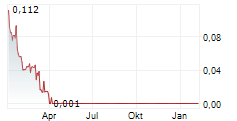

TORONTO, April 16, 2025 (GLOBE NEWSWIRE) -- Rivalry Corp. (TSXV: RVLY) (OTCQB: RVLCF) ("Rivalry" or the "Company"), the leading sportsbook and iGaming operator for digital-first players, today shared preliminary key performance indicators ("KPIs") and revenue figures for the three months ended March 31, 2025 ("Q1 2025"), underscoring the success of its strategic transformation and path toward sustainable, profitable growth. All dollar figures are quoted in Canadian dollars.

Q1 2025 marks the first full quarter under Rivalry's revamped operating model, following significant changes to product offerings, organizational structure, cost management, and user acquisition strategies. Underlying KPIs show improved unit economics, deeper engagement, and structural momentum toward long-term sustainability.

Revenue in the quarter was lower than prior periods - a result of Rivalry's deliberate shift to a leaner, more efficient model - creating a stronger foundation that the Company is now building on. The shortfall also reflected temporary variance in sportsbook hold, amplified by a strategic focus on high-value and VIP players. The Company believes that these segments drive significantly greater long-term value but can introduce short-term volatility as they scale.

"Our Q1 KPIs are delivering tangible results that validate our strategic shift," said Steven Salz, Co-Founder and CEO of Rivalry. "The structural changes we implemented over the past six months - from streamlining operations and refocusing the product, to modernizing our platform and concentrating on high-value players - are now clearly reflected in our KPIs. We're operating more efficiently than ever, generating significantly more revenue per user, and moving closer to achieving sustainable profitability."

Q1 2025 Highlights1:

- Operational Efficiency Up 400%: In Q1 2025, Rivalry generated over 400% more net revenue per user per dollar of operating expense as compared to its average before the strategic overhaul. This marks a significant leap in cost efficiency and operating leverage, validating the impact of recent changes.

- Shift to High-Value Players Driving 175% Increase in Player Monthly Deposits: Total deposits rose 36% month over month in February 2025 and another 12% in March 2025, despite a smaller active user base than past peaks. In Q1 2025, average monthly deposits per player were just over 175% higher than the periods prior to Rivalry's October 2024 strategic overhaul - a clear result of the Company's focus on acquiring and retaining high-value players, while improving unit economics and lowering variable costs.

- 115% Increase in Monthly Deposit Frequency: In Q1 2025, average monthly deposit frequency per player increased by 115% compared to the average prior to Rivalry's October 2024 rebuild - signaling strong user re-engagement and validating the Company's refined product experience and more targeted player strategy.

- All-Time High in Monthly Betting Handle per User: Monthly betting handle per active user hit a new all-time high in March 2025, marking the fifth consecutive month of record-breaking engagement and deeper player value.

- Record Revenue per User: In March 2025, monthly Gross and Net Revenue per active user reached all-time highs (normalized for margin variance), extending a four-month streak of consistent revenue per active user growth and player monetization strength.

- Month over Month Active User Growth: Monthly active players grew by 9% in March 2025, following a similar increase in February 2025, despite a significantly reduced global marketing budget compared to the same period last year.

- Ontario Regulated Market Showing Strong, Improving Unit Economics: Since the Company's operational shift, Rivalry's Average Revenue Per Playing Account ("ARPPA") in Ontario - a monthly metric defined by and publicly reported by gaming regulator iGO - has generally trended in line with the market average, and in some months exceeded it by as much as 50%. ARPPA has also nearly doubled compared to pre-overhaul levels at Rivalry, reflecting strengthening unit economics supported by efficient customer acquisition, with customer acquisition cost paybacks consistently within single-digit weeks.

Operational Momentum and Efficiency Gains Reflect Structural Progress

The Company's Q1 2025 performance reflects the first full quarter operating under a significantly leaner structure, with total monthly run rate operating expenses reduced by approximately 65% as compared to prior peak periods.

Betting handle in Q1 2025 was $58.2 million, and net revenue $1.3 million1, for a net revenue margin of 2.3%. This compares to Rivalry's full-year 2024 net revenue margin of 4.4%1, with the Q1 2025 margin variance largely attributable to short-term fluctuations in sportsbook hold. This was amplified by the Company's strategic pivot toward high-value and VIP players - segments that offer significantly greater long-term value but naturally introduce more short-term variability in margin performance as they scale.

On a normalized margin basis, Rivalry's Q1 2025 net revenue would have covered approximately 75% of current run rate operating expenses, inclusive of additional cost reductions completed in early April that lowered monthly operating expenses by approximately $140,000. Growing user value, rising engagement, and stronger unit economics reflect encouraging momentum toward long-term financial sustainability.

