Press release - 2024 Annual results

Sainte-Marie, March 5, 2025, 8:45 p.m.

2024 ANNUAL RESULTS

Success of the Group's property investment strategy

- Sharp rise in the property investment net recurring income [1]

- Total net rental income (including €3.6 million of equity affiliates): €27.6 m[2], +6.4%, of which +8.1% for the commercial property division

- Strong increase in the property investment net recurring income: +21.2% to €15.1 million

- Delivery of France Travail offices in Combani

- Property Development: decline in revenue, but solid profit margin due change in product mix

- Property development revenue: €38.5 million (-33.8% compared with €58.1 million in 2023)

- Rapid shift in product mix: block sales at 59% of the mix (+19 pt vs 2023), decline in retail sales (end of programs eligible for the Pinel Dom scheme and slowdown in the sales of building plots) and absence of commercial property development

- Property development margin: €6.2 million or 16.1% of sales (vs €8.9 million, or 15.4% in 2023)

- Net income Group share up (3.3%) and strong financial position

- Consolidated revenue: €66.6 million (-21.5%, €84.9 million in 2023)

- Operating income: €24.2 million (-3.7%), holding up well thanks to the ramp-up of the property investment business

- Net income group share: €14.6 million (+3.3% from €14.1 million in 2023)

- Net asset value: €245.6 million (+1.5% over 12 months) and €6.96/share (+3.0%)

- Net financial debt reduced to €126.3 million (-€6.8 m), secured and long-term maturity (> 8 years)

- Cash position of €27.6 million

- LTV (excluding transfer taxes): 31.5% (vs. 32.7% at end 2023)

- Proposed stable dividend for 2024: €0.24/share

- Outlook

- o 2025 Target: growth in gross rental income from the total economic portfolio[3] (approximately +1.0%)

- Commercial property pipeline[4]: €70 million of projects in progress, including €23 million to be launched in the next 12 to 18 months

- Residential Property development: strong prospects over 12/18 months: €18.4 million of block sales backlog and €23.8 million of plots for sales by the end of 2024

"In a challenging environment, the strong results obtained in the 2024 fiscal year reaffirm the resilience of the regions in which we operate, as well as the robustness of our model, predicated on the complementary nature of our property investment and development companies. Therefore, we are confident in our development strategy" says Géraldine Neyret, Chief Executive Officer of CBo Territoria.

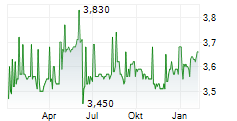

The Board of Directors of CBo Territoria (ISIN: FR0010193979 - CBOT), a significant real estate player in Reunion Island for nearly two decades, met on March 5, 2025, to approve the consolidated financial accounts for the fiscal year ended December 31, 2024. Audits of the consolidated financial statements are now underway.

CHANGES IN THE ECONOMIC PORTFOLIO

At year-end 2024, CBo Territoria owns a total economic portfolio[5] valued at €378.2 million excluding transfer taxes, up 1.7% compared with year-end 2023 (€371.8 million). This variation includes +€8.6 million related to the development of commercial property investment side, including the delivery of France Travail offices in Mayotte and various transfers to investment properties[6], -€1.3 million change in fair value and disposal of housing assets for - €0.9 million. The portfolio's total value excluding transfer taxes (including commercial projects in progress for €2.5 million) amounted to €380.6 million at year-end 2024 (vs. €377.6 million at year-end 2023).

The commercial economic portfolio[7] (87% of the total portfolio) is characterized by strong fundamentals:

- €327.7 million valuation excluding transfer duties (+2.8% compared to year-end 2023),

- high and stable occupancy rate of 98%, attesting to the quality of the assets held and the reliability of the tenants,

- annualized gross rental income of €28.3 m (including contribution from equity affiliates) vs €26.9 m at end 2023,

- gross yield rate including transfer duties of 8.1% (vs. 8.0% at year-end 2023).

