- Net sales for the year ended December 31, 2024 were $57.8 million, down 5.5% compared to $61.2 million for the year ended December 31, 2023

- Net income for the year ended December 31, 2024 was $3.9 million, or $0.35 per diluted share, compared to $4.2 million, or $0.35 per diluted share, for the year ended December 31, 2023

- Cash of $18.6 million and working capital of $47.5 million with no debt, as of December 31, 2024

NOGALES, Ariz., March 12, 2025 (GLOBE NEWSWIRE) -- Alpha Pro Tech, Ltd. (NYSE American: APT), a leading manufacturer of products designed to protect people, products and environments, including disposable protective apparel and building products, today announced financial results for the three month period and full year, ended December 31, 2024.

Lloyd Hoffman, President and Chief Executive Officer of Alpha Pro Tech, commented, "The housing market continues to show weakness, with housing starts down 4.4% in 2024 compared to 2023. Although sales of the core building products (housewrap and synthetic roof underlayment), were down 7.9% in 2024, exceeding the decline in housing starts, we are optimistic about the future for the following reasons. Excluding the decline of sales by two private label distributors, the 2024 sales performance of our core building products would have resulted in a lower percentage decline then the reduction in housing starts, indicating that we otherwise outperformed the overall market.

Housewrap sales were encouraging through the first nine months of 2024, especially since the percentage decline of housing starts was higher than the percentage decline of housewrap sales of 2.6%. Lower housewrap sales in the final quarter of 2024, were primarily due to one of our larger distributors losing business from certain end users, but we have not lost share with this distributor. Presenting an additional challenge in 2024, multi-family housing starts in 2024 were down 11.3% compared to 2023 with 2024 being the lowest in ten years.

Sales of synthetic roof underlayment, which were down double digits through the first nine months of 2024, ended the year down single digits. After hurricanes Helene and Milton, we saw a surge in synthetic roof underlayment orders in the fourth quarter of 2024 to assist in the southeast rebuild. Sales of this product line continue to be affected by uncertain economic conditions, more offshore competition and a push in the market to reduce product selling prices. We expect growth in 2025 in the synthetic roof underlayment category.

Despite the challenges faced in 2024, our efforts are now focused on builders and contractors and we are educating the industry on our extensive manufacturing capabilities which are expected to contribute to future growth. Our top fifteen accounts have increased sales compared to 2023, excluding one of our top accounts mentioned above. This is a testament to the hard work and commitment of our sales team. Late in the year, we added two Territory Mangers that will assist in strengthening relationships with our customers and driving new business.

Sales of other woven material decreased by $1.3 million, or 28.2% in 2024 compared to 2023, primarily due to one of our customers being acquired by another company. We are pursuing new opportunities for other woven material sales that could improve sales. We have recently created the position of Director of Product and Business Development. This role will be instrumental in helping us expand our product offerings and explore new opportunities and industries where we currently do not have a presence.

Management expects growth in the Building Supply segment in the coming year, as the projected number of housing starts in 2025 is expected to increase. However, there continues to be uncertainty in housing starts and the economy in general that could affect this segment."

Mr. Hoffman continued, "Sales of disposable protective garments in 2024 were up approximately 19% as compared to pre-pandemic levels, increasing due to further integration and growth among some of our largest regional channel partners. We have signed new distribution agreements with regional and national channel partners, which should provide for an enhanced level of engagement and mutual growth incentives. In addition, we signed a new agreement with our largest international channel partner and achieved elevated status and were named as a preferred supplier going forward. We believe this achievement will provide some growth opportunities, and management expects continued growth for disposable protective garments in 2025."

2024 Results

Consolidated sales for the three months ended December 31, 2024 decreased to $13.8 million, from $15.3 million for the three months ended December 31, 2023, representing a decrease of $1.5 million, or 9.5%.

