This new release constitutes a "designated news release" for the purposes of the Company's prospectus supplement dated January 31, 2025 to its short form base shelf prospectus dated November 1, 2024.

HIGHLIGHTS

The Eureka deposit of the Nikolai project is a globally significant nickel resource with multiple accessory critical and strategic metals including copper, cobalt, chromium, platinum and palladium. It is the largest nickel resource in the USA. The deposit remains open in three directions and is well positioned to provide a reliable, long-life, secure domestic source of strategic and critical mineral resources in the USA.

The updated resource now outlines 5.61 billion pounds of nickel with 1.77 billion pounds of copper (11.03 billion pounds nickel equivalent) in the Measured & Indicated category (a 46 percent (%) increase) and 9.38 billion pounds of nickel with 2.43 billion pounds of copper (17.98 billion pounds nickel equivalent) in the Inferred category (122% increase).

Hallmarks of the Eureka deposit include a low strip ratio, higher grade core at surface, and highly consistent, continuous, homogenous mineralization. Metallurgical work continues and AEMC expects the deposit will respond well to processing using a conventional flow sheet methodology.

Resource Update

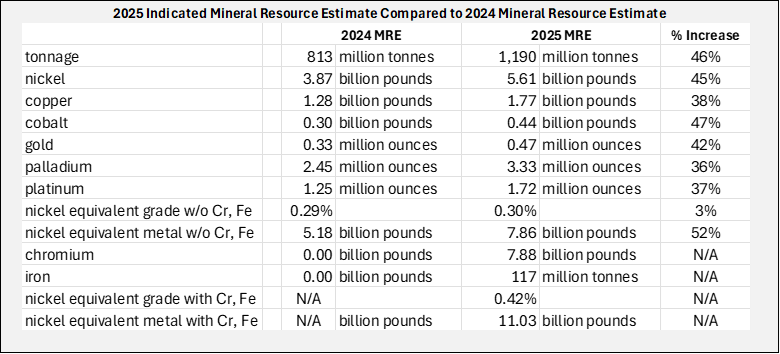

The new Eureka deposit Mineral Resource Estimate ("2025 MRE") has increased the tonnage, metal content, and grade, relative to the 2024 Mineral Resource Estimate ("MRE"), dated February 12, 2024

In situ Indicated resource contains 1,190 million tonnes at a grade of 0.30% NiEq (0.42% NiEq including chromium and iron), a 46% increase in tonnage.

In situ Inferred resource contains 2,087 million tonnes at a grade of 0.28% NiEq (0.39% NiEq including chromium and iron), a 133% increase in tonnage.

Chromium and iron have been included in the 2025 MRE. 7.88 billion pounds of chromium and 117 million tonnes of iron are added to the in situ Indicated resource. 12.29 billion pounds of chromium and 205 million tonnes of iron are added to the in situ Inferred resource.

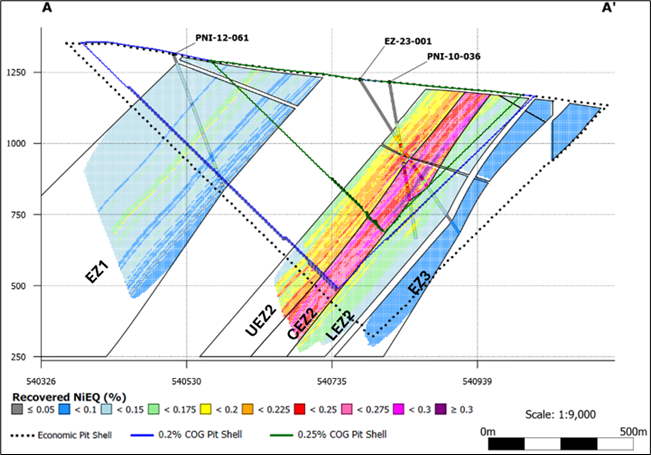

The Eureka Zone 2 ("EZ2"), within the Central Eureka deposit, contains an in situ Indicated resource of 818 million tonnes at a grade of 0.32% NiEq (0.44% NiEq with chromium and iron) and an in situ Inferred resource of 951 million tonnes at a grade of 0.31% NiEq (0.42% NiEq with chromium and iron).

