PAREF pursues its expansion in Europe and continues to lay the foundations for sustainable operational and financial performance

REIT activity: growing asset value despite temporary pressure on occupancy rate

- €186 m of owned asset, a slight increase compared to December 31, 2023

- Financial occupancy rate down to 75 %

Third-party asset management: r esilient performance in an uncertain market

- Assets under management for third parties: € 2.9 bn , up 4% over the year

- Revenues on management fees: €18m, up 17%

- Gross subscriptions: down to € 34 m, affected by a sluggish market, with inflows heavily concentrated in certain SCPIs

Operational and strategic developments: expanded, adapted and optimized portfolio

- Signature of a lease renewal with a significant expansion of over 2,000 sqm in the Franklin Tower, in La Défense

- Assistance to Parkway Life REIT in the acquisition and management of its first European portfolio, valued at more than €110m

- Initiation of the fund management activity in Italy, the Italian branch of PAREF Gestion being appointed as the fund manager of Fondo Broggi, owner of The Medelan asset, one of Milan's most attractive addresses

- Launch of SOLIA Paref, the Group's property management subsidiary, managing 350 assets and obtaining a new management mandate from an institutional investor

- Renewal of the fund range managed by PAREF Gestion, increasing distribution rates for 2024 while maintaining, once again, subscription prices

- Concrete progress and awards for the ESG Strategy "Create More"

2024 dividend and 2025 outlook

- Proposal by the Board of Directors to maintain a dividend of €1.5 per share payable in cash for the 2024 financial year, subject to approval by the General Assembly of May 22, 2025

- Continued development and diversification of the Group's activities, particularly through the integrated "ONE-STOP-SHOP" offering to attract new management mandates

- Maintaining a selective and value-creating investment strategy, through rigorous and sustainable portfolio transformation and management

| Once again, this year PAREF leveraged its historic expertise to support clients and enhance performance, while continuing its development on a European scale. In so doing, the Group reaffirms the quality of its operational management and its resilience in a still constrained market. Key achievements such as the signing of a strategic partnership with Parkway Life REIT, the appointment as manager of Fondo Broggi and the launch of SOLIA Paref are tangible proof of our teams' efforts and illustrate the Group's ability to provide complementary expertise in real estate services. Building on this momentum, PAREF continues to lay the foundations for sustainable performance and the satisfaction of its clients and shareholders. |

| Antoine Castro Chairman & CEO of PAREF |

| Anne Schwartz Deputy CEO of PAREF and CEO of PAREF Gestion |

| In 2024, we accelerated our expansion in Europe by capitalizing on the complementary nature of our businesses and our commitment to CSR. Real estate needs and uses evolve. The Group has successfully adapted by meeting the expectations of both clients and end users and by repositioning its range of funds. The strong performance of the funds once again demonstrates the know-how of our teams. For 2025, we will continue to prioritize performance, adaptability to changing usage patterns, asset sustainability and strong relationships with our clients at the heart of our real estate management. |

The Board of Directors, during the meeting held on February 27, 2025, approved the closing of the annual statutory and consolidated accounts as at December 31, 2024. The review of the results by auditors is in progress.

1 - R esilient operational activit ies

1.1 Increas ing assets under management

As at December 31, 2024, the Group's assets under management amounted to nearly €3.1 billion, reflecting a 4% increase compared to December 31, 2023.

| In M€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| |||

| PAREF owned assets | 169 | 173 | 2% |

| PAREF participations[1] | 13 | 13 | 3% |

| Total PAREF portfolio | 182 | 186 | 2% |

| |||

| Fund management | 2,009 | 2,549 | 27% |

| Mandate management | 785 | 971 | 24% |

| Adjustments[2] | - | -601 | n.a |

| Total Third-party Assets under Management | 2,794 | 2,920 | 4% |

| Adjustments[3] | -13 | -13 | 3% |

| 2,963 | 3,092 | 4% |

1.2 REIT activity: increasing asset value and revenues temporarily impacted by vacancy

As at December 31, 2024, PAREF holds:

- seven directly owned assets, mainly office assets in Greater Paris area;

- minority shareholdings in SCPIs/OPPCIs.

Value of real estate assets in slight increase

As at December 31, 2024, the value of PAREF's portfolio stood at €186m, reflecting a slight increase of 3% on a like-for-like basis compared to the end of 2023. This includes €173m[4] for the seven real estate assets representing a leasable area of 73,526 sqm, and €13m in financial investments in funds managed by the Group.

The evolution of real estate assets is mainly explained by:

- €10m in costs and improvement work, in particular on the Tempo restructuring asset delivered in 2024;

- Portfolio asset revaluation: -€5.4m (-3%); and

- disposal of an asset for €0.7m.

The portfolio held by PAREF remains strong

- The weighted average lease maturity (WALB) reached 4.85 years, compared to 4.5 years at the end of 2023. WALB's extension is tied to a lease renewal of 6-year firm term with a significant increase in space for a subsidiary of a French banking group, expanding its workspace to over 4,000 sqm in the Tour Franklin in La Défense.

- The portfolio's financial occupancy rate stood at 75%, down 24 percentage points compared to December 31, 2023, temporarily impacted by the strategic vacancy on the Croissy-Beaubourg asset and the delivery of the Tempo asset, currently in the rental commercialization phase.

The rent expiry schedule for owned assets is as follows:

Net rental income in decline

Net rental income from PAREF's assets stood at €7.8m as at December 31, 2024, down 11% compared to the previous year. This change is due to the strategic vacancy at Croissy-Beaubourg and the tenant's turnover at the Franklin Tower in La Défense, partially offset by rental indexation. Rents on a like-for-like basis were down 9.5%.

The average gross initial yield on owned assets was 5.5% compared to 7.5% at the end of 2023[5].

1.3 Third -party asset management: a dynamic year with strategic breakthroughs in the Group's development, tempered by a decline in subscription inflows

The Group relies on its two subsidiaries, PAREF Gestion and PAREF Investment Management, which leverage their expertise to serve institutional investors and individuals. They provide a full range of services covering the entire value chain of real estate assets and funds.

Fund management: management of a new fund in Italy strengthening the Group's European position and renewal of the SCPI fund range with enhanced performance

| Type | Assets under management(M€) 2023 | Assets under management(M€) 2024 | Evolution | |||

| SCPI | 1,900 | 1,845 | -3% | |||

| OPPCI | 84 | 80 | -5% | |||

| Other AIF | 25 | 624 | 25x | |||

| Total | 2,009 | 2,549 | 27% | |||

The fund management activity was initiated in Italy with the appointment of PAREF Gestion's Italian branch as fund manager of Fondo Broggi, owner of The Medelan asset, one of Milan's most emblematic assets.

This appointment illustrates the Group's know-how, which has been supporting the fund in development and asset management since its creation. It further strengthens the Group's European presence and its ability to stand out in the market through a comprehensive and integrated service offering.

Since 2022, the real estate market has experienced a significant economic downturn. In 2024, SCPI gross subscription inflows were nearly halved compared to 2023. Market conditions remain highly varied across asset types and market players. In 2025, the SCPI market may stabilize, with early signs pointing to a recovery in new inflows.

Amid these conditions, PAREF Gestion entered a new era, driven by a strategic transformation led by management and supported by all teams. Building on PAREF Gestion's proven track record, the SCPI fund range has been redesigned to provide investors with diversified, attractive and sustainable real estate investment opportunities, aligned with the evolving real estate paradigm.

In 2024, the SCPIs managed by PAREF Gestion continued to deliver solid performance with stable subscription prices and steady increases in yields (distribution rates between 5% and 6%), in line with performance projections.

The Group also continued its portfolio rotation strategy, completing disposals of €42.2m in 2024, including:

- €16.4m for PAREF Prima

- €12.1m or Novapierre 1

- €10.1m for Novapierre Résidentiel

- €3.6m for PAREF Hexa

Gross subscriptions for the SCPI funds under management amounted to €34m during the 2024 financial year, a 64% decrease compared to the previous year, reflecting the overall market slowdown and the concentration of SCPI inflows over several consecutive quarters.

Mandate management: a strategy pursued and developed through significant new mandates

A good showcase of the Group's ONE-STOP-SHOP strategy was the conclusion of a management mandate with Parkway Life REIT, one of the largest healthcare REITs listed in Asia, as it embarks its investment strategy in Europe.

The signing of this 5-year management mandate for a portfolio of 11 nursing homes valued at €111.2m strengthens PAREF's position in the market and underscores the team's commitment to providing long-term support for institutional investors' strategies.

PAREF provides investors with its knowledge across the entire real estate value chain: investment, asset management, property management as well as restructuring and project development.

