VANCOUVER, British Columbia, Feb. 27, 2025 (GLOBE NEWSWIRE) -- American Lithium Corp. ("American Lithium" or the "Company") (TSX-V:LI | OTCQX:AMLIF | Frankfurt:5LA1) is pleased to announce an updated Mineral Resource Estimate ("MRE") for the Tonopah Lithium Claims ("TLC") project, located in the Esmerelda lithium district northwest of Tonopah, Nevada. The updated MRE has successfully converted Indicated Resources to the Measured category, increasing Measured Resources 47% from the previous 2023 MRE at TLC. The resource block model has been further refined, increasing the confidence of the TLC resource. The vast majority of resources used in the 2024 PEA Mine Plan are now within the more reliable Measured Resource footprint.

The updated MRE was completed by Stantec Consulting Services Inc. of Salt Lake City, UT and is based on an additional 44 drill holes drilled since the previously filed January 2023 MRE.

Highlights: (see Table 1 February 2025 TLC MRE & Table 2 Previous January 2023 TLC MRE, below)

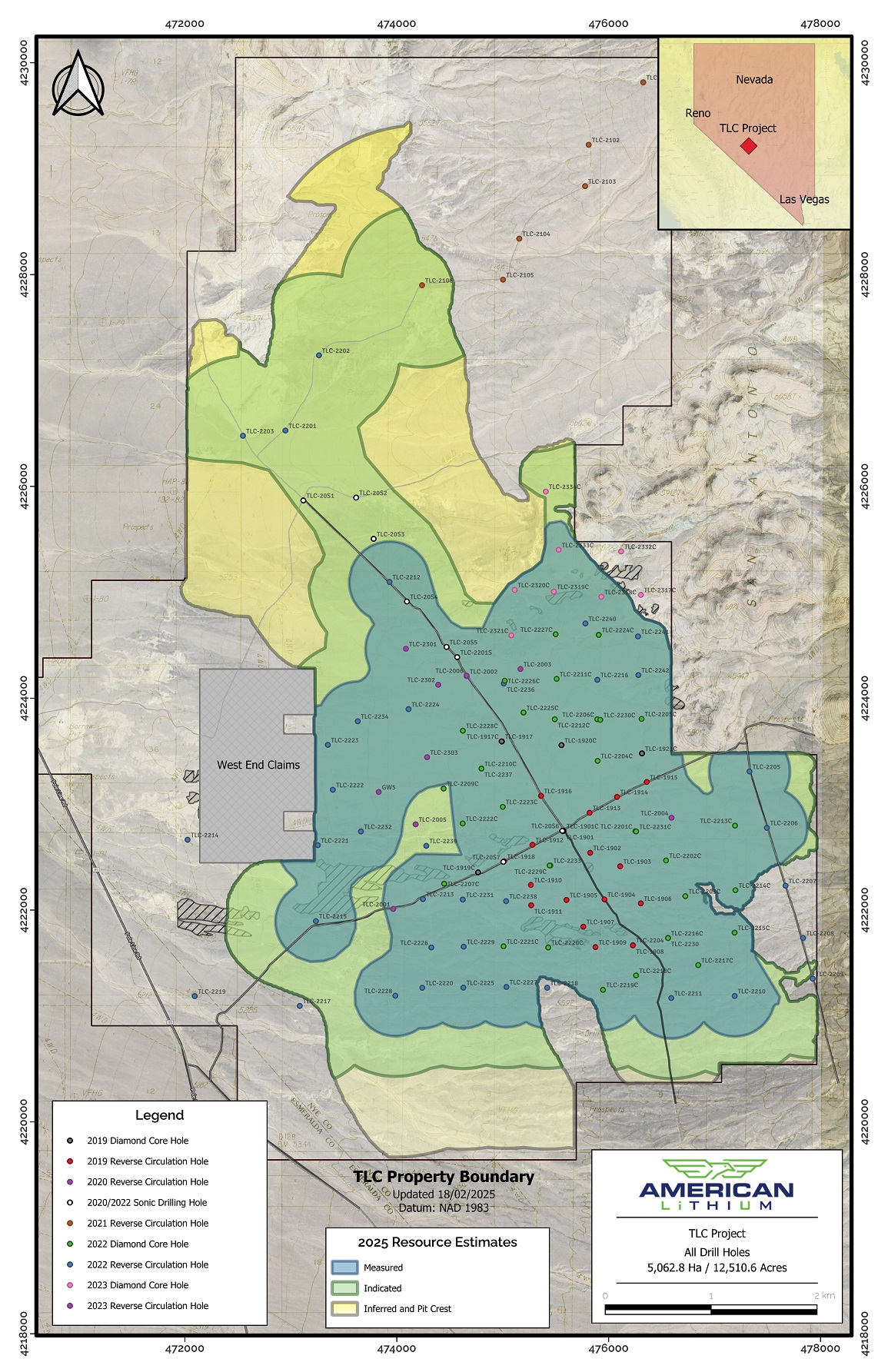

Link to: Figure 1 - TLC Project Updated Mineral Resource Block Outline and Drill Hole Location Map (also see below)

