Robinhood's stock has experienced remarkable development despite recent fluctuations, trading at $47.02 on NASDAQ after a slight 2.3% decline. The online broker's performance has been extraordinary over the past year, with shares surging approximately 193%. This impressive trajectory is largely driven by explosive growth in the cryptocurrency sector, which generated record revenue of $360 million in Q4 2024-now accounting for nearly 40% of total revenue. The company's overall financial picture reflects this momentum, with total revenue doubling year-over-year to $1.01 billion and earnings per share rising substantially to $1.04. Robinhood's assets under management have reached $193 billion, with 1.8 million new funded accounts established in 2024, reinforcing its popularity particularly among younger investors.

Future Growth Prospects

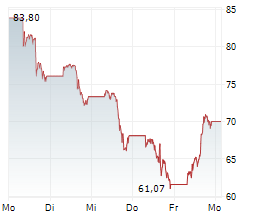

Several analysis firms remain optimistic about Robinhood's future despite the stock retreating about 30% from its mid-February 2025 high of $66.07. The company's expansion in the crypto sector continues to offer promising opportunities, supported by favorable regulatory developments. Beyond cryptocurrency trading, additional growth vectors include the successful Robinhood Gold premium subscription service and expanded product offerings like futures and index options. Analysts project earnings of $1.46 per share for full-year 2025, with upcoming Q1 2025 results expected in early May potentially providing further insight into sustainable growth. Compared to traditional brokerages, Robinhood demonstrates faster growth in total assets, assets per account, order flow revenue, and margin balances-suggesting continued potential despite the recent price correction.

Ad

Robinhood Stock: New Analysis - 07 MarchFresh Robinhood information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Robinhood analysis...