Key Points:

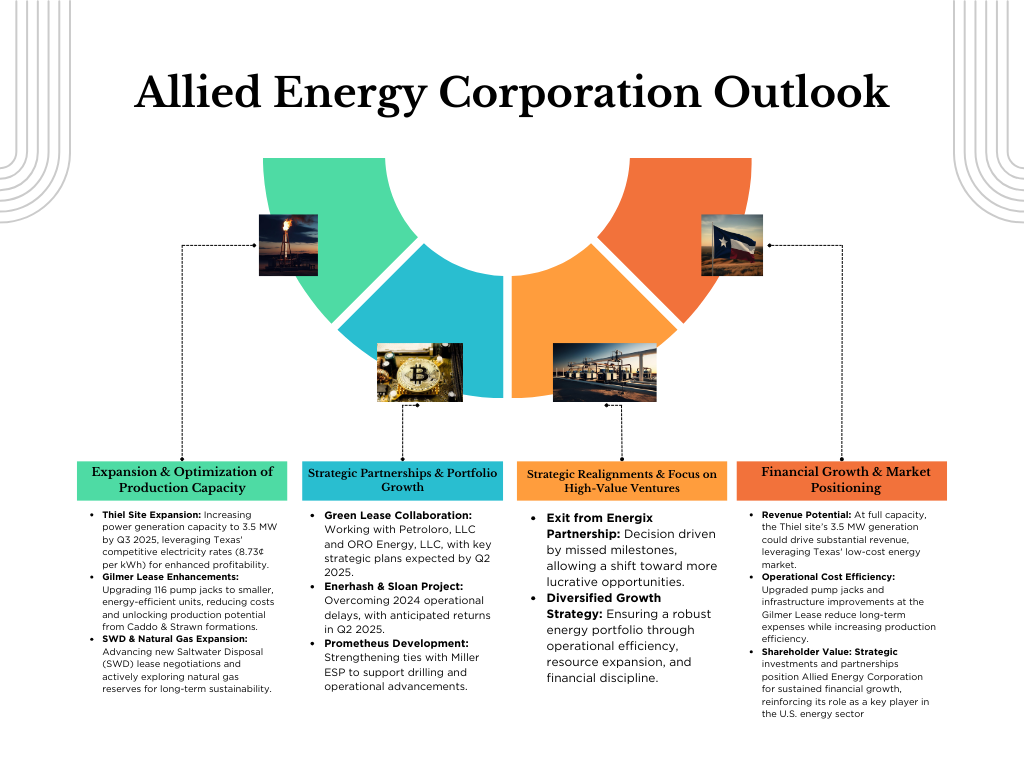

Expansion & Optimization of Production Capacity

- Thiel Site Expansion: Increasing power generation capacity to 3.5 MW by Q3 2025, leveraging Texas' competitive electricity rates (8.73¢ per kWh) for enhanced profitability.

- Gilmer Lease Enhancements: Upgrading 116 pump jacks to smaller, energy-efficient units, reducing costs and unlocking production potential from Caddo & Strawn formations.

- SWD & Natural Gas Expansion: Advancing new Saltwater Disposal (SWD) lease negotiations and actively exploring natural gas reserves for long-term sustainability.

Strategic Partnerships & Portfolio Growth

- Green Lease Collaboration: Working with Petroloro, LLC and ORO Energy, LLC, with key strategic plans expected by Q2 2025.

- Enerhash & Sloan Project: Overcoming 2024 operational delays, with anticipated returns in Q2 2025.

- Prometheus Development: Strengthening ties with Miller ESP to support drilling and operational advancements.

Strategic Realignments & Focus on High-Value Ventures

- Exit from Energix Partnership: Decision driven by missed milestones, allowing a shift toward more lucrative opportunities.

- Diversified Growth Strategy: Ensuring a robust energy portfolio through operational efficiency, resource expansion, and financial discipline.

