VANCOUVER, BC AND MELBOURNE, AUSTRALIA / ACCESS Newswire / March 3, 2025 / Southern Cross Gold Consolidated Ltd ("SXGC", "SX2" or the "Company") (TSXV:SXGC)(ASX:SX2)(OTCPK:MWSNF)(FRA:MV3.F) announces a doubling of the Sunday Creek gold and antimony Exploration Target in Victoria, Australia (Figures 1 and 2).

HIGHLIGHTS

The estimated range of potential mineralization for the Exploration Target is (also see Tables 1 and 2):

8.1 - 9.6 million tonnes grading from 8.3 g/t gold equivalent ("AuEq") to 10.6 g/t AuEq for:

2.2 M oz AuEq to 3.2 M oz AuEq

The potential quantity and grade of the Exploration Target is conceptual in nature and therefore is an approximation. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been completed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition ("JORC").

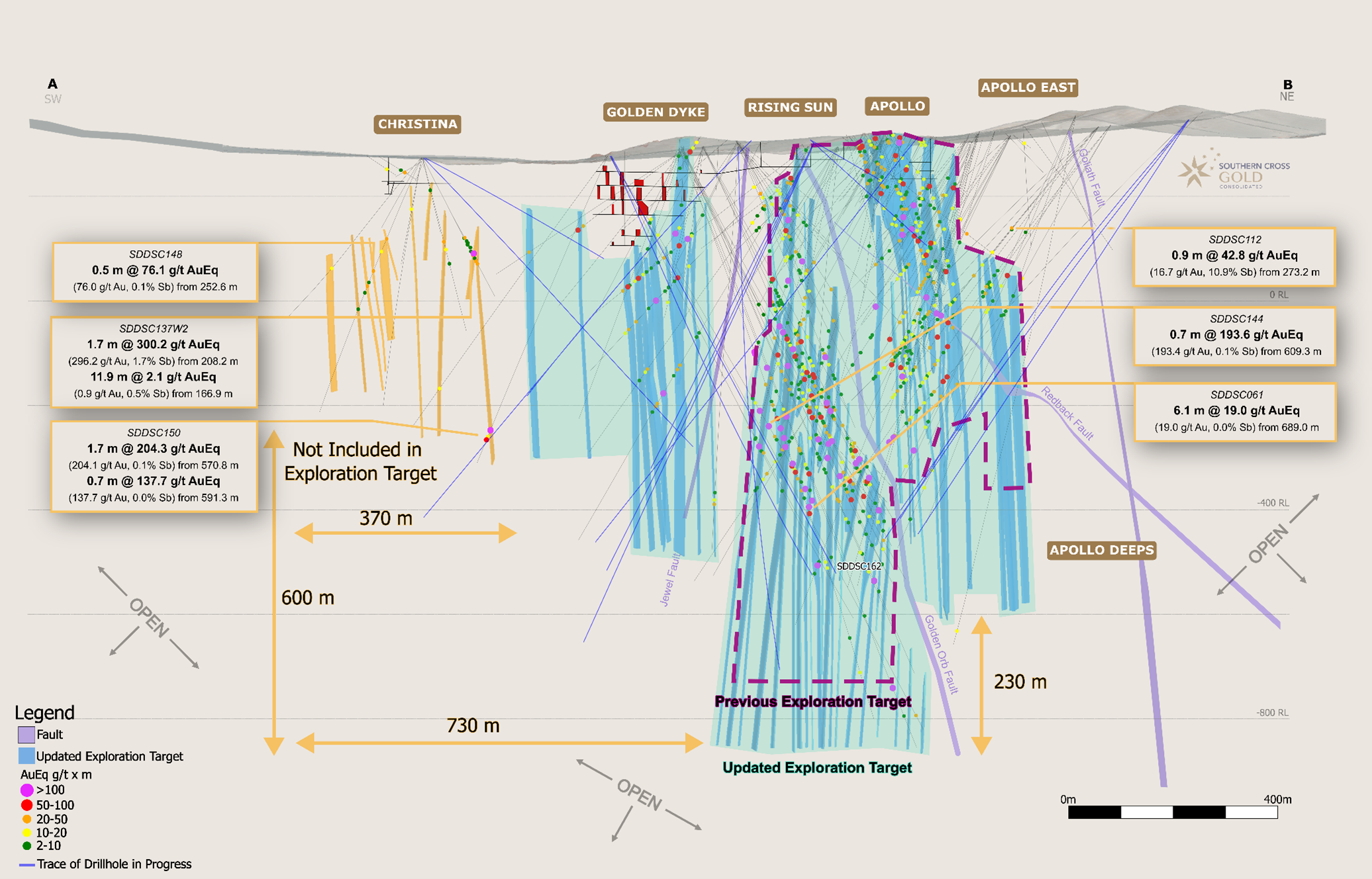

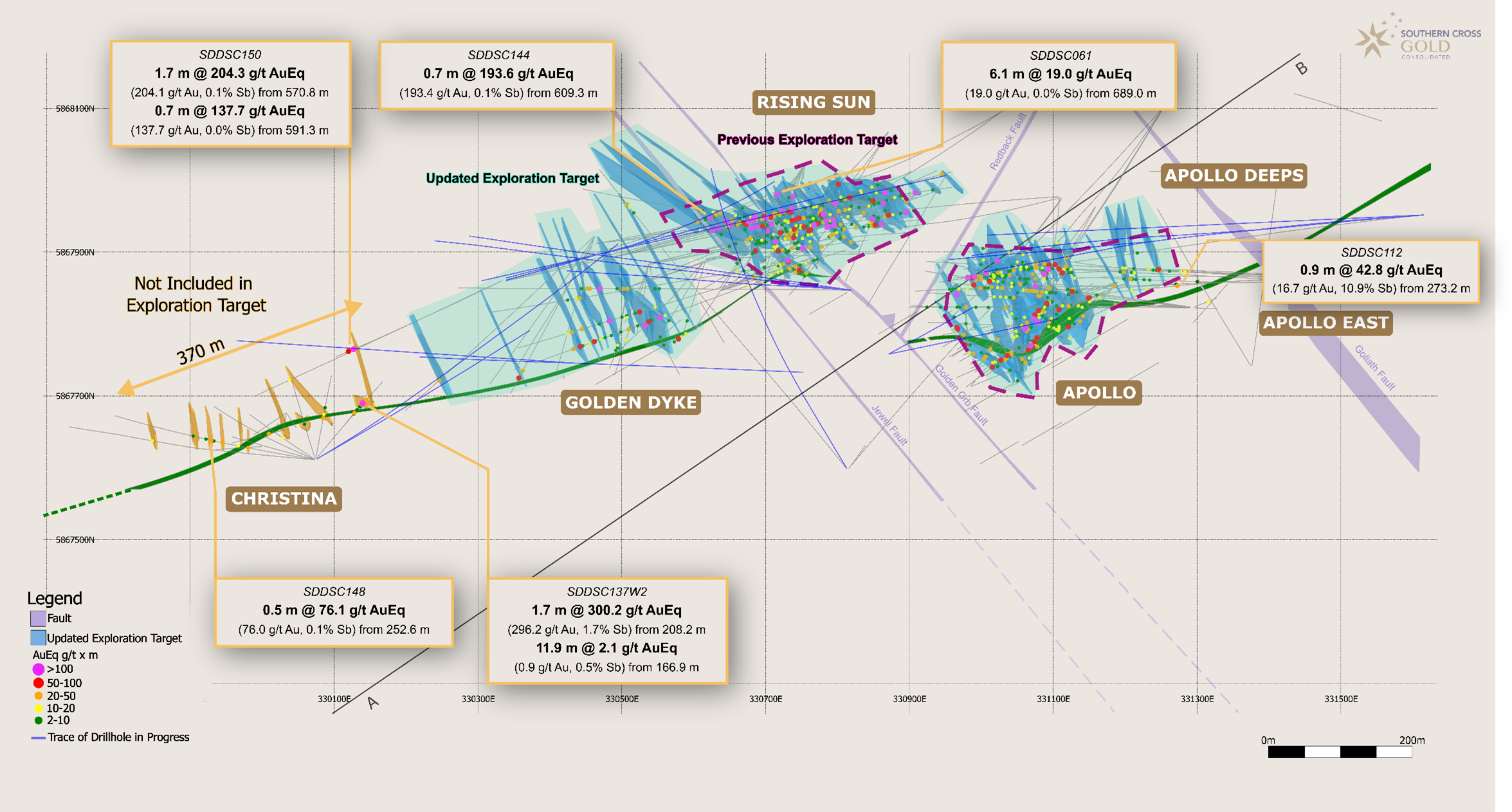

Notably, the Exploration Target is constrained to three of the four main areas along the strike of the dyke breccia host on the project: Rising Sun (over 340 m strike), Apollo (over 280 m strike) and Golden Dyke (over 400 m strike) for a total 1,020 m of strike. This does not include the recently drilled high grade Christina mineralization and strike represents approximately 67% of the 1.5 km strike of the main drill footprint to date at Sunday Creek.

The 2025 Exploration Target demonstrates strong growth compared to the 2024 Exploration Target reported January 23, 2024, with tonnage increasing by up to 88%, grades improving by up to 15%, and total contained AuEq metal growing by up to 120%. The project's spatial coverage has expanded significantly, now covering 67% of the 1.5 km main drill footprint, while technical improvements include a 40% increase in drill holes, nearly double the assay results, more than tripled density measurements, and deeper mineralization reaching 1,120 m below surface. These comprehensive advancements underscore the project's expanding scale while maintaining its exceptional high-grade characteristics.

Drilling operations at Sunday Creek continue with six active rigs, and expansion is imminent as two additional drill rigs are scheduled to join the project-one in late March and another in early April. 2025-to accelerate exploration along strike and at deeper depths.

Michael Hudson, President & CEO of SXGC states: "Sunday Creek continues to demonstrate why it is one of the most significant high-grade gold-antimony discoveries made in recent times. The dramatic expansion of Sunday Creek's exploration target - doubling in both tonnage and contained metal while maintaining exceptional grades over the last year - while only representing 67% of the drilled area, represents another key milestone for Sunday Creek.

"In the last year we have grown our exploration target from 1.0 to 1.6 Moz AuEq to 2.2 to 3.2 Moz AuEq, while maintaining exceptional grades ranging from 8.3 to 10.6 g/t AuEq. This represents significant growth across all metrics, with tonnage increasing by 84 to 88%, grades improving by 9 to 15%, and total contained gold equivalent ounces growing by 100 to 120%. This constitutes an addition of 1.2 to 1.6 Moz AuEq to our target through both tonnage expansion and improved grades, particularly at Rising Sun where we're seeing consistently higher grade results at depth. Most significantly, this target captures only 67% of the main 1.5 km drill footprint, suggesting substantial upside remains both within and outside of the drilled footprint.

"The target demonstrates Sunday Creek's exceptional high grades that place it in the highest global quartile offering substantially high margin potential. The project benefits from its location in a Tier 1 jurisdiction with excellent infrastructure with direct road access, nearby power, and no need for remote camps or extensive diesel transport.

"Our metallurgical testing demonstrates excellent gold and antimony recoveries (93 to 98%), with non-refractory mineralization suitable for conventional processing. The gold-antimony system shows remarkable continuity from surface to 1,120 m depth, with evidence from nearby mines suggesting potential for even higher grades below our current exploration depth, presenting significant upside for future exploration, while the strategic antimony content (contributing 21 to 24% of in-situ value) takes on heightened importance given China's recent export restrictions and Western nations' push for secure critical mineral supply chains.