The Group has announced the launch of SOLIA Paref, its subsidiary dedicated to Property Management on behalf of third parties. This entity provides a premium property management service, adhering to the highest standards of excellence with a strong focus on customer satisfaction. The team manages 950 leases across 350 assets, covering all property types: retail, office, industrial, residential, senior housing, hotels, and vacation villages.

As part of its development, a management mandate has been signed with Hémisphère, a leading investment and management company, for a real estate asset comprising offices and a retail unit at the foot of a building located in the heart of Paris.

Management commissions grew by 17%, despite a decline in subscription commissions

Management commissions amounted to €18.1m, making a 17% increase compared to 2023. This growth was primarily driven by investment commissions from the mandate signed with Parkway Life REIT and the revenue from the management of the Fondo Broggi fund.

Subscription commissions amounted to €3.4m, down 64% compared to 2023, due to the significant slowdown in new fund inflows.

2 - Current operating income improved

The current operating income was €4.4m for the year, up 34% compared to 2023. Driven primarily by:

- net rental income of €7.8m, down 11% due to vacancies on two assets in 2024;

- revenues on commissions of €21.5m, down -14% compared to 2023. This decrease is mainly due to lower gross inflows in the SCPI market in 2024, partially offset by higher management fees from new mandates signed in 2024;

- remuneration of intermediaries, down 38% to €6.2m, correlated to the volume of subscriptions;

- general operating expenses of €17.1m, down 10% compared to the previous year, due to cost optimization and one-off savings.

In addition to the above, the following items also contributed to net result:

- the change in fair value on investment properties of -€5.4m as at December 31, 2024, mainly due to the rise in market capitalization rates, which negatively impacted the valuation of assets;

- financial expenses of €3.6m, compared with €1.7m in 2023, primarily due to refinancing carried out at the end of 2023;

- results of companies consolidated under the equity-method of -€0.6m, compared with €0.9m in 2023, linked to the negative change of the value of assets held by the OPPCI.

3 - Rigorous management of financial resources

PAREF Group applies rigorous management of its short-term requirements and commitments.

- The nominal amount of gross financial debt drawn by the PAREF Group stood at €77m at the end of 2024, compared to €70m as at December 31, 2023, with 75% covered by hedging derivatives;

- The Loan-to-Value (LTV) was 31%, compared to 28% as at December 31 2023;

- The average cost of drawn debt was 4.32% in 2024, compared to 1.62% in 2023;

- The average debt maturity was 3.5 years, compared to 4.5 years as at December 31, 2023.

The financial covenants are respected as at December 31, 2024:

| Dec 31 , 2023 | Dec 31 , 2024 | Covenant | |

| Loan-To-Value | 28% | 31% | <50% |

| Interest Coverage Ratio | 4.0x | 1.87x | >1.75x |

| Secured Financial Debt | 23% | 23% | <30% |

| Consolidated Asset Value [6] | €219m | €223m | >€150m |

4 - EPRA net asset value decreased slightly for the year

EPRA Net Reinstatement Value (NRV) stood at €108.3 per share, down 5% compared to December 31, 2023.

The change is explained by a decrease in the fair value of investment properties on a like-for-like basis, amounting to -€4.9 per share, a dividend payout in 2024 of -€1.5 per share and a decrease in the revaluation of other non-current assets, i.e. -€0.8 per share, partially offset by recurring net income of +€1.1 per share and the change in fair value of financial instruments of +€1.1 per share.

In accordance with the EPRA Best Practices Recommendations, EPRA NAV indicators are determined based on consolidated shareholders' equity under IFRS, as well as the market value of debt and financial instruments.

| EPRA Net Reinstatement Value (NRV) - in K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including: | |||

| Revaluation of other non-current investments (PAREF Gestion[7] ) | 37,873 | 36,203 | -4% |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding: | |||

| Fair value of financial instruments | -378 | 1,312 | n.a. |

| Intangibles as per the IFRS balance sheet | - | - | |

| Including: | |||

| Real estate transfer tax | 12,394 | 14, 079 | 14% |

| NAV | 171,089 | 163,301 | -5% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | €113.4 | €108.3 | -5% |

5 - "Create more" ESG strategy: structuring advances

Thanks to the expertise of its teams, PAREF has continued to integrate the "Create More" ESG strategy into its real estate portfolio. The Group has launched concrete initiatives in line with its commitments to transparency, sustainability and financial performance, receiving recognition for its significant progress in 2024.

- A more sustainable real estate portfolio

The Group's commitment is demonstrated by 69% of assets under management being classified as SFDR Article 8. PAREF group has conducted vulnerability studies on its fund portfolio to identify climate risks and adjust management strategies for greater resilience.

Furthermore, a pilot project has been launched to automate the data collection of energy consumption and carbon emission at the asset level. This initiative will enable more efficient annual performance analysis and help optimize action plans to reduce the carbon footprint.

Meanwhile, decarbonization remains a strategic priority, with the implementation of an ambitious plan that includes the gradual replacement of heating equipment by 2030, thermal insulation improvements, and the installation of intelligent building management systems. These measures ensure compliance with the Tertiary Decree and alignment with CRREM 1.5°C trajectory.

- Sustainable financing integrated into fund management practices

In 2024, PAREF Group extended sustainable financing to fund management. As a result, a "Sustainability Linked Loan" and a "decarbonization credit" were signed. Part of the financing terms are linked to the annual carbon performance, which will be assessed by an independent expert.

- Several awards recognized PAREF's ESG strategy

PAREF has received awards for its progress in ESG reporting and performance.

In the GRESB 2024 ranking, the global benchmark for ESG performance in real estate, PAREF was awarded 5 stars and a score of 97/100 for the Tempo project. This distinction places it in 1st place within the reference group.

PAREF was also honored by the EPRA and received the sBPR Award Silver, highlighting its alignment with the best standards in extra-financial reporting.

- Stronger social and community commitment

The Group has consolidated the social and community initiatives, particularly with the implementation of a new competency development plan, and through the PAREF4Good program, which encourages each employee toengage in solidarity initiatives. A score of 93/100 on the gender equality index was achieved, illustrating the Group's commitment to inclusion and equality.

6 - Post-closing events

As part of its disposal program, PAREF completed the sale of a leased 11,000 sqm warehouse located in Aubergenville (78). The net seller price is in line with the latest appraisal value.

7 - Outlook and priorities for 2025: a clear growth strategy

With over 30 years of expertise, PAREF drives its strategy and growth across complementary activities, including investment, development, fund management, asset management, and property management. PAREF will continue to pursue its objectives through three key pillars:

- maximize financial performance through dynamic and strategic management to secure and enhance the value of assets under management in an ever-evolving market.

- develop a sustainable and resilient asset base, notably by investing to accelerate asset transformation and integrating digital solutions to optimize ESG performance of the portfolio.

- placing clients at the heart of its approach by understanding and anticipating their needs, delivering tailored offerings, and fostering trusted relationships.

Combining deep understanding of local challenges with global perspectives, PAREF stands on a solid foundation to drive growth in assets under management, expand its geographical reach and strengthen strategic partnerships.

Financial Agenda

April 29, 2025: Financial information as at March 31, 2025

May 22, 2025: Combined Shareholders' Meeting

About the PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy, and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management, and property management.

This 360° approach enables the Group to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy.

As at December 31, 2024, PAREF Group manages over €3 billion AUM.

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press Contacts

| Groupe PAREF Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Agence Shan Alexandre Daudin / Aliénor Kuentz +33(6) 34 92 46 15 / +33(6) 28 81 30 83 paref@shan.fr |

APPENDIX

Rental income

| Rental income on directly held assets (in K€) | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| Gross rental income | 9,012 | 8,455 | -6% |

| Re-invoiced Rental expenses | 3,614 | 2,989 | -17% |

| Rental service charges | -3,809 | -3,625 | -5% |

| Non-recoverable rental expenses | -195 | -636 | 226% |

| Other income | 1 | 1 | -50% |

| Total net rental income | 8,818 | 7,819 | -11% |

EPRA Earnings per share as at December 31, 2024

| K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution in % |

| Earnings per IFRS income statement | -16,428 | -5,386 | -67% |

| Adjustments | |||

| (i) Change in fair-value of investment properties | -18,612 | -5,380 | -71% |

| (ii) Profits or losses on disposal of investment properties and other interests | - | 11 | n.a |

| (iii) Profits or losses on disposal of financial assets available for sale | - | - | |

| (iv) Tax on profits or losses on disposals | - | - | |

| (v) Negative goodwill / goodwill impairment | - | - | |

| (vi) Changes in fair value of financial instruments and associated close-out costs | 77 | 279 | 263% |

| (vii) Acquisition costs on share deals and non-controlling joint-venture | - | - | |

| (viii) Deferred tax in respect of the adjustments above | - | - | |

| (ix) Adjustments (i) to (viii) above in respect of companies consolidated under equity method | -99 | 1,720 | n.a. |

