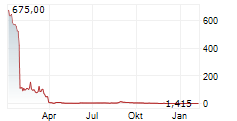

NEW YORK, April 24, 2025 (GLOBE NEWSWIRE) -- Sharps Technology, Inc. (NASDAQ: "STSS" and "STSSW") ("Sharps"), an innovative medical device and pharmaceutical packaging company offering patented, best-in-class smart-safety syringe products to the healthcare industry, today announced that it will effect a 1-for-300 reverse stock split (the "reverse split") of its common stock, par value $0.0001 per share (the "Common Stock"), that will become effective on April 27, 2025 at 11:59 PM Eastern Time, before the opening of trading on The Nasdaq Capital Market ("Nasdaq"). Sharps has requested that its Common Stock begin trading on April 28, 2025, on a post-reverse split basis on the Nasdaq under the existing symbol "STSS".

The reverse split is primarily intended to bring Sharps into compliance with the minimum bid price requirement for maintaining its listing on the Nasdaq. The new CUSIP number for the Common Stock following the reverse split will be 82003F309.

The reverse split was effected by the Sharps' Board of Directors (the "Board"), pursuant to Section 78.207 of the Nevada Revised Statutes, without shareholder approval as the reverse split provides for a proportionate reduction in the number of both the authorized and outstanding shares and does not adversely affect any other classes of stock of the Company. The Company's amended and restated Articles of Incorporation, filed with the Nevada Secretary of State, reduce the authorized common shares from 500,000,000 to 1,666,667 and effectuate a reverse split of 1-for-300.

About Sharps Technology:

Sharps Technology is an innovative medical device and pharmaceutical packaging company offering patented, best-in-class smart-safety syringe products to the healthcare industry. The Company's product lines focus on providing ultra-low waste capabilities, that incorporate syringe technologies that use both passive and active safety features. Sharps also offers products that are designed with specialized copolymer technology to support the prefillable syringe market segment. The Company has a manufacturing facility in Hungary. For additional information, please visit www.sharpstechnology.com.

FORWARD-LOOKING STATEMENTS:

This press release contains "forward-looking statements". Forward-looking statements reflect our current view about future events. When used in this press release, the words "anticipate," "believe," "estimate," "expect," "future," "intend," "plan," "poised" or the negative of these terms and similar expressions, as they relate to us or our management, identify forward-looking statements. Such statements, include, but are not limited to, statements contained in this press release relating to our business strategy, our future operating results and liquidity, and capital resources outlook. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy, and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees of assurance of future performance. We caution you therefore against relying on any of these forward-looking statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, our ability to raise capital to fund continuing operations; our ability to protect our intellectual property rights; the impact of any infringement actions or other litigation brought against us; competition from other providers and products; our ability to develop and commercialize products and services; changes in government regulation; our ability to complete capital raising transactions; and other factors relating to our industry, our operations and results of operations. Actual results may differ significantly from those anticipated, believed, estimated, expected, intended, or planned. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We cannot guarantee future results, levels of activity, performance, or achievements. The Company assumes no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this release.

Investor Contact:

Holdsworth Partners

Adam Holdsworth

Phone: 917-497-9287

Email: IR@sharpstechnology.com