Karelian Diamond Resources Plc - Half-yearly results for the six months ended 30 November 2024

PR Newswire

LONDON, United Kingdom, February 28

![]()

28 February 2025

Karelian Diamond Resources plc

("Karelian" or "the Company")

Half-yearly results for the six months ended 30 November 2024

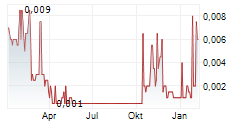

Karelian Diamond Resources plc (AIM: KDR), the diamond exploration and natural resources company focused on Finland and Ireland, today announces its unaudited results for the six months ended 30 November 2024. Details of these can be found below and a full copy of the interim results statement can be viewed on the Company's website (www.kareliandiamondresources.com). Further operational progress was made by Karelian during the period, while the final approval for the proposed diamond mine remains awaited.

Highlights of the half-year period included:

- Lahtojoki diamond mine boundaries were finalised with no change to the existing boundaries. Landowner compensation agreed and paid. Final approval on the three outstanding items is expected in H2 2025.

- Exploration programme in the Kuhmo region of Finland continues with a follow-up detailed electromagnetic survey conducted over the target area which has identified two diatreme-shaped anomalies that could represent the kimberlitic source of the green diamond.

- New licence areas and extensions of existing ones have been granted over, and adjacent to, the target areas in Finland.

- In Northern Ireland expert assessment on the nickel, copper and platinum anomalies have proven very encouraging as being capable of hosting significant economic deposits and as a result further work is being carried out.

Brendan McMorrow, Chairman of Karelian Diamonds, said:

"The Company has made further progress in the period, especially with regards to the granting of the mining permit at the Lahtojoki diamond deposit. We have also made progress towards determining the source of the green diamond the Company discovered in the Kuhmo region in Finland and the Board is very excited regarding the potential for metal ores in Northern Ireland."

Further Information:

Karelian Diamond Resources PLC Brendan McMorrow, Chairman Maureen Jones Managing Director |

+353-1-479-6180 |

Allenby Capital Limited (Nomad) Nick Athanas / Nick Harriss |

+44-20-3328-5656 |

Peterhouse Capital Limited (Joint Broker) Lucy Williams / Duncan Vasey |

+44-20-7469-0930 |

CMC Markets (Joint Broker) Douglas Crippen |

+44-20-3003-8632 |

Lothbury Financial Services Michael Padley |

+44-20-3290-0707 |

Hall Communications Don Hall |

+353-1-660-9377 |

http://www.kareliandiamondresources.com

Chairman's statement

Dear Shareholder,

I have great pleasure in presenting the Company's Half-Yearly Report and condensed Financial Statements for the period ended 30 November 2024.

The Lahtojoki Diamond Deposit

The mine boundaries for the Lahtojoki diamond deposit were finalised in the period. A hearing of the Finnish Land Court resulted in no change to the existing boundaries. This decision was an essential and long-awaited step as the Company proceeds with its plans for the proposed development of the Lahtojoki diamond deposit.

Additionally, the appeals by two landowners regarding the terms were rejected by the Land Court, except for three minor items. The Company has been informed that these will be determined in the next quarter.

Diamond Exploration Programme in Finland

The Company's exploration programme in the Kuhmo region of Finland continues to be encouraging up-ice of the Company's discovery of a green diamond. Basal till sampling suggests that two of the sample locations may be close to the source of the green diamond.

A follow-up semi-airborne unmanned aerial vehicle ("UAV") based detailed electromagnetic ("EM") survey has been conducted over the target area. A UAV-based EM survey is a geophysical method used to map the electrical conductivity of the subsurface.

As announced on 24 January 2025, the geophysical interpretation of the electromagnetic data has identified two diatreme-shaped anomalies that could represent the kimberlitic source of the green diamond (and the indicator mineral fan). The anomalies are up-ice of the two highly anomalous basal till sample locations documented in the pitting programme carried out in 2023 (announced by the Company on 19 December 2023) and the green diamond previously discovered in till by the Company (as announced by the Company on 31 January 2017).

Several new licences and licence extensions have been obtained in the area.

As announced on 7 February 2025, the Company has applied for, and been granted, a new reservation, Kuumu 1, at Lentiira in northern Kuhmo, 30 kilometres to the north of the Company's green diamond discovery (announced by Karelian on 31 January 2017). The reservation provides a one-year privilege to apply for an exploration permit in the area. The Lentiira area is considered highly prospective by the Company.

