STATEN ISLAND, N.Y., March 18, 2025 /PRNewswire/ -- Acurx Pharmaceuticals, Inc. (NASDAQ: ACXP) ("Acurx" or the "Company"), a clinical stage biopharmaceutical company developing a new class of antibiotics for difficult-to-treat bacterial infections, announced today certain financial and operational results for the fourth quarter and full year ended December 31, 2024.

Highlights of the fourth quarter ended December 31, 2024, or in some cases shortly thereafter, include:

- In October 2024, we exhibited at ID Week in Los Angeles, which was the annual scientific conference of the Infectious Diseases Society of America and where Drs. Garey and Eubank, from the University of Houston School of Pharmacy, presented a scientific poster showing that in the Phase 2b clinical trial, ibezapolstat had comparable clinical cure and sustained clinical cure rates and safety profile to vancomycin. As previously reported, the overall observed Clinical Cure rate in the combined Phase 2 trials (Ph2a and Ph2b) in patients with CDI was 96% (25 out of 26 patients); AND 100% (25 of 25) of ibezapolstat-treated patients in Phase 2 (again, Phase 2a + 2b) who had Clinical Cure at End of Treatment, (or EOT), remained cured through one month after EOT, as compared to 86% (12 of 14) for the vancomycin patient group in Ph2b. Also, in a subset of ibezapolstat patients, 5 of 5 followed for 3 months after end of treatment (EOT) experienced no recurrence of infection. IBZ-treated patients showed decreased concentrations of fecal primary bile acids, and higher ratios of secondary to primary bile acids than vancomycin-treated patients.

According to Dr. Garey: "These exciting results demonstrate two properties of ibezapolstat which may contribute to its anti-recurrence effect. First, the preservation and restoration of beneficial bacterial classes in the gut provide resistance to recolonization by C. difficile. Second, these data, presented for the first time, indicate that these beneficial bacteria known to metabolize primary to secondary bile acids persist in ibezapolstat-treated patients providing another important mechanism to prevent recurrent CDI." - In November 2024, we announced Sponsorship and Participation in the Peggy Lillis Foundation Inaugural CDI Scientific Symposium and Presented an Ibezapolstat Ph2b Clinical Data Update.

- In January 2025, the Company announced it had closed a $2.5 million registered direct offering priced at the market under Nasdaq rules.

- Also in January 2025, we announced that we received positive regulatory guidance from the European Medicines Agency (EMA) for the ibezapolstat Phase 3 clinical trial program, which is aligned with FDA on matters of manufacturing, non-clinical and clinical aspects of the Phase 3 program. The EMA guidance also confirmed ibezapolstat's regulatory pathway for a Marketing Authorization Application to be filed by the Company after successful completion of the Phase 3 clinical trials. With mutually consistent feedback from both EMA and FDA, Acurx is well positioned to commence our international Phase 3 registration program.

- In February 2024 and in March 2025, we announced new publications in the Journal of Antimicrobial Agents and Chemotherapeutics of two very important non-clinical studies which we believe we can leverage to show further positive differentiation for competitive advantage of IBZ vs all other antibiotics used for the first line therapy of C. difficile infection. And, for that matter, given our clinical results to date, we're hopeful that this anti-recurrence effect of IBZ could mitigate the need for expensive microbiome therapeutic agents to prevent recurrent CDI.

- In February 2025, we announced positive results from this first study, conducted by Dr. Justin McPherson from the University of Houston and funded by the National Institute of Allergy and Infectious Diseases (or NIAID). It was an in-silico study that predicted the microbiome-restorative potential of IBZ for treating CDI. Our scientific advisors consider this to be a major finding which provides a mechanistic explanation for IBZ's selectivity in that the predicted bactericidal interaction between IBZ and its target, the DNA pol IIIC enzyme, allows regrowth of gut microbes known to confer health benefits. The second study, conducted by Dr. Trenton Wolfe, from the University of Montana, was funded by the National Institute of Allergy and Infectious Diseases (NIAID), the National Cancer Institute (NCI), National Center for Advancing Translational Sciences (NCATS), and the Company.

This study is the first ever head-to-head comparison of gut microbiome changes associated with IBZ when compared to other anti-CDI antibiotics in a germ-free mouse model.

The data showed that changes in alpha and beta microbiome diversities following IBZ treatment were less pronounced compared to those observed in vancomycin (VAN)-or metronidazole (MET)-treated groups, complementing prior Phase 2 clinical findings showing IBZ's more selective antibacterial activity.

Further, and very importantly, notable differences were observed between the microbiome of IBZ- and the fidaxomicin (FDX)-treated groups, which may allow for differentiation of these two anti-CDI antibiotics in future studies.

