Burlington, Ontario--(Newsfile Corp. - February 27, 2025) - Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) ("SBMI" or "the Company") announces it has shipped its first order of silver concentrate processed from material from the Super Champ in Arizona. The Company expects further shipments to this same customer as further concentrate is generated, eventually reaching a goal of regular deliveries against regular payments.

John Carter, SBMI's CEO, said, "This revenue generation has been the goal since SBMI started work. The developments of the last few months, the success of our recently closed financing, this first shipping of concentrate, and the first generation of revenue is the cumulation of much hard work by so many people. The surprise gold values provide a large upside for the shareholders. We are confident that this will only get better from here."

At its 100% owned mill in Globe, Arizona, SBMI has reached and maintained its targeted production rate of six to seven tons per hour. In creating the concentrate SBMI processed the majority of the lower grade material from Super Champ and is moving to process the higher grade material. Management reasonably expects the silver grade in the concentrate to increase as the higher grade material is processed.

The Company has roughly 3,000 tons of material on the ground at the mine and at the mill, representing roughly sixty days of processing. A video of the mill in operation can be viewed at www.silverbulletmines.com.

To maintain and further increase production rate the Company has purchased a larger excavator with twice the capacity of the rental unit currently being used at the Super Champ for the removal of material. The Company has also purchased a larger well pump to provide additional water for the increase in volume required for the higher throughput of material at the mill. With the revenue generation milestone being reached the Company is also contemplating increasing the hours of operation at its mine and mill facilities.

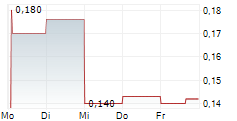

With respect to the financing closed on February 18, 2025, the Company announces it issued 597,300 finders warrants having a term of three years exercisable at sixteen cents to arm's length parties.

For further information, please contact:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1 (905) 302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management's current expectation of future events, and can be identified by words such as "believe", "expects", "will", "intends", "plans", "projects", "anticipates", "estimates", "continues" and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions, and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global virus; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the production and processing of ore; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI's properties; risks of future legal proceedings; income tax matters; fires, floods and other natural phenomena; the rate of inflation; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global pathogens create risks that at this time are immeasurable and impossible to define.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/242729

SOURCE: Silver Bullet Mines Corp.