| (x) Non-controlling interests in respect of the above | - | - | |

| EPRA Earnings | 2,162 | 1,982 | -8% |

| Average number of shares (diluted) | 1,508,609 | 1,508,510 | |

| EPRA Earnings per share (diluted) | 1.43 € | 1.31 € | -8% |

Consolidated P&L 2024

| Detailed consolidated P&L (in €K) | 2023 | 2024 | Evolution |

| Gross rental income | 9 ,012 | 8,455 | -6% |

| Reinvoiced service charges, taxes and insurance | 3,614 | 2,989 | -17% |

| Rental service charges, taxes and insurance | - 3,809 | -3,625 | -5% |

| Non-recoverable rental expenses | -195 | -636 | 226% |

| Other income | 1 | 1 | -50% |

| Net rental income | 8,818 | 7,819 | -11% |

| Revenues on commissions | 24,948 | 21,528 | -14% |

| - of which management commissions | 15,536 | 18,108 | 17% |

| - of which subscription commissions | 9,412 | 3,420 | -64% |

| Revenues on commissions | 24,948 | 21,528 | -14% |

| Remuneration of intermediaries | -10,095 | -6,240 | -38% |

| -4,277 | -4,178 | -2% |

| -5,816 | -2,061 | -65% |

| General expenses | -19,025 | -17,091 | -10% |

| Depreciation and amortization | - 1,346 | -1,610 | 20% |

| Current operating result | 3,300 | 4,407 | 34% |

| Variation of fair value on investment properties | -18,612 | -5,380 | -71% |

| Result of disposal of investment properties | 0 | 11 | n.a. |

| Operating income | -15,312 | -962 | -94% |

| Financial incomes | 2,173 | 934 | -57% |

| Financial expenses | -3,833 | -4,498 | 17% |

| Cost of net financial debt | - 1,660 | -3,563 | 115% |

| Other expenses and incomes on financial assets | -102 | 234 | n.a. |

| Fair-value adjustments of financial instruments | -77 | -279 | 262% |

| Results of companies consolidated under the equity-method[8] | 847 | -568 | n.a. |

| Result before tax | -16,304 | -5,139 | -68 % |

| Income tax | -124 | -247 | 99% |

| Consolidated net result | -16,428 | -5,386 | -67% |

| Consolidate net result (owners of the parent) | -16,428 | -5,386 | --67% |

| Average number of shares (non-diluted) | 1,508,609 | 1,508,510 | |

| Consolidated net income per share (Group share) | -10.89 | -3.57 | -67% |

| Average number of shares (diluted) | 1,508,609 | 1,508,510 | |

| Consolidated net income per share (diluted Group share) | -10.89 | -3.57 | -67% |

CONSOLIDATED BALANCE SHEET

| BALANCE SHEET (IN K€) | Dec 31, 2023 | Dec 31, 2024 |

| Non-current assets | ||

| Investment properties | 168,130 | 168,810 |

| Intangible assets | 652 | 618 |

| Other property, plant and equipment | 2,331 | 1,706 |

| Financial assets | 358 | 357 |

| Shares and investments in companies under the equity method | 13,982 | 12,985 |

| Financial instruments | 1,088 | 1,078 |

| Derivative instruments | ||

| Total non-current assets | 186,540 | 185,555 |

| Current assets | ||

| Stocks | - | - |

| Trade receivables and related | 14,200 | 12,782 |

| Other receivables | 2,500 | 1,975 |

| Financial instruments | 378 | - |

| Cash and cash equivalents | 7,558 | 10,123 |

| Total current assets | 24,637 | 24,880 |

| Properties and shares held for sale | 740 | 3,900 |

| TOTAL ASSETS | 211,917 | 214,334 |

| Balance Sheet (and K€) | Dec 31, 2023 | Dec 31, 2024 |

| Equity | ||

| Share capital | 37,755 | 37,755 |

| Additional paid-in capital | 42,193 | 42,193 |

| Fair-value through equity | 82 | 88 |

| Fair-value evolution of financial instruments | 99 | -1,312 |

| Consolidated reserved | 57,500 | 38,370 |

| Consolidated net result | -16,428 | -5,386 |

| Shareholder equity | 121,200 | 111,708 |

| Total Equity | 121,200 | 111,708 |

| Liability | ||

| Non-current liabilities | ||

| Non-current financial debt | 70,627 | 77,258 |

| Non-current financial instruments | - | 1,312 |

| Non-current taxes due & other employee-related liabilities | 42 | 41 |

| Non-current provisions | 344 | 1,065 |

| Total non-current liabilities | 71,013 | 79,676 |

| Current liabilities | ||

| Current financial debt | 369 | 351 |

| Trade payables and related | 7,626 | 10,524 |

| Current taxes due & other employee-related liabilities | 8,022 | 7,806 |

| Other current liabilities | 3,687 | 4,270 |

| Total current liabilities | 19,704 | 22,950 |

| TOTAL LIABILITIES | 211,917 | 214,334 |

CASHFLOW STATEMENT

| CASHFLOW STATEMENT (in K€) | Dec 31, 2023 | Dec 31, 2024 |

| Operating cash-flow | ||

| Net result | -16,428 | -5,386 |

| Depreciation and amortization | 1,279 | 1,607 |

| Valuation movements on assets | 18,612 | 5,380 |

| Valuation movements on financial instruments | 77 | 279 |

| Valuation on financial assets held for sale | - | - |

| Tax | 124 | 247 |

| Plus ou moins-values de cession d'immobilisations net d'impôt | 1 | -178 |

| Results of companies consolidated under the equity method | -847 | 568 |

| Cash-flow from operating activities after net financial items and taxes | 2,817 | 2,518 |

| Net financial expenses | 1,660 | 3,563 |

| Tax paid | -424 | -90 |

| Cash-flow from operating activities before net financial items and taxes | 4,053 | 5,991 |

| Other variations in working capital | -675 | 1,765 |

| Net cash-flow from operating activities | 3,378 | 7,756 |

| Investment cash-flow | ||

| Acquisition of tangible assets | -8,052 | -6,641 |

| Acquisition of other assets | -144 | -262 |

| Assets disposal | 751 | |

| Acquisition of financial assets | 95 | 4 |

| Disposal of financial assets | 169 | |

| Financial assets disposal | ||

| Financial products received | 93 | - |

| Change in perimeter | -107 | - |

| Cash-flow from investments | -8,116 | -5,980 |

| Financing cash-flow | ||

| Variation in capital | - | - |

| Self-detention shares | -5 | 4 |

| Variation in bank loans | 10,000 | 7,000 |

| Variation in other financial debt | - | - |

| Repayment of financial lease | -524 | -618 |

| Repayment of bank loan | - | |

| Costs of loan issurance | 19 | -19 |

| Variation on bank overdraft | -1,544 | - 3,274 |

| Financial expenses paid | -1,402 | -40 |

| Dividend paid to shareholders and minorities | -4,527 | -2,263 |

| Cash-flow from financial activities | 2,017 | 790 |

| Increase/ Decrease in cash | -2,721 | 2,565 |

| Cash & cash equivalent at opening | 10,279 | 7,558 |

| Cash & cash equivalent at closing | 7,558 | 10,123 |

EPRA Net Tangible Assets (NTA ) as at 31 December 2024

| EPRA Net Tangible Assets (NTA) - in K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Including / Excluding : | |||

| Hybrid instruments | - | - | - |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including : | |||

| Revaluation of investment properties (if IAS 40 cost option is used) | - | - | - |

| Revaluation of investment property under construction (IPUC) (if IAS 40 cost option is used) | - | - | - |

| Revaluation of other non-current investments (PAREF GESTION[9]) | 37,873 | 36,203 | -4% |

| Revaluation of tenant leases held as finance leases | - | - | - |

| Revaluation of trading properties | - | - | - |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding : | |||

| Differed tax in relation to fair value gains of IP | - | - | - |

| Fair value of financial instruments | -378 | 1,312 | n.a. |

| Goodwill as a result of deferred tax | - | - | - |

| Goodwill as per the IFRS balance sheet | - | - | - |

| Intangibles as per the IFRS balance sheet | -652 | -618 | -5% |

| Including : | |||

| Fair value of debt | - | - | |

| Revaluation of intangible to fair value | - | - | - |

| Real estate transfer tax | 12,393 | 14,079 | 14% |

| NAV | 170,437 | 162,683 | -5% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | 113.0 € | 107.8€ | -5% |

EPRA Net Disposal Value (NDV ) as at 31 December 2024

| EPRA NDV (Net Liquidation Value) - in K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including : | |||

| Revaluation of other non-current investments (PAREF GESTION[10] ) | 37,873 | 36,203 | -4% |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding : | |||

| Fair value of debt | 409 | 195 | -52% |

| NAV | 159,483 | 148,105 | -7% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | 105.7 € | 98.2 € | -7% |

