Recent Operating Highlights:

- Cyngn received approximately $1.3M of new bookings for DriveMod vehicles from direct sales during Q4-2024

- Cyngn Signed Contract to Deploy DriveMod Tugger at a Major Consumer Packaged Goods Company

- Cyngn Announced Multiple Deployments at Major Automotive Brands, including Coats.

- Cyngn Raised $33m in December to Scale Customer Deployments and Fuel Its Growth

- Cyngn Highlighted its Proprietary Computer Vision Advancements with NVIDIA Accelerated Computing

- Cyngn Hired Marty Petraitis, a veteran of Industrial Automation, as VP of Sales.

- Cyngn Successfully Completed Initial Deployment of Its DriveMod Tugger at a Major Defense Contractor

- Cyngn Completed First Paid DriveMod Forklift Deployment at Customer Facility

- Cyngn's Next-Generation 12,000-lb DriveMod Tugger Completed Production Builds at Motrec Facility

MENLO PARK, Calif., March 5, 2025 /PRNewswire/ -- Cyngn Inc. (Nasdaq: CYN) today announced financial results for its fourth quarter and year, which ended December 31, 2024.

"We continued to gain commercial momentum with our autonomous DriveMod technology," said Lior Tal, Cyngn CEO. "Building on the direct sales progress made earlier in the year-including our selection by John Deere to supply the DriveMod Tugger-we received over $1M in new bookings from direct sales in the fourth quarter and are actively expanding our focus on channel sales to accelerate adoption.

"We have also recently achieved a meaningful market expansion milestone with a contract signed for our DriveMod Tugger at a Consumer Packaged Goods company, an important progression to bringing our solutions to an even wider swath of industries. Additionally, we kicked off a production deployment of our vehicles at Coats, a major North American Automotive Service Equipment Manufacturer, which continues to emphasize our traction in the automotive manufacturing industry."

Steve Bergmeyer, Continuous Improvement and Quality Manager at Coats, said "Cyngn's self-driving tugger was the perfect solution to support our strategy of advancing automation and incorporating scalable technology seamlessly into our operations. With its high load capacity, we can concentrate on increasing our ability to manage heavier components and bulk orders, driving greater efficiency, reducing costs, and accelerating delivery timelines."

Cyngn hired Marty Petraitis, an experienced veteran of the industrial automation industry, as VP of Sales to capitalize on its growing opportunities. The company is actively focusing on expanding into more Fleet Purchases, creating more scaled opportunities with onboarded customers. Cyngn is seeing validation of its solutions, especially through traction in heavy manufacturing industries like automotive.

The company's momentum is highlighted by the additional recent deployments of the next-generation 12,000 lb. DriveMod Tugger at customer facilities and multiple new customer contracts and LOIs. The next-gen DriveMod Tugger boasts increased towing capacity and enhanced autonomous capabilities with a small form factor for its high towing capacity. Technological improvements have expanded possible use cases, broadened the environments where Cyngn's autonomous vehicles deliver value, and ultimately created new sales opportunities.

Having ramped up the production of its DriveMod Tugger, Cyngn has also been able to shift to revenue-generating activities with its autonomous DriveMod Forklift solution. The first paid DriveMod Forklift deployment marked a key turning point in monetizing the valuable solution offered by an autonomous forklift.

The global forklift market is expected to double to $103.9 billion by 2031. The opportunity for autonomous forklifts is significant, and this milestone positions Cyngn for the critical next steps that will result in the DriveMod Forklift being widely available to under-served forklift automation applications that require 10k+ lb. load capacity and use non-standard pallets.

2024 Financial Review:

2024 revenue was $368 thousand compared to $1.5 million in 2023. 2024 revenue was derived primarily from EAS software subscriptions from DriveMod Stockchaser vehicle deployments whereas prior year revenue was primarily the result of NRE ("Non-Recurring Engineering") contracts.