2024 FINANCIAL PERFORMANCE

Property Investment: Recurring net income of €15.1 million (+21.2%)

In 2024, the gross rental income generated by the economic portfolio of the property investment company, including the share of commercial assets held in partnership (affiliates' rental income contribution of €3.7 million in 2024, +0.5% vs. 2023), amounts to €30.3 million compared with €29.2 million in 2023 (+3.7%). The overall increase consists of +5.7% from the commercial sector expansion (€1.7 million), +3.2% from rent indexation (€0.9 million), +0.4% from commercial rental operations (€0.1 million), +0.7% from variable rents (€0.2 million), -3.0% non-recurring effect (i.e. -€0.9 million), mainly related to the one-off impact of variable rents adjustment recognized in 2023 (-€0.6 million) and -3.2% (i.e. -€0.9 million) impact of non-rental activities, mainly attributable to the disposal of residential assets, primarily in 2023 (-€1.1 million)[8].

The net rental income rose by 6.4% to €27.6 million, which includes €3.6 million from equity affiliates. This comprises €26.5 million in commercial rents, which represents an 8.1% increase to €25.9 million in 2023. In 2024, the net rental income from agricultural land and residential assets stood at €1.1 million, a decrease of 21.7% from €1.4 m in 2023.

Due to the tertiarization of the property portfolio and the reduction of structural costs, the property investment company's net recurring income has increased to €15.1 m in 2024 from €12.5 m in 2023 (+21.2%) and €11.0 m in 2022.

Property Development: Sustained strong profit margin (16.1% of revenue) despite the decline in sales (-33.8%)

In 2024, the turnover of the Property Development company stands at €38.5 million (compared with €58.1 million in 2023, i.e., -33.8%). This trend is explained by the decline in residential (-€16.1 million, or -29.8%) and the lack of commercial transactions[9] (impact of -€3.5 million compared to 2023).

The residential product mix is undergoing a swift transformation. Block sales now account for 59% of the Property Development revenue (vs. 40% in 2023) at €22.7 million, compared with €23.3 million in 2023 (-2.4%). After the surge recorded in 2023 for the Group's latest retail schemes programs, retail sales of apartments to private individuals are naturally lower due to the anticipated drying-up of supply, at €6.1 million (compared with €19.1 million in 2023). Sales of building plots remains robust at €9.1 million (compared with €11.6 million in 2023), it has experienced a decline in momentum due to the obstacles that purchasers encounter in completing their housing projects (access to credit, rising construction costs, etc.). Nevertheless, this change in the Property Development mix has resulted in a 16.1% increase in the margin rate (vs. 15.4% in 2023) and a property development margin of €6.2 million (-31%, compared with €8.9 million in 2023).

Resilient and strong operating result supported by the Property investment company: €24.2 million (- €0.9 million, or -3.7% vs 2023)

Overall, the 2024 revenue amounts to €66.6 million, down 21.5% due to the property development business.

The commercial property investment dynamism and the effective management of structural costs mitigated the decline in property development, resulting in an operating profit of €24.2 million (-€0.9 m, or - 3.7% vs 2023).

The change in fair value amounted to -€2.7 million in 2024 (-€2.8 million in 2023). The resilience of the Group's assets, which driven by indexation, has been offset by the revision of its long-term project portfolio (discontinued studies and land values). In Mayotte, the delivery of the France Travail offices partially compensated for the asset value decline that resulted from the devastation caused by Cyclone Chido.

The affiliates' share of profits is up to €2.2 million (from €1.3 million in 2023), given the 2023 base effect, which had recorded mechanical decreases in fair value related to the transition from VAT to registration fees. Consequently, the operating result (including affiliates' contribution) stands at €23.7 million, stable compared to 2023.

Overall, the net income (Group share) amounted to €14.6 million compared with €14.1 million (+3.3%), or €0.41/share (compared with €0.39/share in 2023, or +3.7% when considering the accretive impact of the share buy-backs carried out in 2024). This was achieved after accounting a lower cost of net financial debt, of -€4.4 million (compared with -€5.3 million in 2023), benefiting from €1.47 million in cash investments (compared with €0.5 million in 2023) and a €4.9 million income tax charge (compared with €4.6 million in 2023).

