BEIJING, March 12, 2025 /PRNewswire/ -- Hello Group Inc. (NASDAQ: MOMO) ("Hello Group" or the "Company"), a leading player in mainland China's online social networking space, today announced its unaudited financial results for the fourth quarter and the full year ended December 31, 2024.

Fourth Quarter of 2024 Highlights

- Net revenues decreased by 12.2% year over year to RMB2,636.5 million (US$361.2 million *) in the fourth quarter of 2024.

- Net income attributable to Hello Group Inc. decreased to RMB187.2 million (US$25.6 million) in the fourth quarter of 2024, from RMB452.5 million in the same period of 2023.

- Non-GAAP net income attributable to Hello Group Inc. (note 1) decreased to RMB230.5 million (US$31.6 million) in the fourth quarter of 2024, from RMB514.7 million in the same period of 2023.

- Diluted net income per American Depositary Share ("ADS") was RMB1.05 (US$0.14) in the fourth quarter of 2024, compared to RMB2.32 in the same period of 2023.

- Non-GAAP diluted net income per ADS (note 1) was RMB1.30 (US$0.18) in the fourth quarter of 2024, compared to RMB2.63 in the same period of 2023.

- Monthly Active Users ("MAU") on Tantan app were 10.8 million in December 2024, compared to 13.7 million in December 2023.

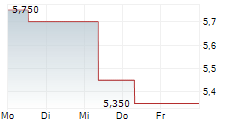

- For the Momo app total paying users was 5.7 million for the fourth quarter of 2024, compared to 7.4 million for the same period last year. Tantan had 0.9 million paying users for the fourth quarter of 2024 compared to 1.2 million from the year ago period.

Full Year 2024 Highlights

- Net revenues decreased by 12.0% year over year to RMB10,563.0 million (US$1,447.1 million) for the full year of 2024.

- Net income attributable to Hello Group Inc. was RMB1,039.6 million (US$142.4 million) for the full year of 2024, compared to RMB1,957.6 million during the same period of 2023.

- Non-GAAP net income attributable to Hello Group Inc. (note 1) was RMB1,232.9 million (US$168.9 million) for the full year of 2024, compared to RMB2,224.7 million during the same period of 2023.

- Diluted net income per ADS was RMB5.57 (US$0.76) for the full year of 2024, compared to RMB9.84 during the same period of 2023.

- Non-GAAP diluted net income per ADS (note 1) was RMB6.60 (US$0.90) for the full year of 2024, compared to RMB11.17 during the same period of 2023.

"2024 was a year fraught with challenges and opportunities. Our team maneuvered through external uncertainties well and delivered satisfactory financial and operational results." commented Yan Tang, Chairman and CEO of Hello Group. "Momo cash cow business continues to be productive, with an ecosystem that is healthier in comparison to the previous year. Our overseas business maintained its robust growth momentum and made more meaningful contributions to the group's financial standing. This impels us to take bolder measures to propel growth and innovation in international markets in the future."

* This press release contains translations of certain Renminbi amounts into U.S. dollars at specified rate solely for the convenience of readers. Unless otherwise noted, all translations from Renminbi to U.S. dollars, in this press release, were made at a rate of RMB7.2993 to US$1.00, the effective noon buying rate for December 31, 2024 as set forth in the H.10 statistical release of the Federal Reserve Board. |

Fourth Quarter of 2024 Financial Results

Net revenues

Total net revenues were RMB2,636.5 million (US$361.2 million) in the fourth quarter of 2024, a decrease of 12.2% from RMB3,002.9 million in the fourth quarter of 2023.

Live video service revenues were RMB1,264.9 million (US$173.3 million) in the fourth quarter of 2024, a decrease of 17.0% from RMB1,523.9 million during the same period of 2023. The decrease was primarily attributable to our proactive operational adjustments to de-emphasize large scale competition events in the Momo app and a soft consumer sentiment in the current macro environment, and to a lesser degree, Tantan pivoting away from the less dating-centric live video service.

Value-added service revenues mainly include virtual gift revenues and membership subscription revenues. Total value-added service revenues were RMB1,326.8 million (US$181.8 million) in the fourth quarter of 2024, a decrease of 6.9% from RMB1,424.9 million during the same period of 2023. The decrease was primarily due to our product adjustments to improve Momo app's ecosystem as well as the impact of the macro economy on consumer sentiment, and to a lesser extent, the decline in Tantan's paying users which was in turn due to the decline in user base. The decrease was partially offset by the revenue growth from the new standalone apps.

Mobile marketing revenues were RMB43.6 million (US$6.0 million) in the fourth quarter of 2024, compared to RMB44.9 million during the same period of 2023.

Net revenues from the Momo segment decreased from RMB2,728.7 million in the fourth quarter of 2023 to RMB2,423.1 million (US$332.0 million) in the fourth quarter of 2024, primarily due to the decrease in net revenues from live video service and value-added service on Momo app. The decrease was partially offset by the revenue growth of the new standalone apps. Net revenues from the Tantan segment decreased from RMB272.2 million in the fourth quarter of 2023 to RMB213.4 million (US$29.2 million) in the fourth quarter of 2024, mainly due to the decrease in net revenues from live video service and value-added service.

Cost and expenses

Cost and expenses were RMB2,407.8 million (US$329.9 million) in the fourth quarter of 2024, a decrease of 1.0% from RMB2,431.8 million in the fourth quarter of 2023. The decrease was primarily attributable to: (a) a decrease in revenue sharing with broadcasters related to live video service on Momo app and Tantan app, and a decrease in revenue sharing with virtual gift recipients of virtual gift service on Momo app. The decrease was partially offset by an increase in revenue sharing with virtual gift recipients for new standalone apps; and (b) a decrease in salary expenses and share-based compensation expenses, due to our continuous optimization in personnel costs and the newly granted share options which had lower fair value. The decrease was partially offset by an increase of RMB 94.1 million (US$12.9 million) in production costs in connection with films.

Non-GAAP cost and expenses (note 1) were RMB2,364.6 million (US$323.9 million) in the fourth quarter of 2024, compared to RMB2,369.5 million during the same period of 2023.

Other operating income, net

Other operating income was RMB8.0 million (US$1.1 million) in the fourth quarter of 2024, compared to RMB30.8 million during the fourth quarter of 2023. The decrease was primarily due to reduced government incentives and input VAT super deduction in the fourth quarter of 2024.

Income from operations

Income from operations was RMB236.7 million (US$32.4 million) in the fourth quarter of 2024, compared to RMB602.0 million during the same period of 2023. Income from operations of the Momo segment was RMB226.4 million (US$31.0 million) in the fourth quarter of 2024, which decreased from RMB576.9 million in the fourth quarter of 2023. Income from operations of the Tantan segment was RMB11.1 million (US$1.5 million) in the fourth quarter of 2024, which decreased from RMB26.8 million in the fourth quarter of 2023.

