Toronto, Ontario--(Newsfile Corp. - February 27, 2025) - Awakn Life Sciences Corp. (CSE: AWKN) (OTC Pink: AWKNF) (FSE: 954) ("Awakn" or the "Company") a clinical-stage biotechnology company developing therapeutics for substance use and mental health disorders, is pleased to announce that, further to its press release of December 16, 2024, the Company has entered into an arrangement agreement dated February 22, 2025 (the "Agreement") with Solvonis Therapeutics plc (LSE: SVNS) (formerly, Graft Polymer (UK) PLC) ("Solvonis") setting out the basis on which the parties will cooperate to execute a transaction whereby Solvonis will acquire all of the outstanding common shares (the "Common Shares") in the capital of the Company, all outstanding restricted share units (the "RSUs") in the capital of the Company, and all outstanding deferred share units (the "DSUs") in the capital of the Company, pursuant to a plan of arrangement (the "Transaction").

Pursuant to the Agreement, each Awakn shareholder will receive 46.67 ordinary shares in the capital of Solvonis (the "Consideration Shares") (each, a "Solvonis Share") for each one (1) Common Share held. Holders of RSUs and DSUs will receive 46.67 Solvonis Shares for each one (1) DSU and one (1) RSU, respectfully. All issued and outstanding Common Share purchase warrants (each, a "Warrant") shall be converted into or exchanged for new ordinary share purchase warrants (each, a "Solvonis Warrant") with adjustments to: (i) the number of Solvonis Shares issued upon exercise of the Warrants; and (ii) the exercise price, such that the Warrant holder will be entitled to receive upon exercise of the Solvonis Warrants that number of Solvonis Shares at such exercise price that the holder would have been entitled to receive had it exercised the Warrants immediately prior to the closing of the Transaction. It is intended that Awakn will seek consent from holders of all outstanding stock options to cancel such options.

Benefits to Awakn Shareholders

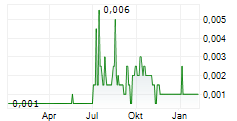

Premium. Under the terms of the Agreement, the consideration payable by Solvonis to shareholders of Awakn implies a value of C$0.146 per Common Share which represents a 53.52% premium to the closing share price of the Common Share on the Canadian Securities Exchange ("CSE") on December 13, 2024, the last trading day prior to the date of the announcement of the Arrangement and trading of the Awakn Common Shares was halted, and a 37.59% premium to the volume weighted average trading price of Common Share on the CSE over the 90 trading days ending on December 13, 2024.

Access to Capital. The Arrangement will provide Awakn, through Solvonis' listing on the London Stock Exchange (the "LSE"), with direct access to the London international capital markets and to a broader range of investors - including a range of institutional investors - than as offered by the CSE.

Future Development. The risks and potential rewards associated with Awakn continuing to execute its business and strategic plan as an independent entity, as an alternative to the Transaction, and that Solvonis will be better positioned to pursue a growth and value maximizing strategy as compared with Awakn on a standalone basis, as a result of Solvonis' larger market capitalization, increased technical expertise, asset diversification, increased financial capacity and enhanced access to capital over the long term and the likelihood of increased investor interest and access to business development opportunities due to the Solvonis' larger market presence.

Transaction Details

Upon completion of the Transaction, not including any shares issued by Solvonis pursuant to the Solvonis Financing (as defined below), existing Awakn and Solvonis shareholders will own approximately 47.47% and 52.53% of Solvonis, respectively. There are no finders fees payable by Awakn pursuant to the Transaction.

The Transaction will be completed pursuant to a court-approved plan of arrangement under the Business Corporations Act (British Columbia). The consummation of the Transaction is subject to a number of conditions customary to transactions of this nature, including, among others:

(a) the adoption of a resolution approving the Transaction at an annual general and special meeting of Awakn shareholders (the "Meeting") by (i) 662/3% of the votes cast by all Awakn shareholders present in person or represented by proxy at the Meeting; and (ii) 662/3% of the votes cast collectively by Awakn shareholders, and holders of Awakn Warrants, RSUs and DSUs present in person or represented by proxy at the Meeting;

(b) the approval of Solvonis shareholders, at a general meeting of Solvonis (to be convened), of resolutions to provide authority to the Solvonis directors to issue and allot the Consideration Shares, otherwise than on a pre-emptive basis;

(c) immediately prior to the closing of the Transaction Solvonis having binding commitments from investors for an equity financing (at a price and otherwise on terms acceptable to Awakn) to raise sufficient working capital for the requirements of the resulting issuer for a period of at least 12 months (the "Solvonis Financing");

(d) Solvonis obtaining the necessary regulatory approvals of the United Kingdom Financial Conduct Authority ("FCA") in relation to a prospectus which Solvonis is required to publish in order for Solvonis to issue the Consideration Shares; and

(e) the admission of Consideration Shares to trading on the Main Market of the London Stock Exchange and to listing on the equity shares (transition) category of the FCA's Official List.