Other EPRA indicators

- EPRA vacancy rate[11]

| In K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution in pts |

| Estimated rental income on vacant space | 95 | 3,245 | |

| Estimated rental value of the whole portfolio | 10,925 | 12,746 | |

| EPRA Vacancy Rate | 0.87% | 25.46% | 24.59 pts |

- EPRA Net Initial Yield (NIY) and 'topped-up' NIY

| In % | Dec 31 , 2023 | Dec 31 , 2024 | Evolution in pts |

| PAREF Net yield | 6.54% | 5.36% | -1.18pts |

| Impact of estimated duties and costs | -0.39% | -0.36% | +0.03pts |

| Impact of changes in scope | 0.00% | -0.02% | -0.02pts |

| EPRA Net initial yield[12] | 6.15% | 4.98% | -1,17 pts |

| Excluding lease incentives | 1.71% | 0.47% | -1.24 pts |

| EPRA "Topped-Up" Net initial yield [13] | 7.86% | 5.45% | -2.41 pts |

- Capital expenditure

| and K€ | Dec 31 , 2023 | Dec 31 , 2024 |

| Acquisition | ||

| Development[14] | 6,456 | 6,965 |

| Maintenance CAPEX | 222 | 3,241 |

| with surface creation | ||

| without surface creation | 222 | 3,241 |

| commercial advantages | ||

| Other expenses | ||

| Capitalized interest | ||

| Total CAPEX | 6,553 | 10,206 |

| Difference between recognized and disbursed CAPEX | 1,671 | -3,319 |

| Total CAPEX Cash | 8,224 | 6,888 |

- LTV (Loan to Value) EPRA

| In K€ | Group as reported | Proportionate Consolidation | Combined | ||||

| Share of JV | Share of Material Associates | Non-controlling Interests | |||||

| Include: | |||||||

| Borrowings from Financial Institutions | 77,000 | n.a. | 9,695 | n.a. | 86,695 | ||

| Commercial paper | - | n.a. | - | n.a. | - | ||

| Hybrids (including convertibles, preference shares, debt, options, perpetuals) | - | n.a. | - | n.a. | - | ||

| Bond loans | - | n.a. | - | n.a. | - | ||

| Foreign currency derivatives (futures, swaps, options and forwards) | - | n.a. | - | n.a. | - | ||

| Net payables[15] | 7,853 | n.a. | 206 | n.a. | 8,059 | ||

| Owner-occupied property (debt) | - | n.a. | - | n.a. | - | ||

| Current accounts (equity characteristic) | - | n.a. | - | n.a. | - | ||

| Exclude: | n.a. | n.a. | - | ||||

| Cash and cash equivalents | 10,123 | n.a. | 122 | n.a. | 10,245 | ||

| Net Debt (A) | 74,730 | n.a. | 9,778 | n.a. | 84,508 | ||

| Include: | |||||||

| Owner-occupied property | - | n.a. | - | n.a. | - | ||

| Investment properties at fair value | 168,810 | n.a. | 21,683 | n.a. | 190,493 | ||

| Properties held for sale | 3,900 | n.a. | - | n.a. | 3,900 | ||

| Properties under development | - | n.a. | - | n.a. | - | ||

| Intangibles[16] | 38,341 | n.a. | - | n.a. | 38,341 | ||

| Net receivables | - | n.a. | - | n.a. | - | ||

| Financial assets | 1,435 | n.a. | - | n.a. | 1,435 | ||

| Total Property Value (B) | 212,486 | n.a. | 21,683 | n.a. | 234,169 | ||

| Optionnel: | |||||||

| Real estate transfer taxes | 12,743 | n.a. | 1,496 | n.a. | 14,239 | ||

| Total asset value (including RETT) © | 12,743 | n.a. | 1,496 | n.a. | 14,239 | ||

| LTV (A/B) | 35.2% | n.a. | 45.1% | n.a. | 36.1% | ||

| LTV (INCL. RETT) (A/C) (OPTIONNEL) | 33.2% | n.a. | 42.2% | n.a. | 34.0% | ||

• EPRA cost ratios

The ratios below are calculated on the basis of PAREF's own assets[17] (including equity arrangements).

| and K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| Include : | |||

| (2,522) | (1,912) | -24% |

| |||

| (3,809) | (3,625) | -5% |

| (355) | (74) | -79% |

| Exclude: | |||

| 1,573 | 1,159 | -26% |

| 2,155 | 1,830 | -15% |

| EPRA Costs (including direct vacancy costs) (A) | (2,958) | (2,623) | -11% |

| 202 | 671 | 232% |

| EPRA Costs (excluding direct vacancy costs) (B) | (2,756) | (1,952) | -29% |

| 11,167 | 10,285 | -8% |

| (2,155) | (1,830) | -15% |

| 1,356 | 1,603 | 18% |

| Gross Rental Income © | 10,367 | 10,058 | -3% |

| EPRA Cost Ratio (including direct vacancy costs) (A/C) | 28.5% | 26.1% | -24 pts |

| EPRA Cost Ratio (excluding direct vacancy costs) (B/C) | 26.6% | 19.4% | -7 pts |

Glossary

DFS (Secured Financial Debt): secured financial debt divided by the consolidated value of assets, including the value of PAREF Gestion shares and financial interests in funds managed by the Group.

ICR (Interest Coverage Ratio): EBITDA divided by consolidated financial expenses excluding setup fees for financing. DFS: secured financial debt divided by the consolidated asset value (including the value of PAREF Gestion's share and financial participation in the funds managed by the Group).

LTV (Loan to Value): consolidated withdrawn net debt divided by the consolidated asset value excluding transfer taxes and including the valuation of PAREF Gestion and financial participation in the funds managed by the Group.

SCPI Distribution Rate: dividing the gross dividend-before withholding tax and any other taxes paid by the fund on behalf of the shareholder-distributed for year N (including exceptional interim dividends and the share of distributed capital gains) by the subscription price as at January 1 of year N for open-ended SCPIs.

TOF (Financial occupancy ratio): dividing the total amount of rents and occupancy allowances invoiced (including rent compensation allowances) as well as the market rental values of other premises not available for rental, by the total amount of rents billable in the hypothesis where the entirety of the assets shall be rented.

WALB ( Weighted Average Lease Break): average remaining duration of the tenancy until the next break option.

[1] Participations in SCPI/OPPCI

[2] The Medelan asset included in fund management and mandate management

[3] Participation in the OPPCI Vivapierre

[4] Excluding minority stakes in SCPI/OPPCI.

[5] Excluding the Tempo (Léon Frot) asset under restructuring as at December 31, 2023

[6] Including the value of PAREF Gestion, realized by a qualified external expert as at Dec 31st 2024 and financial participations in the funds managed by the Group

[7] The valuation of PAREF Gestion was made by a qualified external expert as at Dec 31, 2024

[8] Including participations in the companies consolidated in equity method OPPCI Vivapierre at 27.24%

[9] The valuation of PAREF Gestion was performed by a qualified external expert Dec 31, 2024

[10] The valuation of PAREF Gestion was performed by a qualified external expert Dec 31, 2024

[11] Excluding the participation in OPPCI Vivapierre

[12] The EPRA Net Initial Yield rate is defined as the annualized rental income, net of property operation expenses, after deducting rent adjustments, divided by the value of the portfolio, including duties

[13] The EPRA 'topped-up' Net Initial Yield rate is defined as the annualized rental income, net of property operating expenses, excluding lease incentives, divided by the value of the portfolio, including taxes.