Total costs and expenses in 2024 were $23.2 million, a decrease of $1.6M or 6.5% from $24.8 million in 2023. This decrease was caused by a decrease of $686.6 thousand in cost of revenue, $1.5 million in R&D, offset by an increase of $507.9 thousand in G&A. The decrease in cost of revenue is driven by the lower costs associated with EAS revenue compared to the NRE contracts in 2023. The decrease in R&D expense was primarily driven by capitalizing costs for specific customers and capitalizing costs related to the development of software. The increase in G&A expenses is due to an increase in executive bonuses offset by a decrease in personnel costs, reduced insurance premiums and spending improvements on general office expenses. Other income (expense), net were $(6.4) million compared to $534.7 thousand in 2023. The increase in expense was primarily driven by the fair value measurement of $5.4 million for the warrant liability.

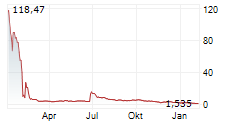

Net loss for 2024 was $(29.3) million compared to $(22.8) million in 2023. For the year-end 2024 net loss per share was $(2,213), based on basic and diluted weighted average shares outstanding of approximately 13.2(1) thousand. This compares to a net loss per share of $(6,529) in 2023, based on approximately 3.5(1) thousand basic and diluted weighted average shares outstanding.

Q4 2024 Financial Review:

Fourth quarter revenue was $306.4 thousand compared to $40.4 thousand in the fourth quarter of 2023. Similar to prior year, fourth quarter 2024 revenue consisted of EAS software subscriptions from DriveMod Stockchaser vehicle deployments.

Total costs and expenses in the fourth quarter were $5.8 million, an increase of $400 thousand or 7.4% from $5.4 million in the fourth quarter of 2023. This increase was due to an increase of $149.2 thousand in cost of revenue due to additional EAS subscriptions in 2024 vs 2023, and an increase of $1.2 million in G&A primarily due to an increase in personnel costs. This is offset by a $912.6 thousand reduction in R&D expenses, primarily driven by capitalizing costs for specific customers and capitalizing costs related to the development of software. For the fourth quarter 2024, other income (expense), net was $(6.5) million compared to $38 thousand in the fourth quarter of 2023. The increase in expense was primarily driven by the fair value measurement of $5.4 million for the warrant liability.

Net loss for the fourth quarter was $(12.0) million compared to $(5.4) million in the corresponding quarter of 2023. Fourth quarter 2024 net loss per share was $(502), based on basic and diluted weighted average shares outstanding of approximately 24 thousand in the quarter. This compares to a net loss per share of $(1,376) in the fourth quarter of 2023, based on approximately 3.9 thousand basic and diluted weighted average shares outstanding.

(1) | All information has been retroactively adjusted to reflect the 1-for-100 reverse stock split effected on July 3, 2024 and the 1-for-150 reverse stock split effected on February 18, 2025. |

Balance Sheet Highlights:

Cyngn's unrestricted cash and short-term investments at the end of 2024 total $23.6 million compared to $3.6 million as of December 31, 2023. At the end of the same period, working capital was $22.1 million and total stockholders' equity was $11.6 million, as compared to year-end working capital of $7.4 million and total stockholders' equity of $10.6 million, respectively as of December 31, 2023. The Company had no debt as of December 31, 2024 and December 31, 2023 and to date, no one on the current management team has sold any shares of Company stock.

About Cyngn

Cyngn develops and deploys scalable, differentiated autonomous vehicle technology for industrial organizations. Cyngn's self-driving solutions allow existing workforces to increase productivity and efficiency. The Company addresses significant challenges facing industrial organizations today, such as labor shortages, costly safety incidents, and increased consumer demand for eCommerce.

Cyngn's DriveMod Kit can be installed on new industrial vehicles at end of line or via retrofit, empowering customers to seamlessly adopt self-driving technology into their operations without high upfront costs or the need to completely replace existing vehicle investments.