"Environmental baseline studies are progressing concurrently with drilling, and successful regional exploration results could potentially expand our overall resource footprint beyond the current Sunday Creek focus."

EXPLORATION TARGET

The approximate combined Exploration Target ranges are listed in Table 1, while Table 2 provides a summary of the Exploration Targets for each prospect. Locations shown in Figures 1 and 2.

Table 1. Sunday Creek Exploration Target for Apollo, Rising Sun, Golden Dyke at the Sunday Creek Project

Range | Tonnes (Mt) | AuEq g/t* | Au g/t | Sb % | Au Eq (Moz) | Au (Moz) | Sb (kt) |

Lower Case | 8.1 | 8.3 | 6.4 | 0.8 | 2.2 | 1.7 | 66.6 |

Upper Case | 9.6 | 10.6 | 8.3 | 0.9 | 3.2 | 2.6 | 88.2 |

Table 2. Exploration Targets for Rising Sun, Apollo and Golden Dyke prospects at the Sunday Creek Project

Prospect | Tonnes Range (Mt) | AuEq Grade Range (g/t) | Au Grade Range (g/t) | Sb Grade Range (%) | Contained AuEq (Moz) | Contained Au (Moz) | Contained Sb (Kt) | |||||||

Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | Low | High | |

Rising Sun | 3.1 | 3.8 | 11.3 | 16.1 | 9.3 | 13.7 | 0.8 | 1.0 | 1.1 | 2 | 0.9 | 1.7 | 25.4 | 38.3 |

Apollo | 3.2 | 3.6 | 5.9 | 6.4 | 4.2 | 4.5 | 0.7 | 0.8 | 0.6 | 0.7 | 0.4 | 0.5 | 23.1 | 28.6 |

Golden Dyke | 1.8 | 2.1 | 7.6 | 7.6 | 5.2 | 5.2 | 1.0 | 1.0 | 0.4 | 0.5 | 0.3 | 0.4 | 18.1 | 21.4 |

Total | 8.1 | 9.6 | 8.3 | 10.6 | 6.4 | 8.3 | 0.8 | 0.9 | 2.2 | 3.2 | 1.7 | 2.6 | 66.6 | 88.2 |

The potential quantity and grade of the Exploration Target is conceptual in nature and therefore is an approximation. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been completed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition ("JORC").

EXPLORATION TARGET UPSIDE

The Sunday Creek Project continues to demonstrate significant upside potential well beyond its recently expanded exploration target area. The project combines high-grade mineralization with multiple high-grade zones drilled that remain outside the current target area.

The Exploration Target covers 67% of the strike of the core 1.5 km main drill area. The other portion of the main drill area has not been drilled to the intensity required to include in this Exploration Target, highlighting the potential to further increase the overall gold-antimony endowment of the Sunday Creek gold-antimony project. Drilled areas not yet included in the Exploration Target include:

Geographic/Spatial Upside:

1. Christina Zone

Shows system capable of bonanza grades 400 m west of the current Exploration Target, including:

SDDSC148: 0.5 m @ 76.1 g/t AuEq (76.0 g/t Au, 0.1% Sb) from 252.6 m

SDDSC137W2: 1.7 m @ 300.2 g/t AuEq (296.2 g/t Au, 1.7% Sb) from 208.2 m

SDDSC137W2: 11.9 m @ 2.1 g/t AuEq (0.9 g/t Au, 0.5% Sb) from 166.9 m

SDDSC150: 1.7 m @ 204.3 g/t AuEq (204.1 g/t Au, 0.1% Sb) from 570.8 m

SDDSC150: 0.7 m @ 137.7 g/t AuEq (137.7 g/t Au, 0.0% Sb) from 591.3 m

Multiple high-grade intersections suggest mineralization is of a similar style to Apollo and Rising Sun

2. Rising Sun Extensions

Unconstrained drill results not yet included in the Exploration Target within the footprint of Rising Sun including:

SDDSC144: 0.7 m @ 193.6 g/t AuEq (193.4 g/t Au, 0.1% Sb) from 609.3 m

SDDSC061: 6.1 m @ 19.0 g/t AuEq (19.0 g/t Au, 0.0% Sb) from 689.0 m

Demonstrate high grades continue with depth

3. Apollo East

High antimony grades (up to 10.9% Sb) showing metal zoning potential up to 100 m above and east of the exploration target, with drill results including:

SDDSC112: 0.9 m @ 42.8 g/t AuEq (16.7 g/t Au, 10.9% Sb) from 273.2 m

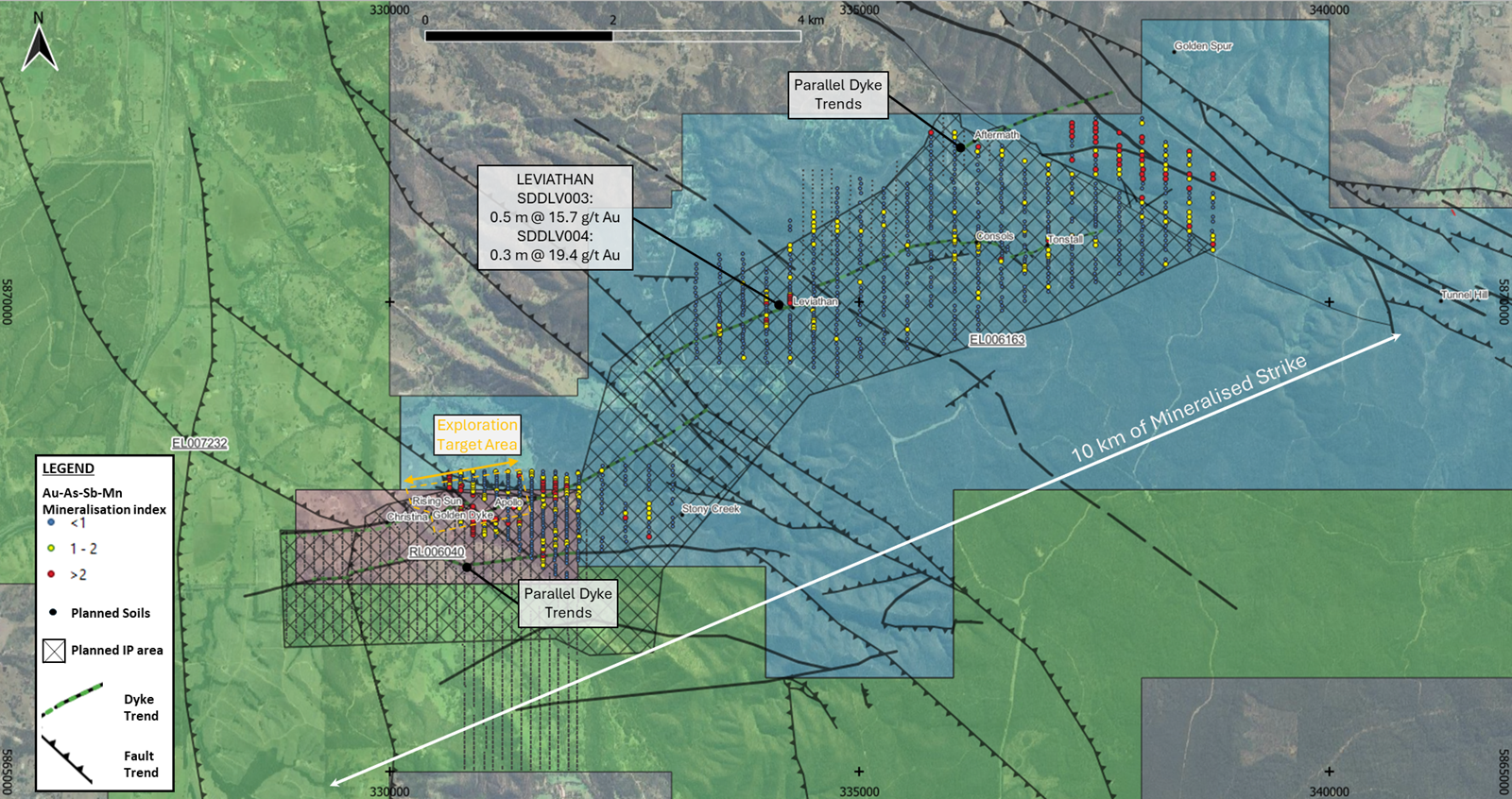

4. Regional Scale

The Sunday Creek mineralized system extends far beyond the current drill area, with compelling evidence for a 12 km strike length of prospective geology.

The mineralizing system is defined by multiple parallel dyke-breccia structures and extensive zones of altered sediments, all following a consistent east-west trend. This structural framework has been validated by a network of historic mine workings and documented gold-antimony production from multiple locations along the trend.

Modern technical work has further confirmed this potential through multiple independent datasets:

Strong Induced Polarization (IP) geophysical anomalies align with systematic soil geochemistry anomalies and detailed geological mapping, all confirming the continuity of the mineralized system.

Early stage drilling by SXGC includes the Leviathan prospect 3 km east showing gold mineralization, including:

SDDLV003: 0.5 m @ 15.7 g/t Au from 87.0 m

SDDLV004: 0.3 m @ 5.6 g/t Au from 73.4 m and 0.3 m @ 19.4 g/t Au from 100.7 m

5. Depth Potential

Mineralization proven to >1,120m depth

System remains open at depth, where surrounding mines have proved mineralization down to 2 km below surface

Deep drill holes showing continuation of high grades

6. Grade Upside

Potential for additional high-grade domain definition: for example, no high-grade domains have been wireframed at Golden Dyke to date

