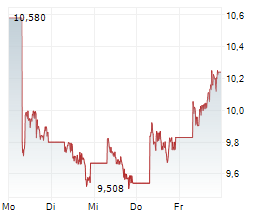

Chinese electric vehicle manufacturer BYD has raised $5.59 billion in a significantly expanded share issue, making it Hong Kong's largest capital measure of its kind in four years. The company increased its initially planned offering from 118 million to 129.8 million shares, placing them at HK$335.20 each - a 7.8% discount to Monday's closing price. BYD's stock faced pressure following the announcement, dropping 6.8% on the Hong Kong Stock Exchange, while Asian markets broadly suffered from Trump's announcements regarding new tariffs. Despite this setback, BYD shares have performed robustly year-to-date, gaining 36.38% in Hong Kong and 27.4% in Shenzhen, bolstered by an increasingly optimistic sentiment in China's technology sector and signals from the Chinese government indicating stronger support for the private economic sector.

Strategic Growth Investments

The proceeds from the share issue will be strategically deployed to fuel the company's continued expansion, with specific plans to invest in research and development, advance international expansion, and bolster working capital. BYD has also announced intentions to invest approximately 20 billion yuan in a new production facility in Shenzhen, which will include a global R&D center to strengthen innovation in electric vehicles. These forward-looking investments come amid positive financial results, with BYD reporting a quarterly profit of 4.35 HKD per share for the period ending September 30, 2024 - an increase from 3.87 HKD in the previous year - while revenue climbed an impressive 24.65% to 214.39 billion HKD.

Ad

BYD Stock: New Analysis - 05 MarchFresh BYD information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated BYD analysis...