The Central Eureka Zone 2 ("CEZ2"), a subset of the Central Eureka EZ2 deposit, now has continuity along ~ 2.5 km of strike length. This higher-grade core contains an in situ Indicated resource of 225 million tonnes at a grade of 0.39% NiEq (0.52% NiEq including chromium and iron) and an in situ Inferred resource of 246 million tonnes at a grade of 0.36% NiEq (0.48% NiEq including chromium and iron).

The tables below reflect the 2025 MRE compared to the 2024 MRE.

Indicated MRE:

Inferred MRE:

VANCOUVER, BC / ACCESS Newswire / March 10, 2025 / Alaska Energy Metals Corporation (TSXV:AEMC)(OTCQB:AKEMF) ("AEMC" or the "Company") announced today an updated independent mineral resource estimate prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101") ("2025 MRE" or "2025 Resource") for its 100% owned Eureka Deposit, Nikolai Nickel Project ("Nikolai" or "Deposit") in Alaska, USA, with an effective date of March 7, 2025. The newly published 2025 MRE contains 1,190 million tonnes of in situ Indicated resource (an increase of 46%), 2,087 million tonnes of in situ Inferred resource (an increase of 133%), and features an increase in the NiEq grade, a deeper economic pit due to a decrease in the cutoff grade ("COG") of 0.064% recovered NiEq, and a 1.6 to 1 strip ratio. The study was completed by Stantec Consulting Services, Inc., to include the four diamond drill holes (1,597.6 meters) completed by AEMC in 2024. Note: in-situ resources refer to metal in the ground and do not account for metal recoveries. Metallurgical studies to determine metal recoveries are in progress.

Alaska Energy Metals President & CEO Gregory Beischer commented, "In less than two years, we have taken the Nikolai Project from an exploration concept to a substantial deposit of nickel and multiple other critical metals. The Eureka deposit represents a globally significant accumulation of nickel and is the largest of its type in the United States. At a time when the United States government has prioritized the reshoring of critical mineral supply chains to America, AEMC's Nikolai project offers immediate opportunity on US soil in Alaska. I am particularly encouraged by the extension and delineation of the higher-grade core zone. This zone comes right to surface and could be mined in the early years to achieve rapid payback of capital. Nikolai could potentially become an important source of nickel for the USA, catering to the needs of various manufacturing sectors including stainless steel, defense components, aeronautical components, rechargeable batteries, grid-scale renewable energy storage systems and a myriad of other uses. The significant achievement speaks volumes about AEMC's commitment to developing the Nikolai Project and to the hard work our team has put into the project over the past two years."

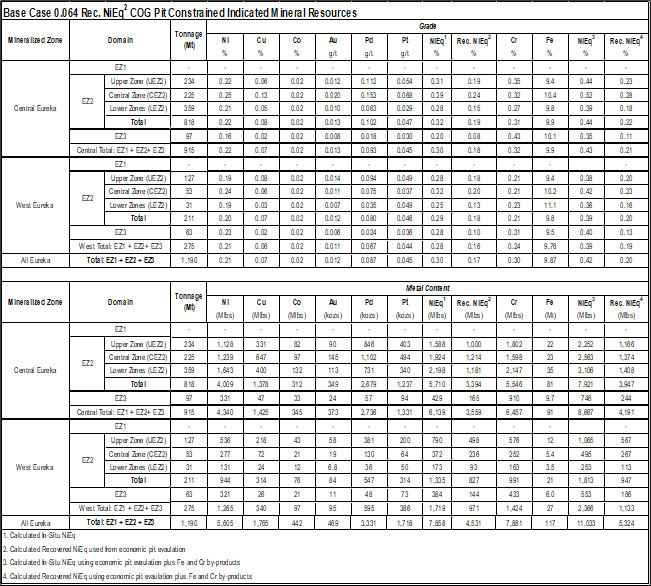

Nikolai Mineral Resource Estimate Update

Total in situ Indicated mineral resources of 5.60 billion pounds of nickel, 1.76 billion pounds of copper, 442 million pounds of cobalt, plus a total of 5.5 million ounces of platinum, plus palladium and gold in a constrained model totaling 1,190 million tonnes, at an average grade of 0.30% NiEq, using a 0.064% recovered NiEq COG. Additionally, 7.88 billion pounds of chromium and 117 million tonnes of iron are included in the resource and increase the in situ NiEq grade to 0.42%. See detailed breakdown in Table 1 below.

