Achieves Record Quarterly Adjusted EBITDA of at least $1 Million & Positive Free Cash-Flow

CALGARY, AB, Feb. 27, 2025 /PRNewswire/ - Nanalysis Scientific Corp. "the Company", (TSXV: NSCI), (OTCQX: NSCIF), (FRA: 1N1), a leader in portable NMR instruments and imaging technology and services for industrial and research applications, provides an estimate of Q4 2024 unaudited revenue, adjusted EBITDA, and highlights some other recent business accomplishments. These unaudited numbers may change materially before filings in April.

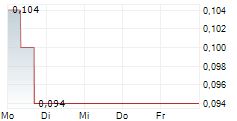

CEO, Sean Krakiwsky states: " We are pleased with the way we closed 2024, particularly with regards to positive adjusted EBITDA of over $1.0 million on revenue of at least $11 million for the three month period. This represents growth of at least $1.2MM in revenue and at least $1.8MM in adjusted EBITDA over Q4 2023. In addition, the significant improvements, both on the revenue and cost side of the ledger, have resulted in positive operating and free cash flow in 2024. For the last six quarters, since meaningful revenue has commenced in our airport security services business, we've been focused on increasing adjusted EBITDA and generating positive cash-flow. The chart below illustrates the progress that the Company has made in generating adjusted EBITDA over the past six quarters:

"With continued strength in our Benchtop NMR product line, the growth trajectory of the Company's airport security maintenance project, and cost cutting measures that were begun in 2023 and will continue through to the end of 2025, we are meeting our corporate objective of generating and growing positive EBITDA and will continue to do so going forward."

Financial and Operational Highlights:- New Adjusted EBITDA Record: Q4 2024 revenue will be at least $11MM and adjusted EBITDA will be at least $1MM, driven by expansion of security services related to the Company's airport maintenance project, as well as continued strength in Benchtop NMR sales.

- Co-Published Study Demonstrating Efficacy of Benchtop NMR for Quality Control with The United States Pharmacopeia (USP): The study concluded that Benchtop NMR is efficacious for quality control of active pharmaceutical ingredients (API) paving the way for use in pharma/biotech quality control and helping establish the value proposition to do so.

- 100 MHz Benchtop NMR Product: In Q4, the Company sold 15 100MHz Benchtop NMR units, the highest number or 100 MHz units in a quarter since the Company cleared its backlog in 2022. This drove continued strength in Benchtop NMR revenue. Customer satisfaction is high, and we continue to seek value-added partnerships and new software applications to drive growth.

- Consistent Revenue in Security Services Business: We achieved revenue of approximately $26 million in 2024, including approximately $5MM in parts flow-through. At the beginning of 2024, gross margin %age in this business was still negative, and rose to positive double digit gross margins by the end of the year. We must continue to make gross margin improvements in this business to achieve corporate objectives.

- New Patent Grants: The Company continues to add to its IP portfolio with two important US patents associated with the Company's Benchtop NMR magnet and software platform. Among other things, these patents address fundamental materials science challenges associated with creating an accurate and stable magnetic field at 2.4 Tesla, as well as being able to identify and quantify particular "hidden" compounds in samples. Patent numbers are US 12,153,108B2 (granted) and US20230168323A1 (allowed, soon to be granted).

The company will be making announcements in Q1 2025 regarding its Benchtop NMR technology platform and new products, in association with two important Exhibitions in Boston and San Diego in March:

- https://pittcon.org/expo/

- https://www.acs.org/meetings/acs-meetings/spring/attend/exposition.html

The Company continues to innovate in the area of magnetic resonance products and is entrenching its leadership position in Benchtop NMR, in particular. In our services business, we are in the beginning stages of Enterprise Resource Planning (ERP) implementation for better operational control. For our ERP implementation, we are taking a modular approach, with several phases. Ultimately, these tools will allow us to continue to expand profit margins, enhance performance, and grow revenue.

In 2024, while company generated positive EBITDA and cash-flow, after tax Net Income (which includes non-cash charges) was still negative, and will be quantified in our 2024 financials to filed in April. Going into 2025, we are focused on understanding the potential US tariff implications and have been contingency planning. In terms of our business internally, we expect to deliver substantial positive EBITDA growth, and also continued positive operational and free cash-flow: This is our core objective for this year.

