the following: failure of suppliers to consistently supply the Company with opportunistic products at attractive pricing; inability to successfully identify trends and maintain a consistent level of opportunistic products or general inventory; failure to maintain or increase comparable store sales; any significant disruption to our distribution network, the operations, technology and capacity of our distribution centers and our timely receipt of inventory; risks associated with newly opened stores; risks associated with our growth strategy, including opening, relocating or remodeling stores on schedule and on budget, as well as the revised near-term new store growth strategy as reflected in the Restructuring Plan; financial and operating impacts associated with our Restructuring Plan; inflation and other changes affecting the market prices of the products we sell; failure to maintain our reputation and the value of our brand, including protecting our intellectual property; failure to remediate our material weakness in our internal control over financial reporting; inability to maintain sufficient levels of cash flow from our operations to fund our growth strategy; risks associated with leasing substantial amounts of space; inability to attract, train and retain highly qualified employees or the loss of executive officers or other key personnel; costs and successful implementation of marketing, advertising and promotions; natural or man-made disasters, climate change, power outages, major health epidemics, pandemic outbreaks, terrorist acts, global political events or other serious catastrophic events and the concentration of our business operations; unexpected costs and negative effects if we incur losses not covered by our insurance program; difficulties associated with labor relations and shortages; failure to participate effectively in the growing online retail marketplace; failure to properly integrate or achieve the expected benefits of any acquired businesses; risks associated with economic conditions; competition in the retail food industry; movement of consumer trends toward private labels and away from name-brand products; risks associated with deploying the Company's own private label brands; inability to attract and retain qualified independent operators of the Company ("IOs"); failure of the IOs to successfully manage their business; failure of the IOs to repay notes outstanding to the Company; inability of the IOs to avoid excess inventory shrink; any loss or changeover of an IO; legal proceedings initiated against the IOs; legal challenges to the IO/independent contractor business model; failure to maintain positive relationships with the IOs; risks associated with actions the IOs could take that could harm the Company's business; material disruption to information technology systems, including risks associated from our technology initiatives or third-party security breaches or other disruptions; risks associated with products the Company and its IOs sell; risks associated with laws and regulations generally applicable to retailers; legal or regulatory proceedings; the Company's substantial indebtedness could affect its ability to operate its business, react to changes in the economy or industry or pay debts and meet obligations; restrictive covenants in the Company's debt agreements may restrict its ability to pursue its business strategies, and failure to comply with any of these restrictions could result in acceleration of the Company's debt; risks associated with tax matters; changes in accounting standards and subjective assumptions, estimates and judgments by management related to complex accounting matters; and the other factors discussed under "Risk Factors" in the Company's most recent annual report on Form 10-K and in other subsequent reports the Company files with the United States Securities and Exchange Commission (the "SEC"). The Company's periodic filings are accessible on the SEC's website at www.sec.gov.

Moreover, the Company operates in a very competitive and rapidly changing environment, and new risks emerge from time to time. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, and the Company's expectations based on third-party information and projections are from sources that management believes to be reputable, the Company cannot guarantee that future results, levels of activity, performance or achievements. These forward-looking statements are made as of the date of this release or as of the date specified herein and the Company has based these forward-looking statements on current expectations and projections about future events and trends. Except as required by law, the Company does not undertake any duty to update any of these forward-looking statements after the date of this release or to conform these statements to actual results or revised expectations.

About Grocery Outlet:

Based in Emeryville, California, Grocery Outlet is a high-growth, extreme value retailer of quality, name-brand consumables and fresh products sold primarily through a network of independently operated stores. Grocery Outlet and its subsidiaries have more than 530 stores in California, Washington, Oregon, Pennsylvania, Tennessee, Idaho, Maryland, Nevada, North Carolina, New Jersey, Georgia, Ohio, Alabama, Delaware, Kentucky and Virginia.

INVESTOR RELATIONS CONTACTS:

Christine Chen

(510) 877-3192

cchen@cfgo.com

Bruce Williams

(332) 242-4303

Bruce.Williams@icrinc.com

MEDIA CONTACT:

Layla Kasha

(510) 379-2176

lkasha@cfgo.com

| GROCERY OUTLET HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (in thousands, except per share data) (unaudited) | |||||||||||||||

| 13 Weeks Ended | 52 Weeks Ended | ||||||||||||||

| December 28, 2024 | December 30, 2023 | December 28, 2024 | December 30, 2023 | ||||||||||||

| Net sales | $ | 1,097,854 | $ | 989,818 | $ | 4,371,501 | $ | 3,969,453 | |||||||

| Cost of sales | 773,974 | 690,943 | 3,049,564 | 2,727,774 | |||||||||||

| Gross profit | 323,880 | 298,875 | 1,321,937 | 1,241,679 | |||||||||||

| Selling, general and administrative expenses | 312,507 | 279,949 | 1,243,610 | 1,115,897 | |||||||||||

| Operating income | 11,373 | 18,926 | 78,327 | 125,782 | |||||||||||

| Other expenses: | |||||||||||||||

| Interest expense, net | 6,982 | 1,450 | 22,156 | 16,361 | |||||||||||

| Loss on debt extinguishment and modification | - | - | - | 5,340 | |||||||||||

| Total other expenses | 6,982 | 1,450 | 22,156 | 21,701 | |||||||||||

| Income before income taxes | 4,391 | 17,476 | 56,171 | 104,081 | |||||||||||

| Income tax expense | 2,080 | 3,370 | 16,706 | 24,644 | |||||||||||

| Net income and comprehensive income | $ | 2,311 | $ | 14,106 | $ | 39,465 | $ | 79,437 | |||||||

| Basic earnings per share | $ | 0.02 | $ | 0.14 | $ | 0.40 | $ | 0.80 | |||||||

| Diluted earnings per share | $ | 0.02 | $ | 0.14 | $ | 0.40 | $ | 0.79 | |||||||

| Weighted average shares outstanding: | |||||||||||||||

| Basic | 97,407 | 99,292 | 98,707 | 98,709 | |||||||||||

| Diluted | 98,021 | 101,144 | 99,615 | 100,831 | |||||||||||

| GROCERY OUTLET HOLDING CORP. CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands) (unaudited) | |||||||

| December 28, 2024 | December 30, 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 62,828 | $ | 114,987 | |||

| Independent operator receivables and current portion of independent operator notes, net of allowance | 16,051 | 14,943 | |||||

| Other accounts receivable, net of allowance | 4,166 | 4,185 | |||||

| Merchandise inventories | 394,152 | 349,993 | |||||

| Prepaid expenses and other current assets | 26,701 | 32,443 | |||||

| Total current assets | 503,898 | 516,551 | |||||

| Independent operator notes and receivables, net of allowance | 36,441 | 28,134 | |||||

| Property and equipment, net | 750,423 | 642,462 | |||||

| Operating lease right-of-use assets | 1,014,678 | 945,710 | |||||

| Intangible assets, net | 78,778 | 78,556 | |||||

| Goodwill | 782,734 | 747,943 | |||||

| Other assets | 6,869 | 10,230 | |||||

| Total assets | $ | 3,173,821 | $ | 2,969,586 | |||

| Liabilities and Stockholders' Equity | |||||||

| Current liabilities: | |||||||

| Trade accounts payable | $ | 175,871 | $ | 209,354 | |||

| Accrued and other current liabilities | 55,240 | 66,655 | |||||

| Accrued compensation | 19,687 | 24,749 | |||||

| Current portion of long-term debt | 15,000 | 5,625 | |||||

| Current lease liabilities | 72,905 | 63,774 | |||||

| Income and other taxes payable | 10,921 | 13,808 | |||||

| Total current liabilities | 349,624 | 383,965 | |||||

| Long-term debt, net | 462,502 | 287,107 | |||||

| Deferred income tax liabilities, net | 56,178 | 38,601 | |||||

| Long-term lease liabilities | 1,106,219 | 1,038,307 | |||||

| Other long-term liabilities | 1,914 | 2,267 | |||||

| Total liabilities | 1,976,437 | 1,750,247 | |||||

| Stockholders' equity: | |||||||

| Common stock | 97 | 99 | |||||

| Series A preferred stock | - | - | |||||

| Additional paid-in capital | 815,858 | 877,276 | |||||

| Retained earnings | 381,429 | 341,964 | |||||

| Total stockholders' equity | 1,197,384 | 1,219,339 | |||||

| Total liabilities and stockholders' equity | $ | 3,173,821 | $ | 2,969,586 | |||

| GROCERY OUTLET HOLDING CORP. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) (unaudited) | |||||||

| 52 Weeks Ended | |||||||

| December 28, 2024 | December 30, 2023 | ||||||

| Cash flows from operating activities: | |||||||

| Net income | $ | 39,465 | $ | 79,437 | |||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||

| Depreciation of property and equipment | 90,747 | 76,600 | |||||

| Amortization of intangible and other assets | 17,459 | 11,382 | |||||

| Amortization of debt issuance costs and debt discounts | 910 | 1,084 | |||||

| Non-cash rent | 4,780 | 5,226 | |||||

| Loss on debt extinguishment and modification | - | 5,340 | |||||

| Impairment of long-lived assets | 15,888 | - | |||||

| Share-based compensation | 10,516 | 31,091 | |||||

| Provision for independent operator and other accounts receivable reserves | 4,853 | 3,674 | |||||