In addition the exploration permit, Seitaperä, covering the Seitaperä diamondiferous kimberlite (orangeite) in Kuhmo, circa 6 kilometres to the southwest of the exploration permit Kuhmo 1, has been extended for a further 3 year period by TUKES in March 2024 and as announced by the Company on 25 January 2024, extensions for the exploration permits, Riihivaara 26, Riihivaara 24, 24A and 24B in Kuhmo, were granted by TUKES for further 3 years from January 2024. The Riihivaara 26 exploration permit covers Karelian Diamond's kimberlite (olivine lamproite) discovery at Riihivaara, circa 10 kilometres to the south of the exploration permit Kuhmo 1.

The various licence areas in Kuhmo interlink and cover an area that the Company believes has the potential to become a significant diamond province on the Finnish side of the Karelian Craton.

New exploration permits at Liperi, in the Joensuu region of Eastern Finland, and Salla, in Lapland of Finland, have also been recently granted to the Company.

However, the main focus is on the development of a diamond mine at Lahtojoki which will bring significant benefits to the Company and its shareholders in the near to medium term.

Northern Ireland Nickel, Copper and Platinum Group Metals Projects

An assessment prepared by independent geological consultant, Dr Larry Hulbert, announced on 24 June 2024, confirms the potential for Nickel, Copper, and Platinum-Group Elements ("PGE"), in the Company's licence areas in Northern Ireland. The results of this assessment were very encouraging.

Dr Hulbert has been engaged to carry out further work in the licence area and, as previously announced, the Company is actively seeking a strategic partner to carry out a two-year exploration programme with a view to developing a number of the targets identified as being capable of hosting significant economic deposits.

The Company holds three prospecting licences, totalling an area of approximately 750Km2, in Northern Ireland.

Finance

The loss after taxation for the half year ended 30 November 2024 was €121,186 (30 November 2023: loss of €136,351) and the net assets as at 30 November 2024 were €9,993,699 (30 November 2023: €9,832,149).

Directors and Staff

I would like to thank my fellow directors, staff and consultants for their support and dedication, which has allowed the Company to continue to develop, especially since the loss of Professor Conroy. Their support and commitment is key to the success of the Company.

Outlook

Over the period the Company has identified new highly prospective metals targets in Northern Ireland, expanded its knowledge of the Kuhmo region and acquired new adjacent licence areas. The Company is also, hopefully, finally reaching the end of the application process for the Lahtojoki diamond deposit which will allow the Company to move forward and develop a mine at the site.

Yours faithfully,

Brendan McMorrow

Chairman

28 February 2025

Condensed income statement

| Six-month period ended 30 November 2024 (Unaudited) € |

| Six-month period ended 30 November 2023 (Unaudited) € |

| Year ended 31 May 2024

(Audited) €

|

Continuing operations |

|

|

|

|

|

Operating expenses | (164,741) |

| (255,240) |

| (418,312) |

Movement in fair value of warrants | 46,795 |

| 122,128 |

| 187,628 |

|

|

|

|

|

|

Operating loss | (117,946) |

| (133,112) |

| (230,684) |

|

|

|

|

|

|

Interest expense | (3,240) |

| (3,239) |

| (6,476) |

|

|

|

|

|

|

Loss before taxation | (121,186) |

| (136,351) |

| (237,160) |

|

|

|

|

|

|

Income tax expense | - |

| - |

| - |

Loss for the financial period/year | (121,186) |

| (136,351) |

| (237,160) |

Loss per share |

|

|

|

|

|

Basic and diluted loss per share | (0.0012) |

| (0.0014) |

| (0.0023) |

Condensed statement of comprehensive income

|

| Six-month period ended 30 November 2024 (Unaudited) € |

| Six-month period ended 30 November 2023 (Unaudited) € |

| Year ended 31 May 2024

(Audited) €

|

|

|

|

|

|

|

|

Loss for the financial period/year |

| (121,186) |

| (136,351) |

| (237,160) |

|

|

|

|

|

|

|

Income/(expense) recognised in other comprehensive income |

| - |

| - |

|

- |

|

|

|

|

|

|

|

Total comprehensive income/(expense) for the financial period/year |

| (121,186) |

| (136,351) |

|

(237,160) |

Condensed statement of cash flows

For the six-month period ended 30 November 2024

| 30 November 2024 (Unaudited) |

| 30 November 2023 (Unaudited) |

| Year ended 31 May 2024 (Audited) |

| € |

| € |

| € |

Assets |

|

|

|

|

|

Non-current assets |

|

|

|

|

|

Intangible assets | 11,896,405 |

| 11,439,845 |

| 11,690,194 |

Financial assets | - |

| - |

| - |

Total non-current assets | 11,896,405 |

| 11,439,845 |

| 11,690,194 |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents | 47,290 |