The Agreement includes mutual covenants typical for transactions of this nature, including non- solicitation covenants and the completion of the Solvonis Financing. The Agreement provides for a $1,000,000 termination fee payable by either Awakn or Solvonis in certain circumstances.

Anthony Tennyson, the Chief Executive Officer and a director of Awakn, is also the Chief Executive Officer and a director of Solvonis. Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions MI 61-101 ("MI 61-101") provides that, in certain circumstances, where a "related party" (as defined in MI 61-101) of an issuer is entitled to receive a "collateral benefit" (as defined in MI 61-101) in connection with an arrangement transaction such as the Transaction, such transaction may be considered a "business combination" for the purposes of MI 61-101 and subject to minority shareholder approval requirements. An independent committee of Awakn's Board (the "Special Committee"), will conduct a "collateral benefit" assessment and applicable disclosure and any vote exclusions will be disclosed in the information circular for the Meeting.

The Transaction has been unanimously approved by the respective boards of Awakn and Solvonis, with Anthony Tennyson recused from voting. The board of directors of Awakn (the "Awakn Board") formed the Special Committee to, among other things, oversee the negotiations of the terms of the Transaction. The Special Committee, following its review of the terms and conditions of the Agreement and consideration of a number of factors and after receiving advice from its advisors, including an opinion from Evans & Evans, Inc. that the consideration to be received by the securityholders of Awakn pursuant to the Transaction is fair, from a financial point of view, to such securityholders, unanimously recommended that the Awakn Board approve the Transaction. After receiving the recommendation of the Special Committee and advice from its advisors, the Awakn Board has, with Anthony Tennyson recused from voting, unanimously determined that the Transaction is in the best interests of Awakn and recommends that securityholders of Awakn vote in favour of the Transaction.

Awakn shareholders representing an aggregate of over 50.69% of the outstanding Awakn Common Shares, and Awakn securityholders representing an aggregate of over 50.58% of the outstanding Awakn voting securities have entered into voting support agreements with Solvonis, pursuant to which such holders have agreed to vote in favour of the Transaction at the Meeting. Awakn will file a material change report in respect of the Transaction, and copies of the Arrangement Agreement, the plan of arrangement and the forms of voting support agreements will be filed with the applicable Canadian securities regulators and will be available for review on SEDAR+ at www.sedarplus.ca. Full details of the Transaction will be included in the management information circular of Awakn describing the matters to be considered at the Meeting, which is expected to be mailed to the shareholders of Awakn in April 2025. Copies of the management information circular and the Agreement will be made available on SEDAR+ (www.sedarplus.ca) under the profile of Awakn.

The Transaction is expected to close during the second calendar quarter of 2025, subject to the satisfaction (or waiver) of a number of conditions precedent, including approval by the Supreme Court of British Columbia. Following completion of the Transaction, the Common Shares will be delisted from the CSE and Awakn will apply to cease to be a reporting issuer in Canada.

Advisors

Evans & Evans, Inc. are acting as financial advisor to the Special Committee and has provided a fairness opinion to the Awakn Board and Special Committee in connection with the Transaction. Irwin Lowy LLP is acting as legal counsel to Awakn in connection with the Transaction. In connection with the Transaction, Allenby Capital is acting as financial advisor to Solvonis, DuMoulin Black LLP is acting as Canadian counsel to Solvonis, and Hill Dickinson LLP is acting as UK counsel to Solvonis.

Debt Settlement

The Company is pleased to announce that, pursuant to the Policies of the CSE, the Company intends to settle an aggregate of CAD$160,000 owed to the members of the Special Committee through the issuance of 1,000,000 Awakn Shares at a price of CAD$0.16 per Awakn Share (the "Debt Settlement"). The Company intends to issue the Awakn Shares on or about March 6, 2025. The Common Shares issued pursuant to the Debt Settlement shall be subject to a four-month hold period and completion of the Debt Settlement remains subject to final acceptance of the CSE.