High-grade shoots remaining open

Rising Sun showing highest grades to date

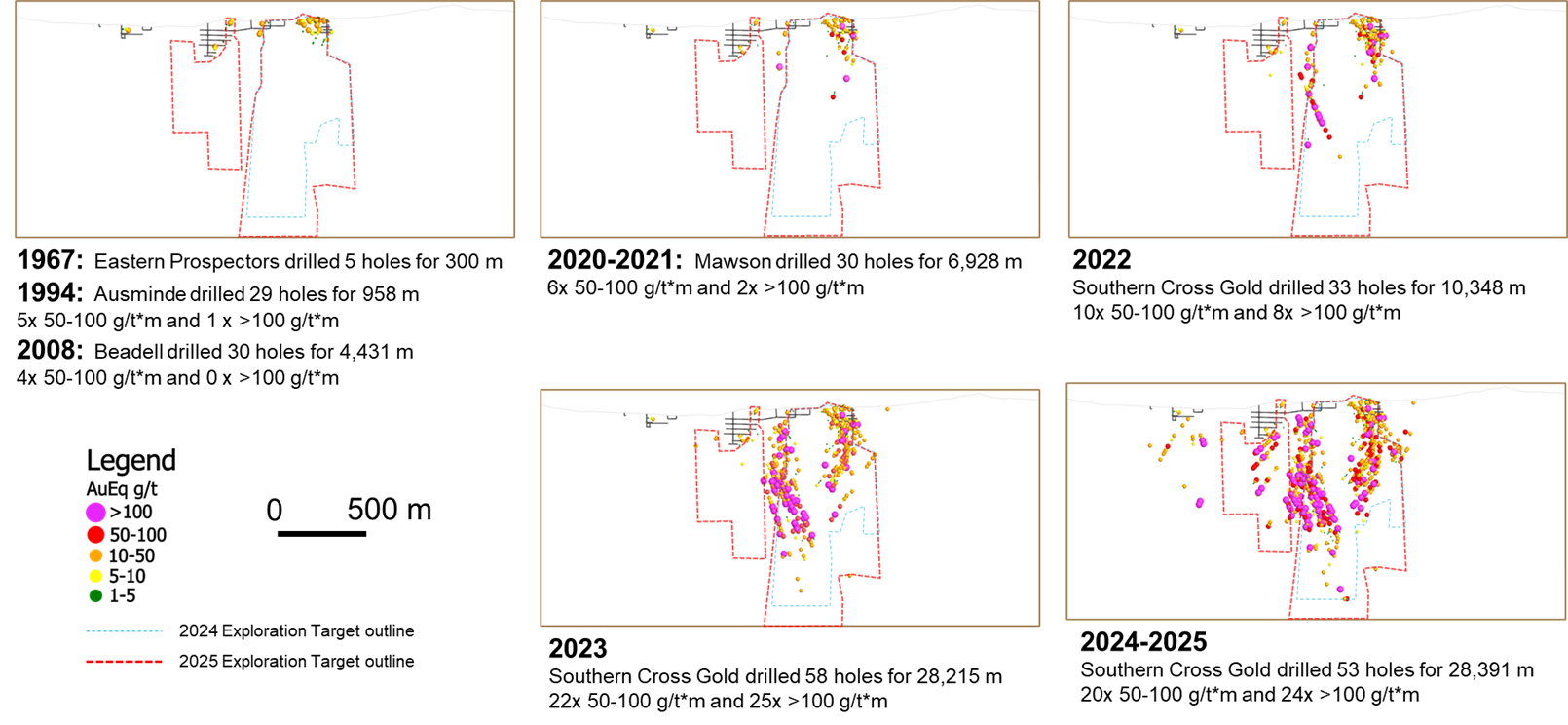

COMPARISON 2024-2025 EXPLORATION TARGETS: SIGNIFICANT GROWTH

Substantial growth was recorded in this updated 2025 Exploration Target based on a very successful year of drilling, which shows strong improvement across all key metrics, highlighting the project's expanding scale and continuing high-grade nature. Figure 4 shows a longitudinal section of the main drill area over time, with the 2024 Exploration target and the current updated exploration target outline highlighting the rapid exploration success over the last few years.

In the prior update released on January 23, 2024, the Company reported an Exploration Target with estimated potential mineralization ranging from 4.4 Mt @ 7.2 g/t AuEq (1.0 Moz AuEq) in the Lower Case to 5.1 Mt @ 9.7 g/t AuEq (1.6 Moz AuEq) in the Upper Case.

The new March 02, 2025 Exploration Target demonstrates significant growth with estimated potential mineralization now ranging from:

Lower Case: 8.1 Mt @ 8.3 g/t AuEq (2.2 Moz AuEq)

Upper Case: 9.6 Mt @ 10.6 g/t AuEq (3.2 Moz AuEq)

The potential quantity and grade of the Exploration Target is conceptual in nature and therefore is an approximation. There has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource. The Exploration Target has been completed in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition ("JORC").

Key Improvements from 2024 to 2025 (lower to upper case)

Tonnage Growth: 84 to 88% increase

AuEq Grade Improvement: 9 to 15% increase

Contained AuEq Metal: 100 to 120% increase (gold 103 to 1030%, antimony 24 to 40%)

Spatial Expansion

2024: Covered 50% of the 1.2 km main drill footprint (620 m)

2025: Covers 67% of the 1.5 km main drill footprint (1,020 m)

Technical Advancements

Increased drill density (from 116 holes to 162 holes)

More assay results (from 26,513 to 49,595)

Better density measurements (from 353 to 1,169)

Deeper mineralization (deepest from 1,003 m to 1,120 m below surface)

SUMMARY OF RELEVANT EXPLORATION DATA, METHODOLOGY, ASSUMPTIONS AND NEXT STEPS

The basis on which the disclosed potential quantity and grade has been determined based on continuity of mineralization defined by exploration diamond drilling results (previously reported, including relevant sections and plans) within proximity to the intrusive "main structure" zone and bleached sediments. Strike extents in the lower-case model are minimized to half drill spacing (~15 m) or to locally restrictive geology (i.e. bounds of bleached sediment or dyke) whichever was smaller. The upper-case model strike extents were extended to the average vein strike (typically around ~40 m) or to geological constraints, whichever was smaller.

The Exploration Target was limited to a vertical depth of 1,120 m below surface (-835 m RL), limited by the deepest mineralization defined to date within the "main structure" dyke/dyke breccia and bleached sediments within Rising Sun.

A series of sub-vertical lodes within a 1,020 m-wide corridor has been outlined at Rising Sun, Apollo and Golden Dyke with mineralization remaining open to the east, west and to depth.

Only the Rising Sun, Apollo and Golden Dyke areas were considered for the Exploration Target as they contain sufficient drilling to suggest continuity and infer grade ranges, but insufficient drill spacing to convert the entire area into a mineral resource estimate. The Exploration Target is based on the interpretation of the following geology and mineralization data that has been collated as of the date of this announcement:

162 structurally oriented drillholes for 73,299.16 m at the main Sunday Creek area that have been drilled by Mawson/SXGC;

64 aircore, reverse circulation and unoriented diamond drill holes for 5,599 m that were drilled historically on the project;

49,595 drill hole assay results;

1,169 density measurements on mineralized diamond drill core, a variable SG was calculated using the average of rock types and a regression calculation dependent on the content of antimony, where Sb% >1 used an SG value of 0.0197 x Sb% + 2.77, and if below 1% Sb a value of 2.77 was applied to the Exploration Target.

Surface geological mapping, costean data and diamond core geological logging;

Detailed LiDAR imagery;

Geophysical datasets including detailed ground magnetic and 3D induced polarization;

Wireframing and modelling of the Apollo, Rising Sun and Golden Dyke mineralized body.

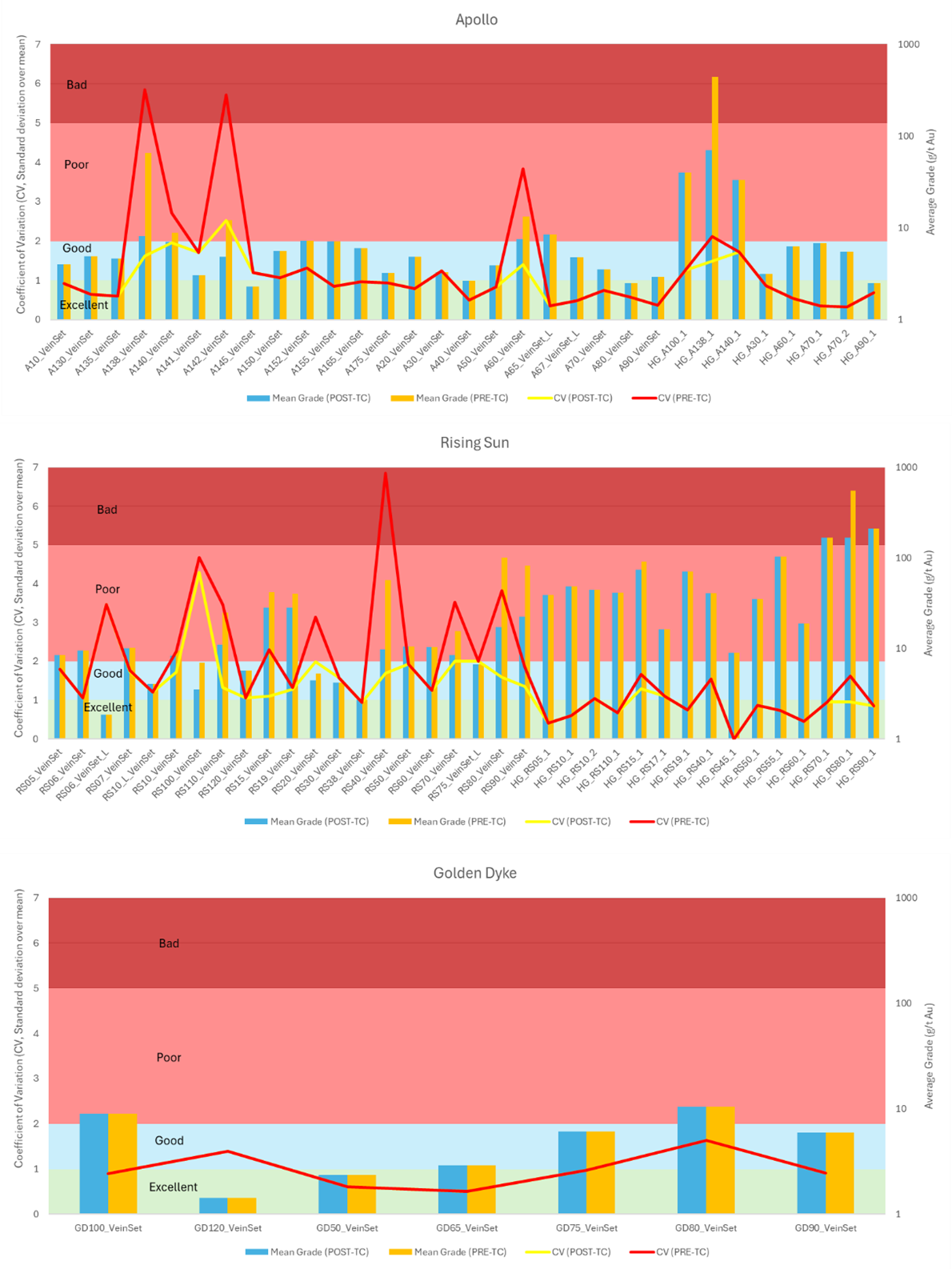

A total of 85 mineralized vein set shapes were created for the Exploration Target of 18 contained high-grade internal shapes (at Rising Sun and Apollo, but not Golden Dyke due to the lack of drill data) were defined (Table 3 & Table 4). A total of 70 of the vein set shapes had grades estimated from composited assay data, while 15 vein set shapes used the average calculated grade of either Rising Sun (lower case 7.8 g/t Au and 0.8% Sb and upper case 11.5 g/t Au and 1.0% Sb), Apollo (lower case 3.8 g/t Au and 0.7% Sb and upper case 4.1 g/t Au and 0.7% Sb) or Golden Dyke (lower and upper case 5.6 g/t Au, 1.0% Sb) and this was applied to the Exploration Target. Drilling indicates Rising Sun could contain higher gold and antimony grades than Apollo and Apollo Deep, with Golden Dyke not yet being tested to depth to determine the propensity of higher grades.

Mineralization across all vein sets was limited by the deepest mineralization defined to date, within the "main structure" dyke/dyke breccia and bleached sediments within Rising Sun approximately 1,120 m below surface. While at Apollo the Exploration Target extended from surface to where drill density decreases, 900 m below surface.

Below drilling intercepts to the lower estimation limit, the low tonnage range used a minimum width of 2 m (~75% of median estimated true width of all modelled domains) while the high tonnage range applied a minimum width of 2.5 m (approximate median true width of all modelled domains). Strike extents in the low tonnage range model were minimized to half drill spacing (~15 m) or to locally restrictive geology (i.e. bounds of altered sediment (ASED) or dyke) whichever was smaller. The high tonnage range model applied strike extents that were extended to the average vein strike (typically around ~40 m) or to geological constraints, whichever was smaller.