CARROLLTON, Texas, Feb. 27, 2025 (GLOBE NEWSWIRE) -- Allied Energy Corporation (OTC: AGYP) is excited to announce significant strides in our ongoing projects and production capacity expansion, reinforcing our optimistic outlook for the company's future. With the momentum of these developments, the company is well-positioned for substantial growth in the coming months.

Production Buildout at Thiel Site: A Game-Changer for Capacity Growth

At our Thiel site, we are making significant strides in expanding operational capacity by constructing and installing two 1.25 MW generators. The new production pad has already been successfully laid, and noise abatement testing is scheduled shortly.

Once the first two generators are running at full capacity, we plan to add a third unit, increasing the site's total capacity to an impressive 3 to 3.5 MW by the end of Q3 2025. This expansion strategically positions Allied Energy to capitalize on Texas' booming energy sector, where industrial power consumption is projected to grow significantly in the coming years.

Market Potential & Financial Impact

- Dominance in Energy Production: Texas leads the nation in energy production, contributing significantly to U.S. crude oil and natural gas outputs. source: eia.gov

- Competitive Electricity Rates: With commercial electricity rates in Texas averaging 8.73¢ per kWh, our scalable operations can take advantage of low-cost power, maximizing margins. source: chooseenergy.com

- Projected Revenue Growth: At full capacity (approximately 3.5 MW), the Thiel site could generate significant revenues, depending on operational efficiency and market conditions.

"By strengthening our infrastructure now, we are ensuring long-term scalability, improved financial performance, and the ability to compete with industry leaders in power generation and energy solutions. The Thiel is a key site in our portfolio, and we are very pleased with the progress. We expect to see strong returns from these investments, and the addition of the third genset will significantly enhance our operational capabilities," said George Monteith, CEO of Allied Energy Corporation.

Strategic Development at Gilmer Lease

At our Gilmer lease, Allied Energy continues to optimize operations with the replacement of 116 pump jacks with smaller, more efficient units. We have also placed a packer in the well to cut off Mississippi water, enabling production from the Caddo and possibly the Strawn formations. One well is currently being converted, and depending on its performance, we plan to convert two additional wells in Q3 and Q4.

Strategic Development at Gilmer Lease: Enhancing Efficiency & Maximizing Production

At our Gilmer lease, Allied Energy continues to optimize operations by replacing 116 pump jacks with smaller, more efficient units. This upgrade reduces maintenance costs, energy consumption, and mechanical failures, ensuring greater long-term operational efficiency.

Additionally, we have strategically placed a packer in the well to cut off Mississippi water intrusion, allowing uninterrupted production from the Caddo formation and potentially unlocking reserves from the Strawn formation. Currently, one well is undergoing conversion, and based on its performance, we plan to convert two additional wells in Q3 and Q4.

Advantages of These Operational Activities

- Improved Efficiency & Cost Reduction: Smaller, modern pump jacks consume up to 30% less energy than traditional units, lowering operating costs while maintaining steady production. (source: API)

- Maximizing Reserve Potential: Unlocking secondary formations like Strawn could increase overall recoverable reserves, extending the well's productive lifespan.

- Environmental & Regulatory Benefits: Optimizing operations aligns with state and federal efficiency standards, reducing environmental impact and ensuring compliance with industry best practices. (source: EIA)

"These strategic enhancements position Allied Energy for sustained growth, ensuring higher production efficiency, lower costs, and maximized asset value. We're committed to ensuring that each well reaches its full potential. Our team is working diligently to implement improvements that will help us achieve optimal production from these properties," said Monteith.

Green Lease: Collaborating for Future Developments

Allied Energy is in ongoing discussions with partners Petroloro, LLC and ORO Energy, LLC to determine future developments at our Green Lease. We are currently awaiting an outline of activities from ORO Energy, LLC and plan to finalize our strategic plans for this lease in Q2 2025. These discussions represent an exciting avenue for growth and diversification of our portfolio.

Prometheus: Focused on Future SWD Development

We are actively negotiating a new SWD lease and exploring potential new locations for drilling. In addition, our partnership with Miller ESP is evolving as we assess future development opportunities. We remain focused on ensuring long-term sustainability and profitability through strategic planning in the SWD space.