Cyngn's flagship product, its Enterprise Autonomy Suite, includes DriveMod (autonomous vehicle system), Cyngn Insight (customer-facing suite of AV fleet management, teleoperation, and analytics tools), and Cyngn Evolve (internal toolkit that enables Cyngn to leverage data from the field for artificial intelligence, simulation, and modeling). For all terms referenced within, please refer to the Company's annual report on Form 10-K with the SEC filed on March 7, 2024.

Where to find Cyngn:

- Website: https://cyngn.com

- X: https://x.com/cyngn

- LinkedIn: https://www.linkedin.com/company/cyngn

- YouTube: https://www.youtube.com/@cyngnhq

Media Contact

Luke Renner

[email protected]

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Any statement that is not historical in nature is a forward-looking statement and may be identified by the use of words and phrases such as "expects," "anticipates," "believes," "will," "will likely result," "will continue," "plans to," "potential," "promising," and similar expressions. These statements are based on management's current expectations and beliefs and are subject to a number of risks, uncertainties and assumptions that could cause actual results to differ materially from those described in the forward-looking statements, including the risk factors described from time to time in the Company's reports to the Securities and Exchange Commission (SEC), including, without limitation the risk factors discussed in the Company's annual report on Form 10-K filed with the SEC on March 7, 2024. Readers are cautioned that it is not possible to predict or identify all the risks, uncertainties and other factors that may affect future results. No forward-looking statement can be guaranteed, and actual results may differ materially from those projected. Cyngn undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events, or otherwise.

CYNGN INC. AND SUBSIDIARIES | ||||||||

CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||

Year Ended December 31, | ||||||||

2024 | 2023 | |||||||

Revenue | $ | 368,138 | $ | 1,489,317 | ||||

Costs and expenses | ||||||||

Cost of revenue | 535,708 | 1,222,321 | ||||||

Research and development | 11,259,641 | 12,719,983 | ||||||

General and administrative | 11,400,864 | 10,892,955 | ||||||

Total costs and expenses | 23,196,213 | 24,835,259 | ||||||

Loss from operations | (22,828,075) | (23,345,942) | ||||||

Other income (expense), net | ||||||||

Interest income (expense), net | (1,117,546) | 137,887 | ||||||

Change in fair value of warrant liability | (5,359,780) | - | ||||||

Other income (expense), net | 53,117 | 396,825 | ||||||

Total other income (expense), net | (6,424,209) | 534,712 | ||||||

Net loss | $ | (29,252,284) | $ | (22,811,230) | ||||

Net loss per share attributable to common stockholders, basic and diluted | $ | (2,212.56) | $ | (6,528.92) | ||||

Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted(1) | 13,221 | 3,494 | ||||||

(1) | All information has been retroactively adjusted to reflect the 1-for-100 reverse stock split effected on July 3, 2024 and the 1-for-150 reverse stock split effected on February 18, 2025. |

