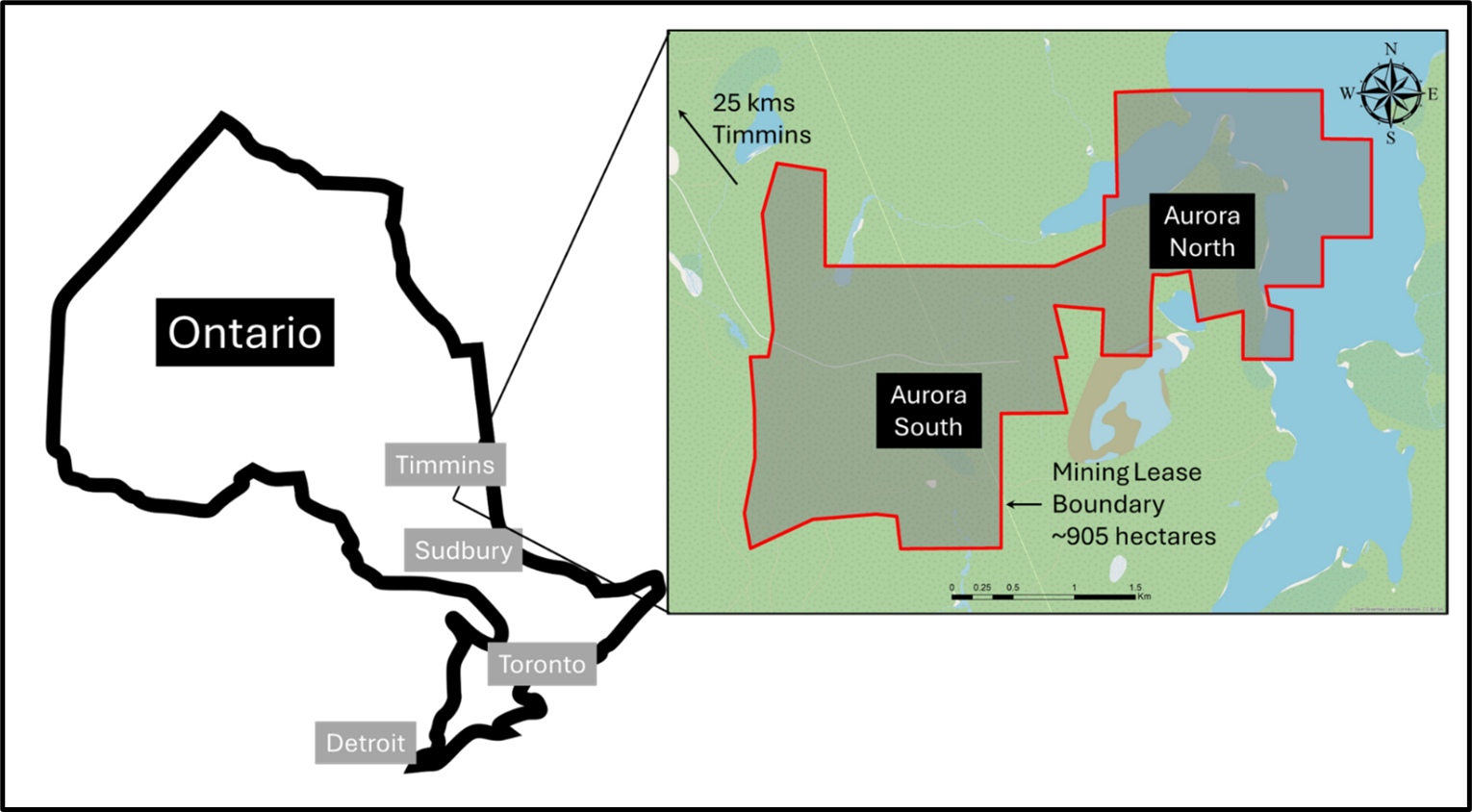

TORONTO, ON / ACCESS Newswire / March 3, 2025 / Clean Energy Transition Inc. (TSX-V:TRAN) ("transition.inc" or the "Company") is pleased to announce an updated Mineral Resource Estimate ("MRE") prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101") at its its wholly-owned Aurora Nickel Project, 25 kilometres southeast of Timmins, ON.