Wireframes have been created in Leapfrog Geo using a threshold of 1.0 g/t Au over 2 m. The economic composite tool was used to allow for the inclusion of thin, high-grade intercepts. Grade ranges have been informed by a preliminary grade estimate conducted on top-cut, composited data using Leapfrog Edge.

Grade estimates were calculated using a post composite top-cut of 80 g/t Au for vein sets in Apollo, Rising Sun and Golden Dyke. The high-grade sub domains had a range restriction of 15% applied (~10 to 15 m) and then a top-cut of 300 g/t Au for Apollo and 400 g/t Au for Rising Sun.

The high- and low-grade ranges are primarily influenced by the proportion of high-grade subdomains ("high-grade cores") within the Rising Sun and Apollo estimates. The low-end grade range assumes the existing ratio of high-grade cores to vein set material - approximately 2% of the exploration shape volume - while the high-end grade range applies a higher ratio of ~4%. This variation reflects the exclusion or inclusion of a distinct high-grade population observed across multiple veins. As additional drilling improves confidence in subdomaining, these high-grade zones may be more precisely delineated and estimated separately.

For the low-range domains, Rising Sun contributes 38% of the tonnes and 55% of the contained ounces, Apollo contributes 40% of the tonnes and 26% of the contained ounces and Golden Dyke contributes 22% of the tonnes and 18% of the contained ounces.

For the high-range domains, Rising Sun contributes 40% of the tonnes and 66% of the contained ounces, Apollo contributes 38% of the tonnes and 21% of the contained ounces and Golden Dyke contributes 22% of the tonnes and 13% of the contained ounces.

Significant upside also remains within the tenor potential of all the prospects when further high-grade domains can be recognized and separated to maintain the high-grade nature of the veins i.e. top cuts can be raised with further data.

Antimony content contributes between 24% (Low-Range) and 21% (High-Range) of the AuEq ounces at an AuEq factor of 2.39.

Notably, the Exploration Target is constrained to three of the four main areas along the strike of the dyke breccia host on the project: Rising Sun (over 340 m strike), Apollo (over 280 m strike) and Golden Dyke (over 400 m strike) for a total 1,020 m of strike. This strike represents approximately 67% of the 1.5 km strike of the main drill footprint to date at Sunday Creek.

Figure 3 illustrates how gold grade capping (top-cuts or "TC") affects both the average grade of composites in the Exploration Target and the statistical reliability of these sample populations. Lower coefficient of variation (CV) values-calculated as standard deviation divided over mean-indicate reduced geological risk through more consistent sample data.

The Sunday Creek project demonstrates favourable statistical characteristics across all zones:

Rising Sun: CV decreased from 1.8 (before top-cutting) to 1.35 (after top-cutting)

Apollo: CV reduced from 1.36 (before top-cutting) to 1.0 (after top-cutting)

Golden Dyke: CV remained stable at 1.0 (both before and after top-cutting)

Importantly, as drilling has progressed and high-grade core sub-domains have been identified, Sunday Creek has shown consistent decreases in CV values both before and after applying top-cuts, indicating improving data reliability and reduced uncertainty.

The estimated true widths of Rising Sun, Apollo, and Golden Dyke are relatively consistent across all prospects. Apollo has the largest estimated true width, averaging 4.2 m (median 3.5 m), Rising Sun at 2.8 m (median 2.4 m), and Golden Dyke at 3.2 m (median 2.3 m). Within the centre of many vein sets high-grade cores show consistency, with Apollo averaging 0.5 m (median 0.4 m, maximum 1.3 m) and Rising Sun averaging 0.6 m (median 0.4 m, maximum 2.4 m).

TOWARDS A MINERAL RESOURCE ESTIMATE

The proposed exploration activities are designed to test the validity of the Exploration Target and to move from an Exploration Target to a Mineral Resource Estimate and will comprise the following activities;

Native Title Heritage Surveys

Heritage surveys required to gain access to the Exploration Target area have been completed in conjunction with the Taungurung Land and Waters Council who represent the Native Title holders, the Taungurung People.

Cultural Heritage Clearances

Heritage walkovers required to gain access to the Exploration Target area have been completed in conjunction with the Taungurung Land and Waters Council who represent the Native Title holders the Taungurung People.

Approvals

The majority of the Exploration Target is contained within a small crown land allotment. SXGC owns 1,054.51 hectares that fully encloses the crown land. Approvals required for exploration drilling to test the Exploration Target have all been obtained on all the crown land and on the freehold land.

Exploration Licences

The vast majority of the Exploration Target is located within granted Retention Licence RL6040 and surrounded by granted EL6163. No further Exploration Licences are required to be granted to test the Exploration Target.

Exploration Program

Expansion and resource definition drilling are continuing at the project with six diamond rigs operating to continue to extend mineralization drill-out within the Exploration Target and to upgrade the mineralization to Mineral Resource status and one rig focused on regional exploration targets. It is expected that these activities will be completed during the second half of 2026.

Metallurgical test work

SXGC has completed initial metallurgical test work on two drill holes from the Exploration Target area which were reported on 10 January 2024. Mineralogical investigations demonstrated a high proportion of non-refractory native gold (82% to 84%). Additionally, gravity and bulk flotation resulted in 93.3% to 97.6% recovery of gold. Flotation gave 88.9% to 95.0% recovery.

Mineral Resource Estimate

SRK Consulting (Australasia) Pty Ltd ("SRK") have been engaged to for ongoing modelling assistance and the eventual preparation of a Mineral Resource Estimate, consistent with the requirements of National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") and the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves, 2012 Edition ("JORC").

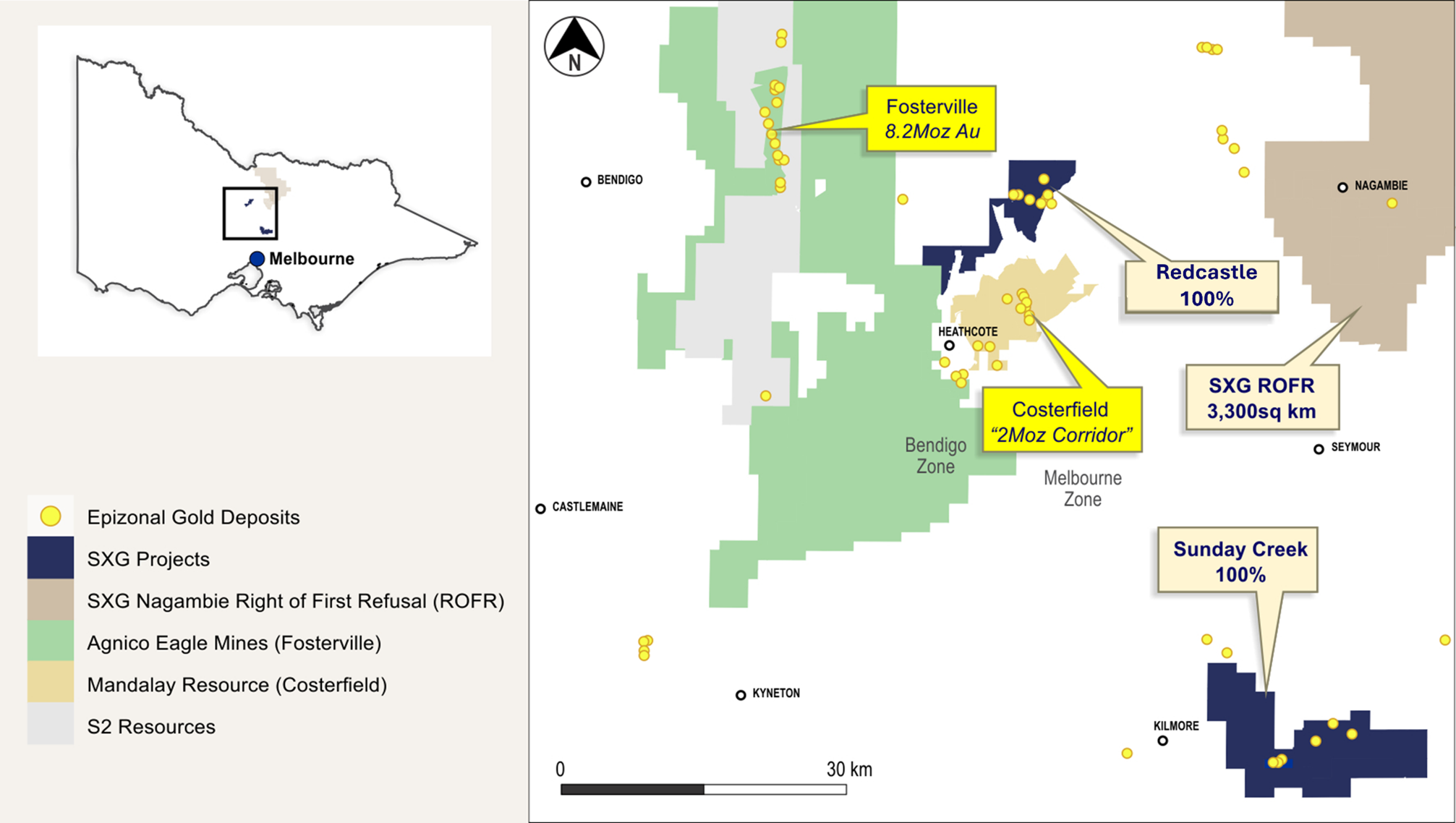

ABOUT SUNDAY CREEK

The Sunday Creek epizonal-style gold project is located 60 km north of Melbourne within 19,365 hectares of granted exploration tenements.

History

The Sunday Creek deposit is a high level orogenic (or epizonal) deposit. Small scale mining has been undertaken in the project area since the 1880s continuing through to the early 1900s. Historical production occurred with multiple small shafts and alluvial workings across the existing permits. Past production at the Sunday Creek prospect is reported as 41,000 oz gold at a grade of 33 g/t gold. Larger historic workings along the trend from west to east include Christina, Golden Dyke, Rising Sun and Apollo.

Regional Geology

Sunday Creek occurs with the Melbourne Zone of the Lachlan Geosyncline, in sequences folded and thrust-faulted by the Late Devonian Tabberabberan Orogeny. The regional host to the Sunday Creek mineralization is an interbedded turbidite sequence of siltstones, mudstones, and minor sandstones, metamorphosed to sub-greenschist facies and folded into a set of open north-west trending synclines and anticlines.

Structural Setting and Local Geology

Intruded into the sedimentary sequence is a series of intermediate monzodiorite - diorite dykes and breccias on an east-west trend. The Sunday Creek dykes have highly variable textures and compositions with the earliest emplaced aphanitic varieties emplaced along thin fracture sets. These fine-grained dykes locally grade into porphyritic to massive varieties as the thickness of the dykes increases and brecciate in areas of complexity or in proximity to fold hinges.

Large scale thrusts sub-parallel to the NW trending structural grain, dislocate the dyke system and an array of sub-vertical extension veins form subparallel to the bedding trend and orthogonal to the intruded dyke sequence. Veining is focused within areas of high competency contrast, such as the intruded dyke and surrounding alteration, fold hinges and areas of structural complexity.

Alteration

Distally a regional chlorite alteration weakly pervades the sediments, with a change in mica composition from phengitic to muscovitic mica approaching mineralization, an increase in carbonate spotting and cementation and proximal to the dyke a very intense texturally destructive alteration of sericite-carbonate-silica "bleaching" of the sediments.

