Fiskars Corporation

Stock Exchange Release

March 12, 2025 at 5.50 p.m. EET

Resolutions of Fiskars Corporation's Annual General Meeting 2025

The Annual General Meeting of shareholders of Fiskars Corporation was held at Finlandia Hall, Congress wing (visiting address: Mannerheimintie 13 e, Entrance loppy M1, Helsinki Finland), on March 12, 2025.

The Annual General Meeting approved the financial statements for 2024 and discharged the members of the Board and the President and CEO from the liability.

THE USE OF PROFIT SHOWN ON THE BALANCE SHEET AND THE PAYMENT OF DIVIDED

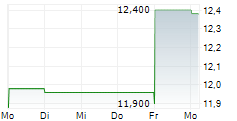

The Annual General Meeting decided, in accordance with the proposal of the Board of Directors, to pay a dividend of EUR 0.84 per share for the financial period that ended on December 31, 2024. The dividend will be paid in two instalments. The ex-dividend date for the first instalment of EUR 0.42 per share will be March 13, 2025. The first instalment will be paid to a shareholder who is registered in the shareholders' register of the company maintained by Euroclear Finland Ltd. on the dividend record date March 14, 2025. The payment date for this instalment is March 21, 2025.

The second instalment of EUR 0.42 per share will be paid in September 2025. The second instalment will be paid to a shareholder who is registered in the shareholders' register of the company maintained by Euroclear Finland Oy on the dividend record date, which, together with the payment date, will be decided by the Board of Directors in its meeting scheduled for September 9, 2025. The ex-dividend date for the second instalment would be September 10, 2025, the dividend record date would be September 11, 2025 and the dividend payment date would be September 18, 2025, at the latest.

REMUNERATION REPORT FOR GOVERNING BODIES

The Annual General Meeting decided to adopt the remuneration report for the governing bodies.

ELECTION AND REMUNERATION OF THE BOARD OF DIRECTORS

The Annual General Meeting decided that the Board of Directors shall consist of nine (9) members. Albert Ehrnrooth, Paul Ehrnrooth, Louise Fromond, Julia Goldin, Carl-Martin Lindahl, Jyri Luomakoski and Susan Repo were re-elected to the Board of Directors. Rolf Ladau and Susanne Skippari were elected as new members of the Board of Directors. The term of the Board members will expire at the end of the Annual General Meeting in 2026.

Convening after the Annual General Meeting, the Board of Directors elected Paul Ehrnrooth as its Chair and Jyri Luomakoski as the Vice Chair. The Board decided to establish a Nomination Committee and appointed Paul Ehrnrooth (Chair) and Louise Fromond as members, and Alexander Ehrnrooth as an external member to the Nomination Committee and further decided to establish an Audit Committee and appointed Jyri Luomakoski (Chair), Albert Ehrnrooth, Louise Fromond and Susan Repo as the members of the Audit Committee, and a Human Resources and Compensation Committee and appointed Paul Ehrnrooth (Chair), Rolf Ladau, Carl-Martin Lindahl and Susanne Skippari as the members of the committee.

The Annual General Meeting decided that the annual fees of the members of the Board of Directors will remain at the level of the previous term. The annual fees of the members of the Board of Directors shall be EUR 70,000, the annual fees of the Vice Chair EUR 105,000 and the annual fees of the Chair EUR 140,000.

In addition, for the Board and Committee meetings other than the meetings of the Audit Committee, the Board/Committee members shall be paid EUR 750 for meetings requiring travel within one (1) country and EUR 2,000 for meetings requiring international travel. The Chairs of the Board of Directors and said Committees shall be paid a fee of EUR 1,500 per meeting requiring travel within one (1) country and EUR 2,000 for meetings requiring international travel.

For the meetings of the Audit Committee, the Committee members shall be paid a fee of EUR 1,000 for meetings requiring travel within one (1) country and EUR 2,250 for meetings requiring international travel. The Chair of the Audit Committee shall be paid a fee of EUR 2,500 per meeting.

For Board/Committee meetings held per capsulam or as teleconference, it was decided that the Chairs of the Board of Directors as well as said Committees be paid a fee per meeting that does not differ from meeting fees otherwise payable to them and the Board/Committee members be paid a fee of EUR 750 per meeting.

Further the members of the Board of Directors are reimbursed for their travel and other expenses incurred due to their activities in the interest of the company.