Non-GAAP income from operations (note 1) was RMB279.9 million (US$38.4 million) in the fourth quarter of 2024, compared to RMB664.2 million during the same period of 2023. Non-GAAP income from operations of the Momo segment was RMB269.4 million (US$36.9 million) in the fourth quarter of 2024, which decreased from RMB638.9 million in the fourth quarter of 2023. Non-GAAP income from operations of the Tantan segment was RMB11.4 million (US$1.6 million) in the fourth quarter of 2024, compared to RMB27.0 million in the fourth quarter of 2023.

Income tax expenses

Income tax expenses were RMB89.5 million (US$12.3 million) in the fourth quarter of 2024, compared to RMB183.4 million in the fourth quarter of 2023. The decrease in income tax expenses was primarily due to the lower profit in the third quarter of 2024, and to a lesser extent, lower withholding tax rate due to our eligibility for a preferential tax rate since the beginning of the year.

Net income

Net income was RMB187.2 million (US$25.6 million) in the fourth quarter of 2024, compared to RMB452.5 million during the same period of 2023. Net income from the Momo segment was RMB176.3 million (US$24.2 million) in the fourth quarter of 2024, compared to RMB430.0 million in the same period of 2023. Net income from the Tantan segment was RMB11.8 million (US$1.6 million) in the fourth quarter of 2024, compared to RMB24.2 million in the fourth quarter of 2023.

Non-GAAP net income (note 1) was RMB230.5 million (US$31.6 million) in the fourth quarter of 2024, compared to RMB514.7 million during the same period of 2023. Non-GAAP net income from the Momo segment was RMB219.3 million (US$30.1 million) in the fourth quarter of 2024, which decreased from RMB492.1 million in the fourth quarter of 2023. Non-GAAP net income of the Tantan segment was RMB12.0 million (US$1.7 million) in the fourth quarter of 2024, compared to RMB24.4 million in the fourth quarter of 2023.

Net income attributable to Hello Group Inc.

Net income attributable to Hello Group Inc. was RMB187.2 million (US$25.6 million) in the fourth quarter of 2024, compared to RMB452.5 million during the same period of 2023.

Non-GAAP net income (note 1) attributable to Hello Group Inc. was RMB230.5 million (US$31.6 million) in the fourth quarter of 2024, compared to RMB514.7 million during the same period of 2023.

Net income per ADS

Diluted net income per ADS was RMB1.05 (US$0.14) in the fourth quarter of 2024, compared to RMB2.32 in the fourth quarter of 2023.

Non-GAAP diluted net income per ADS (note 1) was RMB1.30 (US$0.18) in the fourth quarter of 2024, compared to RMB2.63 in the fourth quarter of 2023.

Cash and cash flow

As of December 31, 2024, the Company's cash, cash equivalents, short-term deposits, long-term deposits, short-term restricted cash and long-term restricted cash totaled RMB14,728.5 million (US$2,017.8 million), compared to RMB13,478.5 million as of December 31, 2023.

Net cash provided by operating activities in the fourth quarter of 2024 was RMB423.6 million (US$58.0 million), compared to RMB415.9 million in the fourth quarter of 2023.

Full Year 2024 Financial Results

Net revenues for the full year of 2024 were RMB10,563.0 million (US$1,447.1 million), a decrease of 12.0% from RMB12,002.3 million in the same period of 2023.

Net income attributable to Hello Group Inc. was RMB1,039.6 million (US$142.4 million) for the full year of 2024, compared to RMB1,957.6 million during the same period of 2023.

Non-GAAP net income attributable to Hello Group Inc. (note 1) was RMB1,232.9 million (US$168.9 million) for the full year of 2024, compared to RMB2,224.7 million during the same period of 2023.

Diluted net income per ADS was RMB5.57 (US$0.76) during the full year of 2024, compared to RMB9.84 in the same period of 2023.

Non-GAAP diluted net income per ADS (note 1) was RMB6.60 (US$0.90) during the full year of 2024, compared to RMB11.17 in the same period of 2023.

Net cash provided by operating activities was RMB1,640.0 million (US$224.7 million) during the full year of 2024, compared to RMB2,277.2 million in the same period of 2023.

Recent Development

Declaration of a special cash dividend

Hello Group's board of directors has declared a special cash dividend in the amount of US$0.30 per ADS, or US$0.15 per ordinary share. The cash dividend will be paid on April 30, 2025 to shareholders of record at the close of business on April 11, 2025. The ex-dividend date will be April 11, 2025. The aggregate amount of cash dividends to be paid is approximately US$50 million, which will be funded by available cash on the Company's balance sheet.

Share repurchase program

On June 7, 2022, Hello Group's board of directors authorized a share repurchase program under which the Company may repurchase up to US$200 million of its shares up to June 6, 2024 (the "Share Repurchase Program"). On March 14, 2024, Hello Group's board of directors approved to amend the Share Repurchase Program to (i) extend the term of the Share Repurchase Program up to June 30, 2026, and (ii) upsize the Share Repurchase Program to US$286.1 million. On March 12, 2025, Hello Group's board of directors approved an additional amendment to the Share Repurchase Program, to (i) extend the term of the Share Repurchase Program up to March 31, 2027, and (ii) upsize the Share Repurchase Program by another $200 million, so that the Company is authorized to, from time to time, acquire up to an aggregate of US$486.1 million worth of its shares in the form of ADSs and/or the ordinary shares of the Company in the open market and through privately negotiated transactions, in block trades and/or through other legally permissible means, depending on market conditions and in accordance with applicable rules and regulations. As of March 12, 2025, after the upsizing of the Share Repurchase Program, the remaining size of the program is US$222 million.

As of March 12, 2025, the Company has repurchased 43.5 million ADSs for US$264.0 million on the open market under Share Repurchase Program announced on June 7, 2022 and amended on March 14, 2024, at an average purchase price of US$6.05 per ADS.

Business Outlook

For the first quarter of 2025, the Company expects total net revenues to be between RMB2.4 billion to RMB2.5 billion, representing a decrease of 6.3% to 2.4% year over year. This forecast reflects the Company's current and preliminary views on the market and operational conditions, which are subject to change.

Note 1: Non-GAAP measures

To supplement our consolidated financial statements presented in accordance with U.S. generally accepted accounting principles ("GAAP"), we, Hello Group, use various non-GAAP financial measures that are adjusted from the most comparable GAAP results to exclude share-based compensation and amortization of intangible assets from business acquisitions, and such adjustments has no impact on income tax.

Reconciliations of our non-GAAP financial measures to our U.S. GAAP financial measures are shown in tables at the end of this earnings release, which provide more details about the non-GAAP financial measures.

Our non-GAAP financial information is provided as additional information to help investors compare business trends among different reporting periods on a consistent basis and to enhance investors' overall understanding of the historical and current financial performance of our continuing operations and our prospects for the future. Our non-GAAP financial information should be considered in addition to results prepared in accordance with GAAP, but should not be considered a substitute for or superior to the GAAP results. In addition, our calculation of the non-GAAP financial measures may be different from the calculation used by other companies, and therefore comparability may be limited.