| 215,025 |

| 39,597 |

Other receivables | 114,183 |

| 57,834 |

| 81,551 |

Total current assets | 161,473 |

| 272,859 |

| 121,148 |

|

|

|

|

|

|

Total assets | 12,057,878 |

| 11,712,704 |

| 11,811,342 |

|

|

|

|

|

|

Equity |

|

|

|

|

|

Capital and reserves |

|

|

|

|

|

Called up share capital presented as equity | 3,209,432 |

| 3,203,532 |

| 3,203,532 |

Share premium | 11,104,265 |

| 10,726,620 |

| 10,736,889 |

Share based payments reserve | 450,658 |

| 450,658 |

| 450,658 |

Retained losses | (4,770,656) |

| (4,548,661) |

| (4,649,470) |

Total equity | 9,993,699 |

| 9,832,149 |

| 9,741,609 |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

Convertible loan | - |

| 122,483 |

| - |

Warrant liabilities | - |

| 95,606 |

| - |

Derivative liability | - |

| 10,304 |

| - |

Total non-current liabilities | - |

| 228,393 |

| - |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

Trade and other payables: amounts falling due within one year | 1,902,683 |

| 1,652,162 |

|

1,903,601 |

Convertible Loan | 128,962 |

| - |

| 125,722 |

Warrant Liabilities | 4,230 |

| - |

| 30,106 |

Derivative Liability | 10,304 |

| - |

| 10,304 |

Total current liabilities | 2,064,179 |

| 1,652,162 |

| 2,069,733 |

|

|

|

|

|

|

Total liabilities | 2,064,179 |

| 1,880,555 |

| 2,069,733 |

|

|

|

|

|

|

Total equity and liabilities | 12,057,878 |

| 11,712,704 |

| 11,811,342 |

Condensed statement of cash flows

For the six-month period ended 30 November 2024

| Six-month period ended 30 November 2024 (Unaudited) € |

| Six-month period ended 30 November 2023 (Unaudited) € |

| Year ended 31 May 2024 (Audited)

€ |

Cash flows from operating activities |

|

|

|

|

|

Loss for the financial period/year | (121,186) |

| (136,351) |

| (237,160) |

Adjustments for: |

|

|

|

|

|

Interest expenses | 3,240 |

| 3,239 |

| 6,476 |

Movement in fair value of warrants | (46,795) |

| (122,128) |

| (187,628) |

Increase in trade and other payables | 71,280 |

| 200,825 |

| 444,507 |

Decrease/(increase) in other receivables | (32,632) |

| 21,168 |

| (2,548) |

Net cash provided by/(used in) operating activities | (126,093) |

| (33,317) |

| 23,647 |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Investment in exploration and evaluation | (206,211) |

| (173,951) |

| (424,300) |

Net cash used in investing activities | (206,211) |

| (173.951) |

| (424,300) |

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Issue of share capital | 409,177 |

| 299,555 |

| 301,205 |

Share issue costs | (14,983) |

| (8,620) |

| - |

Advances from/(repayments to) Conroy Gold and Natural Resources P.L.C |

(54,197) |

|

15,250 |

|

23,007 |

Net cash provided by financing activities | 339,997 |

| 290,935 |

| 324,212 |

|

|

|

|

|

|

Increase in cash and cash equivalents | 7,693 |

| 98,987 |

| (76,441) |

Cash and cash equivalents at beginning of financial period/year | 39,597 |

| 116,038 |

|

116,038 |

Cash and cash equivalents at end of financial period/year | 47,290 |

| 215,025 |

| 39,597 |

Condensed statement of changes in equity

for the six-month period ended 30 November 2024

| Share capital (including deferred share capital) | Share premium | Share-based payment reserve | Retained losses | Total equity |

| € | € | € | € | € |

Balance at 1 June 2024 | 3,203,532 | 10,736,889 | 450,658 | (4,649,470) | 9,741,609 |