Mineralization & Structural Setting

Geological controls on mineralization (structural, chemical, stratigraphic) exist on every ore deposit and Sunday Creek is no different. Mineralization is structurally controlled, with increased mineralization associated within the "bleaching" around the intrusive sequence. Early alteration and sulphide (pyrite) mineralization has exploited the vesicular/amygdaloidal nature of the pervasively altered/mineralized dyke and the brecciated areas, or forms east-west trending pyrite veinlets.

Gold-antimony mineralization is dominantly hosted within zones of sub-vertical, brittle-ductile NW striking shear veins and associated veins, containing visible gold, quartz, stibnite, occasional fibrous sulphosalts and minor ferroan carbonates infill. The veins have an associated selvedge of disseminated sulphides in the form of arsenian pyrite, pyrite and arsenopyrite. Gold and antimony form in a relay of vein sets that cut across a steeply dipping zone of intensely altered rocks (the "host"). These vein sets are like a "Golden Ladder" structure where the main host extends between the side rails deep into the earth, with multiple cross-cutting vein sets that host the gold forming the rungs. At Rising Sun and Apollo these individual 'rungs' have been defined over 600 m depth extent from surface to over 1,100 m below surface, are 2.4 m to 3.8 m wide (median widths) (and up to 10 m), and 20 m to 100 m in strike.

Cumulatively, 162 drill holes for 73,299.16 m have been reported from Sunday Creek since late 2020. An additional 12 holes for 582.55 m from Sunday Creek were abandoned due to deviation or hole conditions. Fourteen drillholes for 2,383 m have been reported regionally outside of the main Sunday Creek drill area. A total of 64 historic drill holes for 5,599 m were completed from the late 1960s to 2008. The project now contains a total of sixty (60) >100 g/t AuEq x m and sixty-seven (67) >50 to 100 g/t AuEq x m drill holes by applying a 2 m @ 1 g/t AuEq lower cut.

Our systematic drill program is strategically targeting these significant vein formations, initially these have been defined over 1,500 m strike of the host from Christina to Apollo prospects, of which approximately 850 m has been more intensively drill tested (Golden Dyke to Apollo). At least 71 'rungs' have been defined with high confidence to date, defined by high-grade cores with intercepts (20 g/t to >7,330 g/t Au) along with lower grade edges. Ongoing step-out drilling is aiming to uncover the potential extent of this mineralized system (Figure 2, 5 & 6).

Further Information

Further discussion and analysis of the Sunday Creek project is available through the interactive Vrify 3D animations, presentations and videos all available on the SXGC website. These data, along with an interview on these results with President & CEO Michael Hudson can be viewed at www.southerncrossgold.com.

No upper gold grade cut is applied in the averaging and intervals are reported as drill thickness. However, during future Mineral Resource studies, the requirement for assay top cutting will be assessed, as it has been in the Exploration Target reported here. The Company notes that due to rounding of assay results to one significant figure, minor variations in calculated composite grades may occur.

Figures 1 to 6 show longitudinal and plan views with new exploration target and select drill results previously reported, geostatistical composites and coefficient of variation and regional project location. Table 1 and 2 contain the Exploration Target range for Sunday Creek and split by prospect and Table 3 and Table 4 summarise individual domains and grade parameters within the Exploration Target. Lower grades were cut at 1.0 g/t AuEq lower cutoff over a maximum width of 2 m with higher grades cut at 5.0 g/t AuEq lower cutoff over a maximum of 1 m width unless specified unless otherwise* specified to demonstrate higher grade assays.

Critical Metal Epizonal Gold-Antimony Deposits

Sunday Creek (Figure 6) is an epizonal gold-antimony deposit formed in the late Devonian (like Fosterville, Costerfield and Redcastle), 60 million years later than mesozonal gold systems formed in Victoria (for example Ballarat and Bendigo). Epizonal deposits are a form of orogenic gold deposit classified according to their depth of formation: epizonal (<6 km), mesozonal (6-12 km) and hypozonal (>12 km).

Epizonal deposits in Victoria often have associated high levels of the critical metal, antimony, and Sunday Creek is no exception. China claims a 56 per cent share of global mined supplies of antimony, according to a 2023 European Union study. Antimony features highly on the critical minerals lists of many countries including Australia, the United States of America, Canada, Japan and the European Union. Australia ranks seventh for antimony production despite all production coming from a single mine at Costerfield in Victoria, located nearby to all SXG projects. Antimony alloys with lead and tin which results in improved properties for solders, munitions, bearings and batteries. Antimony is a prominent additive for halogen-containing flame retardants. Adequate supplies of antimony are critical to the world's energy transition, and to the high-tech industry, especially the semi-conductor and defence sectors where it is a critical additive to primers in munitions.

In August 2024, the Chinese government announced it will place export limits from September 15, 2024 on antimony and antimony products. This puts pressure on Western defence supply chains and negatively affect the supply of the metal and push up pricing given China's dominance of the supply of the metal in the global markets. This is positive for SXGC as we are likely to have one of the very few large and high-quality projects of antimony in the western world that can feed western demand into the future.

Antimony represents approximately 21 to 24% in situ recoverable value of Sunday Creek at an AuEq of 2.39.

About Southern Cross Gold Consolidated Ltd. (TSXV:SXGC) (ASX:SX2)

Southern Cross Gold Consolidated Ltd is now dual listed on the TSXV: SXGC and ASX: SX2

Southern Cross Gold Consolidated Ltd. (TSXV:SXGC, ASX:SX2) controls the Sunday Creek Gold-Antimony Project located 60 km north of Melbourne, Australia. Sunday Creek has emerged as one of the Western world's most significant gold and antimony discoveries, with exceptional drilling results including 60 intersections exceeding 100 g/t AuEq x m from just 73.3 km of drilling. The mineralization follows a "Golden Ladder" structure over 12 km of strike length, with confirmed continuity from surface to 1,100 m depth.

Sunday Creek's strategic value is enhanced by its dual-metal profile, with antimony contributing 21 to 24% of the in-situ value alongside gold. This has gained increased significance following China's export restrictions on antimony, a critical metal for defence and semiconductor applications. Southern Cross' inclusion in the US Defense Industrial Base Consortium (DIBC) and Australia's AUKUS-related legislative changes position it as a potential key Western antimony supplier. Importantly, Sunday Creek can be developed primarily based on gold economics, which reduces antimony-related risks while maintaining strategic supply potential.

Technical fundamentals further strengthen the investment case, with preliminary metallurgical work showing non-refractory mineralization suitable for conventional processing and gold recoveries of 93 to 98% through gravity and flotation.

With A$18M in cash, over 1,000 Ha of strategic freehold land ownership, and a large 60 km drill program planned through Q3 2025, SXGC is well-positioned to advance this globally significant gold-antimony discovery in a tier-one jurisdiction.

NI 43-101 Technical Background and Qualified Person

Michael Hudson, President and CEO and Managing Director of SXGC, and a Fellow of the Australasian Institute of Mining and Metallurgy, and Mr Kenneth Bush, Exploration Manager of SXGC and a Member of Australian Institute of Geoscientists, are the Qualified Persons as defined by the NI 43-101. They have reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services ("On Site") which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 g charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of SXGC consists of the systematic insertion of certified standards of known gold and antimony content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

SXGC considers that both gold and antimony that are included in the gold equivalent calculation ("AuEq") have reasonable potential to be recovered at Sunday Creek, given current geochemical understanding, historic production statistics and geologically analogous mining operations. Historically, ore from Sunday Creek was treated onsite or shipped to the Costerfield mine, located 54 km to the northwest of the project, for processing during WW1. The Costerfield mine corridor, now owned by Mandalay Resources Ltd contains two million ounces of equivalent gold (Mandalay Q3 2021 Results), and in 2020 was the sixth highest-grade global underground mine and a top 5 global producer of antimony.

SXGC considers that it is appropriate to adopt the same gold equivalent variables as Mandalay Resources Ltd in its 2024 End of Year Mineral Reserves and Resources Press Release, dated February 20, 2025. The gold equivalence formula used by Mandalay Resources was calculated using Costerfield's 2024 production costs, using a gold price of US$2,500 per ounce, an antimony price of US$19,000 per tonne and 2024 total year metal recoveries of 91% for gold and 92% for antimony, and is as follows:

???????? = ???? (??/??) + 2.39 × ???? (%).

Based on the latest Costerfield calculation and given the similar geological styles and historic toll treatment of Sunday Creek mineralization at Costerfield, SXGC considers that a ???????? = ???? (??/??) + 2.39 × ???? (%) is appropriate to use for the initial exploration targeting of gold-antimony mineralization at Sunday Creek.

JORC Competent Person Statement

Information in this report that relates to the Exploration Target for the Sunday Creek Project is based on information compiled by Mr Kenneth Bush and Mr Michael Hudson. Mr Bush is a Member of Australian Institute of Geoscientists and Mr Hudson is a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Bush and Mr Hudson each have sufficient experience relevant to the style of mineralization and type of deposit under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Bush is Exploration Manager and Mr Hudson is President & CEO of Southern Cross Gold Consolidated Limited and both consent to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Information in this announcement that relates to new exploration results contained in this report is based on information compiled by Mr Kenneth Bush and Mr Michael Hudson. Mr Bush is a Member of Australian Institute of Geoscientists and a Registered Professional Geologist and Member of the Australasian Institute of Mining and Metallurgy and Mr Hudson is a Fellow of The Australasian Institute of Mining and Metallurgy. Mr Bush and Mr Hudson each have sufficient experience relevant to the style of mineralization and type of deposit under consideration, and to the activities undertaken, to qualify as a Competent Person as defined in the 2012 Edition of the Joint Ore Reserves Committee (JORC) Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. Mr Bush is Exploration Manager and Mr Hudson is President & CEO of Southern Cross Gold Consolidated Limited and both consent to the inclusion in the report of the matters based on their information in the form and context in which it appears.

Certain information in this announcement that relates to prior exploration results is extracted from the Independent Geologist's Report dated 11 December 2024 which was issued with the consent of the Competent Person, Mr Steven Tambanis. The report is included the Company's prospectus dated 11 December 2024 and is available at www2.asx.com.au under code "SX2". The Company confirms that it is not aware of any new information or data that materially affects the information related to exploration results included in the original market announcement. The Company confirms that the form and context of the Competent Persons' findings in relation to the report have not been materially modified from the original market announcement.

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original document/announcement and the Company confirms that the form and context in which the Competent Person's findings are presented have not materially modified from the original market announcement.

- Ends -

This announcement has been approved for release by the Board of Southern Cross Gold Consolidated Ltd.