Net Asset Value (NAV): €245.6 million (+1.5%) and €6.96/share (+3.0%)

The Net Asset Value stood at €245.6 million as of December 31, 2024, a 1.5% increase from €241.8 million on December 31, 2023. The change is due to the positive impact of the profit for the period (+€14.6 million), which far exceeds the 2023 dividend distribution (-€8.6 million). It also considers share buy-backs (-€2.2m), changes in the mark-to-market of financial instruments (-€0.7m) and other items (notably the transfer to investment property of the Lizine offices at La Mare) (+€0.7m). On a per-share basis, NAV 2024 rose by 3.0% to €6.96 (compared with €6.75 at end-December 2023), reflecting the accretive impact of share buy-backs.

Strong financial structure and cash position - Diversified, secure debt profile

In 2024, the Group repaid nearly €18 million in loans and finalized the arrangement of the loan for the Combani shopping center (€8 million). It also repaid the balance of the 2018 ORNANE bonds in circulation (€3.8 million).

As of December 31, 2024, the Group's total financial debt amounted to €165.4 million, a decrease from €179.1 million on December 31, 2023, with 82% attributed to mortgage financing. CBo Territoria maintains a solid cash position of €27.6m, plus €10.1m in term deposits[10].

After taking hedging instruments into account, 87% of the financial debt is at a fixed rate. The average cost of debt is at a low point this year at 2.8% (compared to 3.5% as of December 31, 2023) due to the high level of cash position and high financial income (€1.47 million vs. €0.5 million in 2023). Maturity is 8 years and 1 month (-1 month vs. 2023).

The LTV ratio excluding transfer duties is thus 31.5% at the end of 2024 (vs. 32.7% at end of 2023), the ICR increased to 5.5x (vs. 4.2x at end of 2023) and the Net Debt/EBITDA ratio improves to 4.7x (vs. 5.0x at end of 2023).

Proposed dividend for 2024 stable at €0.24/share

For the 2024 financial year, CBo Territoria will propose to the General Meeting of April 30, 2025, a stable dividend of €0.24 per share with a full payment in cash, ensuring a balanced allocation between financing the development of the Property Investment Division and shareholder remuneration. The ex-dividend date is set for June 11, and the payment date is scheduled for June 13, 2025.

MEDIUM-TERM OUTLOOK AND 2025 TARGETS

The Group aims to increase gross rental revenue across its total economic portfolio[11] (tertiary, agricultural and other, and residential, including affiliates' contributions) by approximately +1% by 2025, taking into account the offsetting of indexation effects by assumptions about changes in the rental situation.

The property investment division's pipeline[12] of commercial projects under development to date represents €70 million of investment, including €23 million of projects to be launched in the next 12 to 18 months, depending on the success of their commercialization.

The existing product mix of block sales and building plots in residential property development enables the Group to maintain a robust position regarding the housing demands of Reunion Island, with a backlog of €18.4 million and an order book of €15.3 million. The Group also owns 115 building plots available for sale (€23.8 million), the liquidation of which may expedite with the progressive decline in interest rates. Currently, 166 lots are under development, and 181 lots are projected to be released during the next 12 months. The Group has medium-term development potential for 810 lots (residential and commercial property for sale) on secured land holdings.

A presentation accompanying this press release will be available online at 11:30 a.m. on March 6

on cboterritoria.com/Finance section / Documents financiers et extra financiers /Financial presentations.

The annual financial report will be filed with the AMF early April 2025, and it will be available on cboterritoria.com Finance section / Financial documents.

2025 Financial calendar: Annual Shareholders' Meeting - Wednesday, April 30, 2025 (Sainte-Marie La Réunion)

About CBo Territoria (FR0010193979, CBOT)

CBo Territoria has been a major real estate operator in La Réunion for nearly 20 years and has evolved into a multi-regional property developer specializing in tertiary assets (€378.28 million assets in value at end 2024). The Group is pursuing its expansion through the exploitation of its land reserves or through land acquisition, as it is involved in the full real estate value chain (property developer, property investor, and real estate company). CBo Territoria can finance its development through its activities as a residential developer (apartment buildings or sale of land plots) and, secondarily, as a service provider, as well as through the planned transfer of its residual residential properties to SHLMR.