Issue of share capital | 5,900 | 403,277 | - | - | 409,177 |

Share issue costs | - | (35,901) | - | - | - |

Warrant issue | - | - | - | - | - |

Loss for the financial period | - | - | - | (121,186) | (121,186) |

Balance at 30 November 2024 | 3,209,432 | 11,104,265 | 450,658 | (4,770,657) | 9,993,699 |

|

|

|

|

|

|

Balance at 1 June 2023 | 3,200,882 | 10,546,844 | 450,658 | (4,412,310) | 9,786,074 |

Issue of share capital | 2,650 | 296,905 | - | - | 299,555 |

Share issue costs | - | (8,620) | - | - | (8,620) |

Share based payments | - | (108,509) | - | - | (108,509) |

Loss for the financial period | - | - | - | (136,351) | (136,351) |

Balance at 30 November 2023 | 3,203,532 | 10,726,620 | 450,658 | (4,548,661) | 9,832,109 |

Share capital

The share capital comprises the nominal value share capital issued for cash and non-cash consideration. The share capital also comprises deferred share capital. The deferred share capital* arose through the restructuring of share capital which was approved at an Annual General Meeting held on 9 December 2016.

Authorised share capital:

The authorised share capital at 30 November 2024 compromised 7,301,301,041 ordinary shares of €0.00025 each, and 317,785,034 deferred shares of €0.00999 each* (€5,000,000), (30 November 2023: 7,301,301,041 ordinary shares of €0.00025 each, and 317,785,034 deferred shares of €0.00999 each* (€5,000,000)).

*Capital reorganisation:

Following approval at an Annual General Meeting ("AGM") held on 9 December 2016, the Company reorganised its share capital by subdividing and reclassifying each issued ordinary share of €0.01 as one ordinary share of €0.00001 each and one deferred share of €0.00999 each. The Deferred Shares have no right to vote, attend or speak at general meetings of the Company and have no right to receive any dividend or other distribution, and have only limited rights to participate in any return of capital on a winding-up or liquidation of the Company, which will be of no material value. No application was made to the London Stock Exchange for admission of the Deferred Shares to trading on the AIM.

Consolidated shares:

On 21 December 2017, the Company passed a Special Resolution at the Company's AGM, that all of the ordinary shares of €0.00001 each in the capital of the Company, whether issued or unissued were consolidated into New Ordinary Shares of €0.00025 each in the capital of the Company ("consolidated shares") on the basis of one consolidated share for every 25 existing ordinary shares. Following the consolidation of the ordinary shares on 21 December 2017, the warrants in issue were consolidated into one consolidated warrant for every 25 existing warrants. The exercise price in relation to the warrants was also adjusted at this time (see Note 2).

Share and Warrant issues during the period:

During the period ended 30 November 2024, the Company raised £328,747 before expenses through the issue of 21,916,479 new ordinary shares at a price of £0.015 per ordinary share. In addition and at the same time as the fundraising, the Company converted amounts owing to certain parties totalling £25,253 into equity by issuing 1,683,516 new ordinary shares at the same price. As part of this fundraise, 11,799,997 warrants to acquire new ordinary shares at a price of £0.03 per share were issued, the value of which at date of issue was deducted from share premium in line with the Company's accounting policies.

Share premium

The share premium comprises the excess consideration received in respect of share capital over the nominal value of the shares issued as adjusted for the costs of share issue in line with the Company's accounting policies.

Share based payment reserve

The share based payment reserve comprises of the fair value of all share options and warrants which have been charged over the vesting period, net of amounts relating to share options and warrants forfeited, exercised or lapsed during the period, which are reclassified to retained earnings.

Retained losses

This reserve represents the accumulated losses incurred by the Company up to the condensed statement of financial position date.

1Accounting policies

Reporting entity

Karelian Diamond Resources plc (the "Company") is a company domiciled in Ireland.

Basis of preparation and statement of compliance

The condensed financial statements for the six months ended 30 November 2024 are unaudited.

The condensed financial statements have been prepared in accordance with International Accounting Standard ("IAS") 34: Interim Financial Reporting.

The condensed financial statements do not include all the information and disclosures required in the annual financial statements, and should be read in conjunction with the Company's annual financial statements as at 31 May 2024, which are available on the Company's website - www.kareliandiamondresources.com. The accounting policies adopted in the presentation of the condensed financial statements are consistent with those followed in the preparation of the Company's annual financial statements for the year ended 31 May 2024.