- Measured Resource - 6.17 Mt Lithium Carbonate Equivalent ("LCE") (1,365 Mt @ 849 ppm Li); increase of 47% contained LCE versus 2023 MRE

- Indicated Resource - 2.39 Mt LCE (553 Mt @ 808 ppm Li); decrease of 48% versus 2023 MRE

- Measured + Indicated Resource - 8.56 Mt LCE (1,918 Mt @ 839 ppm Li); 3% decrease from 2023 MRE

- Inferred Resource - 1.44 Mt LCE (345 Mt @ 780 ppm Li); 22% decrease from 2023 MRE

American Lithium Interim CEO, Alex Tsakumis states: "We are very pleased with the newly established and upgraded Measured Resource footprint at TLC as it not only increases the resource confidence level in the Measured category but also represents the core of the 2024 PEA Mine Plan. Our focus remains on diligently and prudently advancing our projects as we prepare for an anticipated recovery in the battery metals market."

Table 1 - Updated TLC Mineral Resource Estimate (February 2025)

| Cutoff | Volume | Tonnes | Li | Million Tonnes (Mt) | ||

| Li (ppm) | (Mm3) | (Mt) | (ppm) | Li | Li2CO3 | LiOH.H2O |

| Measured | ||||||

| 500 | 803 | 1,365 | 849 | 1.16 | 6.17 | 7.02 |

| 600 | 645 | 1,097 | 923 | 1.01 | 5.37 | 6.11 |

| 800 | 396 | 673 | 1,065 | 0.72 | 3.83 | 4.36 |

| 1,000 | 217 | 369 | 1,208 | 0.45 | 2.39 | 2.72 |

| 1,200 | 100 | 170 | 1,345 | 0.23 | 1.22 | 1.39 |

| Indicated | ||||||

| 500 | 325 | 553 | 808 | 0.45 | 2.39 | 2.72 |

| 600 | 238 | 405 | 903 | 0.37 | 1.97 | 2.24 |

| 800 | 141 | 240 | 1,050 | 0.25 | 1.33 | 1.51 |

| 1,000 | 70 | 119 | 1,212 | 0.14 | 0.74 | 0.85 |

| 1,200 | 32 | 54 | 1,365 | 0.07 | 0.37 | 0.42 |

| Measured plus Indicated | ||||||

| 500 | 1,128 | 1,918 | 839 | 1.61 | 8.56 | 9.74 |

| 600 | 883 | 1,502 | 919 | 1.38 | 7.34 | 8.35 |

| 800 | 537 | 913 | 1,062 | 0.97 | 5.16 | 5.87 |

| 1,000 | 287 | 488 | 1,209 | 0.59 | 3.13 | 3.57 |

| 1,200 | 132 | 224 | 1,339 | 0.30 | 1.59 | 1.81 |

| Inferred | ||||||

| 500 | 203 | 345 | 780 | 0.27 | 1.44 | 1.63 |

| 600 | 139 | 236 | 887 | 0.21 | 1.12 | 1.27 |

| 800 | 83 | 141 | 1,022 | 0.14 | 0.74 | 0.85 |

| 1,000 | 39 | 66 | 1,169 | 0.08 | 0.43 | 0.48 |

| 1,200 | 13 | 22 | 1,326 | 0.03 | 0.16 | 0.18 |

- CIM definitions are followed for classification of Mineral Resource.

- Mineral Resource surface pit extent has been estimated using a lithium carbonate price of US20,000 US$/tonne and mining cost of US$3.00 per tonne, a lithium recovery of 90%, fixed density of 1.70 g/cm3 (1.43 tons/yd3)

- Conversions: 1 metric tonne = 1.102 short tons, metric m3 = 1.308 yd3, Li2CO3:Li ratio = 5.32, LiOH.H2O:Li ratio =6.05

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Joan Kester, PG of Stantec Consulting Services Inc. in conformity with CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