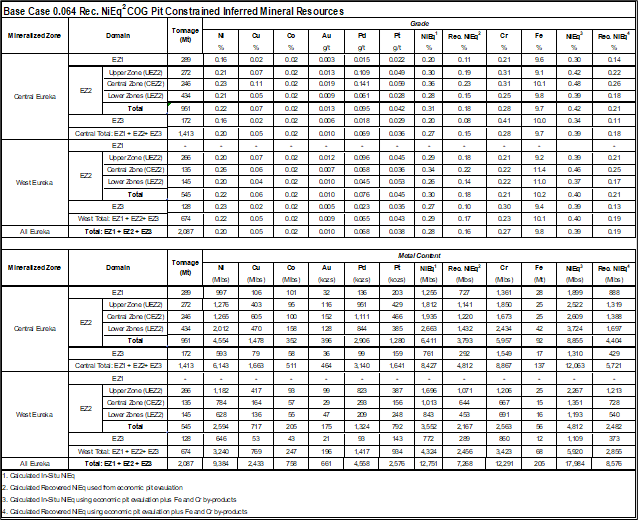

Total in situ Inferred mineral resources of 9.38 billion pounds of nickel, 2.43 billion pounds of copper, and 758 million pounds of cobalt, plus a total of 7.8 million ounces of platinum, plus palladium and gold in a constrained model totaling 2,087 million tonnes, at an average grade of 0.28% NiEq, using a 0.064% recovered NiEq COG. Additionally, 12.3 billion pounds of chromium and 205 million tonnes of iron are included in the resource and increase the in situ NiEq grade to 0.39%. See detailed breakdown in Table 1 below.

EZ2 in situ Indicated mineral resources of 4.00 billion pounds of nickel, 1.38 billion pounds of copper, 312 million pounds of cobalt, plus a total of 4.2 million ounces of platinum, plus palladium and gold in a constrained model totaling 818 million tonnes, at an average grade of 0.32% NiEq, using a 0.064% recovered NiEq COG. Additionally, 5.55 billion pounds of chromium and 81 million tonnes of iron are included in the resource and increase the in situ NiEq grade to 0.44%. See detailed breakdown in Table 1 below.

The CEZ2 zone has continuity along 2.5 km strike length of the Central Eureka deposit. CEZ2 in situ Indicated mineral resources of 1.24 billion pounds of nickel, 647 million pounds of copper, 97 million pounds of cobalt, plus a total of 1.7 million ounces of platinum, plus palladium and gold in a constrained model totaling 225 million tonnes, at an average grade of 0.39% NiEq, using a 0.064% recovered NiEq COG. Additionally, 1.60 billion pounds of chromium and 23 million tonnes of iron are included in the resource and increase the in situ NiEq grade to 0.52%. See detailed breakdown in Table 1 below.

Recovered NiEq has been calculated based on mineralogy, deportment and preliminary metallurgical open circuit testing. Due to the uncertainties of the recovery and marketability of a ferrochrome product, chromium and iron were not used for the reasonable prospects for economic extraction for determining an economic pit shell. Separate NiEq calculations were completed to include these metals. See detailed breakdown in Table 1 below.

The Eureka deposit has now been subdivided into the Central Eureka and West Eureka Deposits. These units were subdivided to reflect the structural nature, grade variation and data confidence levels within the Eureka Zone 2 ("EZ2") mineralization.

The 2025 MRE is defined by 47 drill holes including the four drill holes completed in 2024 by AEMC. The drill holes provide confirmation that mineralization is interconnected across all domains. The deposits remain open along strike and in the down dip direction.

The 2025 MRE represents a significant, material increase in the MRE for the Nikolai Nickel project compared to the 2024 MRE (press release dated February 12, 2024).

The 2025 MRE will be incorporated into a NI 43-101 compliant technical report for the Nikolai Nickel project to be filed within 45 days.

Table 1 - Nikolai Project Mineral Resource Estimate (MRE) - effective March 7, 2025

Indicated Resource

Inferred Resource

Footnotes:

NiEq = nickel equivalent, Rec. NiEq = recovered nickel equivalent, Mt = million tonnes, Mlb = Million pounds, Kozs = thousand troy ounces.

