NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA, BELARUS, HONG KONG, JAPAN, CANADA, NEW ZEALAND, RUSSIA, SINGAPORE, SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH THE RELEASE, DISTRIBUTION OR PUBLICATION WOULD BE UNLAWFUL, REQUIRE REGISTRATION OR OTHER MEASURE PURSUANT TO APPLICABLE LAW. PLEASE SEE "IMPORTANT INFORMATION" AT THE END OF THIS PRESS RELEASE.

The board of directors of Svenska Aerogel Holding AB (publ) ("Svenska Aerogel" or the "Company") has today, 26 February 2025, based on the authorization from the annual general meeting on 18 June 2024, resolved to carry out a new issue of up to 19,001,452 shares with preferential rights for the Company's existing shareholders (the "Rights Issue"). The subscription price has been set at SEK 2.25 per share. Upon full subscription of the Rights Issue, Svenska Aerogel will receive approximately SEK 42.7 million before issue related costs. The Company has received subscription commitments from existing shareholders, including members of the board of directors and management, amounting to approximately SEK 11 million, corresponding to 25.7 percent of the Rights Issue. In addition to subscription commitments, a number of external investors have entered into underwriting commitments of approximately SEK 13.6 million, corresponding to 31.8 percent of the Rights Issue. Thus, the Rights Issue is covered to approximately 57.5 percent through subscription commitments and underwriting commitments.

Summary

- Upon full subscription in the Rights Issue, Svenska Aerogel will receive up to approximately SEK 42.7 million before issue related costs.

- The net proceeds are intended to be used for the following purposes in order of priority: (i) Sales and marketing, (ii) Application development, and (iii) Production development.

- One (1) existing share in the Company entitles the holder to one (1) subscription right. One (1) subscription right entitles the holder to subscribe for two (2) newly issued shares. This means that a total of up to 19,001,452 new shares can be issued in the Rights Issue.

- The subscription price has been set at 2.25 SEK per share.

- Through the Rights Issue, Svenska Aerogel can receive up to approximately SEK 42.7 million before deduction of costs related to the Rights Issue, which are estimated to amount to approximately SEK 3.3 million, of which approximately SEK 1.9 million constitutes compensation for the underwriting commitments, provided that all underwriters choose cash compensation.

- The subscription period runs from 10 March 2025 to 24 March 2025. Subscription rights not exercised during the subscription period will become invalid and lose their value. Trading in subscription rights is planned to take place on Nasdaq First North Growth Market from 10 March to 19 March 2025. Trading in BTA (paid subscribed shares) is expected to occur on Nasdaq First North Growth Market from 10 March 2025 to on or around 2 April 2025.

- The Rights Issue entails a maximum dilution of approximately 66.7 percent for shareholders who choose not to participate in the Rights Issue.

- The Rights Issue is covered to approximately 25.8 percent by subscription commitments and to approximately 31.7 per cent by underwriting commitments. The Rights Issue is thus covered to 57.5 percent by subscription commitments and underwriting commitments. The subscription commitments and underwriting commitments are not secured by bank guarantee, escrow funds, pledging, or similar arrangements.

- Complete information regarding the Rights Issue and information about the Company will be published on the Company's website around 9 March 2025.

Background and rationale

The Company's product, Quartzene®, demonstrates improved barrier properties primarily in four different customer segments: Building & Construction, Process Industry, Transport, and Advanced. The Company's customers have also made several advancements in their development projects. One of them is Outlast® Technologies ("Outlast"), a global company specializing in temperature-regulating solutions for the textile industry, which, after a successful pilot phase, submitted a patent application in November 2024 and launched products in January 2025. Matrix Brands ("Matrix"), specializing in the development and commercialization of global brands in the personal care sector, is another customer planning a launch in 2025.

In 2024, the number of customers investing in product development using Svenska Aerogels technology increased significantly, with a total of 150 customer projects, representing a growth of 60 percent compared to the previous year. A growing proportion of customers are entering the ramp-up phase, while several of the world-leading players within the selected customer segments are developing products based on the Company's technology. The Company has identified a total of six key customers distributed across the four customer segments. All of these are companies that Svenska Aerogel sees significant potential in and are expected to enter the commercial phase quickly.

Quartzene® competes with traditional aerogels by being sustainable, cost-effective, flexible, and scalable. Svenska Aerogel's technology with Quartzene® and production capacity allows for broader use of aerogel materials than was previously possible. Examples of markets where Svenska Aerogel sees great potential include the market for thermally insulating and fire-retardant coatings and the market for boat bottom paints.