Table 2 - Previous TLC Mineral Resource Estimate (January 2023)

| Cutoff | Volume | Tonnes | Li | Million Tonnes (Mt) | ||

| Li (ppm) | (Mm3) | (Mt) | (ppm) | Li | Li2CO3 | LiOH.H2O |

| Measured | ||||||

| 500 | 506 | 860 | 924 | 0.79 | 4.2 | 4.78 |

| 600 | 416 | 707 | 1006 | 0.71 | 3.78 | 4.3 |

| 800 | 283 | 481 | 1153 | 0.55 | 2.93 | 3.33 |

| 1000 | 203 | 345 | 1255 | 0.43 | 2.29 | 2.6 |

| 1200 | 104 | 177 | 1401 | 0.25 | 1.33 | 1.51 |

| Indicated | ||||||

| 500 | 701 | 1192 | 727 | 0.87 | 4.63 | 5.26 |

| 600 | 438 | 745 | 835 | 0.62 | 3.3 | 3.75 |

| 800 | 218 | 371 | 987 | 0.37 | 1.97 | 2.24 |

| 1000 | 80 | 136 | 1148 | 0.16 | 0.85 | 0.97 |

| 1200 | 22 | 37 | 1328 | 0.05 | 0.27 | 0.3 |

| Measured plus Indicated | ||||||

| 500 | 1207 | 2052 | 809 | 1.66 | 8.83 | 10.04 |

| 600 | 854 | 1452 | 916 | 1.33 | 7.08 | 8.05 |

| 800 | 501 | 852 | 1080 | 0.92 | 4.9 | 5.57 |

| 1000 | 283 | 481 | 1227 | 0.59 | 3.14 | 3.57 |

| 1200 | 126 | 214 | 1402 | 0.3 | 1.6 | 1.81 |

| Inferred | ||||||

| 500 | 286 | 486 | 713 | 0.35 | 1.86 | 2.12 |

| 600 | 173 | 294 | 827 | 0.24 | 1.28 | 1.45 |

| 800 | 77 | 131 | 995 | 0.13 | 0.69 | 0.79 |

| 1000 | 31 | 53 | 1151 | 0.06 | 0.32 | 0.36 |

| 1200 | 8 | 14 | 1315 | 0.02 | 0.11 | 0.12 |

- CIM definitions are followed for classification of Mineral Resource.

- Mineral Resource surface pit extent has been estimated using a lithium carbonate price of US20,000 US$/tonne and mining cost of US$3.00 per tonne, a lithium recovery of 90%, fixed density of 1.70 g/cm3 (1.43 tons/yd3)

- Conversions: 1 metric tonne = 1.102 short tons, metric m3 = 1.308 yd3, Li2CO3:Li ratio = 5.32, LiOH.H2O:Li ratio =6.05

- Totals may not represent the sum of the parts due to rounding.

- The Mineral Resource estimate has been prepared by Joan Kester, PG and Derek Loveday, P. Geo. of Stantec Consulting Services Inc. in conformity with CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

Figure 1 - TLC Project Updated Mineral Resource Block Outline and Drill Hole Location Map

Mineral Resource Estimation Calculation Methodology

The geologic model used for reporting of lithium resources was developed using Hexagon Mining's geological modelling and mine planning software, MinePlan version 16.1.1. The geologic model from which lithium resources are reported is a 3D block model developed using the Nevada State Plane Central Zone NAD83 coordinate system and U.S. customary units. Block size is 50ft-X, 50ft-Y and 20ft-Z. Modeling method and approach is similar to that described in the prior Technical Report (Loveday and Kester, 2023) but with a re-interpretation of geologic controls on mineralization using the additional exploration drilling and geophysical data.

A base case lithium resource cut-off grade has been calculated based on the economics of a medium size (100 Mtpa) run-of-mine (ROM) surface mining operation that does not require blasting. Processing of the mineralized material would be onsite extracting lithium from claystone using an acid digestion method. Resources are reported from within an economic pit shell at 45-degree constant slope using Hexagon mining Pseudoflow algorithm. Maximum pit depth is limited to 1,000 feet (304.8 m) below surface. No underground mining is considered.

The following mining, processing, royalty, and recovery costs, in US$, were used to derive a base case cut-off grade to produce a lithium carbonate (Li2CO3) equivalent product:

- Mining costs US$3/tonne;

- Processing costs US$49/tonne;

- Royalties US$1/tonne;

- General and administration US$1/tonne; and Processing recovery 90%.

Revenue from a lithium carbonate product is estimated to be US$20,000/tonne for the cutoff grade calculation. Using the above inputs and Li2CO3:Li ratio of 5.32, a base case cut-off grade for lithium is estimated to be 500 ppm, rounded from 501 ppm. The base case cut-off grade of 500 ppm lithium is the same as the prior (Loveday and Kester, 2023) Mineral Resource Estimate ("MRE") using the same cost assumptions as the prior MRE.

The updated base case MRE represents an increase of 47% Li2CO3 equivalent tonnes in the Measured Category, a decrease of 48% for the Indicated category when compared to the prior MRE (both at 500 ppm Li cutoff). Inferred Li2CO3 equivalent resources have decreased by 22% percent when compared to the prior MRE for the base case.