Totals may vary due to rounding.

CIM definitions are followed for classification of Mineral Resource.

Metal pricing used to calculate NiEq and NiEq + (Cr, Fe) is based on observation of monthly metal pricing for the past 24 months up to end-December 2024 with Ni at US$19,558.71/tonne (US$8.90/lb) (World Bank), Cu at US$8,798.58/tonne (US$3.99/lb) (World Bank), Co US$31,434.18 /tonne (US$14.30/lb) (Y Charts), Pt at US$962.77/toz (World Bank), Pd at US$1,189.80/toz (Trading Economics), Au at US$2,150.48/toz (World Bank), Cr at US$4,017.33/tonne (US$1.80/lb) (Fastmarkets, Argus), and Fe at US$114.86/tonne (US$0.052/lb) (World Bank). Totals may not represent the sum of the parts due to rounding.

Nickel equivalent grade formula is as follows:

NiEq = (Ni%) + (Cu% * 0.45) + (Co% * 1.61) + (Pt% * 1,582.61) + (Pd% * 1,955.80) + (Au% * 3,534.97)

Nickel equivalent + Cr and Fe grade formula is as follows:

NiEq = (Ni%) + (Cu% * 0.45) + (Co% * 1.61) + (Pt% * 1,582.61) + (Pd% * 1,955.80) + (Au% * 3,534.97) + (Cr% * 0.21) + (Fe% * 0.00587)

Coefficients used to calculate the value of other metals to Ni equivalent and are calculated as follows:

Coefficient = Metal Price/Ni Price.

Recovered NiEq grade by domain formula is as follows:

In EZ1: Rec. NiEq = (0.6 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97)

In UEZ2 and CEZ2: Rec. NiEq = (0.65 * Ni%) + (0.7 * Cu% * 0.45) + (0.55 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97)

In LEZ2: Rec. NiEq = (0.55 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97)

In EZ3: Rec. NiEq = (0.35 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97)

Recovered NiEq + Cr and Fe grade by domain formula is as follows:

In EZ1: Rec. NiEq = (0.6 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97) + (0.25 * Cr% * 0.21) + (0.25 * Fe% * 0.00587)

In UEZ2 and CEZ2: Rec. NiEq = (0.65 * Ni%) + (0.7 * Cu% * 0.45) + (0.55 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97) + (0.25 * Cr% * 0.21) + (0.25 * Fe% * 0.00587)

In LEZ2: Rec. NiEQ = (0.55 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97) + (0.25 * Cr% * 0.21) + (0.25 * Fe% * 0.00587)

In EZ3: Rec. NiEQ = (0.35 * Ni%) + (0.5 * Cu% * 0.45) + (0.5 * Co% * 1.61) + (0.5 * Pt% * 1,582.61) + (0.5 * Pd% * 1,955.80) + (0.5 * Au% * 3,534.97) + (0.25 * Cr% * 0.21) + (0.25 * Fe% * 0.00587)

Base case Rec. NiEq cutoff grade is 0.064% calculated from a Ni price of US$19,558.71/tonne (US$8.90/lb), surface mining cost of US$2.50 per tonne with a run-of-mine between 45-60k tonnes/day, processing costs with an estimated US$10.00 per tonne, and variable metal recoveries where:

EZ1 Ni recovery is 60% and Au, Cu, Co, Pd, and Pt is 50%

UEZ2 and CEZ2 Ni recovery is 65%, Cu is 70%, Co is 55%, and Au, Pd, Pt is 50%

LEZ2 Ni recovery is 55% and Au, Cu, Co, Pd, and Pt is 50%

EZ3 Ni recovery is 35% and Au, Cu, Co, Pd, and Pt is 50%

Mineral Resources are reported from within an economic pit shell whose extent has been estimated using a Ni price of US$19,558.71/tonne (US$8.90/lb), surface mining cost of US$2.50 per tonne, from a recovered Ni equivalent grade calculated from Ni, Cu, Co, Pt, Pd, and Au, and a 45-degree constant slope angle.