One notable example in the field of fire-retardant coatings is Dekro Paints (Pty) Ltd, which has developed an advanced intumescent paint system enhanced by Svenska Aerogel's Quartzene® material. Following a series of successful laboratory tests, the customer entered the certification phase of the project - a required step to ensure the performance is verified by an independent institute before launch. Completion of the certification is expected to be completed by mid-2025.

Within the Transport segment has Belcor®, a European provider of nonwoven-based thermal and fire protection solutions, filed a patent application for its technology integrating the Belcotex® fibers with Svenska Aerogels material Quartzene®. This innovation enables Belcor® to deliver remarkable results in OEM applications for electric vehicle (EV) batteries, ensuring highest battery safety and thermal management.

Svenska Aerogel applied for a patent in July 2023 for the product SeaQare®, which is added to boat bottom paint and contributes to controlled copper release that protects boat bottoms from fouling. After good results from two independent static sea tests conducted in Sweden, the Company expanded testing of the product in Florida, USA, where it also achieved positive effects. Two boat bottom paint producers have initiated tests with the goal of using the Company's technology if the tests demonstrate positive results.

Use of proceeds:

The Company will receive net proceeds of approximately SEK 38.5 million, after set-offs of approximately SEK 5.3 million (from Patrik Björn) and deducting issuance costs of around SEK 4.2 million. Given the Company's current business plan and considering the above-mentioned background, the Company will use the net proceeds for the following purposes, listed in order of priority (regardless of the amount of proceeds received in the Rights Issue):

- Sales and marketing, approximately 53 percent.

- Advance the 150 ongoing customer projects toward commercialization, aiming to have at least 10 commercial projects launched by the end of 2025. Further strengthen the incoming pipeline across the customer segments: Building & Construction, Process Industry, Transport, and Advanced Materials.

- Application development, approximately 26 percent.

- Development of the next generation Quartzene® for increased performance and a more efficient manufacturing process.

- Production development, approximately 21 percent.

- Enhance production efficiency to lower the cost per unit while further decreasing environmental impact.

- Further prepare for scalable and cost-efficient capacity expansion through optimized equipment utilization, streamlined processes, and digital adaptation for a seamless continuous production flow.

The Company estimates that the working capital, in the event that the Rights Issue is subscribed to the amount covered by subscription commitments and underwriting commitments, will be sufficient until January 2026.

Terms of the Rights Issue, shares, share capital and dilution

Those who are registered as shareholders in Svenska Aerogel on the record date of 6 March 2025 have preferential rights to subscribe for new shares in the Company in relation to their existing shareholding. Shareholders receive one (1) subscription right for each share held in the Company. The subscription rights entitle the holder to subscribe for new shares in the Rights Issue, whereby one (1) subscription right gives the shareholder the right to subscribe for two (2) new shares. In addition, investors are offered the opportunity to apply for subscription of shares without the support of subscription rights.

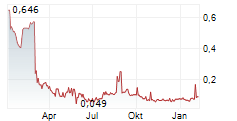

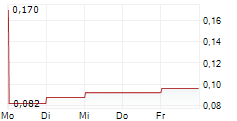

The subscription price in the Rights Issue has been set at 2.25 SEK per share. Through the Rights Issue, the total number of shares in the Company will increase by 19,001,452 shares, from 9,500,726 shares to 28,502,178 shares. The share capital will increase by 1,140,087.12 SEK, from 570,043.56 SEK to 1,710,130.68 SEK. Shareholders who choose not to participate in the Rights Issue will have their ownership diluted by up to approximately 66.7 percent.

If the Rights Issue is fully subscribed and all underwriters choose to receive compensation in the form of shares, the Company's share capital will increase by an additional maximum of 57,879.72 SEK, through the issuance of up to 964,662 shares.

Subscription of the new shares shall take place during the period 10 March 2025 up until 24 March 2025. Trading in subscription rights is expected to take place on Nasdaq First North Growth Market during the period from 10 March 2025 to 19 March 2025, and trading in BTA (paid subscribed shares) is expected to take place from 10 March to 2 April 2025.

No prospectus will be prepared in connection with the Rights Issue. The Company will prepare and publish an information document in the form prescribed by Regulation (EU) 2024/2809 ("Listing Act") Appendix IX.