These results establish IBZ's differentiating effects on the gut microbiome, indicating a more selective spectrum of microbiome alteration compared to broader-spectrum antibiotics like VAN and MET and a narrower spectrum of microbiome alteration compared to FDX. - Also in February 2025, the Japanese Patent Office granted a new patent for our DNA polymerase IIIC inhibitors which expires in December 2039, subject to extension. This constitutes a significant building block for our ongoing development of ACX-375C, our pre-clinical antibiotic candidate targeting the treatment of MRSA, VRE and Anthrax infections.

- In March 2025, we announced the closing of a registered direct offering and concurrent private placement, raising gross proceeds of $1.1 million.

Fourth Quarter and Full Year 2024 Financial Results

Cash Position:

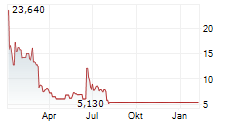

The Company ended the year with cash totaling $3.7 million, compared to $7.5 million as of December 31, 2023. The Company raised a total of $6.6 million of gross proceeds under its ATM financing program for the year ended December 31, 2024.

R&D Expenses:

Research and development expenses for the three months ended December 31, 2024 were $0.8 million compared to $1.9 million for the three months ended December 31, 2023, a decrease of $1.1 million. The decrease was due primarily to a decrease in consulting related costs of $1.2 million, offset by an increase in manufacturing costs of $0.1 million. For the year ended December 31, 2024 research & development expenses were $5.4 million compared to $6.0 million for the year ended December 31, 2023, a decrease of $0.6 million. The decrease was primarily due to a $1.6 million decrease in consulting related costs, offset by a $1.0 million increase in manufacturing related costs.

G&A Expenses:

General and administrative expenses for the three months ended December 31, 2024 were $2.0 million compared to $3.2 million for the three months ended December 31, 2023, a decrease of $1.2 million. The decrease was primarily due to $0.5 million decrease in professional fees, a $0.5 million decrease in share-based compensation costs, and a $0.2 million decrease in employee compensation costs. For the year ended December 31, 2024, general and administrative expenses were $8.7 million compared to $8.5 million for the year ended December 31, 2023, an increase of $0.2 million. The increase was primarily due to $0.7 million increase in professional fees, a $0.3 million increase in legal fees, offset by a $0.6 million decrease in share-based compensation costs and a $0.2 million decrease in insurance costs.

Net Income/Loss:

The Company reported a net loss of $2.8 million or $0.16 per diluted share for the three months ended December 31, 2024 compared to a net loss of $5.1 million or $0.37 per diluted share for the three months ended December 31, 2023, and a net loss of $14.1 million or $0.87 per share for the year ended December 31, 2024, compared to a net loss of $14.6 million or $1.15 per share for the year ended December 31, 2023 for the reasons previously mentioned.

The Company had 17,030,686 shares outstanding as of December 31, 2024.

Conference Call

As previously announced, David P. Luci, President and Chief Executive Officer, and Robert G. Shawah, Chief Financial Officer, will host a conference call to discuss the results and provide a business update as follows:

Date: | Tuesday, March 18, 2025 |

Time: | 8:00 a.m. ET |

Toll free (U.S.): | 1-877-790-1503; Conference ID: 13752142 |

International: | Click here for participant international Toll-Free access numbers |

https://www.incommconferencing.com/international-dial-in |

About Ibezapolstat

Ibezapolstat is the Company's lead antibiotic candidate advancing to international Phase 3 clinical trials to treat patients with C. difficile Infection (CDI). Ibezapolstat is a novel, orally administered antibiotic being developed as a Gram-Positive Selective Spectrum (GPSS®) antibacterial. It is the first of a new class of DNA polymerase IIIC inhibitors under development by Acurx to treat bacterial infections. Ibezapolstat's unique spectrum of activity, which includes C. difficile but spares other Firmicutes and the important Actinobacteria phyla, appears to contribute to the maintenance of a healthy gut microbiome. In June 2018, ibezapolstat was designated by the U.S. Food and Drug Administration (FDA) as a Qualified Infectious Disease Product (QIDP) for the treatment of patients with CDI and will be eligible to benefit from the incentives for the development of new antibiotics established under the Generating New Antibiotic Incentives Now (GAIN) Act. In January 2019, FDA granted "Fast Track" designation to ibezapolstat for the treatment of patients with CDI. The CDC has designated C. difficile as an urgent threat highlighting the need for new antibiotics to treat CDI.

About Acurx Pharmaceuticals, Inc.