The Mineral Resource estimate has been prepared by Erik Lagenfeld of Stantec Consulting Services Inc. in conformity with CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

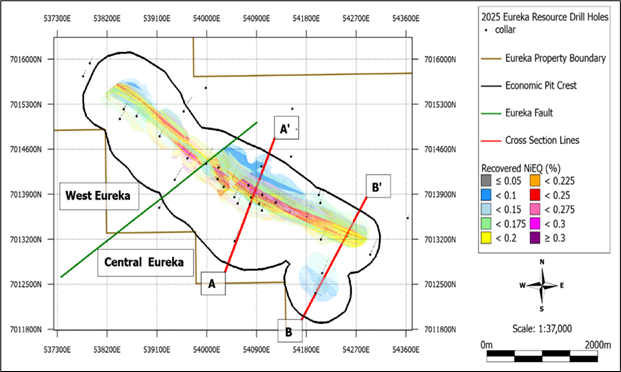

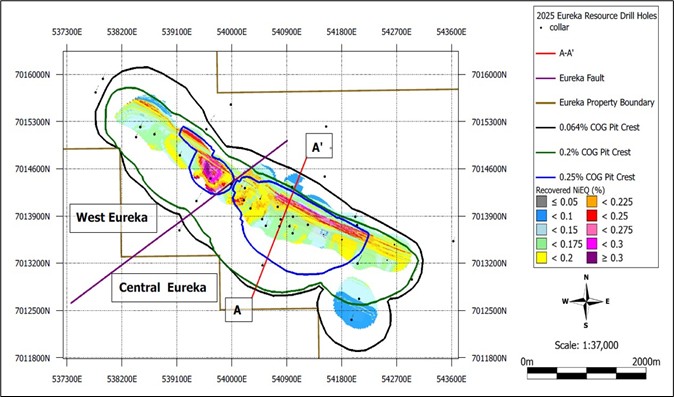

Figure 1. Eureka Zone overview map displaying recovered NiEq% (excluding chromium and iron), the 2025 economic resource pit outline, and drill hole locations.

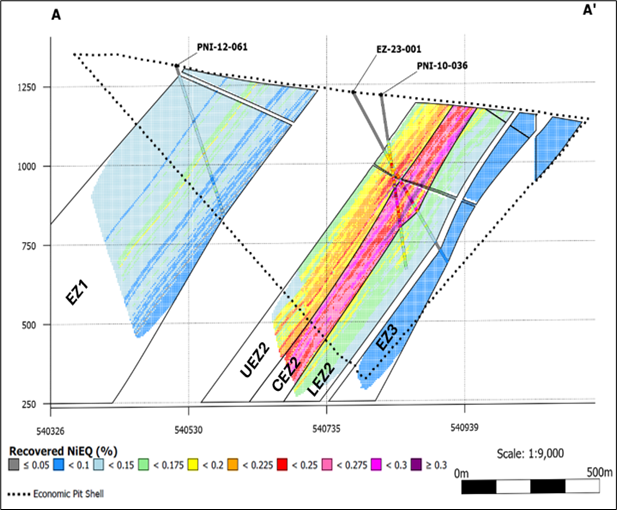

Figure 2. Cross section through the Eureka EZ1, EZ2, and EZ3 2025 MRE. Note: Location of section A-A' is located on Figure 1. Note: Recovered NiEq% excludes chromium and iron.

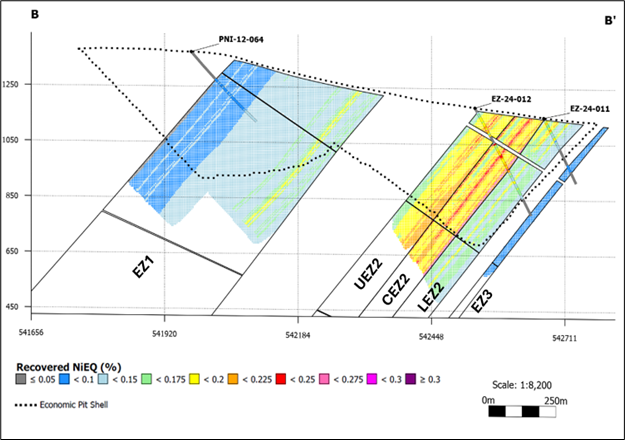

Figure 3. Cross section through the Eureka EZ1, EZ2 & EZ3 2025 MRE. Note: Location of section B-B' is located on Figure 1.

Note: Recovered NiEq % excludes chromium and iron.

