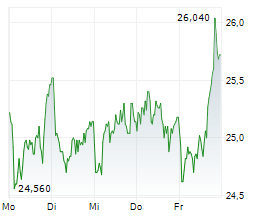

Negotiations for a potential takeover of German packaging manufacturer Gerresheimer have reached a critical juncture, with a consortium comprising investment firms Warburg Pincus and KKR emerging as frontrunners. Other interested buyers have reportedly withdrawn from the acquisition race for the pharmaceutical and cosmetic packaging provider. These developments propelled Gerresheimer's stock upward, with shares trading at €80.30 on Thursday morning, representing a gain of approximately one percent. The Düsseldorf-based company had confirmed in early February that management was engaged in discussions with financial investors regarding a possible acquisition. The talks between Gerresheimer and the consortium are reportedly at an advanced stage, though they could potentially continue for several weeks with no guarantee of a successful conclusion.

Strategic Appeal Drives Investor Interest

Gerresheimer has long been viewed as an attractive takeover target by financial investors, primarily due to its diverse business structure. The company produces both cosmetic glass products like jars and vials as well as specialized glass and plastic packaging and drug delivery systems for the pharmaceutical sector. This structural diversity presents significant potential for value creation through a possible company split. Adding to investor interest is Gerresheimer's recent acquisition of Italy's Bormioli Pharma Group, completed in late 2024, with management already exploring strategic options for this business segment. The company's stock, which has experienced sustained weakness since reaching a record high of €122.90 in September 2023, has made it even more appealing to potential buyers. Before takeover discussions became public in early February, shares had been trading around €72.

Ad

Gerresheimer Stock: New Analysis - 13 MarchFresh Gerresheimer information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Gerresheimer analysis...