Building Supply segment sales for the three months ended December 31, 2024, decreased by $800,000, or 8.1%, to $9.0 million, compared to $9.8 million for the three months ended December 31, 2023. This decrease during the three months ended December 31, 2024 was primarily due to a 16.9% decrease in sales of housewrap and a 17.6% decrease in sales of other woven material, partially offset by an increase in sales of synthetic roof underlayment of 5%, compared to the same period of 2023.

Disposable Protective Apparel segment sales for the three months ended December 31, 2024 decreased by $700,000, or 11.9%, to $4.8 million, compared to $5.5 million for the same period of 2023. This decrease was due to a 13.9% decrease in sales of disposable protective garments and a 2.2% decrease in sales of face masks, slightly offset by a 1.4% increase in face shield sales.

Consolidated sales for the year ended December 31, 2024, decreased to $57.8 million, from $61.2 million for the year ended December 31, 2023, representing a decrease of $3.4 million, or 5.5%.

Building Supply segment sales for the year ended December 31, 2024, decreased by $4.4 million, or 11.0%, to $36.0 million compared to $40.4 million for the year ended December 31, 2023. This decrease was primarily due to a 6.4% decrease in sales of housewrap, an 8.8% decrease in sales of synthetic roof underlayment and a 28.2% decrease in sales of other woven material, compared to the same period of 2023.

Disposable Protective Apparel segment sales for the year ended December 31, 2024, increased by $1.0 million or 5.0%, to $21.9 million, compared to $20.8 million for 2023. This increase was due to a 0.8% increase in sales of disposable protective garments and a 43.5% increase in sales of face shields, partially offset by a 34.6% decrease in sales of face masks.

Gross Profit

Gross profit decreased by $516,000, or 9.0%, to $5.2 million for the three months ended December 31, 2024, from $5.7 million for the three months ended December 31, 2023. The gross profit margin was 37.6% for the three months ended December 31, 2024, compared to 37.4% for the three months ended December 31, 2023.

Gross profit increased by $104,000, or 0.5%, to $22.9 million for the year ended December 31, 2024, from $22.8 million for the year ended December 31, 2023. The gross profit margin was 39.6% for the year ended December 31, 2024, compared to 37.3% for the year ended December 31, 2023.

The gross profit margin in 2024 was positively affected by a margin increase in both the Disposable Protective Apparel and Building Supply segments. However, management expects that the gross profit margin could be negatively affected during 2025 by ocean freight rates that experienced significant volatility in 2024, due to factors such as geopolitical tensions, labor disputes and market dynamics. As we progress into next year, the outlook suggests continued volatility and unpredictability in freight rates.

Net Income

Net income for the three months ended December 31, 2024 was $847,000, compared to net income of $1.1 million for the three months ended December 31, 2023, representing a decrease of $214,000, or 20.2%. Net income as a percentage of net sales for the three months ended December 31, 2024 was 6.1%, and net income as a percentage of net sales for the same period of 2023 was 7.0%. Basic and diluted earnings per common share for the three months ended December 31, 2024, and 2023 were $0.08 and $0.09, respectively.

Net income for the year ended December 31, 2024, was $3.9 million compared to net income of $4.2 million for 2023, representing a decrease of $260,000, or 6.2%. The net income decrease between 2024 and 2023 was due to a decrease in income before provision for income taxes of $405,000, partially offset by a decrease in provision for income taxes of $145,000. Net income as a percentage of net sales was 6.8% for both years ended December 31, 2024 and 2023. Basic and diluted earnings per common share for the years ended December 31, 2024 and 2023, were $0.35.

Balance Sheet

As of December 31, 2024, the Company had cash of $18.6 million compared to $20.4 million as of December 31, 2023. Working capital totaled $47.5 million and the Company's current ratio was 16:1, compared to a current ratio of 21:1 as of December 31, 2023.

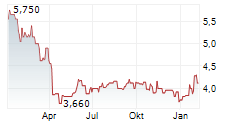

Colleen McDonald, Chief Financial Officer, commented, "As of December 31, 2024, we had $2.7 million available for additional stock purchases under our stock repurchase program. During the year ended December 31, 2024, we repurchased 831,000 shares of common stock at a cost of $4.5 million. As of December 31, 2024, we had repurchased a total of 21.2 million shares of common stock at a cost of approximately $54.8 million through our repurchase program. We retire all stock upon repurchase and future repurchases are expected to be funded from cash on hand and cash flows from operating activities."