SENSITIVITY ANALYSIS

A sensitivity analysis for Indicated and Inferred mineral resources are provided in Table 2 and Table 3 respectively, which demonstrates the variation in grade and tonnage in the deposit at various cut-off grades. Constrained Mineral Resources are reported at a base case cut-off grade of 0.064% recovered NiEq. The values in the table reported should not be misconstrued with a Mineral Resource Statement. The values are only presented to show the sensitivity of the block model estimates to the selection of higher cut-off grade. All figures are rounded to reflect the relative accuracy of the estimate.

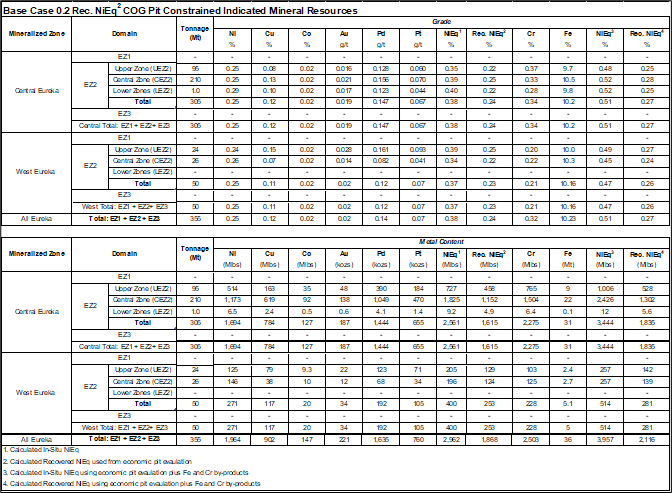

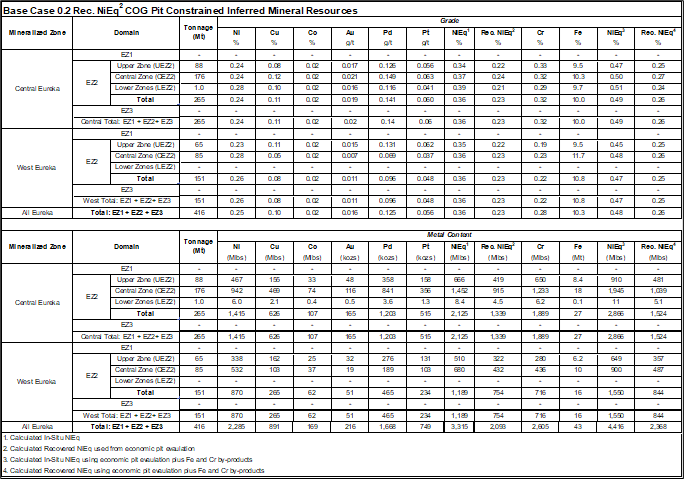

Table 2 - Nikolai Project MRE Indicated and Inferred Grade Sensitivity @ 0.20% COG - effective March 7, 2025