CBo Territoria is a real estate investment firm listed on Euronext Paris (compartment "C") that is qualified for the PEA PME finance program (small and medium-sized enterprises). Responsible and committed to a more sustainable real estate since its inception, CSR (Corporate Social Responsibility) is by nature in the company's DNA. Its commitment and actions are recognized by the Gaïa-Index, the French benchmark index of the most virtuous small and mid-cap companies in terms of CSR. Since its entry in 2016, CBo Territoria has remained at the top of its category.

More information on cboterritoria.com

INVESTORS Contacts

Caroline Clapier - Director of Finance and Administration - direction@cboterritoria.com

Agnès Villeret - Komodo - Tel.: 06 83 28 04 15 - agnes.villeret@agence-komodo.com

PRESS Contacts:

Catherine Galatoire - cgalatoire@cboterritoria.com

APPENDIX

NOTE: Variations are based on precise data; hence, discrepancies in totals may arise from rounding.

PROFIT AND LOSS ACCOUNT (IFRS)

| In € millions | 2024 | 2023 | Var. in € | Var. in % |

| Sales | 66.6 | 84.9 | (18.3) | -21.5% |

| Income from operations | 24.2 | 25.1 | (0.9) | -3.7% |

| Net balance of fair value adjustments | (2.7) | (2.8) | +0.1 | |

| Gains and losses on disposals of investment property | 0.1 | (0.1) | +0.2 | |

| Other operating income and expenses | (0.0) | 0.2 | (0.2) | |

| Operating income | 21.5 | 22.4 | (0.9) | -3.8% |

| Share of equity affiliates' profits | 2.2 | 1.3 | +0.8 | |

| Operating income including equity affiliates' contribution1 | 23.7 | 23.7 | (0.0) | -0.1% |

| Cost of net financial debt | (4.4) | (5.3) | +0.9 | |

| Other financial income and expenses | 0.1 | 0.3 | (0.2) | |

| Net income/loss before tax | 19.5 | 18.7 | +0.7 | +3.8% |

| Income tax expense | (4.9) | (4.6) | (0.2) | |

| Net income/loss | 14.6 | 14.1 | +0.5 | |

| Net income /loss (Group share) | 14.6 | 14.1 | +0.5 | +3.3% |

| Net earnings per share (Group share) (€) | 0.41 | 0.39 | +3.7% | |

| Weighted number of shares | 35,687,532 | 35,809,461 |

1 Operating revenue after contribution of net income of affiliates accounted for by the equity method

- Property investment company's Net Recurring Result

| In € millions | 2024 | 2023 |

| Gross rental income | 26.6 | 25.0 |

| Property service charge | (2.6) | (3.2) |

| Net rental income | 24.0 | 21.8 |

| Net structural costs attributable to the property investment company | (2.6) | (3.2) |

| Profit from the property investment company after allocation of a share of the structural costs | 21.4 | 18.7 |

| Cost of net financial debt | (4.4) | (4.8) |

| Other financial income and expenses | - | - |

| Income taxes (excluding equity affiliates) | (4.3) | (3.5) |

| Equity affiliates' net recurring result | 2.3 | 2.1 |

| Property investment company's Net Recurring Result (Group share) | 15.1 | 12.5 |

| Property investment company's NRR by share (in euros) | 0.42 | 0.35 |

CHANGES IN THE PORTFOLIO (EXCLUDING TRANSFER TAXES)

| In € millions | |

| Total economic assets as of December 31, 2023 | 377.6 |

| Built assets under construction | 5.8 |

| Economic assets as of December 31, 2023 | 371.8 |

| Disposal of housing units | (0.9) |

| Property Investment company's development (delivery, transfers to investment IP) | 8.6 |