For further information, please contact:

Mariana Bermudez - Corporate Secretary - Canada

mbermudez@chasemgt.com or +1 604 685 9316

Executive Office: 1305 - 1090 West Georgia Street Vancouver, BC, V6E 3V7, Canada

Nicholas Mead - Corporate Development

info@southerncrossgold.com or +61 415 153 122

Justin Mouchacca, Company Secretary - Australia

jm@southerncrossgold.com.au or +61 3 8630 3321

Subsidiary Office: Level 21, 459 Collins Street, Melbourne, VIC, 3000, Australia

Forward-Looking Statement

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and assumptions and accordingly, actual results and future events could differ materially from those expressed or implied in such statements. You are hence cautioned not to place undue reliance on forward-looking statements. All statements other than statements of present or historical fact are forward-looking statements including without limitation applicable court, regulatory authorities and applicable stock exchanges. Forward-looking statements include words or expressions such as "proposed", "will", "subject to", "near future", "in the event", "would", "expect", "prepared to" and other similar words or expressions. Factors that could cause future results or events to differ materially from current expectations expressed or implied by the forward-looking statements include general business, economic, competitive, political, social uncertainties; the state of capital markets, unforeseen events, developments, or factors causing any of the expectations, assumptions, and other factors ultimately being inaccurate or irrelevant; and other risks described in SXGC's documents filed with Canadian or Australian securities regulatory authorities (under code SX2). You can find further information with respect to these and other risks in filings made by SXGC with the securities regulatory authorities in Canada or Australia (under code SX2), as applicable, and available for SXGC in Canada at www.sedarplus.ca or in Australia at www.asx.com.au under code SX2. Documents are also available at www.southerncrossgold.com We disclaim any obligation to update or revise these forward-looking statements, except as required by applicable law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) or the Australian Securities Exchange accepts responsibility for the adequacy or accuracy of this release.

Figure 1: Sunday Creek Longitudinal Section showing 85 total vein shapes created for the Exploration Target (blue shapes, shaded blue outline). Notably the Exploration Target is constrained to the three main areas along the strike of the dyke breccia host on the project: Rising Sun (over 340 m strike), Apollo (over 280 m strike) and Golden Dyke (over 400 m strike) for a total 1,020 m of strike. This strike represents only 67% of the 1.5 km main drill footprint to date at Sunday Creek where high-grade drill intersections have been intercepted.

Figure 2: Sunday Creek plan view showing Exploration Target area (blue shapes, shaded blue outline).

Figure 3 illustrates how gold grade capping (top-cuts) affects both the average grade of composites in the Exploration Target and the statistical reliability of these sample populations. The graphs display coefficient of variation (CV) values-calculated as standard deviation divided by mean-for Apollo, Rising Sun, and Golden Dyke prospects, both before and after applying top-cuts.

Lower CV values indicate more consistent sample data with reduced variability, which translates directly to lower geological risk. This statistical improvement is critical for high-grade gold deposits where grade continuity assessment is essential for resource confidence.

The grade estimates were developed using carefully calibrated parameters:

A standard top-cut of 80 g/t Au was applied to vein sets across all three prospects

For high-grade sub-domains, a 15% range restriction (approximately 10 to 15 m) was implemented

Additional higher top-cuts were selectively applied to high-grade zones: 300 g/t Au for Apollo and 400 g/t Au for Rising Sun

This approach optimizes the balance between preserving the high-grade nature of the deposit while reducing statistical outlier effects, ultimately requiring less drilling to achieve higher confidence in the resource model and lowering overall capital requirements.

Figure 4: Evolution of Sunday Creek Exploration (1967-2025), long section showing Progressive Drilling Success and Expansion of High-Grade Intercepts, with both 2024 and 2025 Exploration Target outlines.

Figure 5: Sunday Creek regional plan view showing increased IP Geophysical survey outline, soil sampling (including planned/in progress samples), structural framework, regional historic epizonal gold mining areas and broad regional areas tested by 12 holes for 2,383 m drill program. The regional drill areas are at Tonstal, Consols and Leviathan located 4,000-7,500 m along strike from the main drill area at Golden Dyke- Apollo.

Figure 6: Location of the Sunday Creek project, along with the 100% owned Redcastle Gold-Antimony Project

Table 3: Low Range Exploration Target Split by individual Vein set and grade assumptions

Domain | Volume | Area | Au g/t | Sb % | AuEq | SG | Tonnes | Au (oz) | Sb (t) | AuEq (oz) |

|---|---|---|---|---|---|---|---|---|---|---|

A10_VeinSet: | 38,301 | Apollo | 4.93 | 0.70 | 6.6 | 2.77 | 106,094 | 16,823 | 741 | 22,516 |

A15_VeinSet_L: | 10,045 | Apollo | 5.97 | 0.10 | 6.2 | 2.77 | 27,825 | 5,340 | 29 | 5,559 |

A20_VeinSet: | 22,073 | Apollo | 4.58 | 0.31 | 5.3 | 2.77 | 61,142 | 9,008 | 187 | 10,445 |

A30_VeinSet: | 65,102 | Apollo | 3.36 | 0.75 | 5.1 | 2.77 | 180,333 | 19,462 | 1,351 | 29,840 |

A40_VeinSet: | 45,222 | Apollo | 3.06 | 0.19 | 3.5 | 2.77 | 125,265 | 12,313 | 238 | 14,139 |

A50_VeinSet: | 87,320 | Apollo | 2.24 | 0.22 | 2.8 | 2.77 | 241,876 | 17,382 | 531 | 21,459 |

A60_VeinSet: | 19,754 | Apollo | 6.65 | 0.90 | 8.8 | 2.77 | 54,719 | 11,704 | 490 | 15,468 |

A65_VeinSet_L: | 17,575 | Apollo | 2.53 | 0.56 | 3.9 | 2.77 | 48,683 | 3,963 | 271 | 6,042 |

A67_VeinSet_L: | 11,729 | Apollo | 3.89 | 0.30 | 4.6 | 2.77 | 32,489 | 4,063 | 98 | 4,819 |

A70_VeinSet: | 51,812 | Apollo | 2.84 | 0.93 | 5.1 | 2.77 | 143,519 | 13,085 | 1,336 | 23,347 |

A75_VeinSet: | 13,400 | Apollo | 4.70 | 0.19 | 5.1 | 2.77 | 37,118 | 5,604 | 69 | 6,135 |

A77_VeinSet: | 9764.9 | Apollo | 6.72 | 0.78 | 8.6 | 2.77 | 27,049 | 5,843 | 211 | 7,461 |

A80_VeinSet: | 24,596 | Apollo | 1.76 | 0.29 | 2.5 | 2.77 | 68,131 | 3,855 | 199 | 5,386 |

A90_VeinSet: | 17,743 | Apollo | 2.27 | 0.73 | 4.0 | 2.77 | 49,148 | 3,580 | 357 | 6,320 |

A130_VeinSet: | 56,558 | Apollo | 3.77 | 0.98 | 6.1 | 2.77 | 156,666 | 19,006 | 1,535 | 30,797 |

A131_VeinSet: | 32,128 | Apollo | 8.59 | 2.27 | 14.0 | 2.81 | 90,280 | 24,946 | 2,045 | 40,658 |

A135_VeinSet: | 49,159 | Apollo | 3.90 | 0.57 | 5.3 | 2.77 | 136,170 | 17,070 | 772 | 23,003 |

A138_VeinSet: | 31,947 | Apollo | 6.20 | 0.83 | 8.2 | 2.77 | 88,493 | 17,627 | 738 | 23,300 |

A140_VeinSet: | 41,971 | Apollo | 4.31 | 0.79 | 6.2 | 2.77 | 116,260 | 16,105 | 922 | 23,192 |

A141_VeinSet: | 35,428 | Apollo | 4.44 | 1.02 | 6.9 | 2.79 | 98,844 | 14,117 | 1,012 | 21,892 |

A142_VeinSet: | 64,883 | Apollo | 5.07 | 0.79 | 7.0 | 2.77 | 179,726 | 29,300 | 1,425 | 40,248 |

A143_VeinSet: | 8330.7 | Apollo | 2.18 | 0.93 | 4.4 | 2.77 | 23,076 | 1,617 | 215 | 3,271 |

A144_VeinSet: | 8545.2 | Apollo | 9.97 | 0.91 | 12.1 | 2.77 | 23,670 | 7,586 | 215 | 9,239 |

A145_VeinSet: | 66,002 | Apollo | 2.01 | 0.39 | 2.9 | 2.77 | 182,826 | 11,841 | 713 | 17,318 |

A146_VeinSet: | 5599.6 | Apollo | 4.15 | 0.97 | 6.5 | 2.77 | 15,511 | 2,070 | 150 | 3,226 |

A150_VeinSet: | 51,999 | Apollo | 5.51 | 1.36 | 8.8 | 2.8 | 145,597 | 25,815 | 1,975 | 40,989 |

A152_VeinSet: | 4636.7 | Apollo | 7.12 | 0.58 | 8.5 | 2.77 | 12,844 | 2,941 | 74 | 3,512 |

A155_VeinSet: | 46,879 | Apollo | 4.52 | 0.72 | 6.2 | 2.77 | 129,855 | 18,890 | 936 | 26,082 |

A157_VeinSet: | 15,948 | Apollo | 8.03 | 0.68 | 9.7 | 2.77 | 44,176 | 11,406 | 301 | 13,722 |

A158_VeinSet: | 66,301 | Apollo | 3.81 | 0.66 | 5.4 | 2.77 | 183,654 | 22,478 | 1,210 | 31,778 |

A160_VeinSet: | 46,790 | Apollo | 3.81 | 0.66 | 5.4 | 2.77 | 129,608 | 15,863 | 854 | 22,427 |

A165_VeinSet: | 39,435 | Apollo | 7.44 | 0.68 | 9.1 | 2.77 | 109,235 | 26,113 | 747 | 31,850 |

A175_VeinSet: | 61,783 | Apollo | 3.81 | 0.66 | 5.4 | 2.77 | 171,139 | 20,946 | 1,128 | 29,613 |

RS01_VeinSet: | 99,973 | Rising Sun | 12.71 | 1.56 | 16.4 | 2.8 | 279,924 | 114,427 | 4,357 | 147,907 |

RS05_VeinSet: | 116,930 | Rising Sun | 5.98 | 0.48 | 7.1 | 2.77 | 323,896 | 62,241 | 1,547 | 74,128 |

RS10_VeinSet: | 104,280 | Rising Sun | 8.21 | 1.51 | 11.8 | 2.8 | 291,984 | 77,104 | 4,421 | 111,075 |

RS06_VeinSet: | 41,729 | Rising Sun | 6.16 | 0.31 | 6.9 | 2.77 | 115,589 | 22,892 | 360 | 25,657 |

RS06_VeinSet_L: | 5185.4 | Rising Sun | 0.39 | 0.10 | 0.6 | 2.77 | 14,364 | 179 | 14 | 285 |

RS07_VeinSet: | 27,606 | Rising Sun | 5.13 | 0.46 | 6.2 | 2.77 | 76,469 | 12,622 | 350 | 15,311 |

RS08_VeinSet: | 14,470 | Rising Sun | 8.37 | 1.33 | 11.6 | 2.8 | 40,516 | 10,909 | 540 | 15,061 |

RS09_VeinSet: | 6683.8 | Rising Sun | 2.37 | 0.67 | 4.0 | 2.77 | 18,514 | 1,413 | 124 | 2,366 |

RS10_L_VeinSet: | 4,489 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 12,434 | 3,102 | 100 | 3,870 |

RS15_VeinSet: | 47,573 | Rising Sun | 26.99 | 1.01 | 29.4 | 2.79 | 132,729 | 115,155 | 1,342 | 125,465 |

RS15_VeinSet_L: | 3299.1 | Rising Sun | 5.32 | 0.72 | 7.1 | 2.77 | 9,139 | 1,564 | 66 | 2,072 |

RS16_VeinSet: | 3,835 | Rising Sun | 3.39 | 1.22 | 6.3 | 2.79 | 10,700 | 1,166 | 131 | 2,170 |