"The KPIs are telling the real story - user value is up, efficiency is up, and player engagement is the strongest we've seen in the Company's history," said Steven Salz, Co-Founder and CEO of Rivalry. "Even with soft margin outcomes in Q1 2025, the model is showing strong underlying signals. As sportsbook hold normalizes and our cost base becomes leaner, we believe we're moving in the right direction."

Over the past six months, Rivalry has reduced monthly run rate operating expenses by approximately $1.7 million per month, inclusive of the recently completed April 2025 reductions. These reductions have been enabled by a fully modernized core product with improved site performance and ongoing development velocity across key revenue-driving features. The Company has also realized efficiencies through vendor rationalization and the rollout of AI-driven tools across departments.

"We've built a stronger, leaner, and more focused Rivalry," Salz added. "Our improved KPIs and disciplined cost management have created a healthier foundation. With continued operational momentum and a re-energized product, we believe we're on a promising path forward."

Company Contact:

Steven Salz, Co-founder & CEO

ss@rivalry.com

Investor Contact:

investors@rivalry.com

Financial Outlook

This news release contains a financial outlook within the meaning of applicable Canadian securities laws. The financial outlook has been prepared by management of the Company to provide an outlook for ??net revenue and net revenue margin for the period ending March 31, 2025, and net revenue margin for the 12 months ended December 31, 2024 and may not be appropriate for any other purpose. Preliminary and unaudited financial results are subject to customary financial statement procedures. Actual results could be affected by subsequent events or determinations. The financial outlook has been prepared based on a number of assumptions including the assumptions discussed under the heading "Cautionary Note Regarding Forward-Looking Information and Statements". The actual results of the Company's operations for any period will likely vary from the amounts set forth in these projections and such variations may be material. The Company and its management believe that the financial outlook has been prepared on a reasonable basis. However, because this information is highly subjective and subject to numerous risks, including the risks discussed under the heading "Cautionary Note Regarding Forward-Looking Information and Statements", it should not be relied on as necessarily indicative of future results.

Cautionary Note Regarding Forward-Looking Information and Statements

This news release contains certain forward-looking information within the meaning of applicable Canadian securities laws ("forward-looking statements"). All statements other than statements of present or historical fact are forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as "anticipate", "achieve", "could", "believe", "plan", "intend", "objective", "continuous", "ongoing", "estimate", "outlook", "expect", "project" and similar words, including negatives thereof, suggesting future outcomes or that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking statements in this news release include, but are not limited to, statements with respect to the Company's financial performance, including net revenue and net revenue margin for the three months ended March 31, 2025, the anticipated results of the Company's strategic shift and ongoing efforts to reduce operating expenses and achieving sustainable profitability. Forward-looking statements are based on the opinions and estimates of management of the Company at the date the statements are made based on information then available to the Company. Various factors and assumptions are applied in drawing conclusions or making the forecasts or projections set out in forward-looking statements.

Forward-looking statements are subject to and involve a number of known and unknown, variables, risks and uncertainties, many of which are beyond the control of the Company, which may cause the Company's actual performance and results to differ materially from any projections of future performance or results expressed or implied by such forward-looking statements. Such factors, among other things, include regulatory or political change such as changes in applicable laws and regulations; the ability to obtain and maintain required licenses; the esports and sports betting industry being a heavily regulated industry; the complex and evolving regulatory environment for the online gaming and online gambling industry; the success of esports and other betting products are not guaranteed; changes in public perception of the esports and online gambling industry; negative cash flow from operations and the Company's ability to operate as a going concern; the Company's ability to repay amounts owing under its secured and unsecured indebtedness; failure to retain or add customers; the Company having a limited operating history; operational risks; cybersecurity risks; reliance on management; reliance on third parties and third-party networks; exchange rate risks; risks related to cryptocurrency transactions; risk of intellectual property infringement or invalid claims; the effect of capital market conditions and other factors on capital availability; competition, including from more established or better financed competitors; and general economic, market and business conditions. For additional risks, please see the Company's management's discussion and analysis for the three and nine months ended September 30, 2024 under the heading "Risk Factors", and other disclosure documents available on the Company's SEDAR+ profile at www.sedarplus.ca.

No assurance can be given that the expectations reflected in forward-looking statements will prove to be correct. Although the forward-looking statements contained in this news release are based upon what management of the Company believes, or believed at the time, to be reasonable assumptions, the Company cannot assure shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Readers should not place undue reliance on the forward-looking statements and information contained in this news release. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and the Company does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws.

1 Preliminary and unaudited financial results are subject to customary financial statement procedures by the Company and its auditors. Actual results could be affected by subsequent events or determinations. These preliminary results represent forward-looking information. See "Cautionary Note Regarding Forward-Looking Information and Statements" and "Financial Outlook".