| Deferred income taxes | 12,123 | 18,819 | |||||

| Other | 1,015 | 487 | |||||

| Changes in operating assets and liabilities: | |||||||

| Independent operator and other accounts receivable | (7,515 | ) | (11,031 | ) | |||

| Merchandise inventories | (29,951 | ) | (15,674 | ) | |||

| Prepaid expenses and other assets | 7,645 | (10,716 | ) | ||||

| Income and other taxes payable | (3,766 | ) | 5,918 | ||||

| Trade accounts payable | (36,936 | ) | 73,771 | ||||

| Accrued and other liabilities | (25,240 | ) | 19,723 | ||||

| Accrued compensation | (7,755 | ) | (2,445 | ) | |||

| Operating lease liabilities | 17,725 | 10,761 | |||||

| Net cash provided by operating activities | 111,963 | 303,447 | |||||

| Cash flows from investing activities: | |||||||

| Advances to independent operators | (11,364 | ) | (8,565 | ) | |||

| Repayments of advances from independent operators | 4,778 | 5,734 | |||||

| Business acquisition, net of cash and cash equivalents acquired | (60,526 | ) | - | ||||

| Purchases of property and equipment | (186,611 | ) | (168,990 | ) | |||

| Proceeds from sales of assets | - | 24 | |||||

| Investments in intangible assets and licenses | (20,305 | ) | (23,000 | ) | |||

| Proceeds from insurance recoveries - property and equipment | - | 632 | |||||

| Net cash used in investing activities | (274,028 | ) | (194,165 | ) | |||

| Cash flows from financing activities: | |||||||

| Proceeds from exercise of stock options | 8,845 | 5,958 | |||||

| Tax withholding related to net settlement of employee share-based awards | - | (537 | ) | ||||

| Proceeds from senior term loan due 2028 | - | 300,000 | |||||

| Proceeds from revolving credit facility | 190,000 | 25,000 | |||||

| Principal payments on revolving credit facility | - | (25,000 | ) | ||||

| Principal payments on senior term loan due 2025 | - | (385,000 | ) | ||||

| Principal payments on senior term loan due 2028 | (5,625 | ) | (5,625 | ) | |||

| Principal payments on finance leases | (1,959 | ) | (1,398 | ) | |||

| Repurchase of common stock | (81,355 | ) | (5,893 | ) | |||

| Dividends paid | - | (15 | ) | ||||

| Debt issuance costs paid | - | (4,513 | ) | ||||

| Net cash provided by (used in) financing activities | 109,906 | (97,023 | ) | ||||

| Net (decrease) increase in cash and cash equivalents | (52,159 | ) | 12,259 | ||||

| Cash and cash equivalents at beginning of period | 114,987 | 102,728 | |||||

| Cash and cash equivalents at end of period | $ | 62,828 | $ | 114,987 | |||

| GROCERY OUTLET HOLDING CORP. RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA (in thousands) (unaudited) | |||||||||||||||

| 13 Weeks Ended | 52 Weeks Ended | ||||||||||||||

| December 28, 2024 | December 30, 2023 | December 28, 2024 | December 30, 2023 | ||||||||||||

| Net income | $ | 2,311 | $ | 14,106 | $ | 39,465 | $ | 79,437 | |||||||

| Interest expense, net | 6,982 | 1,450 | 22,156 | 16,361 | |||||||||||

| Income tax expense | 2,080 | 3,370 | 16,706 | 24,644 | |||||||||||

| Depreciation and amortization expenses | 28,957 | 24,301 | 108,206 | 87,982 | |||||||||||

| EBITDA | 40,330 | 43,227 | 186,533 | 208,424 | |||||||||||

| Share-based compensation expenses (benefits) (1) | (6,290 | ) | 5,575 | 10,516 | 31,091 | ||||||||||

| Loss on debt extinguishment and modification (2) | - | - | - | 5,340 | |||||||||||

| Asset impairment and gain or loss on disposition (3) | 86 | 25 | 1,047 | 485 | |||||||||||

| Acquisition and integration costs (4) | 285 | 459 | 8,631 | 459 | |||||||||||

| Amortization of purchase accounting assets (5) | - | - | 839 | - | |||||||||||

| Restructuring(6) | 15,888 | - | 15,888 | - | |||||||||||

| Other(7) | 6,949 | 1,595 | 13,325 | 6,822 | |||||||||||

| Adjusted EBITDA | $ | 57,248 | $ | 50,881 | $ | 236,779 | $ | 252,621 | |||||||