Our non-GAAP information (including non-GAAP cost and operating expenses, income from operations, net income, net income attributable to Hello Group Inc., and diluted net income per ADS) is adjusted from the most comparable GAAP results to exclude share-based compensation and amortization of intangible assets from business acquisitions, and such adjustments has no impact on income tax. A limitation of using these non-GAAP financial measures is that share-based compensation and amortization of intangible assets from business acquisitions have been and will continue to be for the foreseeable future significant recurring expenses in our results of operations. We compensate for such limitation by providing reconciliations of our non-GAAP measures to our U.S. GAAP measures. Please see the reconciliation tables at the end of this earnings release.

Conference Call

Hello Group's management will host an earnings conference call on Wednesday, March 12, 2025, at 8:00 a.m. U.S. Eastern Time (8:00 p.m. Beijing / Hong Kong Time on March 12, 2025).

Participants can register for the conference call by navigating to:

https://s1.c-conf.com/diamondpass/10045617-nl4uc8.html.

Upon registration, each participant will receive details for the conference call, including dial-in numbers, conference call passcode and a unique access PIN. Please dial in 10 minutes before the call is scheduled to begin.

A telephone replay of the call will be available after the conclusion of the conference call through March 19, 2025. The dial-in details for the replay are as follows:

U.S. / Canada: 1-855-883-1031

Hong Kong: 800-930-639

Passcode: 10045617

Additionally, a live and archived webcast of the conference call will be available on the Investor Relations section of Hello Group's website at https://ir.hellogroup.com.

About Hello Group Inc.

We are a leading player in mainland China's online social networking space. Through Momo, Tantan and other properties within our product portfolio, we enable users to discover new relationships, expand their social connections and build meaningful interactions. Momo is a mobile application that connects people and facilitates social interactions based on location, interests and a variety of online recreational activities. Tantan, which was added into our family of applications through acquisition in May 2018, is a leading social and dating application. Tantan is designed to help its users find and establish romantic connections as well as meet interesting people. Starting from 2019, we have incubated a number of other new apps, such as Hertz, Soulchill, and Duidui, which target more niche markets and more selective demographics.

For investor and media inquiries, please contact:

Hello Group Inc.

Investor Relations

Phone: +86-10-5731-0538

Email: [email protected]

Christensen

In China

Ms. Xiaoyan Su

Phone: +86-10-5900-1548

E-mail: [email protected]

In U.S.

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: [email protected]

Safe Harbor Statement

This news release contains "forward-looking" statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and as defined in the Private Securities Litigation Reform Act of 1995. These forward-looking statements include but are not limited to our management quotes, our financial outlook for the first quarter of 2025, as well as the amount of, timing, methods and funding sources for repurchases of our shares under the share repurchase program.

Our forward-looking statements are not historical facts but instead represent only our belief regarding expected results and events, many of which, by their nature, are inherently uncertain and outside of our control. Our actual results and other circumstances may differ, possibly materially, from the anticipated results and events indicated in these forward-looking statements. Announced results for the fourth quarter of 2024 are preliminary, unaudited and subject to audit adjustment. In addition, we may not meet our financial outlook for the first quarter of 2025 and may be unable to grow our business in the manner planned. We may also modify our strategy for growth. Moreover, there are other risks and uncertainties that could cause our actual results to differ from what we currently anticipate, including those relating to our ability to retain and grow our user base, our ability to attract and retain sufficiently trained professionals to support our operations, our ability to anticipate and develop new services and enhance existing services to meet the demand of our users or customers, the market price of the Company's stock prevailing from time to time, the nature of other investment opportunities presented to the Company from time to time, the Company's cash flows from operations, general economic conditions, and other factors. For additional information on these and other important factors that could adversely affect our business, financial condition, results of operations, and prospects, please see our filings with the U.S. Securities and Exchange Commission.

All information provided in this press release and in the attachments is as of the date of the press release. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise, after the date of this release, except as required by law. Such information speaks only as of the date of this release.

Hello Group Inc. | ||||||||||||

Unaudited Condensed Consolidated Statement of Operations | ||||||||||||

(All amounts in thousands, except share and per share data) | ||||||||||||

Three months | Year | |||||||||||

Ended December 31 | Ended December 31 | |||||||||||

2023 | 2024 | 2024 | 2023 | 2024 | 2024 | |||||||

RMB | RMB | US$ | RMB | RMB | US$ | |||||||

Net revenues: | ||||||||||||

Live video service | 1,523,885 | 1,264,851 | 173,284 | 6,072,871 | 5,092,854 | 697,718 | ||||||

Value-added service | 1,424,893 | 1,326,764 | 181,766 | 5,752,571 | 5,322,726 | 729,210 | ||||||

Mobile marketing | 44,915 | 43,630 | 5,977 | 133,677 | 142,950 | 19,584 | ||||||

Mobile games | 5,441 | - | - | 19,610 | 432 | 59 | ||||||

Other services | 3,798 | 1,251 | 171 | 23,594 | 4,009 | 550 | ||||||

Total net revenues | 3,002,932 | 2,636,496 | 361,198 | 12,002,323 | 10,562,971 | 1,447,121 | ||||||

Cost and expenses: | ||||||||||||

Cost of revenues | (1,770,117) | (1,724,821) | (236,300) | (7,025,394) | (6,447,341) | (883,282) | ||||||

Research and development | (231,445) | (222,684) | (30,508) | (884,590) | (804,425) | (110,206) | ||||||

Sales and marketing | (304,696) | (316,699) | (43,388) | (1,414,949) | (1,329,780) | (182,179) | ||||||

General and administrative | (125,498) | (143,621) | (19,676) | (502,479) | (507,658) | (69,549) | ||||||

Total cost and expenses | (2,431,756) | (2,407,825) | (329,872) | (9,827,412) | (9,089,204) | (1,245,216) | ||||||

Other operating income, net | 30,821 | 8,015 | 1,098 | 130,105 | 59,003 | 8,083 | ||||||

Income from operations | 601,997 | 236,686 | 32,424 | 2,305,016 | 1,532,770 | 209,988 | ||||||

Interest income | 124,354 | 124,045 | 16,994 | 436,253 | 510,964 | 70,002 | ||||||

Interest expense | (20,552) | (36,846) | (5,048) | (62,223) | (127,846) | (17,515) | ||||||

Other gain or loss, net | (31,250) | (46,639) | (6,390) | (26,685) | (90,509) | (12,400) | ||||||

Income before income tax and share of (loss) income on equity method investments | 674,549 | 277,246 | 37,980 | 2,652,361 | 1,825,379 | 250,075 | ||||||

Income tax expenses | (183,377) | (89,497) | (12,261) | (630,023) | (845,022) | (115,768) | ||||||

