- Company generated quarterly sequential growth in YCANTH® dispensed applicator units of 12.3% in Q4'24 concurrent with significantly lower operating expenses -

- Company reports positive quarterly revenue earlier than previously disclosed expectations, as new demand resulted in Company's primary distribution partner ordering applicators of YCANTH during Q4'24 -

- Late-stage pipeline continues to advance with programs in basal cell carcinoma (VP-315) and common warts (VP-102/YCANTH) -

- Recently strengthened balance sheet with the November 2024 $42 million public offering -

- Conference call scheduled for today at 4:30 pm ET -

WEST CHESTER, Pa., March 11, 2025 (GLOBE NEWSWIRE) -- Verrica Pharmaceuticals Inc. ("Verrica" or the "Company") (Nasdaq: VRCA), a dermatology therapeutics company developing medications for skin diseases requiring medical interventions, today announced financial results for the fourth quarter and full year ended December 31, 2024.

"The fourth quarter began a transition period for our company, and we have already achieved several substantial milestones. We completed our commercial strategy realignment, which generated promising sequential growth of dispensed applicator units of YCANTH while simultaneously implementing significant cost reductions across the organization. We also continued advancing our late-stage clinical programs in basal cell carcinoma and common warts," said Dr. Jayson Rieger, PhD, MBA, President and Chief Executive Officer of Verrica. Rieger continued "We successfully raised equity capital in the fourth quarter to strengthen our balance sheet and allow us to remain focused on commercial execution and development of our clinical assets."

"Based on achieving these early milestones, I believe Verrica is now on track to successfully execute our turnaround strategy. Our goal is to generate cash positive monthly operating results by the end of 2025. To achieve this, our focus will remain to establish YCANTH as the standard of care for the treatment of molluscum contagiosum. In parallel, we will work to create significant additional value by advancing our late-stage pipeline. We recently reported positive data from our Phase 2 study of our oncolytic peptide candidate, VP-315, for the treatment of basal cell carcinoma, and we also anticipate advancing VP-102 (YCANTH) into a Phase 3 clinical trial for the treatment of common warts as early as mid-2025. With a leaner and more capital-efficient operating model now in place, I believe 2025 is shaping up to become an important year for Verrica as we seek to address the most significant unmet needs in dermatology."

Conference Call and Webcast Information

The Company will host a conference call today, Tuesday, March 11, 2025, at 4:30 PM, Eastern Time, to discuss its fourth quarter and year-end 2024 financial results and provide a business update. To participate in the conference call, please utilize the following information:

Domestic Dial-In Number: Toll-Free: 1-800-445-7795

International Dial-In Number: 1-785-424-1699

Conference ID: VERRICA

Webcast:

https://viavid.webcasts.com/starthere.jsp?ei=1706610&tp_key=fb81085fc6

Participants can use Guest dial-in s above and be answered by an operator.

The call will also be broadcast live over the Web and can be accessed on Verrica Pharmaceuticals' website: www.verrica.com or directly at

https://viavid.webcasts.com/starthere.jsp?ei=1706610&tp_key=fb81085fc6

The conference call will also be available for replay for one month on the Company's website in the Events Calendar of the Investors section.

Business Highlights and Recent Developments

CORPORATE

- In December 2024, the Company announced a business and operational update outlining the significant progress being made with respect to the new commercial strategy for YCANTH®, Verrica's product for the treatment of molluscum contagiosum ("molluscum").

- YCANTH dispensed applicator units in the fourth quarter of 2024 were 8,654 versus the third quarter of 2024 of 7,706, which represents sequential quarterly growth of 12.3%.

- The Company has normalized YCANTH distributor inventory levels to meet demand.

- Verrica introduced a new single applicator configuration for YCANTH that became available in the first quarter of 2025 to help meet growing product demand, reduce acquisition costs for physician practices and expand distribution and patient access.

- Verrica continued to advance pipeline of product candidates in common warts and basal cell carcinoma.

- In November 2024, the Company announced the pricing of $42 million public offering of common stock, pre-funded warrants and accompanying Series A and B warrants.