The Debt Settlement constitutes a "related party transaction" as defined in MI 61-101 as insiders of the Company will receive an aggregate of 1,000,000 Awakn Shares. The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(b) and 5.7(1)(a) of MI 61-101, as the Company is not listed on a specified market and neither the debt or the fair market value of the Awakn Shares to be issued pursuant to the Debt Settlement exceeds 25% of Awakn's market capitalization, as calculated in accordance with MI 61-101. The Company did not file a material change report at least 21 days in advance of the Debt Settlement, which the Company deems reasonable as the terms of the Debt Settlement were not yet reached.

Share Issuance to Equasy

The Company also announces that it intends to issue 260,000 Awakn Shares, at a deemed price of $0.16 per Common Share, to Equasy Entreprises Inc., a company controlled by Professor Daid Nutt, the Chief Research Officer of the Company, in satisfaction of obligations under an Intellectual Property Transfer Agreement dated March 8, 2021, as amended April 23, 2021. (the "Equasy Issuance"). The Company intends to issue the Awakn Shares on or about March 6, 2025. The Awakn Shares issued pursuant to the Equasy Issuance shall be subject to a four-month hold period and completion of the Equasy Issuance remains subject to final acceptance of the CSE.

The Equasy Issuance constitutes a "related party transaction" as defined in MI 61-101 as an insiders of the Company will receive Awakn Shares. The Company is relying on the exemptions from the valuation and minority shareholder approval requirements of MI 61-101 contained in sections 5.5(b) and 5.7(1)(a) of MI 61-101, as the Company is not listed on a specified market and neither the debt or the fair market value of the Awakn Shares to be issued pursuant to the Equasy Issuance exceeds 25% of Awakn's market capitalization, as calculated in accordance with MI 61-101. The Company did not file a material change report at least 21 days in advance of the Equasy Issuance, which the Company deems reasonable as the terms of the Equasy Issuance were not yet reached.

About Solvonis

Solvonis Therapeutics plc (LSE: SVNS) formerly, Graft Polymer (UK) plc, is UK incorporated LSE-listed innovative biotechnology company focused on developing intellectual property and co-developing therapeutics for mental health and substance use disorders. Its therapeutic priorities include trauma-related mental health disorders such as Post-Traumatic Stress Disorder, which affects approximately 13 million adults in the US and 20 million across the US, UK, and key EU markets. The company emphasises growth through strategic collaborations, joint ventures, and acquisitions.

About Awakn Life Sciences Corp.

Awakn Life Sciences Corp. is a clinical-stage biotechnology company developing therapeutics targeting addiction. Awakn has a near-term focus on Alcohol Use Disorder, a condition affecting 40 million people in the US and key international markets and 285m people globally for which the current standard of care is inadequate. Our goal is to provide breakthrough therapeutics to addiction sufferers in desperate need and our strategy is focused on commercializing our R&D pipeline across multiple channels.

Notice Regarding Forward-Looking Information

Certain statements contained in this news release constitute forward-looking information under applicable Canadian, United States and other applicable securities laws, rules and regulations, including, without limitation, statements with respect to the completion of the Transaction, the conditions to the completion of the Transaction that must be fulfilled and the anticipated benefits and advantages of the Transaction. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on Awakn's current beliefs or assumptions as to the outcome and timing of such future events. There can be no assurance that such statements will prove to be accurate, as Awakn's actual results and future events could differ materially from those anticipated in these forward-looking statements. Factors that could cause actual results and future events to differ materially from those anticipated in these forward-looking statements include the risks, uncertainties and other factors and assumptions made with regard to Awakn's ability to complete the proposed Transaction; and Awakn's ability to secure the necessary securityholder, legal and regulatory approvals required to complete the Transaction. Important factors that could cause actual results to differ materially from Awakn's expectations include risks associated with the business of Solvonis and Awakn; risks related to the satisfaction or waiver of certain conditions to the closing of the Transaction; non-completion of the Transaction; fluctuations in currency exchange rates; and other risk factors as detailed from time to time and additional risks identified in Awakn's filings with Canadian securities regulators on SEDAR+ in Canada (available at www.sedarplus.ca). Various assumptions or factors are typically applied in drawing conclusions or making the forecasts or projections set out in forward-looking information. Those assumptions and factors are based on information currently available to Awakn. The forward-looking information contained in this news release is made as of the date hereof and Awakn undertakes no obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

Investor Enquiries:

Jonathan Held, CFO, Awakn Life Sciences

jonathanh@awaknlifesciences.com

416-270-9566

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/242644

SOURCE: Awakn Life Sciences Corp.