Income before share of (loss) income on equity method | 491,172 | 187,749 | 25,719 | 2,022,338 | 980,357 | 134,307 | ||||||

Share of (loss) income on equity method investments | (38,703) | (514) | (70) | (70,643) | 59,216 | 8,113 | ||||||

Net income | 452,469 | 187,235 | 25,649 | 1,951,695 | 1,039,573 | 142,420 | ||||||

Less: net loss attributable to non-controlling interest | - | - | - | (5,886) | - | - | ||||||

Net income attributable to the shareholders of Hello Group Inc. | 452,469 | 187,235 | 25,649 | 1,957,581 | 1,039,573 | 142,420 | ||||||

Net income per share attributable to ordinary shareholders | ||||||||||||

Basic | 1.20 | 0.54 | 0.07 | 5.18 | 2.81 | 0.39 | ||||||

Diluted | 1.16 | 0.53 | 0.07 | 4.92 | 2.78 | 0.38 | ||||||

Weighted average shares used in calculating net income per ordinary | ||||||||||||

Basic | 376,317,036 | 349,401,183 | 349,401,183 | 377,639,399 | 369,312,997 | 369,312,997 | ||||||

Diluted | 390,956,175 | 355,325,921 | 355,325,921 | 401,833,328 | 373,591,974 | 373,591,974 | ||||||

Hello Group Inc. | ||||||||||||

Unaudited Condensed Consolidated Statement of Comprehensive Income | ||||||||||||

(All amounts in thousands, except share and per share data) | ||||||||||||

Three months | Year | |||||||||||

Ended December 31 | Ended December 31 | |||||||||||

2023 | 2024 | 2024 | 2023 | 2024 | 2024 | |||||||

RMB | RMB | US$ | RMB | RMB | US$ | |||||||

Net income | 452,469 | 187,235 | 25,649 | 1,951,695 | 1,039,573 | 142,420 | ||||||

Other comprehensive (loss) income, net of tax: | ||||||||||||

Foreign currency translation adjustment | (95,774) | 322,935 | 44,242 | 20,414 | 132,248 | 18,118 | ||||||

Comprehensive income | 356,695 | 510,170 | 69,891 | 1,972,109 | 1,171,821 | 160,538 | ||||||

Less: comprehensive (loss) income attributed to the non-controlling | (5,020) | 7,225 | 990 | 357 | 5,111 | 700 | ||||||

Comprehensive income attributable to Hello Group Inc. | 361,715 | 502,945 | 68,901 | 1,971,752 | 1,166,710 | 159,838 | ||||||

Hello Group Inc. | |||||

Unaudited Condensed Consolidated Balance Sheets | |||||

(All amounts in thousands, except share and per share data) | |||||

December 31 | December 31 | December 31 | |||

2023 | 2024 | 2024 | |||

RMB | RMB | US$ | |||

Assets | |||||

Current assets | |||||

Cash and cash equivalents | 5,620,466 | 4,122,659 | 564,802 | ||

Short-term deposits | 1,270,626 | 2,026,245 | 277,594 | ||

Restricted cash | 10,147 | 4,566,477 | 625,605 | ||

Accounts receivable, net of allowance for doubtful accounts of | 201,517 | 192,317 | 26,347 | ||

Amounts due from related parties | 7,258 | - | - | ||

Prepaid expenses and other current assets | 723,364 | 1,104,172 | 151,271 | ||

Total current assets | 7,833,378 | 12,011,870 | 1,645,619 | ||

Long-term deposits | 3,924,975 | 3,059,860 | 419,199 | ||

Long-term restricted cash | 2,652,299 | 953,285 | 130,600 | ||

Right-of-use assets, net | 109,572 | 252,169 | 34,547 | ||

Property and equipment, net | 659,033 | 897,036 | 122,893 | ||

Intangible assets, net | 17,086 | 86,661 | 11,873 | ||

Rental deposits | 12,962 | 13,280 | 1,819 | ||

Long-term investments | 786,911 | 825,533 | 113,098 | ||

Amounts due from RPT-non current | 20,000 | - | - | ||

Other non-current assets | 180,052 | 110,960 | 15,201 | ||

Deferred tax assets | 31,741 | 36,066 | 4,941 | ||

Goodwill | - | 136,250 | 18,666 | ||

Total assets | 16,228,009 | 18,382,970 | 2,518,456 | ||

Liabilities and equity | |||||

Current liabilities | |||||

Accounts payable | 616,681 | 615,254 | 84,288 | ||

Deferred revenue | 442,805 | 427,702 | 58,595 | ||

Accrued expenses and other current liabilities | 630,617 | 704,410 | 96,504 | ||

Amounts due to related parties | 4,314 | - | - | ||

Lease liabilities due within one year | 60,008 | 141,971 | 19,450 | ||

Income tax payable | 94,719 | 157,057 | 21,517 | ||

Deferred consideration in connection with business acquisitions-current | 27,261 | 28,027 | 3,840 | ||

Convertible Senior Notes-current | - | 20,191 | 2,766 | ||

Long-term borrowings, current portion | 215,615 | 1,938,385 | 265,558 | ||

Short-term borrowings | - | 2,365,535 | 324,077 | ||

Total current liabilities | 2,092,020 | 6,398,532 | 876,595 | ||

Deferred consideration in connection with business acquisitions-non | - | 65,694 | 9,000 | ||

Lease liabilities | 52,171 | 115,105 | 15,769 | ||

Deferred tax liabilities | 24,987 | 241,915 | 33,142 | ||

Convertible Senior Notes | 19,571 | - | - | ||

Long-term borrowings | 1,938,385 | - | - | ||

Other non-current liabilities | 114,085 | 129,051 | 17,680 | ||

Total liabilities | 4,241,219 | 6,950,297 | 952,186 | ||

Shareholder's equity (i) | 11,986,790 | 11,432,673 | 1,566,270 | ||

Total liabilities and shareholder's equity | 16,228,009 | 18,382,970 | 2,518,456 | ||

(i): As of December 31, 2024, the number of ordinary shares outstanding was 328,185,708. |

Hello Group Inc. | ||||||||||||

Unaudited Condensed Consolidated Statement of Cash Flows | ||||||||||||

(All amounts in thousands, except share and per share data) | ||||||||||||

Three months | Year | |||||||||||

Ended December 31 | Ended December 31 | |||||||||||

2023 | 2024 | 2024 | 2023 | 2024 | 2024 | |||||||

RMB | RMB | US$ | RMB | RMB | US$ | |||||||

Cash flows from operating activities: | ||||||||||||

Net income | 452,469 | 187,235 | 25,649 | 1,951,695 | 1,039,573 | 142,420 | ||||||

Adjustments to reconcile net income to net cash provided by | ||||||||||||

Depreciation of property and equipment | 15,394 | 11,868 | 1,626 | 74,492 | 52,847 | 7,240 | ||||||