[14] Including the investment related to restructuring project of Tempo asset, located in Paris

[15] Including current debts (accrued interest, guarantee, suppliers, tax payable, other debts) net of current receivable (clients, other receivables and prepaid expenses)

[16] Including the valuation of PAREF Gestion performed by a qualified external expert Dec 31, 2024

[17] excluding the participation in OPPCI Vivapierre

PAREF pursues its expansion in Europe and continues to lay the foundations for sustainable operational and financial performance

REIT activity: growing asset value despite temporary pressure on occupancy rate

- €186 m of owned asset, a slight increase compared to December 31, 2023

- Financial occupancy rate down to 75 %

Third-party asset management: r esilient performance in an uncertain market

- Assets under management for third parties: € 2.9 bn , up 4% over the year

- Revenues on management fees: €18m, up 17%

- Gross subscriptions: down to € 34 m, affected by a sluggish market, with inflows heavily concentrated in certain SCPIs

Operational and strategic developments: expanded, adapted and optimized portfolio

- Signature of a lease renewal with a significant expansion of over 2,000 sqm in the Franklin Tower, in La Défense

- Assistance to Parkway Life REIT in the acquisition and management of its first European portfolio, valued at more than €110m

- Initiation of the fund management activity in Italy, the Italian branch of PAREF Gestion being appointed as the fund manager of Fondo Broggi, owner of The Medelan asset, one of Milan's most attractive addresses

- Launch of SOLIA Paref, the Group's property management subsidiary, managing 350 assets and obtaining a new management mandate from an institutional investor

- Renewal of the fund range managed by PAREF Gestion, increasing distribution rates for 2024 while maintaining, once again, subscription prices

- Concrete progress and awards for the ESG Strategy "Create More"

2024 dividend and 2025 outlook

- Proposal by the Board of Directors to maintain a dividend of €1.5 per share payable in cash for the 2024 financial year, subject to approval by the General Assembly of May 22, 2025

- Continued development and diversification of the Group's activities, particularly through the integrated "ONE-STOP-SHOP" offering to attract new management mandates

- Maintaining a selective and value-creating investment strategy, through rigorous and sustainable portfolio transformation and management

| Once again, this year PAREF leveraged its historic expertise to support clients and enhance performance, while continuing its development on a European scale. In so doing, the Group reaffirms the quality of its operational management and its resilience in a still constrained market. Key achievements such as the signing of a strategic partnership with Parkway Life REIT, the appointment as manager of Fondo Broggi and the launch of SOLIA Paref are tangible proof of our teams' efforts and illustrate the Group's ability to provide complementary expertise in real estate services. Building on this momentum, PAREF continues to lay the foundations for sustainable performance and the satisfaction of its clients and shareholders. |

| Antoine Castro Chairman & CEO of PAREF |

| Anne Schwartz Deputy CEO of PAREF and CEO of PAREF Gestion |

| In 2024, we accelerated our expansion in Europe by capitalizing on the complementary nature of our businesses and our commitment to CSR. Real estate needs and uses evolve. The Group has successfully adapted by meeting the expectations of both clients and end users and by repositioning its range of funds. The strong performance of the funds once again demonstrates the know-how of our teams. For 2025, we will continue to prioritize performance, adaptability to changing usage patterns, asset sustainability and strong relationships with our clients at the heart of our real estate management. |

The Board of Directors, during the meeting held on February 27, 2025, approved the closing of the annual statutory and consolidated accounts as at December 31, 2024. The review of the results by auditors is in progress.

1 - R esilient operational activit ies

1.1 Increas ing assets under management

As at December 31, 2024, the Group's assets under management amounted to nearly €3.1 billion, reflecting a 4% increase compared to December 31, 2023.

| In M€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| |||

| PAREF owned assets | 169 | 173 | 2% |

| PAREF participations[1] | 13 | 13 | 3% |

| Total PAREF portfolio | 182 | 186 | 2% |

| |||

| Fund management | 2,009 | 2,549 | 27% |

| Mandate management | 785 | 971 | 24% |

| Adjustments[2] | - | -601 | n.a |

| Total Third-party Assets under Management | 2,794 | 2,920 | 4% |

| Adjustments[3] | -13 | -13 | 3% |

| 2,963 | 3,092 | 4% |

1.2 REIT activity: increasing asset value and revenues temporarily impacted by vacancy

As at December 31, 2024, PAREF holds:

- seven directly owned assets, mainly office assets in Greater Paris area;

- minority shareholdings in SCPIs/OPPCIs.

Value of real estate assets in slight increase

As at December 31, 2024, the value of PAREF's portfolio stood at €186m, reflecting a slight increase of 3% on a like-for-like basis compared to the end of 2023. This includes €173m[4] for the seven real estate assets representing a leasable area of 73,526 sqm, and €13m in financial investments in funds managed by the Group.

The evolution of real estate assets is mainly explained by:

- €10m in costs and improvement work, in particular on the Tempo restructuring asset delivered in 2024;

- Portfolio asset revaluation: -€5.4m (-3%); and

- disposal of an asset for €0.7m.

The portfolio held by PAREF remains strong

- The weighted average lease maturity (WALB) reached 4.85 years, compared to 4.5 years at the end of 2023. WALB's extension is tied to a lease renewal of 6-year firm term with a significant increase in space for a subsidiary of a French banking group, expanding its workspace to over 4,000 sqm in the Tour Franklin in La Défense.

- The portfolio's financial occupancy rate stood at 75%, down 24 percentage points compared to December 31, 2023, temporarily impacted by the strategic vacancy on the Croissy-Beaubourg asset and the delivery of the Tempo asset, currently in the rental commercialization phase.

The rent expiry schedule for owned assets is as follows:

Net rental income in decline

Net rental income from PAREF's assets stood at €7.8m as at December 31, 2024, down 11% compared to the previous year. This change is due to the strategic vacancy at Croissy-Beaubourg and the tenant's turnover at the Franklin Tower in La Défense, partially offset by rental indexation. Rents on a like-for-like basis were down 9.5%.

The average gross initial yield on owned assets was 5.5% compared to 7.5% at the end of 2023[5].

1.3 Third -party asset management: a dynamic year with strategic breakthroughs in the Group's development, tempered by a decline in subscription inflows

The Group relies on its two subsidiaries, PAREF Gestion and PAREF Investment Management, which leverage their expertise to serve institutional investors and individuals. They provide a full range of services covering the entire value chain of real estate assets and funds.

Fund management: management of a new fund in Italy strengthening the Group's European position and renewal of the SCPI fund range with enhanced performance

| Type | Assets under management(M€) 2023 | Assets under management(M€) 2024 | Evolution | |||

| SCPI | 1,900 | 1,845 | -3% | |||

| OPPCI | 84 | 80 | -5% | |||

| Other AIF | 25 | 624 | 25x | |||

| Total | 2,009 | 2,549 | 27% | |||

The fund management activity was initiated in Italy with the appointment of PAREF Gestion's Italian branch as fund manager of Fondo Broggi, owner of The Medelan asset, one of Milan's most emblematic assets.

This appointment illustrates the Group's know-how, which has been supporting the fund in development and asset management since its creation. It further strengthens the Group's European presence and its ability to stand out in the market through a comprehensive and integrated service offering.

Since 2022, the real estate market has experienced a significant economic downturn. In 2024, SCPI gross subscription inflows were nearly halved compared to 2023. Market conditions remain highly varied across asset types and market players. In 2025, the SCPI market may stabilize, with early signs pointing to a recovery in new inflows.

Amid these conditions, PAREF Gestion entered a new era, driven by a strategic transformation led by management and supported by all teams. Building on PAREF Gestion's proven track record, the SCPI fund range has been redesigned to provide investors with diversified, attractive and sustainable real estate investment opportunities, aligned with the evolving real estate paradigm.

In 2024, the SCPIs managed by PAREF Gestion continued to deliver solid performance with stable subscription prices and steady increases in yields (distribution rates between 5% and 6%), in line with performance projections.

The Group also continued its portfolio rotation strategy, completing disposals of €42.2m in 2024, including:

- €16.4m for PAREF Prima

- €12.1m or Novapierre 1

- €10.1m for Novapierre Résidentiel

- €3.6m for PAREF Hexa

Gross subscriptions for the SCPI funds under management amounted to €34m during the 2024 financial year, a 64% decrease compared to the previous year, reflecting the overall market slowdown and the concentration of SCPI inflows over several consecutive quarters.

Mandate management: a strategy pursued and developed through significant new mandates

A good showcase of the Group's ONE-STOP-SHOP strategy was the conclusion of a management mandate with Parkway Life REIT, one of the largest healthcare REITs listed in Asia, as it embarks its investment strategy in Europe.

The signing of this 5-year management mandate for a portfolio of 11 nursing homes valued at €111.2m strengthens PAREF's position in the market and underscores the team's commitment to providing long-term support for institutional investors' strategies.

PAREF provides investors with its knowledge across the entire real estate value chain: investment, asset management, property management as well as restructuring and project development.

The Group has announced the launch of SOLIA Paref, its subsidiary dedicated to Property Management on behalf of third parties. This entity provides a premium property management service, adhering to the highest standards of excellence with a strong focus on customer satisfaction. The team manages 950 leases across 350 assets, covering all property types: retail, office, industrial, residential, senior housing, hotels, and vacation villages.

As part of its development, a management mandate has been signed with Hémisphère, a leading investment and management company, for a real estate asset comprising offices and a retail unit at the foot of a building located in the heart of Paris.

Management commissions grew by 17%, despite a decline in subscription commissions

Management commissions amounted to €18.1m, making a 17% increase compared to 2023. This growth was primarily driven by investment commissions from the mandate signed with Parkway Life REIT and the revenue from the management of the Fondo Broggi fund.

Subscription commissions amounted to €3.4m, down 64% compared to 2023, due to the significant slowdown in new fund inflows.