- In November 2024, the Company announced the appointments of Dr. Jayson Rieger as President and Chief Executive Officer and as a director, and John Kirby as interim Chief Financial Officer.

- In October 2024, the Company announced a restructuring of its commercial operations to reduce expenses and optimize the efficiency of its field force by reducing the number of sales territories and focusing on those territories that have historically shown a high prevalence of molluscum, a critical mass of previous cantharidin users and strong insurance coverage for YCANTH. The Company also announced that it would reduce headcount in certain support functions to focus on its new commercial strategy. Total operating expenses after the restructuring are expected to be reduced by approximately fifty percent. The Company incurred a one-time charge related to the restructuring of approximately $1.0 million.

YCANTH® (VP-102)

- In December 2024, the Company announced that its development and commercialization partner, Torii Pharmaceutical Co. Ltd. ("Torii"), submitted a New Drug Application of TO-208 (referred to as VP-102 and marketed as YCANTH® in the U.S.) for the treatment of molluscum in Japan.

- Torii and Verrica are finalizing plans for a co-sponsored global Phase 3 clinical program to develop VP-102 (YCANTH) for the treatment of common warts, with Torii providing all initial funding and Verrica paying its portion of trial costs out of future milestones and royalties. Under the terms of the Torii collaboration and license agreement, Torii will make a milestone payment of $8 million to Verrica upon initiation of the Phase 3 clinical trial. Initiation of this global study in common warts could begin as early as mid-2025.

VP-315

- In November 2024, the Company disclosed additional data on VP-315 from a post-hoc analysis of the data from Part 2 of the Phase 2 study of VP-315 for the treatment of basal cell carcinoma, and the results were formally presented in January 2025 at the 2025 Winter Clinical Dermatology Conference. Part 2 of the Phase 2 study was designed to explore dosing regimens to help identify the recommended regimen for a Phase 3 clinical study. The analysis of Part 2 of the Phase 2 study demonstrated that treatment with VP-315 led to a calculated objective response rate, or ORR, of 97%, which was defined as the percentage of study subjects who do not demonstrate disease progression and who experience at least a 30% reduction in tumor size along with partial or complete response following treatment.

- In October 2024, the Company presented two posters at the 2024 Fall Clinical Dermatology Conference featuring positive preliminary topline results from Part 2 of the Phase 2 study. The posters included safety and histologic clearance data from 82 patients with up to 2 target basal cell carcinoma tumors. Preliminary topline results showed that approximately 51% of tumors treated with VP-315 achieved complete histological clearance, while those patients with a residual tumor achieved, on average, approximately 71% reduction in tumor size. VP-315 was also well tolerated. No treatment related serious adverse events were reported in the study, and most treatment related adverse events were mild to moderate.

- The Company expects to report genomic and immune response data from the Phase 2 trial and to receive minutes from an end-of-phase 2 meeting in the first half of 2025, which will help determine the next steps for the advancement of the program into Phase 3 trials.

Financial Results

Fourth Quarter 2024 Financial Results

- Verrica recognized product revenue of $0.3 million in the three months ended December 31, 2024 compared to $1.9 million for the same period in 2023. The decrease is due to demand for YCANTH (VP-102) dispensed applicator units being met during fourth quarter of 2024 by existing inventory held by distributors.

- Costs of product revenue were $0.6 million for the three months ended December 31, 2024, compared to $0.1 million for the three months ended December 31, 2023. The increase was partially due to an obsolete inventory write-off of $0.3 million during the three months ended December 31, 2024.

- Selling, general and administrative expenses were $10.0 million in the three months ended December 31, 2024, compared to $17.0 million for the same period in 2023. The decrease of $7.0 million was primarily due to reduction in headcount related costs of $3.7 million, a result of a restructure at the beginning of the period and decrease in advertising and sponsorship costs of $3.6 million.

- Research and development expenses were $1.2 million in the three months ended December 31, 2024, compared to $5.3 million for the same period in 2023. The decrease of $4.1 million was primarily related to a decrease in VP-315 clinical trial costs of $2.1 million, a decrease in headcount related costs of $1.2 million and a reduction of regulatory costs of $0.7 million.