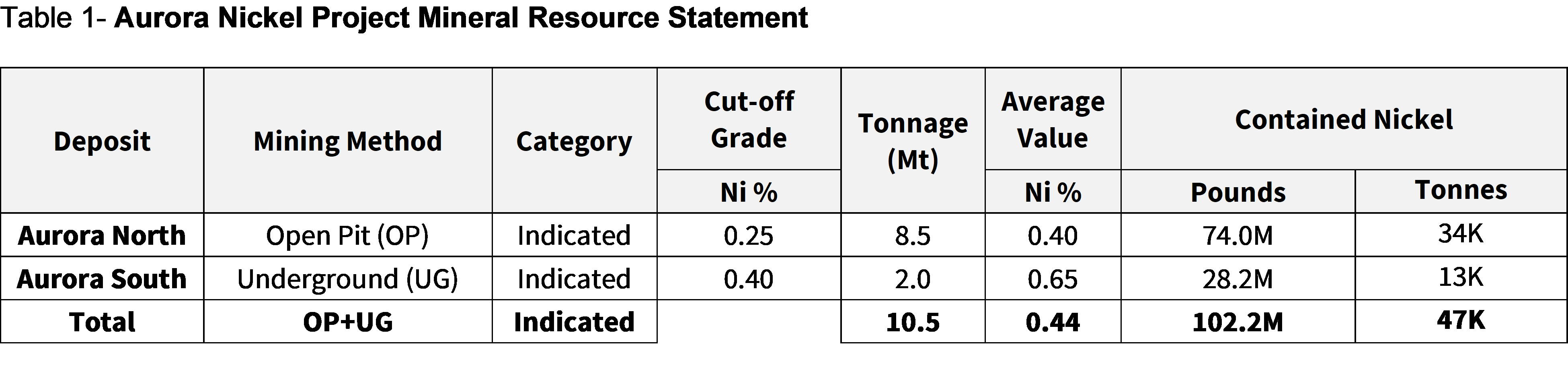

The MRE contains an Indicated Mineral Resource of 10.5M million tonnes ("Mt") at an average 0.44% Ni grade. The Aurora Nickel Project, incorporates the Aurora North and Aurora South Deposits. The Aurora North contains an Indicated Mineral Resource of 8.5 Mt at an average 0.4% Ni grade, likely mined by open-pit and the the Aurora South contains an Indicated Mineral Resource of 2.0 million tonnes ("Mt") at an average 0.65% Ni grade, likely mined with an underground method.

"We are very pleased with this MRE and continue to believe that the Aurora Nickel Project has the potential to become an excellent low-carbon production opportunity," said Sean Samson. "Recent political noise has led some to rethink the future market for critical metals like nickel but we believe that good grade, near surface nickel mineralization, located just outside Timmins will continue to be the type of opportunity the market will need. This week we will be reviewing these results in meetings with CarCos and investors, in Toronto for PDAC- the Prospectors and Developers conference".

Aurora Nickel Project

In 2024 transition.inc acquired a mining lease in Ontario (see news releases dated July 7 and November 12, 2024) which hosts the Aurora Nickel Project, incorporating the Aurora North and Aurora South Deposits. The Aurora Nickel Project's mining lease incorporates ~905 hectares.

Aurora Nickel Project Mineral Resource Estimate

Micon International Limited ("Micon") has completed an updated MRE for the Aurora Nickel Project.

Table 1- Aurora Nickel Project Mineral Resource Statement

The effective date of this Mineral Resource Estimate is March 3, 2025.

The MRE presented above uses economic assumptions for both, surface mining and underground mining.

The MRE has been classified in the Indicated category following spatial grade continuity analysis and geological confidence.