2 - Current operating income improved

The current operating income was €4.4m for the year, up 34% compared to 2023. Driven primarily by:

- net rental income of €7.8m, down 11% due to vacancies on two assets in 2024;

- revenues on commissions of €21.5m, down -14% compared to 2023. This decrease is mainly due to lower gross inflows in the SCPI market in 2024, partially offset by higher management fees from new mandates signed in 2024;

- remuneration of intermediaries, down 38% to €6.2m, correlated to the volume of subscriptions;

- general operating expenses of €17.1m, down 10% compared to the previous year, due to cost optimization and one-off savings.

In addition to the above, the following items also contributed to net result:

- the change in fair value on investment properties of -€5.4m as at December 31, 2024, mainly due to the rise in market capitalization rates, which negatively impacted the valuation of assets;

- financial expenses of €3.6m, compared with €1.7m in 2023, primarily due to refinancing carried out at the end of 2023;

- results of companies consolidated under the equity-method of -€0.6m, compared with €0.9m in 2023, linked to the negative change of the value of assets held by the OPPCI.

3 - Rigorous management of financial resources

PAREF Group applies rigorous management of its short-term requirements and commitments.

- The nominal amount of gross financial debt drawn by the PAREF Group stood at €77m at the end of 2024, compared to €70m as at December 31, 2023, with 75% covered by hedging derivatives;

- The Loan-to-Value (LTV) was 31%, compared to 28% as at December 31 2023;

- The average cost of drawn debt was 4.32% in 2024, compared to 1.62% in 2023;

- The average debt maturity was 3.5 years, compared to 4.5 years as at December 31, 2023.

The financial covenants are respected as at December 31, 2024:

| Dec 31 , 2023 | Dec 31 , 2024 | Covenant | |

| Loan-To-Value | 28% | 31% | <50% |

| Interest Coverage Ratio | 4.0x | 1.87x | >1.75x |

| Secured Financial Debt | 23% | 23% | <30% |

| Consolidated Asset Value [6] | €219m | €223m | >€150m |

4 - EPRA net asset value decreased slightly for the year

EPRA Net Reinstatement Value (NRV) stood at €108.3 per share, down 5% compared to December 31, 2023.

The change is explained by a decrease in the fair value of investment properties on a like-for-like basis, amounting to -€4.9 per share, a dividend payout in 2024 of -€1.5 per share and a decrease in the revaluation of other non-current assets, i.e. -€0.8 per share, partially offset by recurring net income of +€1.1 per share and the change in fair value of financial instruments of +€1.1 per share.

In accordance with the EPRA Best Practices Recommendations, EPRA NAV indicators are determined based on consolidated shareholders' equity under IFRS, as well as the market value of debt and financial instruments.

| EPRA Net Reinstatement Value (NRV) - in K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including: | |||

| Revaluation of other non-current investments (PAREF Gestion[7] ) | 37,873 | 36,203 | -4% |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding: | |||

| Fair value of financial instruments | -378 | 1,312 | n.a. |

| Intangibles as per the IFRS balance sheet | - | - | |

| Including: | |||

| Real estate transfer tax | 12,394 | 14, 079 | 14% |

| NAV | 171,089 | 163,301 | -5% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | €113.4 | €108.3 | -5% |

5 - "Create more" ESG strategy: structuring advances

Thanks to the expertise of its teams, PAREF has continued to integrate the "Create More" ESG strategy into its real estate portfolio. The Group has launched concrete initiatives in line with its commitments to transparency, sustainability and financial performance, receiving recognition for its significant progress in 2024.

- A more sustainable real estate portfolio

The Group's commitment is demonstrated by 69% of assets under management being classified as SFDR Article 8. PAREF group has conducted vulnerability studies on its fund portfolio to identify climate risks and adjust management strategies for greater resilience.

Furthermore, a pilot project has been launched to automate the data collection of energy consumption and carbon emission at the asset level. This initiative will enable more efficient annual performance analysis and help optimize action plans to reduce the carbon footprint.

Meanwhile, decarbonization remains a strategic priority, with the implementation of an ambitious plan that includes the gradual replacement of heating equipment by 2030, thermal insulation improvements, and the installation of intelligent building management systems. These measures ensure compliance with the Tertiary Decree and alignment with CRREM 1.5°C trajectory.

- Sustainable financing integrated into fund management practices

In 2024, PAREF Group extended sustainable financing to fund management. As a result, a "Sustainability Linked Loan" and a "decarbonization credit" were signed. Part of the financing terms are linked to the annual carbon performance, which will be assessed by an independent expert.

- Several awards recognized PAREF's ESG strategy

PAREF has received awards for its progress in ESG reporting and performance.

In the GRESB 2024 ranking, the global benchmark for ESG performance in real estate, PAREF was awarded 5 stars and a score of 97/100 for the Tempo project. This distinction places it in 1st place within the reference group.

PAREF was also honored by the EPRA and received the sBPR Award Silver, highlighting its alignment with the best standards in extra-financial reporting.

- Stronger social and community commitment

The Group has consolidated the social and community initiatives, particularly with the implementation of a new competency development plan, and through the PAREF4Good program, which encourages each employee toengage in solidarity initiatives. A score of 93/100 on the gender equality index was achieved, illustrating the Group's commitment to inclusion and equality.

6 - Post-closing events

As part of its disposal program, PAREF completed the sale of a leased 11,000 sqm warehouse located in Aubergenville (78). The net seller price is in line with the latest appraisal value.

7 - Outlook and priorities for 2025: a clear growth strategy

With over 30 years of expertise, PAREF drives its strategy and growth across complementary activities, including investment, development, fund management, asset management, and property management. PAREF will continue to pursue its objectives through three key pillars:

- maximize financial performance through dynamic and strategic management to secure and enhance the value of assets under management in an ever-evolving market.

- develop a sustainable and resilient asset base, notably by investing to accelerate asset transformation and integrating digital solutions to optimize ESG performance of the portfolio.

- placing clients at the heart of its approach by understanding and anticipating their needs, delivering tailored offerings, and fostering trusted relationships.

Combining deep understanding of local challenges with global perspectives, PAREF stands on a solid foundation to drive growth in assets under management, expand its geographical reach and strengthen strategic partnerships.

Financial Agenda

April 29, 2025: Financial information as at March 31, 2025

May 22, 2025: Combined Shareholders' Meeting

About the PAREF Group

PAREF is a leading European player in real estate management, with over 30 years of experience and the aim of being one of the market leaders in real estate management based on its proven expertise.

Today, the Group operates in France, Germany, Italy, and Switzerland and provides services across the entire value chain of real estate investment: investment, fund management, renovation and development project management, asset management, and property management.

This 360° approach enables the Group to offer integrated and tailor-made services to institutional and retail investors.

The Group is committed to creating more value and sustainable growth and has put CSR concerns at the heart of its strategy.

As at December 31, 2024, PAREF Group manages over €3 billion AUM.

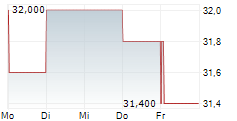

PAREF is a company listed on Euronext Paris, Compartment C, under ISIN FR0010263202 - Ticker PAR.

More information on www.paref.com

Press Contacts

| Groupe PAREF Samira Kadhi +33(7) 60 00 59 52 samira.kadhi@paref.com | Agence Shan Alexandre Daudin / Aliénor Kuentz +33(6) 34 92 46 15 / +33(6) 28 81 30 83 paref@shan.fr |