CYNGN INC. AND SUBSIDIARIES | |||||||

CONSOLIDATED BALANCE SHEETS | |||||||

December 31, | December 31, | ||||||

2024 | 2023 | ||||||

ASSETS | |||||||

CURRENT ASSETS | |||||||

Cash | $ | 23,617,733 | $ | 3,591,623 | |||

Short-term investments | - | 4,561,928 | |||||

Prepaid expenses and other current assets | 1,965,222 | 1,316,426 | |||||

TOTAL CURRENT ASSETS | 25,582,955 | 9,469,977 | |||||

NON-CURRENT ASSETS | |||||||

Property and equipment, net | 2,319,402 | 1,486,672 | |||||

Right-of-use asset, net | 297,918 | 992,292 | |||||

Intangible assets, net | 1,895,074 | 1,084,415 | |||||

TOTAL NON-CURRENT ASSETS | 4,512,394 | 3,563,379 | |||||

TOTAL ASSETS | $ | 30,095,349 | $ | 13,033,356 | |||

LIABILITIES AND STOCKHOLDERS' EQUITY | |||||||

CURRENT LIABILITIES | |||||||

Accounts payable | $ | 297,778 | $ | 196,963 | |||

Accrued expenses and other current liabilities | 2,874,216 | 1,201,142 | |||||

Current operating lease liability | 317,344 | 682,718 | |||||

TOTAL CURRENT LIABILITIES | 3,489,338 | 2,080,823 | |||||

Warrant liability | 15,012,361 | - | |||||

Non-current operating lease liability | - | 317,344 | |||||

TOTAL LIABILITIES | 18,501,699 | 2,398,167 | |||||

Commitments and contingencies (Note 12) | |||||||

STOCKHOLDERS' EQUITY | |||||||

Common stock, Par $0.00001; 200,000,000 shares authorized, 199,110(1) and 5,147(1) shares issued and outstanding as of December 31, 2024 and 2023, respectively | 2 | - | |||||

Additional paid-in capital(1) | 200,863,551 | 170,652,808 | |||||

Accumulated deficit | (189,269,903) | (160,017,619) | |||||

TOTAL STOCKHOLDERS' EQUITY | 11,593,650 | 10,635,189 | |||||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 30,095,349 | $ | 13,033,356 | |||

(1) | All information has been retroactively adjusted to reflect the 1-for-100 reverse stock split effected on July 3, 2024 and the 1-for-150 reverse stock split effected on February 18, 2025. |

CYNGN INC. AND SUBSIDIARIES | ||||||||

CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

Year Ended December 31, | ||||||||

2024 | 2023 | |||||||

CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

Net loss | $ | (29,252,284) | $ | (22,811,230) | ||||

Adjustments to reconcile net loss to net cash used in operating activities: | ||||||||

Depreciation and amortization | 669,409 | 961,281 | ||||||

Stock-based compensation | 2,449,191 | 3,208,103 | ||||||

Realized gain on short-term investments | (113,072) | (443,392) | ||||||

Patent impairment | 118,831 | - | ||||||

Change in fair value of warrant liability | 5,359,780 | - | ||||||

Accretion of interest and amortization of debt issuance costs | 1,177,174 | - | ||||||

Changes in operating assets and liabilities: | ||||||||

Prepaid expenses, operating lease right-of-use assets, and other current assets | (646,282) | (1,403,049) | ||||||

Accounts payable | 100,815 | 41,020 | ||||||

Accrued expenses, lease liabilities, and other current liabilities | 10,642,938 | 969,662 | ||||||

Net cash used in operating activities | (9,493,500) | (19,477,605) | ||||||

CASH FLOWS FROM INVESTING ACTIVITIES | ||||||||

Purchase of property and equipment | (1,051,481) | (1,045,822) | ||||||

Acquisition of intangible asset | (954,229) | (718,711) | ||||||

Disposal of assets | 265,940 | 180,898 | ||||||

Purchase of short-term investments | (7,562,761) | (21,573,199) | ||||||

Proceeds from maturity of short-term investments | 12,237,761 | 29,519,000 | ||||||

Net cash provided by investing activities | 2,935,230 | 6,362,166 | ||||||

CASH FLOWS FROM FINANCING ACTIVITIES | ||||||||

Proceeds from at-the-market equity financing, net of issuance costs | 6,789,427 | 1,747,468 | ||||||

Proceeds from public issuance of common stock and pre-funded warrants and exercise of pre-funded warrants, net of offering costs | 22,369,285 | 4,380,975 | ||||||

Proceeds from the Notes, net of issuance costs | 1,801,265 | - | ||||||

Repayment of the Notes | (4,375,000) | - | ||||||

Proceeds from exercise of stock options | - | 8,528 | ||||||

Issuance costs for stock dividend and restricted stock units | (597) | (16,182) | ||||||

Net cash provided by financing activities | 26,584,380 | 6,120,789 | ||||||

Net increase (decrease) in cash and cash equivalents and restricted cash | 20,026,110 | (6,994,650) | ||||||

Cash and cash equivalents and restricted cash, beginning of year | 3,591,623 | 10,586,273 | ||||||

Cash and cash equivalents and restricted cash, end of year | $ | 23,617,733 | 3,591,623 | |||||

SOURCE Cyngn