The condensed financial statements have been prepared under the historical cost convention, except for derivative financial instruments which are measured at fair value at each reporting date.

The condensed financial statements are presented in Euro ("€"). € is the functional currency of the Company.

The preparation of condensed financial statements requires the Board of Directors and management to use judgements, estimates and assumptions that affect the application of policies and reported amounts of assets, liabilities, income and expenses. Actual results may differ from those estimates. Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognised in the financial period in which the estimate is revised and in any future financial periods affected. Details of critical judgements are disclosed in the accounting policies detailed in the annual financial statements.

The financial information presented herein does not amount to statutory financial statements that are required by Chapter 4 part 6 of the Companies Act 2014 to be annexed to the annual return of the Company. The statutory financial statements for the financial year ended 31 May 2024 were annexed to the annual return and filed with the Registrar of Companies. The audit report on those financial statements was unqualified.

These condensed financial statements were authorised for issue by the Board of Directors on 28 February 2025.

Going concern

The Company recorded a loss of €121,186 for the six-month period ended 30 November 2024 (30 November 2023: loss of €136,351). The Company had net current liabilities of €1,902,276 at that date (30 November 2023: €1,379,302).

The Board of Directors have considered carefully the financial position of the Company and in that context, have prepared and reviewed cash flow forecasts for the period to 28 February 2026. As set out further in the Chairman's statement, the Company expects to incur capital expenditure in 2025, consistent with its strategy as an exploration company. In reviewing the proposed work programme for exploration and evaluation assets, the results obtained from the exploration programme and the prospects for raising additional funds as required, the Board of Directors are satisfied that it is appropriate to prepare the financial statements on a going concern basis.

Statement of compliance

The Company's financial statements have been prepared in accordance with IFRS as adopted by the European Union ("EU").

Recent accounting pronouncements

The following new standards and amendments to standards have been issued by the International Accounting Standards Board but have not yet been endorsed by the EU, accordingly, none of these standards have been applied in the current year. The Board of Directors is currently assessing whether these standards once endorsed by the EU will have any impact on the financial statements of the Company.

- Amendments to IFRS 10 and IAS 28: Sale or contribution of assets between an investor and its associate or joint venture - Postponed indefinitely;

- Amendments to IFRS 16 Leases: Lease liability in a sale and leaseback - Effective date 1 January 2024; and

- Amendments to IAS 1 Presentation of Financial Statements: Classification of liabilities as current or non-current and classification of liabilities as current or non-current - Effective date 1 January 2024.

2Profit/(loss) per share

Basic earnings per share |

|

|

|

|

|

| |||

|

|

| Six-month period ended 30 November 2024 (Unaudited) € |

| Six-month period ended 30 November 2023 (Unaudited) € |

| Year ended 31 May 2024

(Audited)€ | ||

Loss for the financial period/year attributable to equity holders of the Company |

|

|

(121,186) |

|

(136,351) |

|

(237,160) | ||

|

|

|

|

|

|

| |||

Number of ordinary shares for the purposes of earnings per share |

|

|

124,748,635 |

|

95,096,311 |

|

101,040,146 | ||

|

|

|

|

|

|

|

| ||

Basic loss per ordinary share |

|

| (€0.0012) |

| (€0.0014) |

| (€0.0023) | ||

Diluted earnings/(loss) per share

The effect of share options and warrants is anti-dilutive.

3Intangible assets

Exploration and evaluation assets |

|

|

|

|

| |||

Cost | 30 November 2024 (Unaudited) € |

| 30 November 2023 (Unaudited) € |

| 31 May 2024 (Audited) € | |||

At 1 June |

11,690,194 |

|

11,265,894 |

|

11,265,894 | |||

Expenditure during the financial period/year |

|

|

|

|

| |||

| 118,372 |

| 93,258 |

| 246,586 | |||

| 87,839 |

| 80,693 |

| 177,714 | |||

At 30 November/31 May | 11,896,405 |

| 11,439,845 |

| 11,690,194 | |||

Exploration and evaluation assets relate to expenditure incurred in the development of mineral exploration opportunities. These assets are carried at historical cost and have been assessed for impairment in particular with regard to the requirements of IFRS 6: Exploration for and Evaluation of Mineral Resources relating to remaining licence or claim terms, likelihood of renewal, likelihood of further expenditure, possible discontinuation of activities as a result of specific claims and available data which may suggest that the recoverable value of an exploration and evaluation asset is less than its carrying amount.