About Alpha Pro Tech, Ltd.

Alpha Pro Tech, Ltd. is the parent company of Alpha Pro Tech, Inc. and Alpha ProTech Engineered Products, Inc. Alpha Pro Tech, Inc. develops, manufactures and markets innovative disposable and limited-use protective apparel products for the industrial, clean room, medical and dental markets. Alpha ProTech Engineered Products, Inc. manufactures and markets a line of construction weatherization products, including building wrap and roof underlayment. The Company has manufacturing facilities in Nogales, Arizona, Valdosta, Georgia; and a joint venture in India. For more information and copies of all news releases and financials, visit Alpha Pro Tech's website at http://www.alphaprotech.com.

Certain statements made in this press release constitute "forward-looking statements" within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include any statement that may predict, forecast, indicate or imply future results, performance or achievements instead of historical facts and may be identified generally by the use of forward-looking terminology and words such as "expects," "anticipates," "estimates," "believes," "predicts," "intends," "plans," "potentially," "may," "continue," "should," "will" and words of similar meaning. Without limiting the generality of the preceding statement, all statements in this press release relating to estimated and projected earnings, expectations regarding order volume, timing of fulfillment of orders, production capacity and our plans to ramp up production and expand capacity, product demand, availability of raw materials and supply chain access, margins, costs, expenditures, cash flows, sources of capital, growth rates and future financial and operating results are forward-looking statements. We caution investors that any such forward-looking statements are only estimates based on current information and involve risks and uncertainties that may cause actual results to differ materially from the results contained in the forward-looking statements. We cannot give assurances that any such statements will prove to be correct. Factors that could cause actual results to differ materially from those estimated by us include the risks, uncertainties and assumptions described from time to time in our public releases and reports filed with the Securities and Exchange Commission, including, but not limited to, our most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q. Specifically, these factors include, but are not limited to, our exposure to foreign currency exchange risks related to our unconsolidated affiliate operations in India; potential failure to remediate the material weakness in our internal controls; our partnership with a joint venture partner; the loss of any major customer or a reduction in order volume by our customers; the inability of our suppliers and contractors to meet our requirements; potential challenges related to international manufacturing; the inability to protect our intellectual property; competition in our industry; customer preferences; the timing and market acceptance of new product offerings; changes in global economic conditions; security breaches or disruptions to the information technology infrastructure; risks related to climate change and natural disasters or other events beyond ourcontrol; the effects of tariff policies and potential countermeasure; potential liabilities from environmental laws and regulations; uncertainties with respect to the development, deployment, and use of artificial intelligence; the impact of legal and regulatory proceedings or compliance challenges; and volatility in our common stock price and our investments. We also caution investors that the forward-looking information described herein represents our outlook only as of this date, and we undertake no obligation to update or revise any forward-looking statements to reflect events or developments after the date of this press release. Given these uncertainties, investors should not place undue reliance on forward-looking statements as a prediction of actual results.