Indicated Resource

Inferred Resource

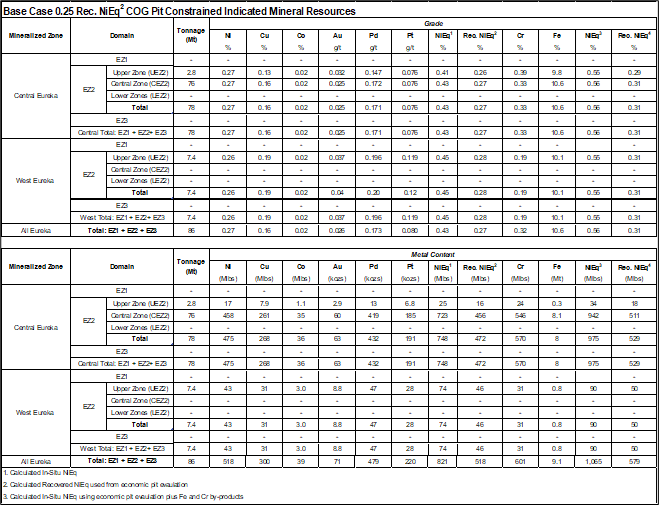

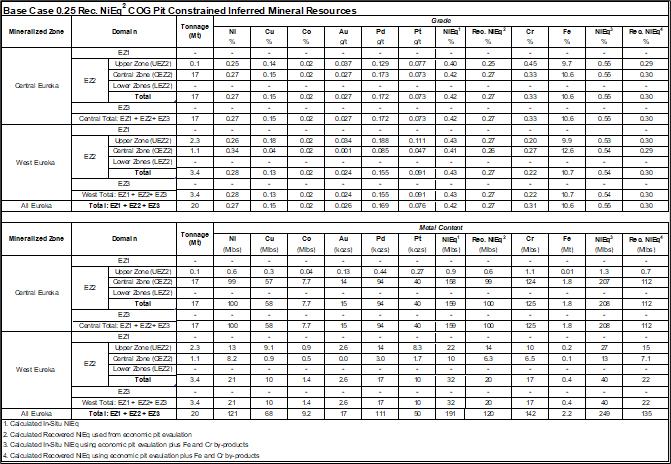

Table 3 - Nikolai Project MRE Indicated and Inferred Grade Sensitivity @ 0.25% COG - effective March 7, 2025

Indicated Resource

Inferred Resource

Figure 4. Eureka Zone overview map displaying recovered NiEq% (excluding chromium and iron) block model and pit shells at varying COG.

Figure 5. Cross section through the Eureka EZ1, EZ2 & EZ3 MRE displaying pit shells ay varying COG. Note: Location of section B-B' is located on Figure 4. Note: Recovered NiEq % excludes chromium and iron

MINERAL RESOURCE ESTIMATION CALCULATION METHODOLOGY

The geologic model used for reporting of mineral resources is a 3D block model that was developed using LeapFrog Edge version 2024.1.1. An economic pit shell was developed from the block model using MinePlan version 16.2.1. The block model was developed using UTM NAD83 6N coordinates and is in metric units. The block size is 30 m (X), 5 m (Y) and 5 m (Z) rotated 26 degrees toward the east to align the X-axis along strike at 118 degrees. The block model captures three mineralized ultramafic intrusive bodies (zones) that dip towards the southwest between 45° and 50°. The three zones are Eureka Zone 1 (EZ1), Eureka Zone 2 (EZ2) and Eureka Zone 3 (EZ3) from south to north across the deposit, respectively. Sub-zones focusing on the deposit's high-grade core were modeled within EZ2; Upper EZ2 (UEZ2), Central EZ2 (CEZ2), and Lower EZ2 (LEZ2) from south to north across the deposit, respectively. The mineralized zones were built using Seequent's Leapfrog Geo software from a drillhole database of 47 drillholes. Mineral sample assays have been validated for 40 of the 47 drillholes. Assay data from these holes has been used to estimate grades for nickel (Ni), copper (Cu), cobalt (Co), platinum (Pt), palladium (Pd), gold (Au), iron (Fe), and chromium (Cr). Au grades were capped prior to estimation at 0.6 parts per million (ppm) within EZ1. Ni, Cu, Co, Au, Pd, and Pt grades were used to calculate both an in situ Nickel Equivalency grade (NiEq) and a recovered NiEq grade based on average (24 month) market prices. A secondary in situ NiEq grade and recovered NiEq grade with Cr and Fe added were calculated but not used for determining an economic pit shell. Ni is approximately 74% of the total in situ value of the metals included in the equivalent grade calculation.

Reasonable prospects for economic extraction have been determined by calculating a recovered NiEq cutoff grade of 0.064 percent (%) using the following assumptions:

Surface mining operation with run-of-mine (ROM) between 45 to 60 thousand tonnes/day;

Mining costs US$2.5/tonne;

Processing costs US$10/tonne;

Variable metal recoveries where:

EZ1 Ni recovery is 60% and Au, Cu, Co, Pd, and Pt is 50%

UEZ2 and CEZ2 Ni recovery is 65%, Cu is 70%, Co is 55%, and Au, Pd, Pt is 50%

LEZ2 Ni recovery is 55% and Au, Cu, Co, Pd, and Pt is 50%

EZ3 Ni recovery is 35% and Au, Cu, Co, Pd, and Pt is 50%

Resources are reported from within an economic pit shell at a 45-degree constant slope using MinePlan's mining Pseudoflow algorithm. No underground mining is considered. Assumed revenue used to drive the pit shell is US$8.90/lb. nickel applied to a recovered NiEq grade assuming the variable metal recoveries listed above. This pit optimization does not represent an economic study. Future engineering studies will be needed to develop optimal bulk tonnage mining methods.