- For the three months ended December 31, 2024, net loss was $16.2 million, or $0.24 per share, compared to a net loss of $24.6 million, or $0.53 per share, for the same period in 2023.

Full Year 2024 Financial Results

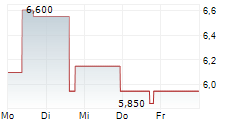

- Verrica recognized product revenue of $6.6 million in the year ended December 31, 2024, compared to $4.7 million for the year ended December 31, 2023. The increase of $1.9 million related to additional sales of YCANTH (VP-102) partially offset by a returns reserve of $3.2 million for estimated returns from certain distributors. The Company determined it was more than probable that product held by certain distributors will be returned based on lower than forecasted sell-through and expiration of product. This increase in reserve was partially offset by a decrease of other gross to net reserves of $1.2 million mostly related to a decrease in co-pay reserve.

- Verrica recognized collaboration revenues of $1.0 million for the year ended December 31, 2024, compared to $0.5 million for the year ended December 31, 2023, each related to supplies and development activity provided to Torii as needed pursuant to the Torii Clinical Supply Agreement.

- Costs of product revenue were $1.9 million for the year ended December 31, 2024, compared to $0.3 million for the year ended December 31, 2023. The increase in product costs of $1.6 million was primarily related to higher sales of YCANTH (VP-102) coupled with obsolete inventory of $0.9 million during the year ended December 31, 2024.

- Costs of collaboration revenue were $0.9 million for the year ended December 31, 2024, compared to $0.5 million for the year ended December 31, 2023. The increase was primarily due to increased manufacturing supply required to support development and testing services pursuant to the Torii Clinical Supply Agreement.

- Selling, general and administrative expenses were $58.8 million for the year ended December 31, 2024, compared to $47.3 million for the year ended December 31, 2023. The increase of $11.5 million was primarily a result of higher expenses related to commercial activities for YCANTH (VP-102) for the treatment of molluscum, including increased compensation, recruiting fees, benefits and travel due to ramp-up of sales force of $8.5 million, as well as increased commercial-related costs of $5.1 million, increased severance costs of $1.8 million due to termination of employees, increased professional services including legal of $4.4 million, and the Dormer legal settlement payment of $0.8 million partially offset by decreased stock compensation expense of $6.8 million related to vesting of restricted stock units and decrease in marketing and sponsorship costs of $2.2 million.

- Research and development expenses were $11.8 million for the year ended December 31, 2024, compared to $20.3 million for the year ended December 31, 2023. The decrease of $8.5 million was primarily attributable to reductions of costs related to YCANTH (VP-102) pre-approval activity of $3.8 million, decreased clinical costs for VP-315 of $3.1 million, decreased stock compensation expense of $0.6 million related to vesting of restricted stock units upon FDA approval and reduction in headcount related costs of $0.7 million, partially offset by increased costs for the development of VP-102 for common warts of $0.5 million.

- Interest income was $1.4 million for the year ended December 31, 2024, compared to $2.7 million for the year ended December 31, 2023. The decrease of $1.3 million was primarily due to a lower cash balance and lower interest rates.

- Interest expense was $9.4 million for the year ended December 31, 2024, compared to $4.0 million for the year ended December 31, 2023. The higher interest expense of $5.4 million was due to Verrica initially borrowing funds pursuant to the OrbiMed credit facility in July 2023.

- Change in fair value of derivative liability was $2.6 million for the year ended December 31, 2024. The OrbiMed Credit Agreement contains a bifurcated settlement feature classified as a derivative liability which is remeasured each accounting period. For the year ended December 31, 2023, the settlement feature was deemed to have no value as the Company did not deem it probable that the repayment of the debt would be accelerated. As a result of the Company failing to meet the revenue threshold specified in the OrbiMed Credit Agreement as of December 31, 2024, the initiation of principal payments beginning in 2025 was triggered. As of December 31, 2024, the embedded derivatives were valued at $2.6 million.

- For the year ended December 31, 2024, net loss on a GAAP basis was $76.6 million, or $1.48 per share, compared to a net loss of $67.0 million, or $1.48 per share, for the year ended December 31, 2023.