Non-IFRS and Supplementary Financial MeasuresThe previewed unaudited financial results in this press release are still subject to the conduct of the year-end audit and may be subject to material change.

The Company prepares and reports its consolidated financial statements in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board, ?as adopted ?by the Canadian Accounting Standards Board ("IFRS"). However, this press release may make reference to certain non-IFRS measures including key ?performance indicators used by management. These measures are not recognized measures under IFRS ?and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable ?to similar measures presented by other companies. Rather, these measures are provided as additional ?information to complement those IFRS measures by providing further understanding of the Company's results of ?operations from management's perspective. Accordingly, these measures should not be considered in ?isolation nor as a substitute for analysis of the Company's financial information reported under IFRS.

The ?Company uses Adjusted Earnings Before Interest, Tax, Depreciation and Amortization ("Adjusted EBITDA") as non-IFRS measures, which may be calculated ?differently by other companies. The Company calculates this as Net Earnings before Other items (as defined in the Company's financial statements), current tax, and deferred tax. Such non-IFRS measure are used to provide investors with a? supplemental measure of the Company's operating performance and liquidity and thus highlight trends in the Company's ?business that may not otherwise be apparent when relying solely on IFRS measures. The Company also ?believes that securities analysts, investors and other interested parties frequently use non-IFRS measures ?in the evaluation of companies in similar industries.

About Nanalysis Scientific Corp. (TSXV: NSCI, OTCQX: NSCIF, FRA:1N1)

Nanalysis Scientific Corp. in operates two primary business segments: Scientific Equipment and Security Services. Within its Scientific Equipment business is what the Company terms "MRI and NMR for industry". The Company develops and manufactures portable Nuclear Magnetic Resonance (NMR) spectrometers or analyzers for laboratory and industrial markets. The NMReady-60 was the first full-feature portable NMR spectrometer in a single compact enclosure requiring no liquid helium or any other cryogens. The Company has followed-up that initial offering with new products and continues to have a strong innovation pipeline. In 2020, the Company announced the launch of its 100MHz device, the most powerful and most advanced commercial compact NMR device ever brought to market.

The Company's devices are used in many industries (oil and gas, chemical, mining, pharma, biotech, flavor and fragrances, agrochemicals, law enforcement, and more) as well as numerous government and university research labs around the world. The Company is working to expand into new global market opportunities independently and with partners. With its partners, the Company provides scientific equipment sales and maintenance services globally.

In 2022 the Company was awarded a five-year, $160 million contract to provide maintenance services for passenger screening equipment in Canadian airports. This has resulted in expansion of the Company's Security Services business. The Company is providing airport security equipment maintenance services in each province and territory of Canada. In addition, the Company provides commercial security equipment installation and maintenance services to a variety of customers in North America.

About USPUSP is an independent scientific organization that collaborates with the world's top experts in health and science to develop quality resources and standards for medicines, dietary supplements and food ingredients. This includes actively collaborating with academic research centers, industry, and regulators to help with the adoption and implementation of advanced manufacturing technologies. Through our resources, standards, advocacy and education, USP helps increase the availability of quality medicines, supplements and foods for billions of people worldwide. For more information, visit:?www.usp.org.

The usage of Nanalysis NMR equipment with USP-ID in the study does not imply approval, endorsement, or certification by USP of Nanalysis products, nor does it imply that Nanalysis products are necessarily the best available product for the purpose or that any other brand or product was judged to be unsatisfactory or inadequate. As a standard setting organization, USP avoids conflicts of interest that interfere or appear to interfere with its impartiality and objectivity.

Notice regarding Forward Looking Statements and Legal DisclaimerThis news release contains certain "forward-looking statements" within the meaning of such statements under applicable securities law. Forward-looking statements are frequently characterized by words such as "anticipates", "plan", "continue", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "potential", "proposed", "positioned" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Various assumptions were used in drawing the conclusions or making the projections contained in the forward-looking statements throughout this news release. Forward-looking statements are based on the opinions and estimates of management at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. The Company is under no obligation, and expressly disclaims any intention or obligation, to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as expressly required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

SOURCE Nanalysis Scientific Corp.