ELECTION AND REMUNERATIONS OF THE AUDITOR AND THE SUSTAINABILITY REPORTING ASSURANCE PROVIDER

Ernst & Young Oy, Authorized Public Accountants firm, was re-elected as auditor for the term that will expire at the end of the Annual General Meeting in 2026. Ernst & Young Oy has announced that the responsible auditor will be Toni Halonen, APA. The Annual General Meeting decided that the auditors' fees shall be paid according to a reasonable invoice approved by the Board of Directors.

Furthermore, Ernst & Young Oy, Authorized Sustainability Audit firm, was re-elected as the company's sustainability reporting assurance provider for the term that will expire at the end of the Annual General Meeting in 2026. Ernst & Young Oy has announced that the responsible sustainability auditor will be Toni Halonen, ASA. The Annual General Meeting decided that the remuneration of the sustainability reporting assurance provider be paid according to a reasonable invoice approved by the Board of Directors.

AUTHORIZING THE BOARD OF DIRECTORS TO DECIDE ON THE REPURCHASE AND/OR THE ACCEPTANCE AS PLEDGE OF THE COMPANY'S OWN SHARES

The Annual General Meeting decided to authorize the Board of Directors to decide on the repurchase of the company's own shares and/or the acceptance as pledge of the company's own shares. The maximum number of shares to be repurchased and/or accepted as pledge is 4,000,000. Acquisitions of own shares may be made in one or several instalments and by using the unrestricted shareholders' equity of the company.

The company's own shares may be acquired in public trading on Nasdaq Helsinki Ltd at a price formed in public trading on the time of the acquisition.

The authorization may be used to acquire shares to be used for the development of the capital structure of the company, as consideration in corporate acquisitions or industrial reorganizations and as part of the company's incentive system as well as otherwise for further transfer, retention or cancellation.

The Board of Directors is authorized to decide on all other terms and conditions regarding the acquisition and/or pledge of the company's own shares. Based on the authorization, the acquisition of the company's own shares may be made otherwise than in proportion to the share ownership of the shareholders (directed acquisition).

The authorization is effective until June 30, 2026 and cancels the authorization to decide on the repurchase of the company's own shares granted to the Board of Directors by the Annual General Meeting on March 13, 2024.

AUTHORIZING THE BOARD OF DIRECTORS TO DECIDE ON THE TRANSFER OF THE COMPANY'S OWN SHARES HELD AS TREASURY SHARES (SHARE ISSUE)

The Annual General Meeting decided to authorize the Board of Directors to decide on the transfer of a total maximum of 4,000,000 own shares held as treasury shares (share issue), in one or several instalments, either against or without consideration.

The company's own shares held as treasury shares may be transferred for example as consideration in corporate acquisitions or industrial reorganizations or for the development of the capital structure of the company, or as part of its incentive systems.

The Board of Directors is authorized to decide on all other terms and conditions regarding the transfer of own shares held as treasury shares. The transfer of own shares may also be carried out in deviation from the shareholders' pre-emptive rights to the company's shares (directed issue).

The authorization is effective until June 30, 2026, and cancels the corresponding authorization granted to the Board of Directors by the Annual General Meeting on March 13, 2024.

FISKARS CORPORATION

Board of Directors

Further information:

Päivi Timonen, Chief Legal Officer, tel. +358 40 776 8264

Fiskars Group in brief

Fiskars Group (FSKRS, Nasdaq Helsinki) is the global home of design-driven brands for indoor and outdoor living. Since 1649, we have designed products of timeless, purposeful, and functional beauty, while driving innovation and sustainable growth. In 2024, Fiskars Group's global net sales were EUR 1.2 billion and we had close to 7,000 employees. We have two Business Areas (BA), Vita and Fiskars.

BA Vita offers premium and luxury products for the tableware, drinkware, jewelry and interior categories. Its well-known brands include Georg Jensen, Royal Copenhagen, Wedgwood, Moomin Arabia, Iittala and Waterford. In 2024, BA Vita's reported net sales were EUR 605 million. Already 50% of BA Vita's net sales comes from direct-to-consumer sales, comprising approximately 500 stores and approximately 60 e-commerce sites.

BA Fiskars consists of the gardening and outdoor categories, in addition to the scissors and creating, as well as cooking categories. The brands include Fiskars and Gerber. In 2024, BA Fiskars' net sales were EUR 547 million.

Read more: fiskarsgroup.com