The economic parameters were in CAD and used metal prices of $12.67/lb Ni, with metallurgical recovery of 77%, an open pit mining cost of $3/t and underground mining cost of $60/t, Processing cost of $20/t and a General & Administration cost of $5/t.

For open pit mining, a slope angle of 53° has been considered.

The Aurora North and South deposit block models use a block size of 10 m x 20 m x 20 m.

Charley Murahwi, M.Sc., P.Geo., FAusIMM and Chitrali Sarkar, M.Sc., P.Geo. from Micon International Limited are the Qualified Persons (QPs) for the current Mineral Resource Estimate (MRE).

Mineral resources unlike mineral reserves do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

The mineral resources have been estimated in accordance with the CIM Best Practice Guidelines (2019 and 2023) and the CIM Definition Standards (2014).

Totals may not add correctly due to rounding.

A Technical Report in support of the MRE will be filed on SEDAR+ (www.sedar.com) within 45 days of the date of this news release.

For context- equivalent number of Electric Vehicles in the MRE's Contained Nickel

It is estimated that the average electric vehicle battery requires ~145 pounds of nickel (Bloomberg New Energy Finance ("BNEF") estimate, for a 100kWh battery*) and based on this, the Contained Nickel in the Aurora Nickel Project's MRE, this represents the equivalent nickel which would be used in more than 705K electric vehicles. For context, this is more than 5x the total 2023 new Battery EV registrations in Canada**.

* Company estimates, based on BNEF calculations https://tinyurl.com/3xswdn8k.

** Company estimates, based on 139,501 Battery EVs registered in Canada (StatsCan) https://tinyurl.com/3z8penz7.

About Clean Energy Transition Inc.

Transition.inc is focused on opportunities to generate positive cash flow across the energy transition. The Company includes a Quartz division focused on advancing its silica/Quartz business with the Snow White Project in Ontario and the Silicon Ridge Project in Québec. The silica in high-quality Quartz can be used to make silicon metal, a key component in solar energy panels. The Company also has a Critical Minerals division, which includes the Aurora Nickel Project in Ontario, where it is working to advance a potential low-carbon production opportunity to supply the growing North American demand for low-carbon nickel. Alongside the mining assets, transition.inc is also looking for additional opportunities, more broadly, from across the energy transition.

Qualified Persons

The Qualified Persons (QPs) for this News Release as defined by NI 43-101, are Mr. Charley Murahwi, M.Sc., P.Geo., Pr. Sci. Nat., FAusIMM and Ms. Chitrali Sarkar, MSc. P.Geo., respectively Senior Economic Geologist and Senior Geologist at Micon International Limited. Both QPs have reviewed and approved the technical information in this press release, related to the Aurora Nickel Project updated Resource. There are no known factors that could materially affect the reliability of the information verified by Mr. Murahwi and Ms. Chitrali.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking information. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "anticipate", "proposed", "estimates", "would", "expects", "intends", "plans", "may", "will", and similar expressions. Forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although the Company believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct.

Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to raise sufficient capital to fund its obligations under various contractual arrangements, to maintain its mineral tenures and concessions in good standing, and to explore and develop its projects and for general working capital purposes, changes in economic conditions or financial markets, the inherent hazards associated with mineral exploration, future prices of metals and other commodities, environmental challenges and risks, the Company's ability to obtain the necessary permits and consents required to explore, drill and develop its projects and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives, changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with such laws and regulations, the Company's ability to obtain required shareholder or regulatory approvals, dependence on key management personnel, natural disasters and global pandemics and general competition in the mining industry.

These risks, as well as others, could cause actual results and events to vary significantly. The forward-looking information in this press release reflects the current expectations, assumptions and/or beliefs of transition.inc based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.transition.inc

Or contact: Sean Samson, President, CEO, and Director at:

Clean Energy Transition Inc.

200 - 150 King St. W.

Toronto, ON M5H 1J9

info@transition.inc

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE: Clean Energy Transition Inc.