Set up for profitability and sales momentum

1 October-31 December

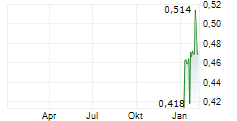

- ARR from subscriptions added with the past four quarters' revenue from non-subscription products were 178,502k (165,259k) SEK, which is an increase of 8% compared to the previous year.

- Invoiced sales for the quarter were 37,812k (33,241k) SEK, an improvement of 14% compared to the previous year.

- Net revenue amounted to 44,741k (44,018k) SEK, an increase of 2% compared to the same period last year.

- EBITDA amounted to -8,414k (6,913k) SEK. The comparative period included a positive one-off effect of 13,002k SEK, resulting in an EBITDA of -6,087k SEK for the comparative period adjusted for these effects.

- EBITA amounted to -12,438k (-1,091) SEK. The comparison period included a positive one-off effect of 13,002k SEK, adjusted depreciation time of -3,024k SEK and a write-down of accumulated values amounting to -850k SEK, which gives an EBITDA for the comparison period of -10,243k adjusted for these effects.

- The result after financial items amounted to -22,243k (22,611) SEK.

- The result for the period amounted to -21,411k (-23,598) SEK.

- Earnings per share amounted to -0.85 (-0.94) SEK, before and after dilution.

- Cash flow from current operations amounted to -12,788k (-5,089) SEK.

- Cash and cash equivalents at the end of the period amounted to 44,472k (80,482) SEK.

1 January-31 December

- ARR from subscriptions added with the past four quarters' revenue from non-subscription products were 178,502k (165,259k) SEK, which is an increase of 8% compared to the previous year.

- Invoiced sales for the period were 182,723k (180,848k) SEK, an increase of 1% compared to the previous year.

- Net revenue amounted to 177,791k (177,893) SEK, which is in line with previous year.

- EBITDA amounted to -30,706k (-6,251) SEK. The comparison period included a positive one-off effect of 13,002k SEK and a negative one-off effect of 3,104k SEK, which gives an EBITDA for the comparison period of -16,149k adjusted for these effects.

- EBITA amounted to -45,984k (-25,096) SEK. Items affecting comparability affected EBITA by -2,889k SEK, which comes from the restructuring program in Q1 2024 and relates to personnel costs.

- The result after financial items amounted to -113,666k (-85,157) SEK.

- The result for the period amounted to -104,789k (-79,897) SEK.

- Earnings per share amounted to -4.17 (-3.18) SEK, before and after dilution.

- Cash flow from current operations amounted to -26,915k (-17,880) SEK.

- Cash and cash equivalents at the end of the period amounted to 44,472k (80,482) SEK.

Significant events in the fourth quarter of 2024

Albert announced that a strategic decision had been made to restructure and reduce the resource allocation to the subsidiary Kids MBA as part of the company's ongoing initiative to improve the group's profitability.

Significant events after the end of the period

Albert Junior was launched in the Czech Republic. The launch was another strategic step toward profitable growth and expanded global presence following the launch in Romania.

In connection with the preparation of the annual financial statements, the company discovered an error in the Q3 report concerning the consolidated income statement and balance sheet. This error resulted in an insufficient impairment of intangible assets in the group when the company wrote down excess values in Kids MBA, as referenced in the press release from 2 October 2024. The error occurred due to a data entry mix-up, where the amounts were mistakenly registered incorrectly. The error will be adjusted for the full year. It negatively impacts intangible items and EBIT by 10 million SEK.

The company has also corrected costs related to marketing expenses in connection with the annual financial statements. These costs pertain to an earlier period this year, Q2, which has negatively impacted the Q4 results with 1.4 million SEK.

Comment from our CEO

Dear shareholders,

It's time to wrap up 2024. Profitability was our focus and we have taken major steps to achieve this in 2025, with positive cash flow in 2026. We end 2024 with a lower cost base, resources reallocated to well-performing areas, positive sales momentum, key product launches, and an organisation set up for efficiency and scalability.

Turnaround and operational restructuring in 2024 to prepare for profitability

Entering 2024, we had 129 people and running costs* (excluding marketing) of 12 million SEK per month. Now, we have 103 people (corresponding 96 FTE) and running costs* of 11 million SEK per month. Staff costs decreased by 9 percent. This is the result of the profitability programme launched in the first quarter of 2024.