Subscription commitments and underwriting commitments

The Rights Issue is covered to approximately 57.5 percent by subscription commitments and underwriting commitments, of which subscription commitments correspond to approximately 25.7 percent of the Rights Issue and bottom underwriting commitments to approximately 31.8 percent of the Rights Issue. For bottom underwriters, compensation is paid in cash amounting to fourteen (14) percent, or in the form of newly issued shares in the Company of sixteen (16) percent of the guaranteed amount. No compensation is paid for subscription commitments. The subscription commitments and underwriting commitments are not secured by bank guarantee, escrow funds, pledging, or similar arrangements.

Preliminary Timetable for the Rights Issue

6 March 2025: Record date for participation in the Rights Issue

7 March 2025: Estimated date for publication of Annex IX and Memorandum

10 March - 24 March 2025: Subscription period

10 March - 19 March 2025: Trading in subscription rights

25 March 2025: Estimated date for publication of the outcome of the Rights Issue

Year-end Report

The company brings forward the publication of the year-end report to 27 February 2025.

Advisors

Svenska Aerogel has mandated Penser by Carnegie, Carnegie Investment Bank AB (publ) and Eversheds Sutherland Advokatbyrå AB as financial and legal advisors respectively in connection with the Rights Issue.

For further information, please contact:

Tor Einar Norbakk, CEO. Telephone: +46 (0)70 616 08 67. E-mail: toreinar.norbakk@aerogel.se

The information is information that Svenska Aerogel Holding AB (publ) is obliged to make public according to the EU Market Abuse Regulation. This information was released, through the agency of the above-mentioned contact person, on 2025-02-26, at 18:30. CET.

About Svenska Aerogel Holding AB (publ)

Svenska Aerogel manufactures and commercializes the mesoporous material Quartzene®. Svenska Aerogel's business concept is to meet the market's need for new materials that are in line with global sustainability objectives. Quartzene® is flexible and can be tailored to different applications to add essential properties to an end product. The company's vision is to be the most valued business partner providing pioneering material solutions for a sustainable world.

Svenska Aerogel Holding AB is listed on Nasdaq First North Growth Market. Certified Adviser is FNCA.

IMPORTANT INFORMATION

THIS PRESS RELEASE DOES NOT CONTAIN AND DOES NOT CONSTITUTE AN OFFER TO ACQUIRE, SUBSCRIBE OR OTHERWISE TRADE IN SHARES, SUBSCRIPTION RIGHTS, BTA, CONVERTIBLES OR OTHER SECURITIES IN SVENSKA AEROGEL. THE OFFER TO RELEVANT PERSONS REGARDING THE SUBSCRIPTION OF SHARES IN SVENSKA AEROGEL WILL ONLY BE MADE THROUGH THE INFORMATION DOCUMENT IN THE FORM PRESCRIBED BY REGULATION (EU) 2024/2809, APPENDIX IX, THAT SVENSKA AEROGEL WILL PUBLISH ON ITS WEBSITE BEFORE THE START OF THE SUBSCRIPTION PERIOD.

THE INFORMATION IN THIS PRESS RELEASE MAY NOT BE DISCLOSED, PUBLISHED OR DISTRIBUTED, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES (INCLUDING ITS TERRITORIES AND POSSESSIONS), AUSTRALIA, JAPAN, CANADA, HONG KONG, NEW ZEALAND, SINGAPORE OR SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE DISTRIBUTION OR PUBLICATION WOULD BE ILLEGAL OR REQUIRE REGISTRATION OR OTHER MEASURES THAN THOSE THAT FOLLOW FROM SWEDISH LAW. ACTIONS THAT VIOLATE THESE RESTRICTIONS MAY CONSTITUTE A VIOLATION OF APPLICABLE SECURITIES LAWS.

NO SHARES, SUBSCRIPTION RIGHTS, BTA, CONVERTIBLES OR OTHER SECURITIES HAVE BEEN REGISTERED, AND NO SHARES, SUBSCRIPTION RIGHTS, BTA, CONVERTIBLES OR OTHER SECURITIES WILL BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933 AS CURRENTLY AMENDED ("SECURITIES ACT") OR THE SECURITIES LEGISLATION OF ANY STATE OR OTHER JURISDICTION OF THE UNITED STATES AND NO SHARES, SUBSCRIPTION RIGHTS, BTA, CONVERTIBLES OR OTHER SECURITIES MAY BE OFFERED, SOLD, OR OTHERWISE TRANSFERRED, DIRECTLY OR INDIRECTLY, WITHIN OR INTO THE UNITED STATES, EXCEPT UNDER AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS UNDER THE SECURITIES ACT AND IN COMPLIANCE WITH THE SECURITIES LEGISLATION IN THE RELEVANT STATE OR ANY OTHER JURISDICTION OF THE UNITED STATES.

