Vancouver, British Columbia--(Newsfile Corp. - February 27, 2025) - American Pacific Mining Corp (CSE: USGD) (OTCQX: USGDF) (FSE: 1QC1) ("American Pacific" or the "Company") highlights the strengthening bull case for copper in light of recent US policy developments and how the Company's US-based copper assets are strategically positioned to benefit from these trends.

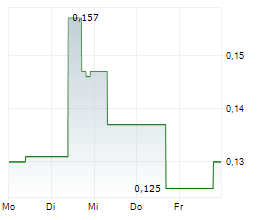

President Trump said on Sunday, that he would impose 25% tariffs on all steel and aluminum imports and also threatened to apply levies on imported copper. US metals prices, including copper, have been increasing with significant premiums ahead of potential tariffs on imports. This surge in domestic copper prices reflects growing concerns about supply constraints and highlights the increasing importance of US-based copper assets.

The Financial Times recently reported that premiums for US copper futures have widened to over US $800 per tonne above London prices, the highest level since early 2020, as US buyers compete to secure copper supplies in anticipation of potential tariffs. The US relies heavily on imports for its copper needs, emphasizing the value of domestic copper supply.

Image 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10322/242574_07b617d754e37a8a_001full.jpg

Warwick Smith, CEO of American Pacific, commented: "The current market dynamics and US policy trends underscore the strategic value of our US-based copper assets. With projects like our Madison Copper-Gold project in Montana, and Palmer Copper-Zinc project in Alaska, we are well-positioned to potentially supply the growing domestic demand for copper, a critical metal for the US economy and clean energy transition."

Palmer Copper-Zinc VMS Project, Alaska

Last year, American Pacific reported the highest-grade copper intercepts ever drilled at its Palmer project, including:

- CMR23-172 Zone 1: 43.8 m grading 6.54% Cu, 3.15% Zn, 0.42 g/t Au and 27.97 g/t Ag (8.22% CuEq)

- CMR23-167 Zone 1: 37.1 m grading 4.57% Cu, 8.44% Zn, 0.50 g/t Au and 29.33 g/t Ag (8.40% CuEq)

- CMR23-169 Zone 1: 33.2 m grading 5.48% Cu, 7.22% Zn, 0.64 g/t Au and 36.78 g/t Ag (8.95% CuEq)

- CMR23-171 Zone 1: 23.9 m grading 9.03% Cu, 3.49% Zn, 0.83 g/t Au and 41.75 g/t Ag (11.15% CuEq)

Notes: Cu = copper; Au = gold; g/t = grams per tonne

Additionally, the Company recently published an updated mineral Resource estimate on the project, which showed a substantial increase in contained copper (see January 20, 2025 news release).

Palmer 2025 Mineral Resource Estimate

Indicated: 4.77 million tonnes at 1.69% copper, 5.17% zinc, 0.14% lead, 28.4 g/t silver, 0.29 g/t gold, 20.6% barite (3.5% copper equivalent or 13.2% zinc equivalent)

Inferred: 12.00 million tonnes at 0.57% copper, 3.92% zinc, 0.47% lead, 66.3 g/t silver, 0.33 g/t gold, 25.5% barite (3.1% copper equivalent or 8.9% zinc equivalent)

Madison Copper-Gold Project, Montana

The high-grade Madison Project was host to small-scale production in the early 2000s with 2.7 million pounds of copper produced at grades ranging from 20-30% copper. Historic drill highlights include:

8.47 metres of 40.03% Cu

61.63 metres of 6.97% Cu

More recent drilling returned additional high-grade intercepts which confirmed the presence of widespread mineralization beyond what was historically mined (see September 23, 2024 news release).

Phase I 2024 Drill Highlights:

8APMMAD24-09: 8.14 metres of 3.66% Cu, 29.72 metres of 2.09% Cu and 9.75 metres of 1.56% Cu, within a broader 75.13-metre zone of 0.98% Cu

APMMAD24-08: 2.90 metres of 2.41% Cu and 3.17 g/t Au

APMMAD24-06: 12.34 metres of 0.88% Cu and 10.36 g/t Au

Underground sampling of the old mine workings also returned high grades (see September 26, 2024 news release).

Sample Highlights:

- MADZH24-003: 45.50% Cu and 2.17 g/t Au

- MADZH24-001: 31.00% Cu and 8.40 g/t Au

- MADZH24-002: 23.30% Cu and 1.90 g/t Au

- MADZH24-004: 3.19% Cu and 0.14 g/t Au

With $16 million in its treasury as of January, American Pacific is well funded to advance its projects and is expected to commence a Phase II 3,000 metre drill program at its high-grade Madison project beginning in March. Phase II and III drilling programs also aim to test deeper regional targets identified through comprehensive field mapping and rock sampling.

About American Pacific Mining Corp.

American Pacific Mining Corp. is a precious and base metals explorer focused on opportunities in the Western United States. The Company has two flagship assets: the Madison Project, a high-grade past-producing copper-gold project in Montana; and the Palmer Project, a copper-zinc Volcanic Massive Sulphide-Sulphate (VMS) project in Alaska. For the Madison transaction, American Pacific was selected as a finalist in both 2021 and 2022 for 'Deal of the Year' at the S&P Global Platts Metals Awards, an annual program that recognizes exemplary accomplishments in 16 performance categories.

Also, in American Pacific's asset portfolio are high-grade, precious metals projects located in key mining districts in Nevada, USA, including the Ziggurat Gold Project and the Tuscarora Gold-Silver District. The Company's mission is to grow by the drill bit, strategic partnerships, and M&A.

On behalf of the American Pacific Mining Corp Board of Directors:

Warwick Smith, CEO & Director

Corporate Office: Suite 910 - 510 Burrard Street

Vancouver, BC, V6C 3A8 Canada

Investor relations contact:

Kristina Pillon, High Tide Consulting Corp.

604.908.1695 / Kristina@americanpacific.ca

Media relations contact:

Adam Bello, Primoris Group Inc.

416.489.0092 / media@primorisgroup.com

The Canadian Securities Exchange has neither approved nor disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/242574

SOURCE: American Pacific Mining Corp.