Lending growth and fine results

The BANK of Greenland achieved a profit before tax of DKK 245.7 million in 2024, compared with DKK 244.6 million in 2023. The result is at the level of the revised guidance from October 2024 of a profit at the level of DKK 225-250 million but exceeds the expectations at the start of the year of a profit of DKK 180-230 million.

Return on opening equity before tax and dividend was 17.5 % compared to 18.9 % in 2023.

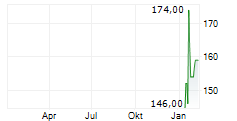

The Bank recommends to the Annual General Meeting that the dividend payment is DKK 100 per share.

Profit before value adjustments and write-downs amounts to DKK 236 million compared to DKK 218.7 million in 2023.

Net interest and fee income increased by DKK 35.3 million compared to 2023, amounting to DKK 470.3 million.

For the overall year, value adjustment of securities and currencies resulted in a gain of DKK 28.6 million compared to a gain of DKK 40.1 million in 2023.

In 2024, impairment of loans etc. amounted to DKK 18.9 million, which is DKK 4.7 million higher than in 2023.

Lending increased by DKK 218 million to DKK 5,031 million at the close of 2024, which is the highest level in the Bank's history. At the same time, the guarantee volume declined in 2024 to DKK 1,423 million, compared with DKK 1,774 million in 2023. The decrease is primarily due to a change in the guarantee scheme with DLR Kredit in 2024.

The BANK of Greenland's capital ratio amounted to 26.9 at end of 2024, and the Bank has calculated the individual solvency requirement at 11.1%.

Outlook for 2025

Short-term yields are expected to fall in 2025 as inflation comes under control in Europe. It is expected that this in turn will reduce costs and increase the Bank's customers' investment appetite. The lower interest rates will have a significant negative effect on core earnings, however.

Uncertainty in the capital markets will affect the Bank's value adjustments. We nonetheless expect losses and write-downs to remain at a low level, and derived risks related to inflation and cyclical uncertainty in 2025 are assessed to be addressed by the current level of impairment write-downs.

In both the short and longer term, the considerable focus on Greenland, which escalated at the beginning of 2025, can affect the economic development and the framework conditions in Greenland. However, the BANK of Greenland has no basis to assess that this will be of any material significance in the short term in 2025, so that it is the circumstances described in this report - the macroeconomic and local conditions - that are generally expected to influence the Bank's operations.

The Bank expects a profit before tax of DKK 150-185 million for 2025. There is thus no change in the expected profit for the year, which is in line with the notification in the stock exchange announcement of 11 December 2024.