IN ALL EEA MEMBER STATES ("EEA"), OTHER THAN SWEDEN, DENMARK, FINLAND AND NORWAY, THIS PRESS RELEASE IS INTENDED FOR AND IS DIRECTED ONLY TO QUALIFIED INVESTORS IN THE RELEVANT MEMBER STATE AS DEFINED IN THE REGULATION (EU) 2017/1129 (TOGETHER WITH ASSOCIATED DELEGATED REGULATIONS AND IMPLEMENTING REGULATIONS, THE "PROSPECTUS REGULATION"), I.E. ONLY TO THOSE INVESTORS WHO CAN RECEIVE THE OFFER WITHOUT AN APPROVED PROSPECTUS IN SUCH EEA MEMBER STATE.

IN THE UNITED KINGDOM, THIS PRESS RELEASE IS DIRECTED AND COMMUNICATED ONLY TO PERSONS WHO ARE QUALIFIED INVESTORS AS DEFINED IN ARTICLE 2(E) OF THE PROSPECTUS REGULATION (AS INCORPORATED INTO DOMESTIC LAW IN THE UNITED KINGDOM) WHO ARE (I) PERSONS WHO FALL WITHIN THE DEFINITION OF "PROFESSIONAL INVESTORS" IN ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS AMENDED) ("THE REGULATION"), OR (II) PERSONS COVERED BY ARTICLE 49(2)(A) - (D) IN THE REGULATION, OR (III) PERSONS TO WHOM THE INFORMATION MAY OTHERWISE LAWFULLY BE COMMUNICATED (ALL SUCH PERSONS REFERRED TO IN (I), (II) AND (III) ABOVE ARE COLLECTIVELY REFERRED TO AS "RELEVANT PERSONS"). SECURITIES IN THE COMPANY ARE ONLY AVAILABLE TO, AND ANY INVITATION, OFFER OR AGREEMENT TO SUBSCRIBE, PURCHASE OR OTHERWISE ACQUIRE SUCH SECURITIES WILL ONLY BE PROCESSED IN RESPECT OF RELEVANT PERSONS. PERSONS WHO ARE NOT RELEVANT PERSONS SHOULD NOT ACT BASED ON OR RELY ON THE INFORMATION CONTAINED IN THIS PRESS RELEASE.

THIS ANNOUNCEMENT DOES NOT CONSTITUTE AN INVESTMENT RECOMMENDATION. THE PRICE AND VALUE OF SECURITIES AND ANY INCOME FROM THEM CAN GO DOWN AS WELL AS UP AND YOU COULD LOSE YOUR ENTIRE INVESTMENT. PAST PERFORMANCE IS NOT A GUIDE TO FUTURE PERFORMANCE. INFORMATION IN THIS ANNOUNCEMENT CANNOT BE RELIED UPON AS A GUIDE TO FUTURE PERFORMANCE.

FORWARD-LOOKING STATEMENTS

MATTERS DISCUSSED IN THIS PRESS RELEASE MAY CONTAIN FORWARD-LOOKING STATEMENTS. SUCH STATEMENTS ARE ALL STATEMENTS THAT ARE NOT HISTORICAL FACTS AND CONTAIN EXPRESSIONS SUCH AS "BELIEVES", "EXPECTS", "ANTICIPATES", "INTENDS", "ESTIMATES", "WILL", "MAY", "CONTINUES", "SHOULD" AND OTHER SIMILAR EXPRESSIONS. THE FORWARD-LOOKING STATEMENTS IN THIS PRESS RELEASE ARE BASED ON VARIOUS ASSUMPTIONS, WHICH IN SEVERAL CASES ARE BASED ON ADDITIONAL ASSUMPTIONS. ALTHOUGH SVENSKA AEROGEL BELIEVES THESE ASSUMPTIONS WERE REASONABLE WHEN MADE, SUCH FORWARD-LOOKING STATEMENTS ARE SUBJECT TO KNOWN AND UNKNOWN RISKS, UNCERTAINTIES, CONTINGENCIES AND OTHER MATERIAL FACTORS THAT ARE DIFFICULT OR IMPOSSIBLE TO PREDICT AND BEYOND ITS CONTROL. SUCH RISKS, UNCERTAINTIES, CONTINGENCIES AND MATERIAL FACTORS COULD CAUSE ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED IN THIS COMMUNICATION THROUGH THE FORWARD-LOOKING STATEMENTS. THE INFORMATION, PERCEPTIONS AND FORWARD-LOOKING STATEMENTS CONTAINED IN PRESS RELEASE SPEAK ONLY AS AT ITS DATE, AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. SVENSKA AEROGEL UNDERTAKES NO OBLIGATION TO UPDATE OR REVISE ANY FORWARD-LOOKING STATEMENTS, WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS OR OTHER CIRCUMSTANCES, EXCEPT FOR WHEN IT IS REQUIRED BY LAW OR OTHER REGULATIONS. ACCORDINGLY, INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON ANY OF THESE FORWARD-LOOKING STATEMENTS.