Ongoing Research and Natural Gas Expansion

Our research into future natural gas resources and the identification of expansion opportunities continues to move forward. We are exploring new locations to broaden our operations and strengthen our presence in areas that complement our existing project sites. These initiatives will further enhance Allied Energy's ability to meet growing demand while maximizing shareholder value.

Enerhash and Sloan Project: Continues to evolve in 2025

Our successful stewardship of the Enerhash and Sloan projects will continue to pay dividends through 2025. However, we were advised in November 2024 that operational issues have caused delays in their scheduled payment. Despite this, Allied Energy anticipates returns from this venture in Q2 of 2025.

Strategic Decision: Parting Ways with Energix for the Time Being

After careful consideration, Allied Energy has made the strategic decision to cut ties with Energix for the time being due to missed critical, time-sensitive milestones. As more lucrative opportunities have emerged, we believe it is in the best interest of the company to focus our resources on these ventures. However, we remain open to the possibility of reigniting a relationship with Energix in the future should the opportunity align with our long-term goals.

"We are constantly seeking the best opportunities to maximize value for our shareholders. While we have decided to part ways with Energix for now, we look forward to exploring future collaborations when the time is right," said Monteith.

Allied Energy Corporation is well-positioned for growth in 2025 and beyond, with a clear focus on increasing capacity, enhancing production, and making strategic partnerships. We remain committed to delivering value to our shareholders and continuing to build a diversified and robust energy portfolio.

About AGYP:

Allied Energy Corp. is an energy development and production company acquiring oil & gas reserves in some of the most prolific hydrocarbon bearing regions of the United States. The Company specializes in the business of reworking & re-completing 'existing' oil & gas wells located in the thousands of mature oil & gas producing fields across the United States. The Company applies its knowledge, experience, and effective well-remediation technologies to achieve higher production volumes, longer well life, and more efficient recovery of the proven and available oil and gas reserves in the fields/projects in which it has acquired an ownership interest. The Company will utilize updated technologies such as hydraulic fracturing ("fracking"), drilling of lateral ("horizontal") legs in productive zones, and utilizing new cased hole electric logging to locate bypassed pays, all to enhance daily rates and oil & gas recoveries. By acquiring interests in a growing number of selected projects in various regions, Allied Energy Corp. is diversifying its exposure and effectively minimizing risk as it pursues corporate growth, top line & bottom-line revenues to the benefit of all stakeholders. There are proven, recoverable reserves contained in the many aging oil & gas fields that have been bypassed by companies moving away from these fields in search of deeper, more plentiful, but more costly reserves. The Company plans to concentrate on bypassed oil and gas as there is less competition and, as mentioned above, the costs are considerably less. Additionally, the company will acquire interests in marginal wells that can be acquired at minimal cost, of which there are 420,000 wells in the U.S. Quoting Barry Russell, President of the Independent Petroleum Association of America ("IPAA") - "With approximately 20 percent of American oil production and 10 percent of American natural gas production coming from marginal wells, they are America's true strategic petroleum reserve."

Safe Harbor Statement:

This press release may contain certain forward-looking statements that are within the meaning of the Private Securities Litigation Reform Act of 1995. The Company has tried, whenever possible, to identify these forward-looking statements using words such as "anticipates," "believes," "estimates," "expects," "plans," "intends," "potential" and similar expressions. These statements reflect the Company's current beliefs and are based upon information currently available to it. Accordingly, such forward-looking statements involve known and unknown risks, uncertainties and other factors which could cause the Company's actual results, performance or achievements to differ materially from those expressed in or implied by such statements. The Company undertakes no obligation to update or advise in the event of any change, addition or alteration to the information catered in this Press Release, including such forward-looking statements.

Contact:

Allied Energy Corporation

Phone: 972-632-2393

Email: info@alliedengycorp.com

Twitter: https://twitter.com/AlliedEnergyCo1

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2612d1fd-1f10-4e95-91f3-d9fa7cca0e78