NEW DELHI (dpa-AFX) - Wayfair Inc. (W), an American e-commerce company, on Monday announced that its subsidiary Wayfair LLC intends to offer Senior Secured Notes, due 2030 of around $700 million in aggregate principal amount, in a private offering. The company also plans to update the credit agreement.

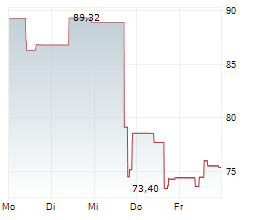

Shares of Wayfair are dropping in the pre-market.

The company plans to use the net proceeds from the Notes offering to buy back part of the outstanding 2025 and 2026 convertible senior notes, either at the same time or after the offering. The funds may also be used for general corporate purposes, including repaying existing debt.

Around the same time as issuing the notes, the company plans to update the credit agreement to create a new credit facility called the 'Revolver.' This is expected to extend the loan maturity to 2030 and provide up to $500 million in total commitments.

The issuance of the Notes and the credit agreement update are independent of each other.

In pre-market trading, Wayfair is 3.39% lesser at $18 on the New York Stock Exchange.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News