Amortization of intangible assets | 1,279 | 2,049 | 281 | 5,116 | 5,886 | 806 | ||||||

Share-based compensation | 62,224 | 42,493 | 5,822 | 267,101 | 192,572 | 26,382 | ||||||

Share of loss (income) on equity method investments | 38,703 | 514 | 70 | 70,643 | (59,216) | (8,113) | ||||||

Gain on repurchase of convertible senior notes | - | - | - | (4,565) | - | - | ||||||

Cash received on distributions from equity method investments | - | 730 | 100 | 2,067 | 1,927 | 264 | ||||||

Loss on long-term investments | 31,250 | 46,639 | 6,390 | 31,250 | 90,509 | 12,400 | ||||||

Gain or loss on disposal of property and equipment | 2 | - | - | (518) | (62) | (8) | ||||||

Provision of loss (income) on receivable and other assets | 1,553 | (57) | (8) | 11,624 | 3,618 | 496 | ||||||

Changes in operating assets and liabilities: | ||||||||||||

Accounts receivable | (11,392) | (4,347) | (596) | (21,308) | 7,605 | 1,042 | ||||||

Prepaid expenses and other current assets | (13,492) | 27,035 | 3,704 | 84,802 | (64,811) | (8,879) | ||||||

Amounts due from related parties | (144) | - | - | (27,203) | - | - | ||||||

Rental deposits | 5,524 | - | - | 7,776 | (309) | (42) | ||||||

Deferred tax assets | 1,728 | (128) | (18) | 2,600 | (4,323) | (592) | ||||||

Other non-current assets | 16,033 | 101,561 | 13,914 | (11,606) | (81,837) | (11,212) | ||||||

Accounts payable | (25,118) | 8,139 | 1,115 | 13,707 | (7,571) | (1,037) | ||||||

Income tax payable | 5,456 | 63,625 | 8,717 | 25,952 | 62,337 | 8,540 | ||||||

Deferred revenue | (31,253) | (26,219) | (3,592) | (42,390) | (25,651) | (3,514) | ||||||

Accrued expenses and other current liabilities | (11,586) | 78,250 | 10,720 | (183,772) | 139,607 | 19,126 | ||||||

Amount due to related parties | 639 | - | - | (4,865) | - | - | ||||||

Deferred tax liabilities | (130,345) | (81,498) | (11,165) | (147) | 212,835 | 29,158 | ||||||

Other non-current liabilities | 6,953 | (34,247) | (4,692) | 24,710 | 74,458 | 10,201 | ||||||

Net cash provided by operating activities | 415,877 | 423,642 | 58,037 | 2,277,161 | 1,639,994 | 224,678 | ||||||

Cash flows from investing activities: | ||||||||||||

Purchase of property and equipment | (316,847) | (21,727) | (2,977) | (576,310) | (285,541) | (39,119) | ||||||

Payment for long-term investments | (9,750) | (35,959) | (4,926) | (18,750) | (69,209) | (9,482) | ||||||

Payment for business acquisition | - | (136,642) | (18,720) | - | (136,642) | (18,720) | ||||||

Purchase of short-term deposits | - | - | - | (1,028,556) | (2,133,086) | (292,232) | ||||||

Cash received on maturity of short-term deposits | 800,000 | 1,047,165 | 143,461 | 6,209,820 | 2,128,181 | 291,560 | ||||||

Cash received from sales of short-term investment | 308,550 | - | - | 308,550 | - | - | ||||||

Cash received on investment income distribution | - | 120 | 16 | 1,517 | 120 | 16 | ||||||

Purchase of long-term deposits | (361,165) | - | - | (4,210,025) | (718,860) | (98,483) | ||||||

Cash received on maturity of long-term deposits | - | 200,000 | 27,400 | 1,700,000 | 918,860 | 125,883 | ||||||

Cash received from sales of long-term investment | 10,000 | - | - | 25,000 | 2,000 | 274 | ||||||

Loan to a third-party company | - | (168,933) | (23,144) | - | (265,613) | (36,389) | ||||||

Other investing activities | 1 | 8 | 1 | 1,823 | 903 | 124 | ||||||

Net cash provided by (used in) investing activities | 430,789 | 884,032 | 121,111 | 2,413,069 | (558,887) | (76,568) | ||||||

Cash flows from financing activities: | ||||||||||||

Proceeds from exercise of share options | 31 | 1 | - | 601 | 18 | 2 | ||||||

Repurchase of ordinary shares | (150,191) | (425,176) | (58,249) | (212,195) | (1,197,439) | (164,048) | ||||||

Repurchase of subsidiary's share options | - | - | - | (4,319) | - | - | ||||||

Dividends payment | (20,803) | - | - | (958,052) | (716,302) | (98,133) | ||||||

Proceeds from short-term borrowings | - | - | - | - | 2,365,535 | 324,077 | ||||||

Proceeds from long-term borrowings | - | - | - | 2,154,000 | - | - | ||||||

Repayment of long-term borrowings | - | - | - | - | (215,615) | (29,539) | ||||||

Payment for redemption of convertible bonds | - | - | - | (2,679,942) | - | - | ||||||

Net cash (used in) provided by financing activities | (170,963) | (425,175) | (58,249) | (1,699,907) | 236,197 | 32,359 | ||||||

Effect of exchange rate changes | (34,609) | 172,439 | 23,628 | 93,988 | 42,205 | 5,784 | ||||||

Net increase in cash and cash equivalents | 641,094 | 1,054,938 | 144,527 | 3,084,311 | 1,359,509 | 186,253 | ||||||

Cash, cash equivalents and restricted cash at the beginning of period | 7,641,818 | 8,587,483 | 1,176,480 | 5,198,601 | 8,282,912 | 1,134,754 | ||||||

Cash, cash equivalents and restricted cash at the end of period | 8,282,912 | 9,642,421 | 1,321,007 | 8,282,912 | 9,642,421 | 1,321,007 | ||||||

Hello Group Inc. | |||||||||||||||

Reconciliation of Non-GAAP financial measures to comparable GAAP measures | |||||||||||||||

(All amounts in thousands, except per share data) | |||||||||||||||

1. | Reconciliation of Non-GAAP cost and operating expenses, income from operations, and net income to comparable GAAP measures. | ||||||||||||||

Three months | Three months | Three months | |||||||||||||

Ended December 31, 2023 | Ended December 31, 2024 | Ended December 31, 2024 | |||||||||||||

GAAP | Share-based | Non-GAAP | GAAP | Amortization of | Share-based | Non-GAAP | GAAP | Amortization of | Share-based | Non-GAAP | |||||

RMB | RMB | RMB | RMB | RMB | RMB | RMB | US$ | US$ | US$ | US$ | |||||

Cost of revenues | (1,770,117) | 1,909 | (1,768,208) | (1,724,821) | 128 | 1,822 | (1,722,871) | (236,300) | 18 | 250 | (236,032) | ||||