- For the year ended December 31, 2024, non-GAAP net loss was $64.6 million, or $1.25 per share, compared to a non-GAAP net loss of $51.8 million, or $1.14 per share, for the year ended December 31, 2023.

- As of December 31, 2024, Verrica had cash and cash equivalents of $46.3 million. Under GAAP, the cash and cash equivalents as of December 31, 2024, would not be sufficient to fund operations for the one-year period following the release of Verrica's 2024 financial statements. However, should Verrica receive the $8 million milestone payment from Torii (triggered by the initiation of the Phase 3 clinical trial in Japan for common warts) or a portion of the $25 million in proceeds from the exercise of the Series A warrants (issued as part of our November 2024 equity financing with an exercise price of $1.0680 per share and expiring in November 2025), Verrica could have sufficient cash to fund operations for such period.

Non-GAAP Financial Measures

In evaluating the operating performance of its business, Verrica's management considers non-GAAP loss from operations, non-GAAP net loss and non-GAAP net loss per share. These non-GAAP financial measures exclude stock-based compensation expense and non-cash interest expense that are required by GAAP. Verrica excludes non-cash stock-based compensation expense from these non-GAAP measures to facilitate comparison to peer companies who also provide similar non-GAAP disclosures and because it reflects how management internally manages the business. In addition, Verrica excludes non-cash interest expense from these non-GAAP measures to facilitate an understanding of the effects of the debt service obligations on the Company's liquidity and comparisons to peer group companies who also provide similar non-GAAP disclosures and because it is reflective of how management internally manages the business. Non-GAAP loss from operations, non-GAAP net loss and non-GAAP net loss per share should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for, or superior to, GAAP results. Non-GAAP loss from operations, non-GAAP net loss and non-GAAP net loss per share have been reconciled to the nearest GAAP measure in the tables following the financial statements in this press release.

About YCANTH® (VP-102)

YCANTH® is a proprietary drug-device combination product that contains a GMP-controlled formulation of cantharidin delivered via a single-use applicator that allows for precise topical dosing and targeted administration for the treatment of molluscum. YCANTH® is the first and only commercially available product approved by the FDA to treat adult and pediatric patients two years of age and older with molluscum contagiosum - a common, highly contagious skin disease that affects an estimated six million people in the United States, primarily children. Approval of YCANTH® was based upon the positive results from two Phase 3 clinical trials in approximately 500 patients which demonstrated that YCANTH® was a safe and effective therapeutic for the treatment of molluscum. Approximately 225 million lives are eligible to receive YCANTH® covered by insurance. YCANTH® is available to all patients with and without insurance coverage for $25 per treatment, and further financial assistance is available for patients in need. Please visit YCANTHPro.com for additional information.

About Verrica Pharmaceuticals Inc.

Verrica is a dermatology therapeutics company developing medications for skin diseases requiring medical interventions. Verrica's product YCANTH® (VP-102) (cantharidin), is the first and only commercially available treatment approved by the FDA to treat adult and pediatric patients two years of age and older with molluscum contagiosum, a highly contagious viral skin infection affecting approximately 6 million people in the United States, primarily children. YCANTH® (VP-102) is also in development to treat common warts, the largest remaining unmet need in medical dermatology. Verrica has also entered a worldwide license agreement with Lytix Biopharma AS to develop and commercialize VP-315 (formerly LTX-315 and VP-LTX-315) for non-melanoma skin cancers including basal cell carcinoma and squamous cell carcinoma. For more information, visit www.verrica.com.

