Not for release to US wire services or distribution in the United States

ANNOUNCEMENT TO THE TORONTO STOCK EXCHANGE AND AUSTRALIAN SECURITIES EXCHANGE

Highlights:

Mt. Labo Exploration and Development Corporation ("Mt. Labo") enters strategic partnership with one of the largest natural resource companies in the world, Glencore International AG, to finance Stage 1 of the high-grade Copper and Gold Mabilo Project

The parties have entered into a binding term sheet for a financing facility and offtake, and will now proceed to long form documentation

Secured Financing Facility provides for a total of up to US$30m (in three-tranches), on attractive terms, for the development of Stage 1 of the Project as well as working capital requirements

Tranche A, for US$3.5m, provides early funding flexibility to complete Stage 1 Project land acquisition, with limited conditions precedent.

Tranche B provides US$21.5m for the balance of development of Stage 1 of the Project together with any working capital needs.

Tranche C provides US$5.0m for any additional working capital purposes subject to consent of both parties

The facility provides funding for 100% of the estimated development budget, together with a further US$5m for any cost overruns and working capital needs

Offtake terms were provided for all Stage 1 products, being the Gold Oxide Cap, Oxide Copper - Gold Skarn and the Supergene Chalcocite, on market terms

Stage 1 high-grade Direct Shipping Operation ("DSO") will mine, amongst other products, approximately 100,000t of supergene chalcocite material which runs in the order of 21% reserve grade copper

RTG's share in the project cashflow from Stage 1 DSO, based on current commodity prices, is expected to be in the order of 50% of total proceeds, including the following components:

Early repayment of approximately US$26m in debt owing by Mt. Labo to RTG;

2% NSR on the gross revenue of the project; and

40% of net profits

Mabilo Project Overview of Key Metrics Before any Exploration Success

| Project |

|

Resources | 12.76Mt @ 1.9g/t Au, 1.8% Cu, 40.5% Fe Contained Cu 226,800 t Contained Au 762,500 oz |

|

Reserves | 7.792Mt @ 2.04g/t Au, 1,95% Cu, 45.5% Fe Contained Cu 151,900 t Contained Au 511,100 oz |

|

| Stage 1 -Total | Stage 2 - Annual |

Total/Annual Tonnes Treated | 578,048 t Approx. 1 year | 1,350,000 tpa Approx. 6 years |

Total/Annual Production | Total Cu - 25,200 t Total Au - 52,900 oz | Total Cu - 18,400 t Total Au - 66,800 oz Total Fe - 346,700 t |

Total/Annual Payable Metal | Approx. 19,000 t of Cu Approx. 29,400 oz of Au | Approx. 16,400 t of Cu Approx. 47,100 oz of Au Approx. 346,700 t of Fe |

Cash Cost | US$72.0/t | US$91.5/t |

Estimates based on the Feasibility Study dated March 2016 and announced on 18 March 2016

Importantly, drilling at the Mabilo Project was truncated early due to a then dispute with the previous joint venture partner. With additional planned drilling, Mt. Labo is confident there are extensions both along strike and at depth but more importantly, extensive work has been done identifying the potential porphyry source, which would be a game changer in terms of scale for the project. Development of the Stage 2 plant has been designed on a compartmentalised basis to allow for easy and cost effective expansion.

SUBIACO, AU / ACCESS Newswire / March 6, 2025 / The Board of RTG Mining Inc. (" RTG ", or the " Company ") (TSX:RTG)(ASX:RTG) is pleased to announce that Mt. Labo has entered into a strategic partnership with, Glencore International AG ("Glencore"), for offtake and finance for the development of Stage 1 of the high-grade Copper and Gold Mabilo Project ("the Project").

Following a comprehensive and competitive financing process, including extensive due diligence to address all key issues, Mt. Labo, which owns 100% of the high grade copper-gold Mabilo Project, received multiple offers of finance and is pleased to announce a partnership with Glencore with a binding term sheet executed, with the most competitive terms for the debt finance and offtake to fund 100% of the planned capital expenditure for the development of Stage 1 of the Project.

A summary of the key terms is set out below in this document.

Management Commentary:

Commenting on this key development, RTG's CEO Justine Magee said: "This is a very important and exciting step in the start-up of the high-grade Mabilo Copper-Gold Project and signals the transition of RTG from explorer / developer to producer.

We are delighted to be partnering with Glencore to advance Mabilo, and the favourable finance and offtake terms also come with a strong counterparty and group that have been both active and successful themselves in the Philippines via the PASAR Refinery. We are very confident our partnership with Glencore will add significant value to Mt. Labo's collective shareholder bases and the Philippines as a whole.

Stage 1 of the Project is low risk with only nominal upfront capital, but generates very strong cashflow quite quickly, as there is no processing required - you simply mine the products, crush and then ship.

With a reserve grade of 21% copper, demand for the product is strong and it should allow us to internally fund our equity contribution for Stage 2, which produces a high-grade copper-gold concentrate, and commit to drilling to identify the porphyry source, which could be a game changer for the scale and value of the Project.

As we enter this important phase, RTG remains very well positioned to capitalise on consensus views of strong and improving forecasts for copper and gold prices. We believe this is a key milestone that will clearly demonstrate the value of the Mabilo Project, and we are excited to be moving the Project through to operations."