Research and development | (231,445) | 13,375 | (218,070) | (222,684) | 120 | 10,198 | (212,366) | (30,508) | 16 | 1,397 | (29,095) | ||||

Sales and marketing | (304,696) | 8,653 | (296,043) | (316,699) | 521 | 4,480 | (311,698) | (43,388) | 71 | 614 | (42,703) | ||||

General and administrative | (125,498) | 38,287 | (87,211) | (143,621) | - | 25,993 | (117,628) | (19,676) | - | 3,561 | (16,115) | ||||

Cost and operating expenses | (2,431,756) | 62,224 | (2,369,532) | (2,407,825) | 769 | 42,493 | (2,364,563) | (329,872) | 105 | 5,822 | (323,945) | ||||

Income from operations | 601,997 | 62,224 | 664,221 | 236,686 | 769 | 42,493 | 279,948 | 32,424 | 105 | 5,822 | 38,351 | ||||

Net income attributable to Hello Group Inc. | 452,469 | 62,224 | 514,693 | 187,235 | 769 | 42,493 | 230,497 | 25,649 | 105 | 5,822 | 31,576 | ||||

Hello Group Inc. | |||||||||||||

Reconciliation of Non-GAAP financial measures to comparable GAAP measures | |||||||||||||

(All amounts in thousands, except per share data) | |||||||||||||

1. | Reconciliation of Non-GAAP cost and operating expenses, income from operations, and net income to comparable GAAP measures-continued. | ||||||||||||

Year | Year | Year | |||||||||||

Ended December 31, 2023 | Ended December 31, 2024 | Ended December 31, 2024 | |||||||||||

GAAP | Share-based | Non-GAAP | GAAP | Amortization of | Share-based | Non-GAAP | GAAP | Amortization of | Share-based | Non-GAAP | |||

RMB | RMB | RMB | RMB | RMB | RMB | RMB | US$ | US$ | US$ | US$ | |||

Cost of revenues | (7,025,394) | 6,307 | (7,019,087) | (6,447,341) | 128 | 7,643 | (6,439,570) | (883,282) | 18 | 1,047 | (882,217) | ||

Research and development | (884,590) | 64,561 | (820,029) | (804,425) | 120 | 43,526 | (760,779) | (110,206) | 16 | 5,963 | (104,227) | ||

Sales and marketing | (1,414,949) | 29,066 | (1,385,883) | (1,329,780) | 521 | 19,520 | (1,309,739) | (182,179) | 71 | 2,674 | (179,434) | ||

General and administrative | (502,479) | 167,167 | (335,312) | (507,658) | - | 121,883 | (385,775) | (69,549) | - | 16,698 | (52,851) | ||

Cost and operating expenses | (9,827,412) | 267,101 | (9,560,311) | (9,089,204) | 769 | 192,572 | (8,895,863) | (1,245,216) | 105 | 26,382 | (1,218,729) | ||

Income from operations | 2,305,016 | 267,101 | 2,572,117 | 1,532,770 | 769 | 192,572 | 1,726,111 | 209,988 | 105 | 26,382 | 236,475 | ||

Net income attributable to Hello Group Inc. | 1,957,581 | 267,101 | 2,224,682 | 1,039,573 | 769 | 192,572 | 1,232,914 | 142,420 | 105 | 26,382 | 168,907 | ||

Hello Group Inc. | |||||||||

Unaudited Condensed Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Three months | |||||||||

Ended December 31, 2024 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Net revenues: | |||||||||

Live video service | 1,189,118 | 75,733 | - | 1,264,851 | 173,284 | ||||

Value-added service | 1,198,951 | 127,813 | - | 1,326,764 | 181,766 | ||||

Mobile marketing | 33,772 | 9,858 | - | 43,630 | 5,977 | ||||

Other services | 1,222 | - | 29 | 1,251 | 171 | ||||

Total net revenues | 2,423,063 | 213,404 | 29 | 2,636,496 | 361,198 | ||||

Cost and expenses (ii): | |||||||||

Cost of revenues | (1,621,151) | (103,670) | - | (1,724,821) | (236,300) | ||||

Research and development | (181,255) | (41,429) | - | (222,684) | (30,508) | ||||

Sales and marketing | (267,065) | (48,978) | (656) | (316,699) | (43,388) | ||||

General and administrative | (134,200) | (9,124) | (297) | (143,621) | (19,676) | ||||

Total cost and expenses | (2,203,671) | (203,201) | (953) | (2,407,825) | (329,872) | ||||

Other operating income | 7,032 | 928 | 55 | 8,015 | 1,098 | ||||

Income (loss) from operations | 226,424 | 11,131 | (869) | 236,686 | 32,424 | ||||

Interest income | 123,822 | 216 | 7 | 124,045 | 16,994 | ||||

Interest expense | (36,846) | - | - | (36,846) | (5,048) | ||||

Other gain or loss, net | (46,639) | - | - | (46,639) | (6,390) | ||||

Income (loss) before income tax and share of loss on equity method | 266,761 | 11,347 | (862) | 277,246 | 37,980 | ||||

Income tax (expenses) benefits | (89,919) | 455 | (33) | (89,497) | (12,261) | ||||

Income (loss) before share of loss on equity method investments | 176,842 | 11,802 | (895) | 187,749 | 25,719 | ||||

Share of loss on equity method investments | (514) | - | - | (514) | (70) | ||||

Net income (loss) | 176,328 | 11,802 | (895) | 187,235 | 25,649 | ||||

(ii) Share-based compensation was allocated in cost of revenues and operating expenses as follows: |

Three months | ||||||||||||||||||||||||||||||||||||||||||||||||

Ended December 31, 2024 | ||||||||||||||||||||||||||||||||||||||||||||||||

Momo | Tantan | QOOL | Total | Total | ||||||||||||||||||||||||||||||||||||||||||||

RMB | RMB | RMB | RMB | US$ | ||||||||||||||||||||||||||||||||||||||||||||

Cost of revenues | 1,822 | - | - | 1,822 | 250 | |||||||||||||||||||||||||||||||||||||||||||

Research and development | 9,956 | 242 | - | 10,198 | 1,397 | |||||||||||||||||||||||||||||||||||||||||||

Sales and marketing | 4,480 | - | - | 4,480 | 614 | |||||||||||||||||||||||||||||||||||||||||||

General and administrative | 25,993 | - | - | 25,993 | 3,561 | |||||||||||||||||||||||||||||||||||||||||||

Total cost and expenses | 42,251 | 242 | - | 42,493 | 5,822 | |||||||||||||||||||||||||||||||||||||||||||

Hello Group Inc. | |||||||||

Reconciliation of GAAP and NON-GAAP Results of Unaudited Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Three months | |||||||||

Ended December 31, 2024 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Income (loss) from operations | 226,424 | 11,131 | (869) | 236,686 | 32,424 | ||||