| Change in fair value | (1.3) |

| Economic assets as of December 31, 2024 | 378.2 |

| Built assets under construction | 2.5 |

| Overall Economic assets as of December 31, 2024 | 380.6 |

BALANCE SHEET (IFRS)

| ASSETS in € millions | 31/12/2024 | 31/12/2023 |

| Non-current assets | 374.0 | 368.9 |

| Investment properties | 339.3 | 337.0 |

| Investments in equity affiliates | 15.9 | 13.9 |

| Financial assets (hedging instruments valuation) | 11.5 | 11.4 |

| Other non-current assets (1) | 7.3 | 6.6 |

| Current assets | 100.7 | 119.4 |

| Inventories and work in progress | 54.6 | 63.1 |

| Investment properties held for sale | 1.1 | 0.9 |

| Trade and other receivables | 17.3 | 20.7 |

| Cash and cash equivalents | 27.6 | 34.7 |

| LIABILITIES in € million | ||

| Shareholders' equity | 245.6 | 241.8 |

| Group | 245.6 | 241.8 |

| Minority interests | 0.0 | 0.0 |

| Non-current liabilities | 185.4 | 195.0 |

| Financial debts at long- and medium-term | 145.8 | 156.8 |

| Deferred tax liabilities | 37.9 | 37.7 |

| Other non-current liabilities | 1.8 | 0.4 |

| Current liabilities | 43.7 | 51.5 |

| Current financial debts (including bonds) | 19.6 | 22.3 |

| Trade and other payables | 24.0 | 29.2 |

| Total Balance sheet | 474.7 | 488.3 |

- Excluding equity interests presented under Other non-current assets

LOAN-TO-VALUE (LTV)

| In € millions | 31/12/2024 | 31/12/2023 | |

| Investment property | 339.3 | 337.0 | |

| Investment property held for sale | + | 1.1 | 0.9 |

| Operating property excluding headquarters | + | 5.7 | 5.7 |

| Inventories / development | + | 54.6 | 63.1 |

| Total Assets (A) | = | 400.7 | 406.7 |

| Medium- and long-term debts | 145.8 | 156.8 | |

| Short-term debts | + | 19.6 | 22.3 |

| Other financial assets | - | 11.5 | 11.4 |

| Available cash and cash equivalents | - | 27.6 | 34.7 |

| Total Liabilities (B) | = | 126.3 | 133.0 |

| LTV Excluding transfer taxes (B/A) | 31.5% | 32.7% |

Breakdown of gross debt as of December 31, 2024

(€165.4 million vs €179.1 million as of 31 December 2023)

GLOSSARY

Adjusted NAV - Adjusted Net Asset value: The Adjusted Net Asset value is calculated based on consolidated equity, including unrealized capital gains and losses on the property portfolio. The property portfolio is measured at market value by means of an independent appraisal

Adjusted NAV per share: Adjusted Net Asset value per share excluding treasury stock.

Diluted Adjusted NAV per share: Adjusted Net Asset Value per share after factoring in the maximum number of shares that could be created by outstanding dilutive instruments (ORNANE)

Backlog: Sales (before tax) from completed residential and commercial property sales (excluding land sales) that have not yet been recognized

Order book (or booking stock): Total revenue (excluding tax) of lots under reservation contract on the cut-off date

Average cost of debt: Ratio of interest paid over the course of the year prior to capitalization to the average amount of debt outstanding for the year

EBITDA: Operating profit adjusted for depreciation, amortization and provisions

ICR - Interest Coverage Ratio: Proportion of debt costs covered by net rental income

RY - Rental Yield Property: All built real estate assets providing recurring rental income

IP - Investment Property: Built Investment Properties (Commercial+ Residential) + IP Land (excluding Land in Stock/Development)

FV - Fair Value: method of valuing assets according to IFRS international accounting standards, that applies to consolidated accounts; defined as "the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date".

Net rental income = Property investment company's operating margin: Rental income net of property expenses, considering provisions for bad debts.