Acurx Pharmaceuticals is a late-stage biopharmaceutical company focused on developing a new class of small molecule antibiotics for difficult-to-treat bacterial infections. The Company's approach is to develop antibiotic candidates with a Gram-positive selective spectrum (GPSS®) that blocks the active site of the Gram-positive specific bacterial enzyme DNA polymerase IIIC (pol IIIC), inhibiting DNA replication and leading to Gram-positive bacterial cell death. Its R&D pipeline includes antibiotic product candidates that target Gram-positive bacteria, including Clostridioides difficile, methicillin- resistant Staphylococcus aureus (MRSA), vancomycin resistant Enterococcus (VRE), drug- resistant Streptococcus pneumoniae (DRSP) and B. anthracis (anthrax; a Bioterrorism Category A Threat-Level pathogen). Acurx's lead product candidate, ibezapolstat, for the treatment of C. difficile Infection is Phase 3 ready with plans in progress to begin international clinical trials next year. The Company's preclinical pipeline includes development of an oral product candidate for treatment of ABSSSI (Acute Bacterial Skin and Skin Structure Infections), upon which a development program for treatment of inhaled anthrax is being planned in parallel.

To learn more about Acurx Pharmaceuticals and its product pipeline, please visit www.acurxpharma.com.

Forward-Looking Statements

Any statements in this press release about our future expectations, plans and prospects, including statements regarding our strategy, future operations, prospects, plans and objectives, and other statements containing the words "believes," "anticipates," "plans," "expects," and similar expressions, constitute forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors, including: whether ibezapolstat will benefit from the QIDP designation; whether ibezapolstat will advance through the clinical trial process on a timely basis; whether the results of the clinical trials of ibezapolstat will warrant the submission of applications for marketing approval, and if so, whether ibezapolstat will receive approval from the FDA or equivalent foreign regulatory agencies where approval is sought; whether, if ibezapolstat obtains approval, it will be successfully distributed and marketed; and other risks and uncertainties described in the Company's annual report filed with the Securities and Exchange Commission on Form 10-K for the year ended December 31, 2024, and in the Company's subsequent filings with the Securities and Exchange Commission. Such forward- looking statements speak only as of the date of this press release, and Acurx disclaims any intent or obligation to update these forward-looking statements to reflect events or circumstances after the date of such statements, except as may be required by law.

Investor Contact:

Acurx Pharmaceuticals, Inc.

David P. Luci, President & Chief Executive Officer

Tel: 917-533-1469

Email: [email protected]

ACURX PHARMACEUTICALS, INC. BALANCE SHEETS AS OF DECEMBER 31, 2024 and 2023 | ||||||

December 31, | December 31, | |||||

2024 | 2023 | |||||

ASSETS | ||||||

CURRENT ASSETS | ||||||

Cash | $ | 3,706,713 | $ | 7,474,188 | ||

Other Receivable | 51,127 | 129,159 | ||||

Prepaid Expenses | 100,123 | 105,776 | ||||

TOTAL ASSETS | $ | 3,857,963 | $ | 7,709,123 | ||

LIABILITIES AND SHAREHOLDERS' EQUITY | ||||||

CURRENT LIABILITIES | ||||||

Accounts Payable and Accrued Expenses | $ | 3,242,842 | $ | 3,042,438 | ||

TOTAL CURRENT LIABILITIES | 3,242,842 | 3,042,438 | ||||

TOTAL LIABILITIES | 3,242,842 | 3,042,438 | ||||

COMMITMENTS AND CONTINGENCIES | ||||||

SHAREHOLDERS' EQUITY | ||||||

Common Stock; $.001 par value, 200,000,000 shares authorized, 17,030,686 and 14,468,229 shares issued and outstanding at December 31, 2024 and December 31, 2023, respectively | 17,031 | 14,468 | ||||

Additional Paid-In Capital | 67,920,046 | 57,871,070 | ||||

Accumulated Deficit | (67,321,956) | (53,218,853) | ||||

TOTAL SHAREHOLDERS' EQUITY | 615,121 | 4,666,685 | ||||

TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | $ | 3,857,963 | $ | 7,709,123 | ||

ACURX PHARMACEUTICALS, INC. STATEMENTS OF OPERATIONS YEARS ENDED DECEMBER 31, 2024 AND 2023 | |||||||

Years Ended | |||||||

December 31, | |||||||

2024 | 2023 | ||||||

OPERATING EXPENSES | |||||||

Research and Development | $ | 5,403,836 | $ | 6,043,597 | |||

General and Administrative | 8,699,267 | 8,534,171 | |||||

TOTAL OPERATING EXPENSES | 14,103,103 | 14,577,768 | |||||

NET LOSS | $ | (14,103,103) | $ | (14,577,768) | |||

LOSS PER SHARE | |||||||

Basic and diluted net loss per common share | $ | (0.87) | $ | (1.15) | |||

Weighted average common shares outstanding, basic and diluted | 16,163,366 | 12,671,572 | |||||

SOURCE Acurx Pharmaceuticals, Inc.