APPENDIX

Rental income

| Rental income on directly held assets (in K€) | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| Gross rental income | 9,012 | 8,455 | -6% |

| Re-invoiced Rental expenses | 3,614 | 2,989 | -17% |

| Rental service charges | -3,809 | -3,625 | -5% |

| Non-recoverable rental expenses | -195 | -636 | 226% |

| Other income | 1 | 1 | -50% |

| Total net rental income | 8,818 | 7,819 | -11% |

EPRA Earnings per share as at December 31, 2024

| K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution in % |

| Earnings per IFRS income statement | -16,428 | -5,386 | -67% |

| Adjustments | |||

| (i) Change in fair-value of investment properties | -18,612 | -5,380 | -71% |

| (ii) Profits or losses on disposal of investment properties and other interests | - | 11 | n.a |

| (iii) Profits or losses on disposal of financial assets available for sale | - | - | |

| (iv) Tax on profits or losses on disposals | - | - | |

| (v) Negative goodwill / goodwill impairment | - | - | |

| (vi) Changes in fair value of financial instruments and associated close-out costs | 77 | 279 | 263% |

| (vii) Acquisition costs on share deals and non-controlling joint-venture | - | - | |

| (viii) Deferred tax in respect of the adjustments above | - | - | |

| (ix) Adjustments (i) to (viii) above in respect of companies consolidated under equity method | -99 | 1,720 | n.a. |

| (x) Non-controlling interests in respect of the above | - | - | |

| EPRA Earnings | 2,162 | 1,982 | -8% |

| Average number of shares (diluted) | 1,508,609 | 1,508,510 | |

| EPRA Earnings per share (diluted) | 1.43 € | 1.31 € | -8% |

Consolidated P&L 2024

| Detailed consolidated P&L (in €K) | 2023 | 2024 | Evolution |

| Gross rental income | 9 ,012 | 8,455 | -6% |

| Reinvoiced service charges, taxes and insurance | 3,614 | 2,989 | -17% |

| Rental service charges, taxes and insurance | - 3,809 | -3,625 | -5% |

| Non-recoverable rental expenses | -195 | -636 | 226% |

| Other income | 1 | 1 | -50% |

| Net rental income | 8,818 | 7,819 | -11% |

| Revenues on commissions | 24,948 | 21,528 | -14% |

| - of which management commissions | 15,536 | 18,108 | 17% |

| - of which subscription commissions | 9,412 | 3,420 | -64% |

| Revenues on commissions | 24,948 | 21,528 | -14% |

| Remuneration of intermediaries | -10,095 | -6,240 | -38% |

| -4,277 | -4,178 | -2% |

| -5,816 | -2,061 | -65% |

| General expenses | -19,025 | -17,091 | -10% |

| Depreciation and amortization | - 1,346 | -1,610 | 20% |

| Current operating result | 3,300 | 4,407 | 34% |

| Variation of fair value on investment properties | -18,612 | -5,380 | -71% |

| Result of disposal of investment properties | 0 | 11 | n.a. |

| Operating income | -15,312 | -962 | -94% |

| Financial incomes | 2,173 | 934 | -57% |

| Financial expenses | -3,833 | -4,498 | 17% |

| Cost of net financial debt | - 1,660 | -3,563 | 115% |

| Other expenses and incomes on financial assets | -102 | 234 | n.a. |

| Fair-value adjustments of financial instruments | -77 | -279 | 262% |

| Results of companies consolidated under the equity-method[8] | 847 | -568 | n.a. |

| Result before tax | -16,304 | -5,139 | -68 % |

| Income tax | -124 | -247 | 99% |

| Consolidated net result | -16,428 | -5,386 | -67% |

| Consolidate net result (owners of the parent) | -16,428 | -5,386 | --67% |

| Average number of shares (non-diluted) | 1,508,609 | 1,508,510 | |

| Consolidated net income per share (Group share) | -10.89 | -3.57 | -67% |

| Average number of shares (diluted) | 1,508,609 | 1,508,510 | |

| Consolidated net income per share (diluted Group share) | -10.89 | -3.57 | -67% |

CONSOLIDATED BALANCE SHEET

| BALANCE SHEET (IN K€) | Dec 31, 2023 | Dec 31, 2024 |

| Non-current assets | ||

| Investment properties | 168,130 | 168,810 |

| Intangible assets | 652 | 618 |

| Other property, plant and equipment | 2,331 | 1,706 |

| Financial assets | 358 | 357 |

| Shares and investments in companies under the equity method | 13,982 | 12,985 |

| Financial instruments | 1,088 | 1,078 |

| Derivative instruments | ||

| Total non-current assets | 186,540 | 185,555 |

| Current assets | ||

| Stocks | - | - |

| Trade receivables and related | 14,200 | 12,782 |

| Other receivables | 2,500 | 1,975 |

| Financial instruments | 378 | - |

| Cash and cash equivalents | 7,558 | 10,123 |

| Total current assets | 24,637 | 24,880 |

| Properties and shares held for sale | 740 | 3,900 |

| TOTAL ASSETS | 211,917 | 214,334 |

| Balance Sheet (and K€) | Dec 31, 2023 | Dec 31, 2024 |

| Equity | ||

| Share capital | 37,755 | 37,755 |

| Additional paid-in capital | 42,193 | 42,193 |

| Fair-value through equity | 82 | 88 |

| Fair-value evolution of financial instruments | 99 | -1,312 |

| Consolidated reserved | 57,500 | 38,370 |

| Consolidated net result | -16,428 | -5,386 |

| Shareholder equity | 121,200 | 111,708 |

| Total Equity | 121,200 | 111,708 |

| Liability | ||

| Non-current liabilities | ||

| Non-current financial debt | 70,627 | 77,258 |

| Non-current financial instruments | - | 1,312 |

| Non-current taxes due & other employee-related liabilities | 42 | 41 |

| Non-current provisions | 344 | 1,065 |

| Total non-current liabilities | 71,013 | 79,676 |

| Current liabilities | ||

| Current financial debt | 369 | 351 |

| Trade payables and related | 7,626 | 10,524 |

| Current taxes due & other employee-related liabilities | 8,022 | 7,806 |

| Other current liabilities | 3,687 | 4,270 |

| Total current liabilities | 19,704 | 22,950 |

| TOTAL LIABILITIES | 211,917 | 214,334 |

CASHFLOW STATEMENT

| CASHFLOW STATEMENT (in K€) | Dec 31, 2023 | Dec 31, 2024 |

| Operating cash-flow | ||

| Net result | -16,428 | -5,386 |

| Depreciation and amortization | 1,279 | 1,607 |

| Valuation movements on assets | 18,612 | 5,380 |

| Valuation movements on financial instruments | 77 | 279 |

| Valuation on financial assets held for sale | - | - |

| Tax | 124 | 247 |

| Plus ou moins-values de cession d'immobilisations net d'impôt | 1 | -178 |

| Results of companies consolidated under the equity method | -847 | 568 |

| Cash-flow from operating activities after net financial items and taxes | 2,817 | 2,518 |

| Net financial expenses | 1,660 | 3,563 |

| Tax paid | -424 | -90 |

| Cash-flow from operating activities before net financial items and taxes | 4,053 | 5,991 |

| Other variations in working capital | -675 | 1,765 |

| Net cash-flow from operating activities | 3,378 | 7,756 |

| Investment cash-flow | ||

| Acquisition of tangible assets | -8,052 | -6,641 |

| Acquisition of other assets | -144 | -262 |

| Assets disposal | 751 | |

| Acquisition of financial assets | 95 | 4 |

| Disposal of financial assets | 169 | |

| Financial assets disposal | ||

| Financial products received | 93 | - |

| Change in perimeter | -107 | - |

| Cash-flow from investments | -8,116 | -5,980 |

| Financing cash-flow | ||

| Variation in capital | - | - |

| Self-detention shares | -5 | 4 |

| Variation in bank loans | 10,000 | 7,000 |

| Variation in other financial debt | - | - |

| Repayment of financial lease | -524 | -618 |

| Repayment of bank loan | - | |

| Costs of loan issurance | 19 | -19 |

| Variation on bank overdraft | -1,544 | - 3,274 |

| Financial expenses paid | -1,402 | -40 |

| Dividend paid to shareholders and minorities | -4,527 | -2,263 |

| Cash-flow from financial activities | 2,017 | 790 |

| Increase/ Decrease in cash | -2,721 | 2,565 |

| Cash & cash equivalent at opening | 10,279 | 7,558 |

| Cash & cash equivalent at closing | 7,558 | 10,123 |

EPRA Net Tangible Assets (NTA ) as at 31 December 2024

| EPRA Net Tangible Assets (NTA) - in K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Including / Excluding : | |||

| Hybrid instruments | - | - | - |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including : | |||

| Revaluation of investment properties (if IAS 40 cost option is used) | - | - | - |

| Revaluation of investment property under construction (IPUC) (if IAS 40 cost option is used) | - | - | - |

| Revaluation of other non-current investments (PAREF GESTION[9]) | 37,873 | 36,203 | -4% |

| Revaluation of tenant leases held as finance leases | - | - | - |

| Revaluation of trading properties | - | - | - |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding : | |||

| Differed tax in relation to fair value gains of IP | - | - | - |

| Fair value of financial instruments | -378 | 1,312 | n.a. |

| Goodwill as a result of deferred tax | - | - | - |

| Goodwill as per the IFRS balance sheet | - | - | - |

| Intangibles as per the IFRS balance sheet | -652 | -618 | -5% |

| Including : | |||

| Fair value of debt | - | - | |

| Revaluation of intangible to fair value | - | - | - |

| Real estate transfer tax | 12,393 | 14,079 | 14% |

| NAV | 170,437 | 162,683 | -5% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | 113.0 € | 107.8€ | -5% |