| Company Contact: | Investor Relations Contact: |

| Alpha Pro Tech, Ltd. | HIR Holdings |

| Donna Millar | Cameron Donahue |

| 905-479-0654 | 651-707-3532 |

| e-mail:ir@alphaprotech.com | e-mail:cameron@hirholdings.com |

| Consolidated Balance Sheets | |||||||

| December 31, | December 31, | ||||||

| 2024 | 2023 | ||||||

| Assets | |||||||

| Current assets: | |||||||

| Cash and cash equivalents | $ | 18,636,000 | $ | 20,378,000 | |||

| Accounts receivable, net | 3,692,000 | 5,503,000 | |||||

| Accounts receivable, related party | 1,202,000 | 1,042,000 | |||||

| Inventories, net | 22,733,000 | 20,131,000 | |||||

| Prepaid expenses | 4,376,000 | 6,010,000 | |||||

| Total current assets | 50,639,000 | 53,064,000 | |||||

| Property and equipment, net | 8,520,000 | 5,587,000 | |||||

| Goodwill | 55,000 | 55,000 | |||||

| Right-of-use assets | 8,714,000 | 4,810,000 | |||||

| Equity investment in unconsolidated affiliate | 5,814,000 | 5,247,000 | |||||

| Total assets | $ | 73,742,000 | $ | 68,763,000 | |||

| Liabilities and Shareholders' Equity | |||||||

| Current liabilities: | |||||||

| Accounts payable | $ | 1,283,000 | $ | 802,000 | |||

| Accrued liabilities | 947,000 | 1,103,000 | |||||

| Lease liabilities | 893,000 | 661,000 | |||||

| Total current liabilities | 3,123,000 | 2,566,000 | |||||

| Lease liabilities, net of current portion | 7,882,000 | 4,187,000 | |||||

| Deferred income tax liabilities, net | 503,000 | 442,000 | |||||

| Total liabilities | 11,508,000 | 7,195,000 | |||||

| Commitments and contingencies | |||||||

| Shareholders' equity: | |||||||

| Common stock, $.01 par value: 50,000,000 shares authorized; 10,816,878 and 11,416,212 shares outstanding as of December 31, 2024 and December 31, 2023, respectively | 108,000 | 114,000 | |||||

| Additional paid-in capital | 16,368,000 | 16,339,000 | |||||

| Retained earnings | 47,257,000 | 46,552,000 | |||||

| Accumulated other comprehensive loss | (1,499,000) | (1,437,000) | |||||

| Total shareholders' equity | 62,234,000 | 61,568,000 | |||||

| Total liabilities and shareholders' equity | $ | 73,742,000 | $ | 68,763,000 | |||

| Consolidated Statements of Income | |||||||||||||

| Three Months Ended | Year Ended | ||||||||||||

| December 31, | December 31, | ||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||

| Net sales | $ | 13,817,000 | $ | 15,265,000 | $ | 57,840,000 | $ | 61,232,000 | |||||

| Cost of goods sold, excluding depreciation and amortization | 8,627,000 | 9,559,000 | 34,907,000 | 38,403,000 | |||||||||

| Gross profit | 5,190,000 | 5,706,000 | 22,933,000 | 22,829,000 | |||||||||

| Operating expenses: | |||||||||||||

| Selling, general and administrative | 4,377,000 | 4,497,000 | 18,611,000 | 17,772,000 | |||||||||

| Depreciation and amortization | 139,000 | 238,000 | 873,000 | 925,000 | |||||||||

| Total operating expenses | 4,516,000 | 4,735,000 | 19,484,000 | 18,697,000 | |||||||||

| Income from operations | 674,000 | 971,000 | 3,449,000 | 4,132,000 | |||||||||

| Other income: | |||||||||||||

| Equity in income of unconsolidated affiliate | 194,000 | 85,000 | 629,000 | 477,000 | |||||||||

| Gain on sale of property and equipment | - | - | 30,000 | - | |||||||||

| Interest income, net | 212,000 | 267,000 | 912,000 | 816,000 | |||||||||

| Total other income, net | 406,000 | 352,000 | 1,571,000 | 1,293,000 | |||||||||

| Income before provision for income taxes | 1,080,000 | 1,323,000 | 5,020,000 | 5,425,000 | |||||||||

| Provision for income taxes | 233,000 | 262,000 | 1,091,000 | 1,236,000 | |||||||||

| Net income | $ | 847,000 | $ | 1,061,000 | $ | 3,929,000 | $ | 4,189,000 | |||||

| Basic earnings per common share | $ | 0.08 | $ | 0.09 | $ | 0.35 | $ | 0.35 | |||||

| Diluted earnings per common share | $ | 0.08 | $ | 0.09 | $ | 0.35 | $ | 0.35 | |||||