Share-based compensation | 42,251 | 242 | - | 42,493 | 5,822 | ||||

Amortization of intangible assets from | 769 | - | - | 769 | 105 | ||||

Non-GAAP income (loss) from | 269,444 | 11,373 | (869) | 279,948 | 38,351 | ||||

Net income (loss) | 176,328 | 11,802 | (895) | 187,235 | 25,649 | ||||

Share-based compensation | 42,251 | 242 | - | 42,493 | 5,822 | ||||

Amortization of intangible assets from | 769 | - | - | 769 | 105 | ||||

Non-GAAP net income (loss) | 219,348 | 12,044 | (895) | 230,497 | 31,576 | ||||

Hello Group Inc. | |||||||||

Unaudited Condensed Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Three months | |||||||||

Ended December 31, 2023 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$[1] | |||||

Net revenues: | |||||||||

Live video service | 1,423,730 | 100,155 | - | 1,523,885 | 214,635 | ||||

Value-added service | 1,264,358 | 160,535 | - | 1,424,893 | 200,692 | ||||

Mobile marketing | 33,395 | 11,520 | - | 44,915 | 6,326 | ||||

Mobile games | 5,441 | - | - | 5,441 | 766 | ||||

Other services | 1,760 | - | 2,038 | 3,798 | 535 | ||||

Total net revenues | 2,728,684 | 272,210 | 2,038 | 3,002,932 | 422,954 | ||||

Cost and expenses (iii): | |||||||||

Cost of revenues | (1,638,915) | (130,237) | (965) | (1,770,117) | (249,316) | ||||

Research and development | (180,343) | (51,102) | - | (231,445) | (32,598) | ||||

Sales and marketing | (244,043) | (58,444) | (2,209) | (304,696) | (42,916) | ||||

General and administrative | (117,923) | (6,882) | (693) | (125,498) | (17,676) | ||||

Total cost and expenses | (2,181,224) | (246,665) | (3,867) | (2,431,756) | (342,506) | ||||

Other operating income, net | 29,442 | 1,301 | 78 | 30,821 | 4,341 | ||||

Income (loss) from operations | 576,902 | 26,846 | (1,751) | 601,997 | 84,789 | ||||

Interest income | 124,294 | 57 | 3 | 124,354 | 17,515 | ||||

Interest expense | (20,552) | - | - | (20,552) | (2,895) | ||||

Other gain or loss, net | (31,250) | - | - | (31,250) | (4,401) | ||||

Income (loss) before income tax and share of loss on equity | 649,394 | 26,903 | (1,748) | 674,549 | 95,008 | ||||

Income tax expenses | (180,669) | (2,708) | - | (183,377) | (25,828) | ||||

Income (loss) before share of loss on equity method investments | 468,725 | 24,195 | (1,748) | 491,172 | 69,180 | ||||

Share of loss on equity method investments | (38,703) | - | - | (38,703) | (5,451) | ||||

Net income (loss) | 430,022 | 24,195 | (1,748) | 452,469 | 63,729 | ||||

(iii) Share-based compensation was allocated in cost of revenues and operating expenses as follows: |

Three months | |||||||||||||||||||||||||||||||||

Ended December 31, 2023 | |||||||||||||||||||||||||||||||||

Momo | Tantan | QOOL | Total | Total | |||||||||||||||||||||||||||||

RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||||||||||||

Cost of revenues | 1,905 | 4 | - | 1,909 | 269 | ||||||||||||||||||||||||||||

Research and development | 13,194 | 181 | - | 13,375 | 1,884 | ||||||||||||||||||||||||||||

Sales and marketing | 8,653 | - | - | 8,653 | 1,219 | ||||||||||||||||||||||||||||

General and administrative | 38,279 | 8 | - | 38,287 | 5,393 | ||||||||||||||||||||||||||||

Total cost and expenses | 62,031 | 193 | - | 62,224 | 8,765 | ||||||||||||||||||||||||||||

[1] All translations from RMB to U.S. dollars are made at a rate of RMB7.0999 to US$1.00, the effective noon buying rate for December 29, 2023 as set forth in the H.10 statistical release of the Federal Reserve Board. |

Hello Group Inc. | |||||||||

Reconciliation of GAAP and NON-GAAP Results of Unaudited Segment Report (All amounts in thousands, except share and per share data) | |||||||||

Three months | |||||||||

Ended December 31, 2023 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Income (loss) from operations | 576,902 | 26,846 | (1,751) | 601,997 | 84,789 | ||||

Share-based compensation | 62,031 | 193 | - | 62,224 | 8,765 | ||||

Non-GAAP income (loss) from | 638,933 | 27,039 | (1,751) | 664,221 | 93,554 | ||||

Net income (loss) | 430,022 | 24,195 | (1,748) | 452,469 | 63,729 | ||||

Share-based compensation | 62,031 | 193 | - | 62,224 | 8,765 | ||||

Non-GAAP net income (loss) | 492,053 | 24,388 | (1,748) | 514,693 | 72,494 | ||||

Hello Group Inc. | |||||||||

Unaudited Condensed Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Year | |||||||||

Ended December 31, 2024 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Net revenues: | |||||||||

Live video service | 4,779,865 | 312,989 | - | 5,092,854 | 697,718 | ||||

Value-added service | 4,772,811 | 549,915 | - | 5,322,726 | 729,210 | ||||

Mobile marketing | 105,169 | 37,781 | - | 142,950 | 19,584 | ||||

Mobile games | 432 | - | - | 432 | 59 | ||||

Other services | 3,137 | - | 872 | 4,009 | 550 | ||||

Total net revenues | 9,661,414 | 900,685 | 872 | 10,562,971 | 1,447,121 | ||||

Cost and expenses (iv): | |||||||||

Cost of revenues | (6,029,415) | (417,887) | (39) | (6,447,341) | (883,282) | ||||

Research and development | (643,457) | (160,968) | - | (804,425) | (110,206) | ||||

Sales and marketing | (1,103,475) | (220,966) | (5,339) | (1,329,780) | (182,179) | ||||

General and administrative | (473,778) | (32,868) | (1,012) | (507,658) | (69,549) | ||||

Total cost and expenses | (8,250,125) | (832,689) | (6,390) | (9,089,204) | (1,245,216) | ||||

Other operating income | 56,069 | 2,853 | 81 | 59,003 | 8,083 | ||||

Income (loss) from operations | 1,467,358 | 70,849 | (5,437) | 1,532,770 | 209,988 | ||||

Interest income | 510,162 | 789 | 13 | 510,964 | 70,002 | ||||

Interest expense | (127,846) | - | - | (127,846) | (17,515) | ||||

Other gain or loss, net | (90,509) | - | - | (90,509) | (12,400) | ||||

Income (loss) before income tax and share of income on equity method | 1,759,165 | 71,638 | (5,424) | 1,825,379 | 250,075 | ||||

