Higher for Longer From Fed May Throttle Deposit Growth

BRIARCLIFF MANOR, NEW YORK / ACCESS Newswire / March 3, 2025 / Whalen Global Advisors LLC (WGA) has published the latest edition of The IRA Bank Book (ISBN 978-0-692-09756-4), the quarterly survey of the U.S. banking industry.

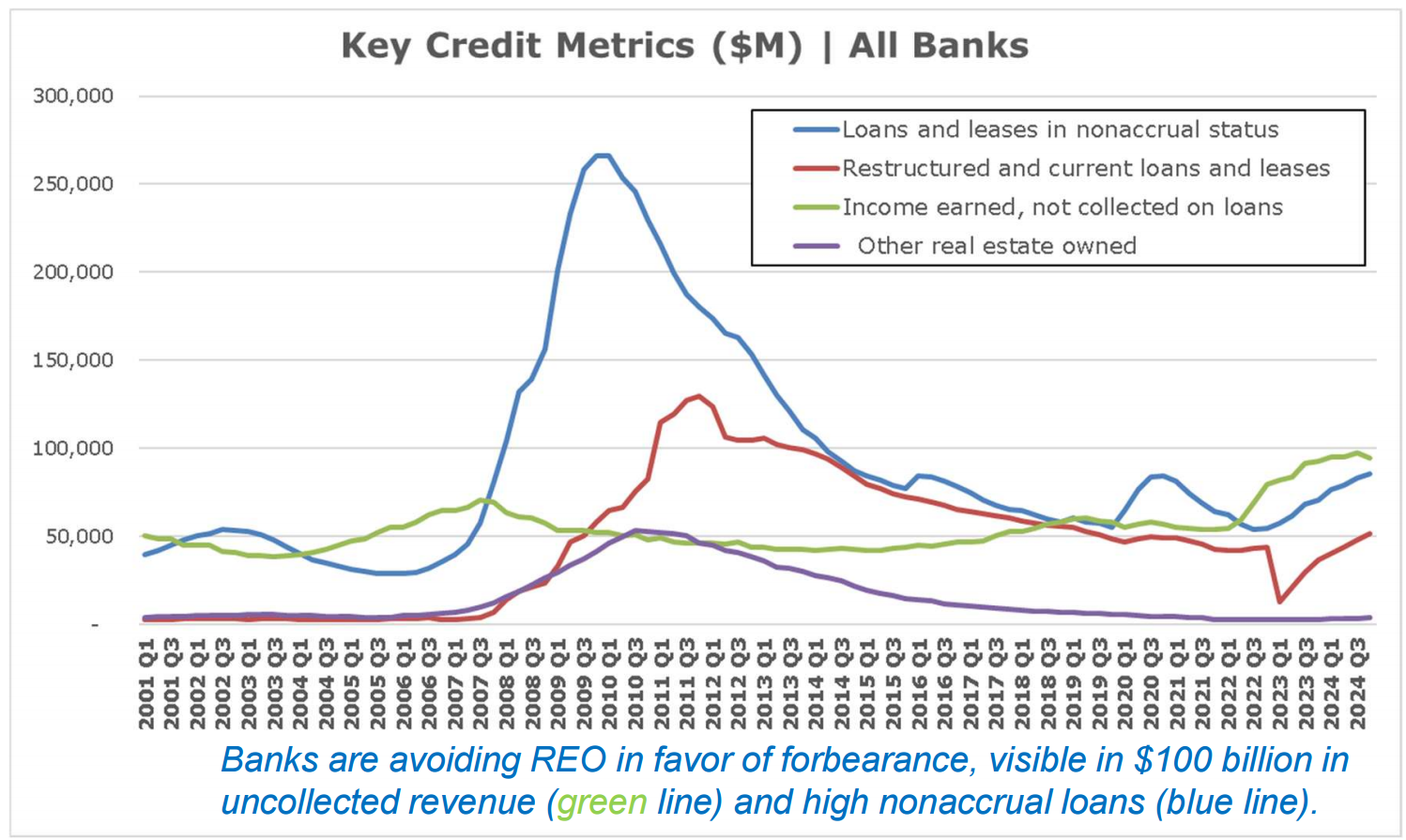

Chart

The highlights of the Q1 2025 report include:

A description of the drivers of bank profitability in 2024 and the outlook for 2025

Operating and credit metrics for the U.S. banking industry

Detailed credit charts for major bank asset categories

Key risk factors illustrating the growth of credit forbearance by banks

"Industry results in 2024 were reasonably good, but the banking industry is still 200 bp below 2019 levels of asset and equity returns," notes WGA Chairman Christopher Whalen. "Investors in bank stocks are paying more for less."

The report notes that based upon multiples of book value, Wells Fargo (WFC) and U.S. Bancorp (USB) are the two most improved bank stocks in the past year, but that JPMorgan Chase (JPM) is "in another category altogether" because of that bank's strong financial results.

The report notes that loss severities on defaulted multifamily and larger commercial properties are now above pre-COVID levels, but still well below 2008 levels. The report also criticizes federal bank regulators for recently ending the practice of reporting the assets of troubled banks and calls the decision counterproductive in terms of boosting public confidence.

"Loan loss rates in sectors such as auto loans and multifamily properties are finally rising," notes Whalen, "but with the exception of commercial real estate and multifamily assets. The rest of the real estate sector shows little stress. The real issue for 2025 is deposit growth and the Fed. Markets were expecting interest rate cuts and deposit growth in 2025, but that narrative has been put on hold by the election of Donald Trump and a significant revision of views by FOMC members."

WGA notes that bank stocks soared in the second half of 2024, but the industry has retreated in the first two months of 2025. "The good news in Q4 was lower funding costs than yields, thus better NIM," notes the report. "In Q1 2025, we may see the reverse, but because of compression in yields rather than higher funding costs."

Copies of the IRA Bank Book quarterly are available to subscribers to the Premium Service of The Institutional Risk Analyst. Stand-alone copies of the report are also available for purchase in our online store. Media wishing to receive a courtesy copy of the report, please email us: info@rcwhalen.com.

About Whalen Global Advisors LLC

Whalen Global Advisors LLC is a New York-based consulting, publishing and financial analytics firm. We publish The Institutional Risk Analyst newsletter (ISSN 2692-1812), The IRA Bank Book (ISBN 978-0-692-09756-4) industry quarterly review and the WGA Bank Top Indices. For more information, please contact us: info@rcwhalen.com.

Contact Information

Chris Whalen

Chairman

chris@rcwhalen.com

914-645-5304

SOURCE: Whalen Global Advisors LLC