Forward-Looking Statements

Any statements contained in this press release that do not describe historical facts may constitute forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as "believe," "expect," "may," "plan," "potential," "will," and similar expressions, and are based on Verrica's current beliefs and expectations. These forward-looking statements include statements about the commercialization of YCANTH, cost management initiatives and preservation of capital resources, Verrica's ability to generate cash positive monthly operating results by the end of 2025, the potential receipt of a milestone payment from Torii, the potential exercise of Series A warrants and receipt of proceeds therefrom, and the clinical development and benefits of Verrica's product candidates, including YCANTH (VP-102) and VP-315. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements. Risks and uncertainties that may cause actual results to differ materially include risks and uncertainties related to market conditions, satisfaction of customary closing conditions related to the proposed public offering and other risks and uncertainties that are described in Verrica's Annual Report on Form 10-K for the year ended December 31, 2024 and other filings Verrica makes with the SEC. Any forward-looking statements speak only as of the date of this press release and are based on information available to Verrica as of the date of this release, and Verrica assumes no obligation to, and does not intend to, update any forward-looking statements, whether as a result of new information, future events or otherwise.

| VERRICA PHARMACEUTICALS INC. | |||||||

| Statements of Operations | |||||||

| (in thousands except share and per share data) | |||||||

| (unaudited) | |||||||

| Three Months Ended December 31, | |||||||

| 2024 | 2023 | ||||||

| Product revenue, net | $ | 315 | $ | 1,866 | |||

| Collaboration revenue | 29 | 122 | |||||

| Total revenue | 344 | 1,988 | |||||

| Operating expenses: | |||||||

| Cost of product revenue | 596 | 145 | |||||

| Cost of collaboration revenue | 29 | 128 | |||||

| Selling, general and admin. | 10,019 | 16,994 | |||||

| Research and development | 1,168 | 5,320 | |||||

| Loss on disposal of assets | (58 | ) | 2,537 | ||||

| Total operating expenses | 11,754 | 25,124 | |||||

| Loss from operations | (11,410 | ) | (23,136 | ) | |||

| Interest income | 205 | 792 | |||||

| Interest expense | (2,349 | ) | (2,306 | ) | |||

| Change in fair value of derivative liability | (2,648 | ) | - | ||||

| Other expense | - | 36 | |||||

| Net loss | $ | (16,202 | ) | $ | (24,614 | ) | |

| Net loss per share, basic and diluted | $ | (0.24 | ) | $ | (0.53 | ) | |

| Weighted-average common shares outstanding, basic and diluted | 67,325,994 | 46,311,454 | |||||

| VERRICA PHARMACEUTICALS INC. | |||||||

| Statements of Operations | |||||||

| (in thousands except share and per share data) | |||||||

| Year Ended December 31, | |||||||

| 2024 | 2023 | ||||||

| Product revenue, net | $ | 6,574 | $ | 4,658 | |||

| Collaboration revenue | 992 | 466 | |||||

| Total revenue | 7,566 | 5,124 | |||||

| Operating expenses: | |||||||

| Cost of product revenue | 1,853 | 289 | |||||

| Cost of collaboration revenue | 887 | 457 | |||||

| Selling, general and administrative | 58,822 | 47,305 | |||||

| Research and development | 11,840 | 20,295 | |||||

| Loss on disposal of assets | 83 | 2,537 | |||||

| Total operating expenses | 73,485 | 70,883 | |||||

| Loss from operations | (65,919 | ) | (65,759 | ) | |||

| Interest income | 1,417 | 2,740 | |||||

| Interest expense | (9,412 | ) | (3,962 | ) | |||

| Change in fair value of derivative liability | (2,648 | ) | - | ||||

| Other expense | (17 | ) | (14 | ) | |||

| Net loss | $ | (76,579 | ) | $ | (66,995 | ) | |

| Net loss per share, basic and diluted | $ | (1.48 | ) | $ | (1.48 | ) | |

| Weighted-average common shares outstanding, basic and diluted | 51,808,228 | 45,342,451 | |||||