Income tax expenses | (843,640) | (1,349) | (33) | (845,022) | (115,768) | ||||

Income (loss) before share of income on equity method investments | 915,525 | 70,289 | (5,457) | 980,357 | 134,307 | ||||

Share of income on equity method investments | 59,216 | - | - | 59,216 | 8,113 | ||||

Net income (loss) | 974,741 | 70,289 | (5,457) | 1,039,573 | 142,420 | ||||

(iv) Share-based compensation was allocated in cost of revenues and operating expenses as follows: |

Year | |||||||||||||||||||||||||||||||||||||||||

Ended December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

Momo | Tantan | QOOL | Total | Total | |||||||||||||||||||||||||||||||||||||

RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||||||||||||||||||||

Cost of revenues | 7,639 | 4 | - | 7,643 | 1,047 | ||||||||||||||||||||||||||||||||||||

Research and development | 38,452 | 5,074 | - | 43,526 | 5,963 | ||||||||||||||||||||||||||||||||||||

Sales and marketing | 19,520 | - | - | 19,520 | 2,674 | ||||||||||||||||||||||||||||||||||||

General and administrative | 121,867 | 16 | - | 121,883 | 16,698 | ||||||||||||||||||||||||||||||||||||

Total cost and expenses | 187,478 | 5,094 | - | 192,572 | 26,382 | ||||||||||||||||||||||||||||||||||||

Hello Group Inc. | |||||||||

Reconciliation of GAAP and NON-GAAP Results of Unaudited Segment Report (All amounts in thousands, except share and per share data) | |||||||||

Year | |||||||||

Ended December 31, 2024 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Income (loss) from operations | 1,467,358 | 70,849 | (5,437) | 1,532,770 | 209,988 | ||||

Share-based compensation | 187,478 | 5,094 | - | 192,572 | 26,382 | ||||

Amortization of intangible assets from | 769 | - | - | 769 | 105 | ||||

Non-GAAP income (loss) from operations | 1,655,605 | 75,943 | (5,437) | 1,726,111 | 236,475 | ||||

Net income (loss) | 974,741 | 70,289 | (5,457) | 1,039,573 | 142,420 | ||||

Share-based compensation | 187,478 | 5,094 | - | 192,572 | 26,382 | ||||

Amortization of intangible assets from | 769 | - | - | 769 | 105 | ||||

Non-GAAP net income (loss) | 1,162,988 | 75,383 | (5,457) | 1,232,914 | 168,907 | ||||

Hello Group Inc. | |||||||||

Unaudited Condensed Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Year | |||||||||

Ended December 31, 2023 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Net revenues: | |||||||||

Live video service | 5,567,894 | 504,977 | - | 6,072,871 | 855,346 | ||||

Value-added service | 5,085,541 | 667,030 | - | 5,752,571 | 810,233 | ||||

Mobile marketing | 109,125 | 24,552 | - | 133,677 | 18,828 | ||||

Mobile games | 19,610 | - | - | 19,610 | 2,762 | ||||

Other services | 16,337 | - | 7,257 | 23,594 | 3,323 | ||||

Total net revenues | 10,798,507 | 1,196,559 | 7,257 | 12,002,323 | 1,690,492 | ||||

Cost and expenses (v): | |||||||||

Cost of revenues | (6,404,042) | (599,348) | (22,004) | (7,025,394) | (989,506) | ||||

Research and development | (664,340) | (220,250) | - | (884,590) | (124,592) | ||||

Sales and marketing | (1,138,505) | (268,652) | (7,792) | (1,414,949) | (199,291) | ||||

General and administrative | (467,537) | (26,482) | (8,460) | (502,479) | (70,773) | ||||

Total cost and expenses | (8,674,424) | (1,114,732) | (38,256) | (9,827,412) | (1,384,162) | ||||

Other operating income | 125,318 | 4,411 | 376 | 130,105 | 18,325 | ||||

Income (loss) from operations | 2,249,401 | 86,238 | (30,623) | 2,305,016 | 324,655 | ||||

Interest income | 435,451 | 713 | 89 | 436,253 | 61,445 | ||||

Interest expense | (62,223) | - | - | (62,223) | (8,764) | ||||

Other gain or loss, net | (26,685) | - | - | (26,685) | (3,759) | ||||

Income (loss) before income tax and share of loss on equity method | 2,595,944 | 86,951 | (30,534) | 2,652,361 | 373,577 | ||||

Income tax expenses | (623,844) | (6,179) | - | (630,023) | (88,737) | ||||

Income (loss) before share of loss on equity method investments | 1,972,100 | 80,772 | (30,534) | 2,022,338 | 284,840 | ||||

Share of loss on equity method investments | (70,643) | - | - | (70,643) | (9,950) | ||||

Net income (loss) | 1,901,457 | 80,772 | (30,534) | 1,951,695 | 274,890 | ||||

(v) Share-based compensation was allocated in cost of revenues and operating expenses as follows: |

Year | |||||||||||||||||||||||||||||||||

Ended December 31, 2023 | |||||||||||||||||||||||||||||||||

Momo | Tantan | QOOL | Total | Total | |||||||||||||||||||||||||||||

RMB | RMB | RMB | RMB | US$ | |||||||||||||||||||||||||||||

Cost of revenues | 6,167 | 140 | - | 6,307 | 888 | ||||||||||||||||||||||||||||

Research and development | 49,987 | 14,574 | - | 64,561 | 9,093 | ||||||||||||||||||||||||||||

Sales and marketing | 29,061 | 5 | - | 29,066 | 4,094 | ||||||||||||||||||||||||||||

General and administrative | 167,135 | 32 | - | 167,167 | 23,545 | ||||||||||||||||||||||||||||

Total cost and expenses | 252,350 | 14,751 | - | 267,101 | 37,620 | ||||||||||||||||||||||||||||

Hello Group Inc. | |||||||||

Reconciliation of GAAP and NON-GAAP Results of Unaudited Segment Report | |||||||||

(All amounts in thousands, except share and per share data) | |||||||||

Year | |||||||||

ended December 31, 2023 | |||||||||

Momo | Tantan | QOOL | Total | Total | |||||

RMB | RMB | RMB | RMB | US$ | |||||

Operating income (loss) from operations | 2,249,401 | 86,238 | (30,623) | 2,305,016 | 324,655 | ||||

Share-based compensation | 252,350 | 14,751 | - | 267,101 | 37,620 | ||||

Non-GAAP operating income (loss) from | 2,501,751 | 100,989 | (30,623) | 2,572,117 | 362,275 | ||||

Net income (loss) | 1,901,457 | 80,772 | (30,534) | 1,951,695 | 274,890 | ||||

Share-based compensation | 252,350 | 14,751 | - | 267,101 | 37,620 | ||||

Non-GAAP net income (loss) | 2,153,807 | 95,523 | (30,534) | 2,218,796 | 312,510 | ||||

SOURCE Hello Group Inc.