Progress Validates Business Model with Anticipated Profitability Milestone

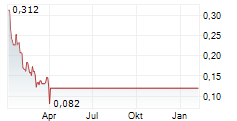

NEW YORK, NY / ACCESS Newswire / March 6, 2025 / 1847 Holdings LLC (NYSE American:EFSH) ("1847 Holdings" or the "Company") today announced financial guidance for 2025 and 2026, marking a transformative achievement in the Company's history.

For the first time since its inception, 1847 Holdings expects to generate net income, projecting approximately $1.3 million in 2025, with revenue exceeding $45 million. This profitability milestone is expected to accelerate in 2026, with anticipated net income of $5.0 million and revenue surpassing $60 million - underscoring the success of the Company's strategic vision and disciplined execution.

Ellery W. Roberts, CEO of 1847 Holdings, stated, "This is a watershed moment for 1847 Holdings. Everything we have been working towards - streamlining our portfolio, optimizing operations, and acquiring high-margin businesses - has culminated in this historic financial turnaround. Achieving net income positive status this year will represent a major validation of our business model and a clear signal to investors that our strategy is working."

Roberts continued, "Our ability to identify, acquire, and enhance undervalued businesses is expected to translate into sustainable profitability starting this year. The acquisition of CMD Inc. ('CMD'), a highly profitable, cash-generating business, is a prime example of our ability to execute on our vision. At the same time, our strategic divestiture of High Mountain Door & Trim Inc. to Builders FirstSource for approximately $17 million - more than double our initial investment - demonstrates our disciplined approach to value creation."

"This is just the beginning. With a strong pipeline of acquisition opportunities and a relentless focus on high-margin, scalable businesses, we believe 1847 Holdings is positioned for exponential growth. Our future has never been brighter, and we are more confident than ever in our ability to drive sustained value for our shareholders."

About 1847 Holdings

1847 Holdings LLC (NYSE American:EFSH), a publicly traded diversified acquisition holding company, was founded by Ellery W. Roberts, a former partner of Parallel Investment Partners, Saunders Karp & Megrue, and Principal of Lazard Freres Strategic Realty Investors. 1847 Holdings' investment thesis is that capital market inefficiencies have left the founders and/or stakeholders of many small business enterprises or lower-middle market businesses with limited exit options despite the intrinsic value of their business. Given this dynamic, 1847 Holdings can consistently acquire businesses it views as "solid" for reasonable multiples of cash flow and then deploy resources to strengthen the infrastructure and systems of those businesses in order to improve operations. These improvements may lead to a sale or IPO of an operating subsidiary at higher valuations than the purchase price and/or alternatively, an operating subsidiary may be held in perpetuity and contribute to 1847 Holdings' ability to pay regular and special dividends to shareholders. For more information, visit www.1847holdings.com.

For the latest insights, follow 1847 on Twitter.

Forward Looking Statements

This press release may contain information about 1847 Holdings' view of its future expectations, plans and prospects that constitute forward-looking statements. All forward-looking statements are based on our management's beliefs, assumptions and expectations of our future economic performance, taking into account the information currently available to it. These statements are not statements of historical fact. Forward-looking statements are subject to a number of factors, risks and uncertainties, some of which are not currently known to us, that may cause our actual results, performance or financial condition to be materially different from the expectations of future results, performance or financial position. Our actual results may differ materially from the results discussed in forward-looking statements. Factors that might cause such a difference include but are not limited to the risks set forth in "Risk Factors" included in our SEC filings.

Contact:

Crescendo Communications, LLC

Tel: +1 (212) 671-1020

Email: EFSH@crescendo-ir.com

SOURCE: 1847 Holdings LLC

View the original press release on ACCESS Newswire