RS17_VeinSet: | 39,763 | Rising Sun | 15.43 | 0.21 | 15.9 | 2.77 | 110,144 | 54,634 | 229 | 56,394 |

RS18_VeinSet: | 31,903 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 88,371 | 22,045 | 711 | 27,508 |

RS19_VeinSet: | 20,043 | Rising Sun | 10.06 | 0.34 | 10.9 | 2.77 | 55,519 | 17,961 | 186 | 19,394 |

RS20_VeinSet: | 61,117 | Rising Sun | 4.25 | 0.56 | 5.6 | 2.77 | 169,294 | 23,135 | 940 | 30,360 |

RS30_VeinSet: | 20,852 | Rising Sun | 4.47 | 0.57 | 5.8 | 2.77 | 57,760 | 8,306 | 331 | 10,852 |

RS38_VeinSet: | 12,561 | Rising Sun | 1.75 | 1.12 | 4.4 | 2.79 | 35,045 | 1,975 | 393 | 4,995 |

RS40_VeinSet: | 54,579 | Rising Sun | 7.54 | 1.30 | 10.7 | 2.8 | 152,821 | 37,044 | 1,991 | 52,340 |

RS45_VeinSet: | 2,441 | Rising Sun | 10.91 | 3.15 | 18.4 | 2.83 | 6,908 | 2,424 | 217 | 4,094 |

RS46_VeinSet_L: | 2390.9 | Rising Sun | 2.31 | 2.23 | 7.6 | 2.81 | 6,718 | 499 | 150 | 1,651 |

RS47_VeinSet: | 2273.9 | Rising Sun | 2.83 | 0.80 | 4.7 | 2.77 | 6,299 | 572 | 50 | 960 |

RS48_VeinSet: | 18,674 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 51,727 | 12,903 | 416 | 16,101 |

RS50_VeinSet: | 109,760 | Rising Sun | 4.44 | 0.78 | 6.3 | 2.77 | 304,035 | 43,395 | 2,370 | 61,606 |

RS55_VeinSet_L: | 5487.2 | Rising Sun | 29.78 | 3.03 | 37.0 | 2.83 | 15,529 | 14,868 | 471 | 18,484 |

RS60_VeinSet: | 46,690 | Rising Sun | 8.48 | 0.97 | 10.8 | 2.77 | 129,331 | 35,246 | 1,257 | 44,901 |

RS70_VeinSet: | 39,725 | Rising Sun | 14.59 | 0.32 | 15.4 | 2.77 | 110,038 | 51,634 | 349 | 54,315 |

RS75_VeinSet: | 8,251 | Rising Sun | 14.72 | 1.34 | 17.9 | 2.8 | 23,103 | 10,931 | 310 | 13,316 |

RS75_VeinSet_L: | 1,202 | Rising Sun | 4.59 | 0.87 | 6.7 | 2.77 | 3,330 | 492 | 29 | 716 |

RS80_VeinSet: | 26,294 | Rising Sun | 15.43 | 0.38 | 16.3 | 2.77 | 72,834 | 36,141 | 279 | 38,284 |

RS90_VeinSet: | 28,802 | Rising Sun | 25.98 | 0.28 | 26.6 | 2.77 | 79,782 | 66,649 | 222 | 68,356 |

RS95_VeinSet_L: | 4,023 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 11,144 | 2,780 | 90 | 3,469 |

RS100_VeinSet: | 15,379 | Rising Sun | 1.76 | 0.04 | 1.9 | 2.77 | 42,600 | 2,409 | 18 | 2,547 |

RS105_VeinSet: | 17,489 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 48,445 | 12,085 | 390 | 15,080 |

RS110_Veinset_L: | 5413.6 | Rising Sun | 1.49 | 0.07 | 1.7 | 2.77 | 14,996 | 717 | 11 | 799 |

RS110_VeinSet: | 14,291 | Rising Sun | 10.15 | 0.06 | 10.3 | 2.77 | 39,586 | 12,918 | 23 | 13,094 |

RS120_VeinSet: | 18,890 | Rising Sun | 5.41 | 0.12 | 5.7 | 2.77 | 52,325 | 9,101 | 63 | 9,586 |

RS150_VeinSet: | 7,407 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 20,517 | 5,118 | 165 | 6,386 |

RS160_VeinSet: | 6,201 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 17,178 | 4,285 | 138 | 5,347 |

RS170_VeinSet: | 11,714 | Rising Sun | 7.76 | 0.80 | 9.7 | 2.77 | 32,448 | 8,094 | 261 | 10,100 |

GD20_VeinSet: | 102,380 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 285,640 | 51,120 | 2,898 | 73,388 |

GD30_VeinSet: | 19,357 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 54,006 | 9,665 | 548 | 13,875 |

GD50_VeinSet: | 102,660 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 286,421 | 51,260 | 2,906 | 73,589 |

GD60_VeinSet: | 31,699 | Golden Dyke | 3.42 | 1.53 | 7.1 | 2.8 | 88,757 | 9,748 | 1,355 | 20,160 |

GD65_VeinSet: | 35,679 | Golden Dyke | 4.47 | 0.43 | 5.5 | 2.77 | 98,831 | 14,192 | 428 | 17,483 |

GD70_VeinSet: | 23,545 | Golden Dyke | 6.71 | 1.74 | 10.9 | 2.8 | 65,926 | 14,216 | 1,147 | 23,027 |

GD80_VeinSet: | 85,110 | Golden Dyke | 3.83 | 0.80 | 5.8 | 2.77 | 235,755 | 29,067 | 1,897 | 43,645 |

GD90_VeinSet: | 11,813 | Golden Dyke | 5.79 | 0.41 | 6.8 | 2.77 | 32,722 | 6,095 | 135 | 7,130 |

GD100_VeinSet: | 127,860 | Golden Dyke | 7.15 | 1.20 | 10.0 | 2.79 | 356,729 | 82,040 | 4,272 | 114,864 |

GD110_VeinSet: | 6,219 | Golden Dyke | 8.13 | 1.73 | 12.3 | 2.8 | 17,413 | 4,553 | 301 | 6,865 |

GD120_VeinSet: | 59,993 | Golden Dyke | 1.86 | 0.52 | 3.1 | 2.77 | 166,181 | 9,935 | 858 | 16,526 |

GD130_VeinSet: | 47,557 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 132,684 | 23,746 | 1,346 | 34,090 |

Table 4: High Range Exploration Target Split by individual Vein set and grade assumptions

Domain | Volume | Area | Au g/t | Sb % | AuEq | SG | Tonnes | Au (oz) | Sb (t) | AuEq (oz) |

|---|---|---|---|---|---|---|---|---|---|---|

A10_VeinSet: | 44,155 | Apollo | 4.93 | 0.70 | 6.6 | 2.77 | 122,309 | 19,395 | 854 | 25,958 |

A15_VeinSet_L: | 12,322 | Apollo | 5.97 | 0.10 | 6.2 | 2.77 | 34,132 | 6,550 | 35 | 6,819 |

A20_VeinSet: | 25,633 | Apollo | 4.58 | 0.31 | 5.3 | 2.77 | 71,003 | 10,460 | 217 | 12,129 |

A30_VeinSet: | 66,432 | Apollo | 4.27 | 1.04 | 6.8 | 2.79 | 185,345 | 25,450 | 1,932 | 40,292 |

A40_VeinSet: | 48,551 | Apollo | 3.06 | 0.19 | 3.5 | 2.77 | 134,486 | 13,220 | 255 | 15,180 |

A50_VeinSet: | 87,855 | Apollo | 2.24 | 0.22 | 2.8 | 2.77 | 243,358 | 17,488 | 534 | 21,590 |

A60_VeinSet: | 20,226 | Apollo | 8.43 | 1.20 | 11.3 | 2.79 | 56,431 | 15,295 | 676 | 20,486 |

A65_VeinSet_L: | 18,259 | Apollo | 2.53 | 0.56 | 3.9 | 2.77 | 50,577 | 4,117 | 281 | 6,278 |

A67_VeinSet_L: | 12,183 | Apollo | 3.89 | 0.30 | 4.6 | 2.77 | 33,747 | 4,220 | 102 | 5,005 |

A70_VeinSet: | 54,806 | Apollo | 3.57 | 1.21 | 6.5 | 2.79 | 152,909 | 17,540 | 1,844 | 31,710 |

A75_VeinSet: | 16,500 | Apollo | 4.70 | 0.19 | 5.1 | 2.77 | 45,705 | 6,901 | 85 | 7,554 |

A77_VeinSet: | 11,942 | Apollo | 6.72 | 0.78 | 8.6 | 2.77 | 33,079 | 7,146 | 257 | 9,124 |

A80_VeinSet: | 24,585 | Apollo | 1.76 | 0.29 | 2.5 | 2.77 | 68,100 | 3,853 | 199 | 5,383 |

A90_VeinSet: | 20,345 | Apollo | 2.43 | 0.87 | 4.5 | 2.77 | 56,356 | 4,403 | 489 | 8,158 |

A130_VeinSet: | 58,783 | Apollo | 3.77 | 0.98 | 6.1 | 2.77 | 162,829 | 19,753 | 1,595 | 32,009 |

A131_VeinSet: | 39,944 | Apollo | 8.59 | 2.27 | 14.0 | 2.81 | 112,243 | 31,015 | 2,542 | 50,549 |

A135_VeinSet: | 52,427 | Apollo | 3.90 | 0.57 | 5.3 | 2.77 | 145,223 | 18,205 | 824 | 24,533 |

A138_VeinSet: | 33,904 | Apollo | 8.06 | 1.42 | 11.4 | 2.8 | 94,931 | 24,608 | 1,345 | 34,942 |

A140_VeinSet: | 50,149 | Apollo | 5.57 | 0.96 | 7.9 | 2.77 | 138,913 | 24,863 | 1,337 | 35,140 |

A141_VeinSet: | 41,796 | Apollo | 4.44 | 1.02 | 6.9 | 2.79 | 116,611 | 16,655 | 1,194 | 25,827 |

A142_VeinSet: | 74,122 | Apollo | 5.07 | 0.79 | 7.0 | 2.77 | 205,318 | 33,473 | 1,628 | 45,979 |

A143_VeinSet: | 10,142 | Apollo | 2.18 | 0.93 | 4.4 | 2.77 | 28,093 | 1,968 | 262 | 3,983 |

A144_VeinSet: | 10,517 | Apollo | 9.97 | 0.91 | 12.1 | 2.77 | 29,132 | 9,337 | 265 | 11,371 |

A145_VeinSet: | 73,357 | Apollo | 2.01 | 0.39 | 2.9 | 2.77 | 203,199 | 13,160 | 792 | 19,248 |

A146_VeinSet: | 6431.7 | Apollo | 4.15 | 0.97 | 6.5 | 2.77 | 17,816 | 2,378 | 173 | 3,706 |

A150_VeinSet: | 61,023 | Apollo | 5.51 | 1.36 | 8.8 | 2.8 | 170,864 | 30,295 | 2,318 | 48,103 |

A152_VeinSet: | 5414.1 | Apollo | 7.12 | 0.58 | 8.5 | 2.77 | 14,997 | 3,434 | 87 | 4,101 |

A155_VeinSet: | 53,946 | Apollo | 4.52 | 0.72 | 6.2 | 2.77 | 149,430 | 21,738 | 1,077 | 30,014 |

A157_VeinSet: | 19,684 | Apollo | 8.03 | 0.68 | 9.7 | 2.77 | 54,525 | 14,078 | 372 | 16,937 |