INFORMATION TO DISTRIBUTORS

SOLELY FOR THE PURPOSES OF THE PRODUCT GOVERNANCE REQUIREMENTS CONTAINED WITHIN: (A) EU DIRECTIVE 2014/65/EU ON MARKETS IN FINANCIAL INSTRUMENTS, AS AMENDED ("MIFID II"); (B) ARTICLES 9 AND 10 OF COMMISSION DELEGATED DIRECTIVE (EU) 2017/593 SUPPLEMENTING MIFID II; AND (C) LOCAL IMPLEMENTING MEASURES (TOGETHER, THE "MIFID II PRODUCT GOVERNANCE REQUIREMENTS"), AND DISCLAIMING ALL AND ANY LIABILITY, WHETHER ARISING IN TORT, CONTRACT OR OTHERWISE, WHICH ANY "MANUFACTURER" (FOR THE PURPOSES OF THE MIFID II PRODUCT GOVERNANCE REQUIREMENTS) MAY OTHERWISE HAVE WITH RESPECT THERETO, THE SHARES IN SVENSKA AEROGEL HAVE BEEN SUBJECT TO A PRODUCT APPROVAL PROCESS, WHICH HAS DETERMINED THAT SUCH SHARES ARE: (I) COMPATIBLE WITH AN END TARGET MARKET OF RETAIL INVESTORS AND INVESTORS WHO MEET THE CRITERIA OF PROFESSIONAL CLIENTS AND ELIGIBLE COUNTERPARTIES, EACH AS DEFINED IN MIFID II; AND (II) ELIGIBLE FOR DISTRIBUTION THROUGH ALL DISTRIBUTION CHANNELS AS ARE PERMITTED BY MIFID II (THE "TARGET MARKET ASSESSMENT"). NOTWITHSTANDING THE TARGET MARKET ASSESSMENT, DISTRIBUTORS SHOULD NOTE THAT: THE PRICE OF THE SHARES IN SVENSKA AEROGEL MAY DECLINE AND INVESTORS COULD LOSE ALL OR PART OF THEIR INVESTMENT; THE SHARES IN SVENSKA AEROGEL OFFER NO GUARANTEED INCOME AND NO CAPITAL PROTECTION; AND AN INVESTMENT IN THE SHARES IN SVENSKA AEROGEL IS COMPATIBLE ONLY WITH INVESTORS WHO DO NOT NEED A GUARANTEED INCOME OR CAPITAL PROTECTION, WHO (EITHER ALONE OR IN CONJUNCTION WITH AN APPROPRIATE FINANCIAL OR OTHER ADVISER) ARE CAPABLE OF EVALUATING THE MERITS AND RISKS OF SUCH AN INVESTMENT AND WHO HAVE SUFFICIENT RESOURCES TO BE ABLE TO BEAR ANY LOSSES THAT MAY RESULT THEREFROM. THE TARGET MARKET ASSESSMENT IS WITHOUT PREJUDICE TO THE REQUIREMENTS OF ANY CONTRACTUAL, LEGAL OR REGULATORY SELLING RESTRICTIONS IN RELATION TO THE RIGHTS ISSUE.

FOR THE AVOIDANCE OF DOUBT, THE TARGET MARKET ASSESSMENT DOES NOT CONSTITUTE: (A) AN ASSESSMENT OF SUITABILITY OR APPROPRIATENESS FOR THE PURPOSES OF MIFID II; OR (B) A RECOMMENDATION TO ANY INVESTOR OR GROUP OF INVESTORS TO INVEST IN, OR PURCHASE, OR TAKE ANY OTHER ACTION WHATSOEVER WITH RESPECT TO THE SHARES IN SVENSKA AEROGEL.

EACH DISTRIBUTOR IS RESPONSIBLE FOR UNDERTAKING ITS OWN TARGET MARKET ASSESSMENT IN RESPECT OF THE SHARES IN SVENSKA AEROGEL AND DETERMINING APPROPRIATE DISTRIBUTION CHANNELS.