Resource Estimate Parameters:

- Resource Update Effective Date - February 7, 2023:

- 44 new drill holes (2022 to 2023) added to current MRE (16 RC and 28 Diamond)

- 82 drill holes (2019 to 2022 in previous MRE)

Quality Assurance, Quality Control and Data Verification

Diamond drilling was conducted by First Drilling of Montrose, Colorado using large diameter, PQ-size, drilling entirely vertical holes in 2022. In 2023 eight (8) additional diamond cores were drilled by IG Drilling

of Payson, Utah using drill rig CS-14 using either a PQ or HQ diameter drill bit. Drill core samples are nominally 5-foot (1.53 m) length and are cut longitudinally, and one half of the HQ-size core, or one quarter of PQ size core is placed in sealed bags and shipped to analytical laboratories.

Reverse Circulation (RC) drilling was conducted by Harris Exploration Drilling and Associates Inc., of Fallon, Nevada with 5.5-inch diameter face centred bit on vertical drill holes. Sampling was conducted using a riffle splitter or a cyclone splitter depending on the moisture content of the sampled material. Sampling was conducted over 5-foot (1.52m) intervals with individual samples placed in sealed bags and transported to the respective analytical labs. In 2023 three (3) RC holes were

drilled by Harris's Canterra Rig using 5.5" diameter.

Samples were shipped to American Assay Laboratories (AAL) in Sparks, Nevada for sample preparation, processing and ICP-MS multi-element analysis. Pulps and rejects are returned and retained by the Company. AAL is an ISO/IEC 17025 certified assay laboratory. The QA/QC program includes a comprehensive analytical quality assurance and control routine comprising the systematic use of Company inserted standards, blanks and field duplicate samples, and internal laboratory QA/QC standard operating procedures. Downhole lengths (depths) for vertical drill holes are considered accurate true depth intersections for the essentially flat-lying, to gently dipping TLC host stratigraphy.

Mineral Resource Estimate Preparation

The Mineral Resource estimate has been prepared by Joan Kester, PG of Stantec Consulting Services Inc. in conformity with CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

Qualified Persons

Ms. Joan Kester, PG and Ms. Mariea Kartick, P. Geo. of Stantec Consulting Services Inc. are Qualified Persons as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, have prepared or supervised the preparation of, or have reviewed and approved, the scientific and technical data pertaining to the Mineral Resource estimates contained in this release, and will be preparing the NI-43-101 Technical Report for filing on SEDAR within 45 days.

Mr. Ted O'Connor, P.Geo., Executive Vice President of American Lithium, and a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the scientific and technical information contained in this news release.

About American Lithium

American Lithium is developing two of the world's largest, advanced-stage lithium projects, along with the largest undeveloped uranium project in Latin America. They include the TLC claystone lithium project in Nevada, the Falchani hard rock lithium project and the Macusani uranium deposit, both in southern Peru. All three projects have been through robust preliminary economic assessments, exhibit significant expansion potential and enjoy strong community support.

For more information, please contact the Company at info@americanlithiumcorp.com or visit our website at www.americanlithiumcorp.com.

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

"Alex Tsakumis"

Interim CEO

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as "may", "will", "plan", "expect", "anticipate", "estimate", "intend", "indicate", "scheduled", "target", "goal", "potential", "subject", "efforts", "option" and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium's ability to achieve its stated goals;, which could have a material adverse impact on many aspects of American Lithium's businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium's ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium's potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium's shares and could negatively affect American Lithium's ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the "Risk Factors" section of American Lithium's Management's Discussion and Analysis filed on October 15, 2024, and in recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Cautionary Note Regarding 32 Concessions

Thirty-two of the one-hundred-seventy-four concessions comprising the Falchani and Macusani Projects are currently subject to Administrative and Judicial processes in Peru to overturn resolutions issued by INGEMMET and the Mining Council of MINEM in February 2019 and July 2019, respectively, which declared title to thirty-two concessions invalid due to late receipt of the annual validity payments. On November 2, 2021, American Lithium was awarded a favorable ruling in regard to title to the concessions, but on November 26, 2021, appeals of the judicial ruling were lodged by INGEMMET and MINEM. A three-judge tribunal of Peru's Superior Court unanimously upheld the ruling in a decision reported in November 2023. American Lithium was subsequently notified that INGEMMET and MINEM have filed petitions to the Supreme Court of Peru to assume jurisdiction in the proceedings. Given the precedent of the original ruling it is hoped that the Supreme Court will not assume jurisdiction; however, there is no assurance of the outcome at this time.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3fae412c-f633-4c9b-80cb-9b9afad01492