A158_VeinSet: | 66,892 | Apollo | 4.13 | 0.75 | 5.9 | 2.77 | 185,291 | 24,626 | 1,385 | 35,268 |

A160_VeinSet: | 57,681 | Apollo | 4.13 | 0.75 | 5.9 | 2.77 | 159,776 | 21,235 | 1,194 | 30,411 |

A165_VeinSet: | 49,124 | Apollo | 7.44 | 0.68 | 9.1 | 2.77 | 136,073 | 32,529 | 930 | 39,675 |

A175_VeinSet: | 72,385 | Apollo | 4.13 | 0.75 | 5.9 | 2.77 | 200,506 | 26,648 | 1,499 | 38,164 |

RS01_VeinSet: | 102,380 | Rising Sun | 12.71 | 1.56 | 16.4 | 2.8 | 286,664 | 117,182 | 4,462 | 151,468 |

RS05_VeinSet: | 156,840 | Rising Sun | 9.23 | 0.63 | 10.7 | 2.77 | 434,447 | 128,943 | 2,739 | 149,987 |

RS10_VeinSet: | 118,740 | Rising Sun | 12.46 | 2.28 | 17.9 | 2.81 | 333,659 | 133,647 | 7,595 | 192,003 |

RS06_VeinSet: | 41,401 | Rising Sun | 6.16 | 0.31 | 6.9 | 2.77 | 114,681 | 22,712 | 357 | 25,455 |

RS06_VeinSet_L: | 5,423 | Rising Sun | 0.39 | 0.10 | 0.6 | 2.77 | 15,021 | 188 | 14 | 298 |

RS07_VeinSet: | 30,587 | Rising Sun | 5.13 | 0.46 | 6.2 | 2.77 | 84,726 | 13,984 | 388 | 16,964 |

RS08_VeinSet: | 22,386 | Rising Sun | 8.37 | 1.33 | 11.6 | 2.8 | 62,681 | 16,877 | 836 | 23,300 |

RS09_VeinSet: | 7,750 | Rising Sun | 2.37 | 0.67 | 4.0 | 2.77 | 21,467 | 1,639 | 144 | 2,744 |

RS10_L_VeinSet: | 4672.7 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 13,037 | 4,801 | 135 | 5,838 |

RS15_VeinSet: | 67,303 | Rising Sun | 47.16 | 1.51 | 50.8 | 2.8 | 188,448 | 285,760 | 2,840 | 307,577 |

RS15_VeinSet_L: | 4074.1 | Rising Sun | 5.32 | 0.72 | 7.1 | 2.77 | 11,285 | 1,931 | 82 | 2,559 |

RS16_VeinSet: | 4741.8 | Rising Sun | 3.39 | 1.22 | 6.3 | 2.79 | 13,230 | 1,442 | 161 | 2,683 |

RS17_VeinSet: | 49,355 | Rising Sun | 26.11 | 0.19 | 26.6 | 2.77 | 136,713 | 114,766 | 264 | 116,792 |

RS18_VeinSet: | 54,347 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 151,628 | 55,839 | 1,570 | 67,905 |

RS19_VeinSet: | 27,793 | Rising Sun | 17.90 | 0.44 | 18.9 | 2.77 | 76,987 | 44,314 | 337 | 46,901 |

RS20_VeinSet: | 82,239 | Rising Sun | 4.25 | 0.56 | 5.6 | 2.77 | 227,802 | 31,131 | 1,265 | 40,853 |

RS30_VeinSet: | 24,810 | Rising Sun | 4.47 | 0.57 | 5.8 | 2.77 | 68,724 | 9,882 | 394 | 12,911 |

RS38_VeinSet: | 13,879 | Rising Sun | 1.75 | 1.12 | 4.4 | 2.79 | 38,722 | 2,182 | 434 | 5,519 |

RS40_VeinSet: | 75,506 | Rising Sun | 8.44 | 1.43 | 11.9 | 2.8 | 211,417 | 57,354 | 3,029 | 80,627 |

RS45_VeinSet: | 3009.7 | Rising Sun | 10.91 | 3.15 | 18.4 | 2.83 | 8,517 | 2,988 | 268 | 5,047 |

RS46_VeinSet_L: | 2955.7 | Rising Sun | 2.31 | 2.23 | 7.6 | 2.81 | 8,306 | 617 | 185 | 2,041 |

RS47_VeinSet: | 2,806 | Rising Sun | 2.83 | 0.80 | 4.7 | 2.77 | 7,773 | 706 | 62 | 1,184 |

RS48_VeinSet: | 18,426 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 51,409 | 18,932 | 532 | 23,023 |

RS50_VeinSet: | 124,450 | Rising Sun | 6.35 | 0.99 | 8.7 | 2.77 | 344,727 | 70,336 | 3,408 | 96,520 |

RS55_VeinSet_L: | 6647.3 | Rising Sun | 44.69 | 4.01 | 54.3 | 2.85 | 18,945 | 27,219 | 760 | 33,056 |

RS60_VeinSet: | 57,277 | Rising Sun | 12.11 | 1.46 | 15.6 | 2.8 | 160,376 | 62,440 | 2,336 | 80,390 |

RS70_VeinSet: | 52,669 | Rising Sun | 22.93 | 0.43 | 24.0 | 2.77 | 145,893 | 107,554 | 632 | 112,412 |

RS75_VeinSet: | 10,288 | Rising Sun | 14.72 | 1.34 | 17.9 | 2.8 | 28,806 | 13,630 | 387 | 16,603 |

RS75_VeinSet_L: | 1,202 | Rising Sun | 4.59 | 0.87 | 6.7 | 2.77 | 3,330 | 492 | 29 | 716 |

RS80_VeinSet: | 32,379 | Rising Sun | 25.34 | 0.41 | 26.3 | 2.77 | 89,690 | 73,062 | 372 | 75,921 |

RS90_VeinSet: | 41,731 | Rising Sun | 46.18 | 0.35 | 47.0 | 2.77 | 115,595 | 171,608 | 404 | 174,712 |

RS95_VeinSet_L: | 4,928 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 13,750 | 5,064 | 142 | 6,158 |

RS100_VeinSet: | 18,054 | Rising Sun | 1.76 | 0.04 | 1.9 | 2.77 | 50,010 | 2,829 | 21 | 2,990 |

RS105_VeinSet: | 22,191 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 61,913 | 22,800 | 641 | 27,727 |

RS110_Veinset_L: | 6624.8 | Rising Sun | 1.49 | 0.07 | 1.7 | 2.77 | 18,351 | 878 | 13 | 978 |

RS110_VeinSet: | 17,003 | Rising Sun | 10.15 | 0.06 | 10.3 | 2.77 | 47,098 | 15,370 | 27 | 15,579 |

RS120_VeinSet: | 28,729 | Rising Sun | 5.41 | 0.12 | 5.7 | 2.77 | 79,579 | 13,841 | 96 | 14,580 |

RS150_VeinSet: | 10,750 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 29,993 | 11,045 | 311 | 13,432 |

RS160_VeinSet: | 8,750 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 24,413 | 8,990 | 253 | 10,933 |

RS170_VeinSet: | 11,698 | Rising Sun | 11.45 | 1.04 | 13.9 | 2.79 | 32,637 | 12,019 | 338 | 14,616 |

GD20_VeinSet: | 102,890 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 287,063 | 51,375 | 2,913 | 73,753 |

GD30_VeinSet: | 23,370 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 65,202 | 11,669 | 662 | 16,752 |

GD50_VeinSet: | 102,660 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 286,421 | 51,260 | 2,906 | 73,589 |

GD60_VeinSet: | 55,376 | Golden Dyke | 3.42 | 1.53 | 7.1 | 2.8 | 155,053 | 17,028 | 2,367 | 35,219 |

GD65_VeinSet: | 43,736 | Golden Dyke | 4.47 | 0.43 | 5.5 | 2.77 | 121,149 | 17,396 | 525 | 21,431 |

GD70_VeinSet: | 35,178 | Golden Dyke | 6.71 | 1.74 | 10.9 | 2.8 | 98,498 | 21,239 | 1,713 | 34,404 |

GD80_VeinSet: | 90,608 | Golden Dyke | 3.83 | 0.80 | 5.8 | 2.77 | 250,984 | 30,945 | 2,020 | 46,464 |

GD90_VeinSet: | 13,496 | Golden Dyke | 5.79 | 0.41 | 6.8 | 2.77 | 37,384 | 6,963 | 154 | 8,146 |

GD100_VeinSet: | 143,080 | Golden Dyke | 7.15 | 1.20 | 10.0 | 2.79 | 399,193 | 91,806 | 4,780 | 128,537 |

GD110_VeinSet: | 11,738 | Golden Dyke | 8.13 | 1.73 | 12.3 | 2.8 | 32,866 | 8,593 | 568 | 12,958 |

GD120_VeinSet: | 74,190 | Golden Dyke | 1.86 | 0.52 | 3.1 | 2.77 | 205,506 | 12,286 | 1,061 | 20,437 |

GD130_VeinSet: | 59,413 | Golden Dyke | 5.57 | 1.01 | 8.0 | 2.79 | 165,762 | 29,666 | 1,682 | 42,588 |

JORC Table 1

Section 1 Sampling Techniques and Data

Criteria | JORC Code explanation | Commentary |

|---|---|---|

Sampling techniques |

|

|

Drilling techniques |

|

|

Drill sample recovery |

|

|

Logging |

|

|

Sub-sampling techniques and sample preparation |

|

|

Quality of assay data and laboratory tests |

|

|

Verification of sampling and assaying |

|

|

Location of data points |

|

|

Data spacing and distribution |

|

|

Orientation of data in relation to geological structure |

|

|

Sample security |

|

|

Audits or reviews |

|

|

Section 2 Reporting of Exploration Results

Criteria | JORC Code explanation | Commentary | ||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Mineral tenement and land tenure status |

|

| ||||||||||||||||||||||||||||||

Exploration done by other parties |

|

Rock chip sampling around Christina, Apollo and Golden Dyke mines.

Exploration focused on finding low grade, high tonnage deposits. The tenements were relinquished after the area was found to be prospective but not economic.

Exploration targeting open cut gold mineralization peripheral to SXG tenements.

Targeting shallow, low grade gold. Trenching around the Golden Dyke prospect and results interpreted along with CRAs costeans. 29 RC/Aircore holes totalling 959 m sunk into the Apollo, Rising Sun and Golden Dyke target areas. ELs 4460 & 4987 - Beadell Resources Ltd

ELs 4460 and 4497 were granted to Beadell Resources in November 2007. Beadell successfully drilled 30 RC holes, including second diamond tail holes in the Golden Dyke/Apollo target areas.

Mawson drilled 30 holes for 6,928 m and made the first discoveries to depth. | ||||||||||||||||||||||||||||||

Geology |

|

| ||||||||||||||||||||||||||||||

Drill hole Information |

|

| ||||||||||||||||||||||||||||||

Data aggregation methods |

|

| ||||||||||||||||||||||||||||||

Relationship between mineralization widths and intercept lengths |

|

| ||||||||||||||||||||||||||||||

Diagrams |

|

| ||||||||||||||||||||||||||||||

Balanced reporting |

|

| ||||||||||||||||||||||||||||||

Other substantive exploration data |

|

The metallurgical characterization test work included:

| ||||||||||||||||||||||||||||||

Further work |

|

|

View the original press release on ACCESS Newswire