Summary of Key Term Sheet Provisions:

Facility size | US$30 million Tranche A - US$3.5 million Tranche B - US$21.5 million Tranche C - US$5.0 million |

Term | 26 months from the Borrower Commitment Date |

Interest | Tranche A and B - 3-month SOFR + 5% Tranche C - 3-month SOFR + 7% |

Security | Fully secured facility: Guarantees from shareholders, first-ranking asset and share securities |

Offtake | Stage 1 offtake for 100% of Gold Oxide Cap, Copper / Gold Oxide Skarn and Supergene Chalcocite on market-based terms |

Draw down | Subject to completion of long form documentation and customary conditions precedent |

With the acceptance of the term sheet, Mt. Labo will progress to finalisation of long-form documentation.

The initial focus will be the finalisation of land acquisition, drawing on Tranche 1 of the facility and then securing any necessary tree cutting permits. Following completion of these two key steps, Mt. Labo will be in a position to commit to the development schedule and start-up of the Project.

About Glencore International AG:

Glencore is one of the world's largest global diversified natural resource companies and a major producer and marketer of more than 60 commodities that advance everyday life. Through a network of assets, customers and suppliers that spans the globe, Glencore produce, process, recycle, source, market and distribute the commodities that support decarbonisation while meeting the energy needs of today.

With around 150,000 employees and contractors and a strong footprint in over 30 countries in both established and emerging regions for natural resources, Glencore marketing and industrial activities are supported by a global network of more than 50 offices.

Glencore mines and processes copper ore in the key mining regions of Africa, Australia, South America, Canada and Kazakhstan and smelts and refines copper at smelters and refineries around the world, including the majority-controlled Philippine Associated Smelting and Refining ("PASAR") smelter in the Philippines and the wholly controlled Mount Isa copper smelter, located in North Queensland.

Glencore is a proud member of the Voluntary Principles on Security and Human Rights and the International Council on Mining and Metals and is an active participant in the Extractive Industries Transparency Initiative.

ABOUT RTG MINING INC

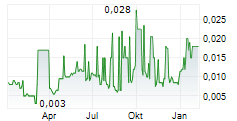

RTG Mining Inc. is a mining and exploration company listed on the main board of the Toronto Stock Exchange and the Australian Securities Exchange. RTG is currently focused primarily on progressing the Mabilo Project to start-up having now received a mining permit for the Project and offer of finance, with a view to moving quickly and safely to a producing gold and copper company.

RTG also has several exciting new opportunities including the Panguna Project in Bougainville, which it remains committed to while also considering further new business development opportunities.

RTG has an experienced management team which has to date developed seven mines in five different countries, including being responsible for the development of the Masbate Gold Mine in the Philippines through CGA Mining Limited. RTG has some of the most respected international institutional investors as shareholders including Equinox Partners and Franklin Templeton.

ENQUIRIES

President & CEO - Justine Magee

Tel: +61 8 6489 2900

Email: jmagee@rtgmining.com

Australia Investor and Media Contact - Sam Burns

Tel: +61 400 164 067

Email: sam.burns@sdir.com.au

COMPLIANCE STATEMENT

Date: 6 March 2025

Authorised for release by: By the Board of Directors

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

The Toronto Stock Exchange has not reviewed nor does it accept responsibility for the accuracy or adequacy of this press release, which has been prepared by management.

This announcement includes certain "forward-looking statements" within the meaning of Canadian securities legislation including, among others, statements made or implied relating to the interpretation of exploration results, accuracy of mineral resource and mineral reserve estimates, parameters and assumptions used to estimate mineral reserves and mineral resources, realization of mineral reserve and mineral resource estimates, estimated economic results of the Mabilo Project, future operational and financial results, including estimated cashflow and the timing thereof, estimated expenditures, expansion, exploration and development activities and the timing thereof, including expectations regarding the DSO, plans for progressing Stage 2 development, completion of a debt funding package, the negotiation of contracts for start up works and offtake arrangements and the completion of merged documentation, RTG's objectives, strategies to achieve those objectives, RTG's beliefs, plans, estimates and intentions, and similar statements concerning anticipated future events, results, circumstances, performance or expectations. All statements, other than statements of historical fact, included herein, are forward-looking statements. Forward looking statements generally can be identified by words such as "objective", "may", "will", "expected", "likely", "intend", "estimate", "anticipate", "believe", "should", "plans", or similar expressions suggesting future outcomes or events. Forward-looking statements involve various risks and uncertainties and are based on certain factors and assumptions. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from RTG's expectations include uncertainties related to fluctuations in gold and other commodity prices and currency exchange rates; uncertainties relating to interpretation of drill results and the geology, continuity and grade of mineral deposits; uncertainty of estimates of capital and operating costs, recovery rates, production estimates and estimated economic return; the need for cooperation of government agencies in the development of RTG's mineral projects; the need to obtain additional financing to develop RTG's mineral projects; the possibility of delay in development programs or in construction projects and uncertainty of meeting anticipated program milestones for RTG's mineral projects and other risks and uncertainties as discussed in RTG's annual report for the year ended December 31, 2023 and detailed from time to time in our other filings with the Canadian securities regulatory authorities available at www.sedar.com. The forward-looking statements made in this announcement relate only to events as of the date on which the statements are made. RTG will not release publicly any revisions or updates to these forward-looking statements to reflect events, circumstances or unanticipated events occurring after the date of this announcement except as required by law or by any appropriate regulatory authority.

NOT FOR RELEASE OR DISTRIBUTION IN THE UNITED STATES

This announcement has been prepared for publication in Canada and Australia and may not be released to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the US Securities Act of 1933, as amended (the "US Securities Act"), or any state securities laws, and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws.

SOURCE: RTG Mining Inc.

View the original press release on ACCESS Newswire