The Board of Directors have considered the proposed work programmes for the underlying mineral resources. They are satisfied that there are no indications of impairment.

The Board of Directors note that the realisation of the intangible assets is dependent on further successful development and ultimate production of the mineral resources and the availability of sufficient finance to bring the resources to economic maturity and profitability.

3Commitments and Contingencies

At 30 November 2024, there were no capital commitments or contingent liabilities (31 May 2024: No capital commitments or contingencies liabilities). Should the Company decide to develop the Lahtojoki project, an amount of €40,000 is payable by the Company to the vendors of the Lahtojoki mining concession.

4Convertible Loan

On 19 May 2023, the Company entered into a convertible loan note agreement for a total amount of €129,550 (£112,500) with Conroy Gold and Natural Resources P.L.C. ("Conroy Gold") which is both a shareholder in the company and has a number of other connections as noted in Note 8. The convertible loan note is unsecured, had an initial term of 18 months and attracts interest at a rate of 5 per cent. per annum which is payable on the maturity or conversion of the convertible loan. The conversion price is at a price of 5 pence per ordinary share.

Conroy Gold has the right to seek conversion of the principal amount outstanding on the convertible loan note and all interest accrued at any time during the term. The term of the formal loan agreement ended in November 2024. The Company has been in discussions to extend the term of the loan and post period end the parties have agreed in principle to extend the term of the convertible loan to 30 November 2025, however this remains subject to, inter alia, finalisation of a variation agreement and any necessary regulatory approvals under the AIM Rules for Companies. The parties are also in discussions to amend the conversion price of the convertible loan note as part of the variation agreement.

The amount of €10,304 relates to derivative liability attached to the total convertible loan note at date of issue above and the net amount of €119,246 was recorded as the value of the convertible loan at 31 May 2023. The value of the convertible loan including interest at 30 November 2024 was €128,962 and is classified as a non-current liability.

5Trade and other payables: amounts falling due within one year

Included in the payables figure of €1,902,683 is an amount of €1,562,388 in respect of amounts owing to both current and former directors of the Company who provide continuing support to the Company through renewing annually a commitment not to seek payment of the amounts owed unless the Company is in a position to discharge them.

6Warrant liabilities

The Company holds Sterling based warrants. The Company estimates the fair value of the sterling-based warrants using the Binomial Lattice Model. The determination of the fair value of the warrants is affected by the Company's share price along with other assumptions.

As part of the share issue in July 2024, the Company issued 11,799,997 warrants at a price of GBP 3 pence per warrant. These warrants expire in July 2025. All other warrants expired during the period and the fair value of the remaining warrants in issue as at 30 November 2024 was €4,230. The movement in fair value of warrants including the effect of warrant expiry resulted in a non-cash gain of €46,795.

7Related party transactions

(a) Apart from Directors' remuneration, equity investment from Directors, and loans from shareholders, (who are also Directors), there have been no contracts or arrangements entered into during the six-month period in which a Director of the Company had a material interest.

(b) The Company shares accommodation and staff with Conroy Gold and Natural Resources plc which have certain common Directors and shareholders. For the six-month period ended 30 November 2024, Conroy Gold and Natural Resources plc incurred costs totalling €34,245 (30 November 2023: €49,596) on behalf of the Company. These costs were recharged to the Company by Conroy Gold and Natural Resources plc. At 30 November 2024, Conroy Gold and Natural Resources plc was owed €126,592 (30 November 2023: €69,870) by the Company.

(c) In May 2023, Conroy Gold and Natural Resources P.L.C. converted amounts owing to it equivalent to €143,943 (£125,000) into ordinary equity in the Company and a further €129,550 (£112,500) into a convertible loan instrument as detailed in Note 5.

8Subsequent events

The Company completed a fundraise of £323,075 at a price of GBP 0.75 pence per ordinary share on 20th February 2025. There were no other material events subsequent to the reporting date which necessitate revision of the figures or disclosures included in the financial statements.

9Approval of the condensed financial statements

These condensed financial statements were approved by the Board of Directors on 28 February 2025. A copy of the condensed financial statements will be available on the Company's website www.kareliandiamondresources.com on 28 February 2025.

4112797_0.jpeg |