| VERRICA PHARMACEUTICALS INC. | ||||||

| Selected Balance Sheet Data | ||||||

| (in thousands) | ||||||

| December 31, 2024 | December 31, 2023 | |||||

| Cash and cash equivalents | $ | 46,329 | $ | 69,547 | ||

| Accts rec., prepaid expenses and inventory | 4,850 | 7,983 | ||||

| Total current assets | 51,179 | 77,530 | ||||

| PP&E, lease right of use asset, other | 2,955 | 4,067 | ||||

| Total assets | $ | 54,134 | $ | 81,597 | ||

| Total liabilities | $ | 63,994 | $ | 61,834 | ||

| Total stockholders' equity | (9,860 | ) | 19,763 | |||

| Total liabilities and stockholders' equity | $ | 54,134 | $ | 81,597 | ||

| VERRICA PHARMACEUTICALS INC. | |||||||||||

| Reconciliation of Non-GAAP Financial Measures (unaudited) | |||||||||||

| (in thousands except per share data) | |||||||||||

| Three Months Ended December 31, 2024 | |||||||||||

| Loss from operations | Net loss | Net loss per share | |||||||||

| GAAP | $ | (11,410 | ) | $ | (16,202 | ) | $ | (0.24 | ) | ||

| Non-GAAP Adjustments: | |||||||||||

| Stock-based compensation - | |||||||||||

| Selling, general and admin (a) | 378 | 378 | |||||||||

| Stock-based compensation - | |||||||||||

| Research and development (a) | 378 | 378 | |||||||||

| Derivative liability change in value | - | 2,648 | |||||||||

| Non-cash interest expense (b) | - | 616 | |||||||||

| Adjusted | $ | (10,654 | ) | $ | (12,182 | ) | $ | (0.18 | ) | ||

| Three Months December 31, 2023 | |||||||||||

| Loss from operations | Net loss | Net loss per share | |||||||||

| GAAP | $ | (23,136 | ) | $ | (24,614 | ) | $ | (0.53 | ) | ||

| Non-GAAP Adjustments: | |||||||||||

| Stock-based compensation - | |||||||||||

| Selling, general & admin (a) | 1,573 | 1,573 | |||||||||

| Stock-based compensation - | |||||||||||

| Research & development (a) | 502 | 502 | |||||||||

| Non-cash interest expense (b) | - | 473 | |||||||||

| Adjusted | $ | (21,061 | ) | $ | (22,066 | ) | $ | (0.48 | ) | ||

| Year Ended December 31, 2024 | |||||||||||

| Loss from operations | Net loss | Net loss per share | |||||||||

| GAAP | $ | (65,919 | ) | $ | (76,579 | ) | $ | (1.48 | ) | ||

| Non-GAAP Adjustments: | |||||||||||

| Stock-based compensation - | |||||||||||

| Selling, general and admin (a) | 5,219 | 5,219 | |||||||||

| Stock-based compensation - | |||||||||||

| Research and development (a) | 1,945 | 1,945 | |||||||||

| Derivative liability change in value | - | 2,648 | |||||||||

| Non-cash interest expense (b) | - | 2,187 | |||||||||

| Adjusted | $ | (58,755 | ) | $ | (64,580 | ) | $ | (1.25 | ) | ||

| Year Ended December 31, 2023 | |||||||||||

| Loss from operations | Net loss | Net loss per share | |||||||||

| GAAP | $ | (65,759 | ) | $ | (66,995 | ) | $ | (1.48 | ) | ||

| Non-GAAP Adjustments: | |||||||||||

| Stock-based compensation - | |||||||||||

| Selling, general & admin (a) | 11,796 | 11,796 | |||||||||

| Stock-based compensation - | |||||||||||

| Research & development (a) | 2,580 | 2,580 | |||||||||

| Non-cash interest expense (b) | - | 810 | |||||||||

| Adjusted | $ | (51,383 | ) | $ | (51,809 | ) | $ | (1.14 | ) | ||

| (a) | The effects of non-cash stock-based compensation are excluded because of varying available valuation methodologies and subjective assumptions. Verrica believes this is a useful measure for investors because such exclusion facilitates comparison to peer companies who also provide similar non-GAAP disclosures and is reflective of how management internally manages the business. |

| (b) | The effects of non-cash interest charges are excluded because Verrica believes such exclusion facilitates an understanding of the effects of the debt service obligations on the Company's liquidity and comparisons to peer group companies and is reflective of how management internally manages the business. |

FOR MORE INFORMATION, PLEASE CONTACT:

Investors:

John J Kirby

Interim Chief Financial Officer

jkirby@verrica.com

Kevin Gardner

LifeSci Advisors

kgardner@lifesciadvisors.com