EPRA Net Disposal Value (NDV ) as at 31 December 2024

| EPRA NDV (Net Liquidation Value) - in K€ | Dec 31, 2023 | Dec 31, 2024 | Evolution |

| IFRS Equity attributable to shareholders | 121,200 | 111,708 | -8% |

| Diluted NAV | 121,200 | 111,708 | -8% |

| Including : | |||

| Revaluation of other non-current investments (PAREF GESTION[10] ) | 37,873 | 36,203 | -4% |

| Diluted NAV at Fair Value | 159,073 | 147,911 | -7% |

| Excluding : | |||

| Fair value of debt | 409 | 195 | -52% |

| NAV | 159,483 | 148,105 | -7% |

| Fully diluted number of shares | 1,508,609 | 1,508,425 | |

| NAV per share (in €) | 105.7 € | 98.2 € | -7% |

Other EPRA indicators

- EPRA vacancy rate[11]

| In K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution in pts |

| Estimated rental income on vacant space | 95 | 3,245 | |

| Estimated rental value of the whole portfolio | 10,925 | 12,746 | |

| EPRA Vacancy Rate | 0.87% | 25.46% | 24.59 pts |

- EPRA Net Initial Yield (NIY) and 'topped-up' NIY

| In % | Dec 31 , 2023 | Dec 31 , 2024 | Evolution in pts |

| PAREF Net yield | 6.54% | 5.36% | -1.18pts |

| Impact of estimated duties and costs | -0.39% | -0.36% | +0.03pts |

| Impact of changes in scope | 0.00% | -0.02% | -0.02pts |

| EPRA Net initial yield[12] | 6.15% | 4.98% | -1,17 pts |

| Excluding lease incentives | 1.71% | 0.47% | -1.24 pts |

| EPRA "Topped-Up" Net initial yield [13] | 7.86% | 5.45% | -2.41 pts |

- Capital expenditure

| and K€ | Dec 31 , 2023 | Dec 31 , 2024 |

| Acquisition | ||

| Development[14] | 6,456 | 6,965 |

| Maintenance CAPEX | 222 | 3,241 |

| with surface creation | ||

| without surface creation | 222 | 3,241 |

| commercial advantages | ||

| Other expenses | ||

| Capitalized interest | ||

| Total CAPEX | 6,553 | 10,206 |

| Difference between recognized and disbursed CAPEX | 1,671 | -3,319 |

| Total CAPEX Cash | 8,224 | 6,888 |

- LTV (Loan to Value) EPRA

| In K€ | Group as reported | Proportionate Consolidation | Combined | ||||

| Share of JV | Share of Material Associates | Non-controlling Interests | |||||

| Include: | |||||||

| Borrowings from Financial Institutions | 77,000 | n.a. | 9,695 | n.a. | 86,695 | ||

| Commercial paper | - | n.a. | - | n.a. | - | ||

| Hybrids (including convertibles, preference shares, debt, options, perpetuals) | - | n.a. | - | n.a. | - | ||

| Bond loans | - | n.a. | - | n.a. | - | ||

| Foreign currency derivatives (futures, swaps, options and forwards) | - | n.a. | - | n.a. | - | ||

| Net payables[15] | 7,853 | n.a. | 206 | n.a. | 8,059 | ||

| Owner-occupied property (debt) | - | n.a. | - | n.a. | - | ||

| Current accounts (equity characteristic) | - | n.a. | - | n.a. | - | ||

| Exclude: | n.a. | n.a. | - | ||||

| Cash and cash equivalents | 10,123 | n.a. | 122 | n.a. | 10,245 | ||

| Net Debt (A) | 74,730 | n.a. | 9,778 | n.a. | 84,508 | ||

| Include: | |||||||

| Owner-occupied property | - | n.a. | - | n.a. | - | ||

| Investment properties at fair value | 168,810 | n.a. | 21,683 | n.a. | 190,493 | ||

| Properties held for sale | 3,900 | n.a. | - | n.a. | 3,900 | ||

| Properties under development | - | n.a. | - | n.a. | - | ||

| Intangibles[16] | 38,341 | n.a. | - | n.a. | 38,341 | ||

| Net receivables | - | n.a. | - | n.a. | - | ||

| Financial assets | 1,435 | n.a. | - | n.a. | 1,435 | ||

| Total Property Value (B) | 212,486 | n.a. | 21,683 | n.a. | 234,169 | ||

| Optionnel: | |||||||

| Real estate transfer taxes | 12,743 | n.a. | 1,496 | n.a. | 14,239 | ||

| Total asset value (including RETT) © | 12,743 | n.a. | 1,496 | n.a. | 14,239 | ||

| LTV (A/B) | 35.2% | n.a. | 45.1% | n.a. | 36.1% | ||

| LTV (INCL. RETT) (A/C) (OPTIONNEL) | 33.2% | n.a. | 42.2% | n.a. | 34.0% | ||

• EPRA cost ratios

The ratios below are calculated on the basis of PAREF's own assets[17] (including equity arrangements).

| and K€ | Dec 31 , 2023 | Dec 31 , 2024 | Evolution |

| Include : | |||

| (2,522) | (1,912) | -24% |

| |||

| (3,809) | (3,625) | -5% |

| (355) | (74) | -79% |

| Exclude: | |||

| 1,573 | 1,159 | -26% |

| 2,155 | 1,830 | -15% |

| EPRA Costs (including direct vacancy costs) (A) | (2,958) | (2,623) | -11% |

| 202 | 671 | 232% |

| EPRA Costs (excluding direct vacancy costs) (B) | (2,756) | (1,952) | -29% |

| 11,167 | 10,285 | -8% |

| (2,155) | (1,830) | -15% |

| 1,356 | 1,603 | 18% |

| Gross Rental Income © | 10,367 | 10,058 | -3% |

| EPRA Cost Ratio (including direct vacancy costs) (A/C) | 28.5% | 26.1% | -24 pts |

| EPRA Cost Ratio (excluding direct vacancy costs) (B/C) | 26.6% | 19.4% | -7 pts |

Glossary

DFS (Secured Financial Debt): secured financial debt divided by the consolidated value of assets, including the value of PAREF Gestion shares and financial interests in funds managed by the Group.

ICR (Interest Coverage Ratio): EBITDA divided by consolidated financial expenses excluding setup fees for financing. DFS: secured financial debt divided by the consolidated asset value (including the value of PAREF Gestion's share and financial participation in the funds managed by the Group).

LTV (Loan to Value): consolidated withdrawn net debt divided by the consolidated asset value excluding transfer taxes and including the valuation of PAREF Gestion and financial participation in the funds managed by the Group.

SCPI Distribution Rate: dividing the gross dividend-before withholding tax and any other taxes paid by the fund on behalf of the shareholder-distributed for year N (including exceptional interim dividends and the share of distributed capital gains) by the subscription price as at January 1 of year N for open-ended SCPIs.

TOF (Financial occupancy ratio): dividing the total amount of rents and occupancy allowances invoiced (including rent compensation allowances) as well as the market rental values of other premises not available for rental, by the total amount of rents billable in the hypothesis where the entirety of the assets shall be rented.

WALB ( Weighted Average Lease Break): average remaining duration of the tenancy until the next break option.

[1] Participations in SCPI/OPPCI

[2] The Medelan asset included in fund management and mandate management

[3] Participation in the OPPCI Vivapierre

[4] Excluding minority stakes in SCPI/OPPCI.

[5] Excluding the Tempo (Léon Frot) asset under restructuring as at December 31, 2023

[6] Including the value of PAREF Gestion, realized by a qualified external expert as at Dec 31st 2024 and financial participations in the funds managed by the Group

[7] The valuation of PAREF Gestion was made by a qualified external expert as at Dec 31, 2024

[8] Including participations in the companies consolidated in equity method OPPCI Vivapierre at 27.24%

[9] The valuation of PAREF Gestion was performed by a qualified external expert Dec 31, 2024

[10] The valuation of PAREF Gestion was performed by a qualified external expert Dec 31, 2024

[11] Excluding the participation in OPPCI Vivapierre

[12] The EPRA Net Initial Yield rate is defined as the annualized rental income, net of property operation expenses, after deducting rent adjustments, divided by the value of the portfolio, including duties

[13] The EPRA 'topped-up' Net Initial Yield rate is defined as the annualized rental income, net of property operating expenses, excluding lease incentives, divided by the value of the portfolio, including taxes.

[14] Including the investment related to restructuring project of Tempo asset, located in Paris

[15] Including current debts (accrued interest, guarantee, suppliers, tax payable, other debts) net of current receivable (clients, other receivables and prepaid expenses)

[16] Including the valuation of PAREF Gestion performed by a qualified external expert Dec 31, 2024

[17] excluding the participation in OPPCI Vivapierre

- SECURITY MASTER Key: xWdwYp2bYm+Xx52caslnbmlsm5tpkmmUbmmYyGNulZvFnHFjmWZnl5jLZnJhlm5u

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-90198-press-release-2024-paref-full-year-results.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free