| GROCERY OUTLET HOLDING CORP. RECONCILIATION OF GAAP NET INCOME TO ADJUSTED NET INCOME (in thousands, except per share data) (unaudited) | |||||||||||||||

| 13 Weeks Ended | 52 Weeks Ended | ||||||||||||||

| December 28, 2024 | December 30, 2023 | December 28, 2024 | December 30, 2023 | ||||||||||||

| Net income | $ | 2,311 | $ | 14,106 | $ | 39,465 | $ | 79,437 | |||||||

| Share-based compensation expenses (benefits) (1) | (6,290 | ) | 5,575 | 10,516 | 31,091 | ||||||||||

| Loss on debt extinguishment and modification (2) | - | - | - | 5,340 | |||||||||||

| Asset impairment and gain or loss on disposition (3) | 86 | 25 | 1,047 | 485 | |||||||||||

| Acquisition and integration costs (4) | 285 | 459 | 8,631 | 459 | |||||||||||

| Amortization of purchase accounting assets and deferred financing costs (5) | 1,389 | 1,423 | 6,328 | 5,838 | |||||||||||

| Restructuring (6) | 15,888 | - | 15,888 | - | |||||||||||

| Other (7) | 6,949 | 1,595 | 13,325 | 6,822 | |||||||||||

| Tax adjustment to normalize effective tax rate (8) | 129 | (2,149 | ) | (1,179 | ) | (6,423 | ) | ||||||||

| Tax effect of total adjustments (9) | (6,229 | ) | (2,853 | ) | (17,746 | ) | (14,936 | ) | |||||||

| Adjusted net income | $ | 14,518 | $ | 18,181 | $ | 76,275 | $ | 108,113 | |||||||

| GAAP earnings per share: | |||||||||||||||

| Basic | $ | 0.02 | $ | 0.14 | $ | 0.40 | $ | 0.80 | |||||||

| Diluted | $ | 0.02 | $ | 0.14 | $ | 0.40 | $ | 0.79 | |||||||

| Adjusted earnings per share: | |||||||||||||||

| Basic | $ | 0.15 | $ | 0.18 | $ | 0.77 | $ | 1.10 | |||||||

| Diluted | $ | 0.15 | $ | 0.18 | $ | 0.77 | $ | 1.07 | |||||||

| Weighted average shares outstanding: | |||||||||||||||

| Basic | 97,407 | 99,292 | 98,707 | 98,709 | |||||||||||

| Diluted | 98,021 | 101,144 | 99,615 | 100,831 | |||||||||||

__________________________

| (1) | Includes non-cash share-based compensation expense and cash dividends paid on vested share-based awards as a result of dividends declared in connection with a recapitalization that occurred in fiscal 2018. | |

| (2) | Represents the write-off of debt issuance costs and debt discounts as well as debt modification costs related to refinancing and/or repayment of the Company's credit facilities. | |

| (3) | Represents non-restructuring asset impairment charges and gains or losses on dispositions of assets. | |

| (4) | Represents costs related to the acquisition and integration of United Grocery Outlet, including due diligence, legal, other consulting and retention bonus expenses. | |

| (5) | For purposes of determining adjusted EBITDA, this line represents the incremental amortization of inventory step-ups resulting from purchase price accounting related to the acquisition. For purposes of determining adjusted net income, in addition to the previously noted item, this line also represents the incremental amortization of an asset step-up resulting from purchase price accounting related to our acquisition in 2014 by an investment fund affiliated with Hellman & Friedman LLC, as well as the amortization of debt issuance costs, as these items are already included in the adjusted EBITDA reconciliation within the depreciation and amortization expenses and interest income, net, respectively. | |

| (6) | Represents the impairment of long-lived assets related to the Restructuring Plan. | |

| (7) | Represents other non-recurring, non-cash or non-operational items, such as certain personnel-related hiring and termination costs, system implementation costs, legal settlements and other legal expenses, costs related to employer payroll taxes associated with equity awards, store closing costs, strategic project costs and miscellaneous costs. | |

| (8) | Represents adjustments to normalize the effective tax rate for the impact of unusual or infrequent tax items that the Company does not consider in its evaluation of ongoing performance, including excess tax expenses or benefits related to stock option exercises and vesting of time-based restricted stock units and performance-based restricted stock units that are recorded in earnings as discrete items in the reporting period in which they occur. | |

| (9) | Represents the tax effect of the total adjustments. The Company calculates the tax effect of the total adjustments on a discrete basis excluding any non-recurring and unusual tax items. | |