LTV - Loan to Value: Amount of outstanding bank debt net of investment assets and cash/market value of investment properties excluding transfer taxes + net carrying amount of operational properties other than head office + inventories and work-in-progress (consolidated value)

Property development company's operating margin: Revenues less costs of sales, sales, and marketing costs and allowances to provisions

Supply available for sale: Revenue from lots offered for sale, not reserved

ORNANE ("Obligation Remboursable en Numéraire et en Actions Nouvelles et Existantes"): A convertible bond that is redeemed in cash at maturity, with the possibility of repaying the difference between the market price and the conversion threshold in the issuer's shares if the conversion option is exercised in the same currency.

Economic portfolio: Investment assets and share in assets held by associates.

Net profit/loss, Group share: The Group share of net profit/loss is the share of the overall net profit attributable to the Group's shareholders.

Income from operations: Sales development margins + Net rental income - Net management fees +/- Other, non-recurring

Net Recurring Result (NRR): IFRS net recurring result from current and recurring activities (EPRA method) = Net rental income - (share of property investment company's structural costs + property investment company's debt servicing costs - corporate income tax (including share of tax of associates accounted for using the equity method)

Operating result including affiliates' contribution accounted for using the equity method: Operating result + change in fair value + gains or losses on disposals of investment properties + other operating income and expenses + share of the profit or loss of companies accounted for using the equity method

Affiliate: Company accounted for under the equity method. Equity accounting is an accounting technique whereby the carrying value of shares held in an entity by its parent company is replaced by a measurement of the portion that the parent company owns in the equity of that entity

Financial occupancy rate: Ratio between market rent for leased space and rent for total surface area (= actual rent for leased space + market rent for vacant space).

Yield on economic assets: Value of gross rental income from leased premises divided by economic assets, including transfer taxes.

Building plots - Property development: Sales of building plots for residential or commercial real estate

Block sales - Property development: Acquisition of an entire building or real estate program by a single buyer.

Retail sales - Property development: Acquisition of a residential unit or lot by an individual client

[1] A glossary is appended to this document.

[2] Corresponding to 91% of the total gross rental income of the economic portfolio of €30.3 million in 2024 (including the share in affiliates' rental income of €3.7 million)

[3] The economic assets of the property investment company comprise investment assets (commercial, real estate and residential) and the share of assets held in partnership, accounted for using the equity method.

[4] Projects to be launched within 12 months and projects identified on controlled land in the medium term.

[5] The economic portfolio of the property investment company consists of investment assets (commercial, land and residential) and the share of assets held in partnership, accounted for using the equity method.

[6] This includes the leasing of former coworking offices transferred to the headquarters in La Mare, and shops at building entrances.

[7] The commercial economic portfolio comprises investment assets (excluding residential and land assets) and the share of assets held under the equity method. It covers a total surface area of 140,900 sq. m (100% affiliates' contribution).

[8] Disposals of 136 lots in December 2023 and 5 lots in 2024. CBo Territoria is left with only 74 housing units as of December 31, 2024, 8 of which are classified as Investment Properties for sale.

[9] The Commercial Development Property company's revenue is limited due to the opportunistic nature of this activity. It stands at €0.5 million in 2024, compared to €5.0 million in 2023 (remaining balance of the transaction intended for EPSMR).

[10] Term deposits classified as financial assets out of a total of €26.9 million in term deposits.

[11] The economic portfolio of the property investment company includes investment assets (tertiary, land and residential) and the share of assets held in partnership, accounted for using the equity method. Gross rental income from the total economic portfolio amounted to €30.3 million in 2024 (including €3.7 million affiliates' contribution).

[12] Projects to be launched in the next 12 months and projects identified on controlled land in the medium term.

- SECURITY MASTER Key: yJtrZ5mZZZydy3GbYchqnJWUbW1ik5bKm5bJlWKeaJ3GbW6RmppnbZaWZnJhl21s

- Check this key: https://www.security-master-key.com.

https://www.actusnews.com/documents_communiques/ACTUS-0-90286-cbot_ra-2024-press-release-05032025.pdf

© Copyright Actusnews Wire

Receive by email the next press releases of the company by registering on www.actusnews.com, it's free