Invoiced sales were 183 million SEK an increase of 1 percent and recognised revenue was 178 million SEK which was in line with previous year.

Despite these reductions, we have organically grown revenues for our key products. Within B2B, the invoiced sales of Strawbees and Swedish Film hit an all time high in 2024. Sumdog returned to growth in the second half, driven by Scotland. Growth in England was slower than expected, as the partnership with YPO underperformed. We retain faith, but will reallocate resources to direct sales. B2C saw a significant positive trend breach during the summer campaign, and momentum has continued. The Q4 campaign performed impressively, delivering a bigger paying subscriber base than expected. This momentum in both B2B and B2C led to us investing more in promotion and commercial staff, increasing costs in autumn 2024.

EBITDA for 2024 was -31 million SEK, 15 million SEK lower than 2023's EBITDA of -16 million SEK adjusted for one-offs. The difference is explained by reduced R&D capitalisation (-), increased marketing (-), higher gross profit (+) and lower running costs (+); all being items that drive a sounder long term business.

We devoted significant effort to improving internal operations - moving from a group of independent businesses to a united group. This lets us capture synergies and act more efficiently. We are set up for scalability, and can more easily add markets, products and brands in future.

Q4 marked the end of the setup for entering 2025 with momentum

In the fourth quarter, we worked to set up a successful 2025, completing our reorganisation. Financially, this quarter is normally slow, as schools prepare for holidays. However, Swedish B2B sales were better than expected, and B2C saw good momentum where Albert Junior had one of its best fourth quarters ever.

Invoiced sales were 38 million SEK, 14 percent up compared to 2023, and recognised revenue 45 million SEK, up 2 percent. EBITDA was -8.4 million SEK, down 2.3 million SEK compared to the EBITDA of -6.1 million SEK in 2023 adjusted for one-offs. The difference is due to reduced R&D capitalisation (-), increased marketing (-), higher gross profit (+) and lower running costs (+).

2025: delivering profitability

In 2025, we aim to reach positive EBITDA. To do this, we will double down on what's performing; growing Albert Junior, US sales of Strawbees, growing Sumdog in England, and optimising Swedish Film's commercial function to upsell content.

In early 2025 we delivered several important releases. Sumdog's fluency booster (in beta) strengthens it as a leading adaptive maths tool. The new swedishfilm.com website enables streaming from major studios to B2B, opening distribution to a wider audience. Albert Junior was released in Czechia, building on Autumn's promising Romanian launch. This drives growth while preserving profitable LTV/CAC.

We feel well prepared to deliver profitability in 2025. We have lowered our cost base, focused on key areas, strengthened marketing and sales, released key product launches, and restructured our organisation. In the first quarter, our focus is to build a pipeline that delivers during the rest of the year.

I would like to thank all shareholders, employees, customers and business partners for 2024. Together we will make 2025 successful in terms of turning to profitability and helping children across the world reach their full potential by making learning engaging and fun.

Best regards,

Jonas Mårtensson, CEO

*Running costs refers to staff costs, external costs and overheads (not including marketing)

For additional information, please contact:

Jonas Mårtensson, CEO

Mobile: +46 (0) 729 70 70 84

Email: jonas@hejalbert.se

For additional information, please contact:

Katarina Strivall, CFO

Mobile: +46 (0) 706 840074

Email: katarina.strivall@hejalbert.se

About eEducation Albert AB (publ)

The Albert Group develops and sells edtech products for schools and consumers. The company was founded in 2015 with the goal of democratizing education and providing every child the opportunity to reach their full potential. The product portfolio includes educational apps, educational videos, and physical learning products under the brands Albert, Jaramba, Holy Owly, Film & Skola, Strawbees, and Sumdog. Since the products were launched, they have helped more than ten million children make learning engaging and personalized. The company is headquartered in Gothenburg, Sweden, and operates actively in several countries in Europe, the USA, and Asia. Albert is listed on Nasdaq First North Growth Market with the ticker symbol ALBERT. The company's certified adviser is Carnegie Investment Bank AB (publ), +46 (0) 73 856 42 65, certifiedadviser@carnegie.se.

Read more at investors.hejalbert.se

This information is information that eEducation Albert is obliged to make public pursuant to the EU Market Abuse Regulation. The information was submitted for publication, through the agency of the contact persons set out above, at 2025-02-28 07:30 CET.