The pit-constrained MRE is at an Indicated and Inferred level of assurance. Mineral resources are reported for the EZ1, EZ2 and EZ3 zones.

MINERAL RESOURCE ESTIMATE PREPARATION

The 2024 MRE has been prepared by Erik Langenfeld, P. Geo. (the "QP") of Stantec Consulting Services Inc. in conformity with CIM "Estimation of Mineral Resource and Mineral Reserves Best Practices" guidelines and are reported in accordance with NI 43-101. The QP is not aware of any environmental, permitting, legal, title, taxation, socio-economic, marketing, political, or other relevant issues that could potentially affect the 2024 MRE. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

CAUTIONARY NOTE CONCERNING TECHNICAL DISCLOSURE AND U.S. SECURITIES LAWS

The MRE has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ in certain material respects from the disclosure requirements under United States securities laws. Unless otherwise indicated, all resource and reserve estimates included in this news release have been prepared in accordance with NI 43-101. The definitions used in NI 43-101 are incorporated by reference from the CIM Definition Standards.

The SEC Modernization Rules replaced the historical disclosure requirements for mining registrants that were included in SEC Industry Guide 7, which has been rescinded. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred mineral resources". Readers are cautioned that while the above terms are "substantially similar" to the corresponding CIM Definition Standards, there are differences in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the same had the Company prepared mineral resource estimates under the standards adopted under the SEC Modernization Rules. Accordingly, information contained or incorporated by reference in this news release describing the Company's mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

QUALIFIED PERSON

Mr. Erik Langenfeld, P. Geo. of Stantec Consulting Services Inc. is the Qualified Person as defined by NI 43-101 who has prepared or supervised the preparation of, or has reviewed and approved, the scientific and technical data pertaining to the MRE contained in this release and will be preparing the NI-43-101 technical report for filing on SEDAR+ within 45 days.

Gabriel Graf, the Company's Chief Geoscientist, is the qualified person, as defined under NI 43-101 having reviewed and approved of all other scientific and technical information contained in this news release.

For additional information, visit: https://alaskaenergymetals.com/

ABOUT ALASKA ENERGY METALS

Alaska Energy Metals Corporation (AEMC) is an Alaska-based corporation with offices in Anchorage and Vancouver working to sustainably deliver the critical materials needed for national security and a bright energy future, while generating superior returns for shareholders.?

AEMC is focused on delineating and developing the large-scale, bulk tonnage, polymetallic Nikolai Project Eureka deposit containing nickel, copper, cobalt, chromium, iron, platinum, palladium, and gold. Located in Interior Alaska near existing transportation and power infrastructure, its flagship project, Nikolai, is well-situated to become a significant domestic source of strategic metals for North America. AEMC also holds a secondary project in western Quebec; the Angliers - Belleterre project. Today, material sourcing demands excellence in environmental performance, technological innovation, carbon mitigation and the responsible management of human and financial capital. AEMC works every day to earn and maintain the respect and confidence of the public and believes that ESG performance is measured by action and led from the top.

ON BEHALF OF THE BOARD

"Gregory Beischer"

Gregory Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gregory A. Beischer, President & CEO

Toll-Free: 877-217-8978 | Local: 604-609-7149

Some statements in this news release may contain forward-looking information (within the meaning of Canadian securities legislation), including, without limitation, the estimation of mineral resources and that the Company (a) will file a NI43-101 technical report within 45 days, b) will complete metallurgical and deportment studies, c) find that the processing of the deposit can be done using a standard flowsheet, d) will perform economic analysis, and e) plan and conduct further exploration drilling. These statements address future events and conditions and, as such, involve known and unknown risks, uncertainties, and other factors which may cause the actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the statements. Forward-looking statements speak only as of the date those statements are made. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements do not guarantee future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include but are not limited to uncertainty relating to the estimation of mineral resources, regulatory actions, market prices, and continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable law, the Company assumes no obligation to update or to publicly announce the results of any change to any forward-looking statement contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions, or changes in other factors affecting the forward-looking statements. If the Company updates any forward-looking statement(s), no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

SOURCE: Alaska Energy Metals Corporation

View the original press release on ACCESS Newswire