VANCOUVER, British Columbia, March 19, 2025 (GLOBE NEWSWIRE) -- West Red Lake Gold Mines Ltd. ("West Red Lake Gold" or the "Company") (TSXV: WRLG) (OTCQB: WRLGF) is pleased to provide an update on mine restart activities at the Madsen Mine, where the mill is now processing low-grade material ahead of introducing Stope 1 of the bulk sample next week.

In addition, the camp is now housing workers, the pace of underground development continues to rise, and the Connection Drift is within 84 metres (94%) of completion. There is active development and mining in multiple areas of the mine.

"Turning on the Madsen Mill to process the bulk sample was a very exciting moment for the entire West Red Lake Gold team, who have been working tirelessly in recent months as we push towards production," said Shane Williams, President and CEO. "A smooth restart of this major piece of infrastructure reinforces that our level of preparation has created translated into successful operational readiness ahead of initial production. With gold prices trading at record levels, it is an exciting and fortuitous time to be making the transition from developer to producer."

Figure 1. Recently collected rock sample with visible gold from South Austin 11 Level, specifically from Heading SA_11_987_SIL.

Mill Restarted

The mill was started up on Monday March 10th after 28 months of maintained dry shutdown. Ahead of restart the Company's mill team completed extensive pre-commissioning work, including replacing mill liners and discharge lines, cycling process water through the system, and revitalizing the CIP and carbon circuits.

The mill encountered no operational issues on restart. For the first five days the facility processed material from a legacy low-grade stockpile, after which feed transitioned to a modern stockpile of low-grade material.

Next week the first batch of bulk sample material from Stope 1 will be processed. The stopes of the bulk sample will be processed sequentially, after which independent authorities will complete full reconciliation calculations between expected and actual tonnes, grade, and ounces for each stope.

Figure 2. Material moving on the conveyer into the Semi-Autogenous Grinding ("SAG") mill.

Figure 3. Thickener tanks at the Madsen Mill, full and operational three days after the mill was restarted.

Figure 4. One of the six leach tanks at the Madsen Mill, full and operational three days after the mill was restarted.

Camp Operational

The new 114-person workforce accommodations facility at the Madsen Mine is now housing workers. All rooms in the camp are executive junior suites. On March 18th the Company hosted a Camp Opening Celebration, with Mr. Williams cutting the ribbon.

"We are very glad that we can hire 60% of our workforce locally, which supports Red Lake and enables workers to live at home," said Hayley Halsall-Whitney, Vice President of Operations. "This new, comfortable camp will help us attract additional quality personnel to work at Madsen and will ease pressure on housing in the community."

Figure 5. Shane Williams speaking ahead at the opening of the Madsen Mine camp.

Underground Development

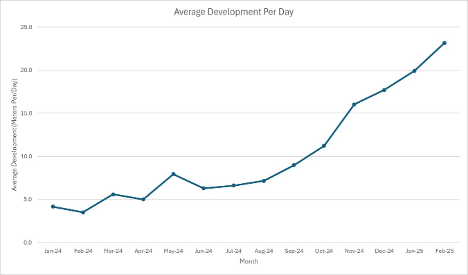

The pace of underground development continues to increase, rising from 20 metres per day average in January to 23.8 metres per day average in February. Being able to access mining areas efficiently and thus create operational flexibility is essential in an underground mine, especially when a deposit requires multiple working faces.

"Attaining a sufficient rate of development is an important requirement at Madsen and it is achieved through focused attention and strong teamwork," said Halsall-Whitney. "I am very pleased to see this rate rising and expect to see this trend continue as the Madsen team's skills and coordination continue to improve."

Figure 6: Average underground development per day, month by month, at the Madsen Mine.

Connection Drift 94% Complete

Work on the Connection Drift continues to advance on schedule. Of the 1.4-km distance, 1,380 metres have been completed, leaving just 84 metres or 6% to go. As is standard near completion of a drift, a diamond drill rig was used to drill from the west side and successfully intercepted the approaching westward advance, ensuring precise alignment between the two advancing faces.

Nebari Credit Facility: Additional US$7.5 Million Drawn

West Red Lake Gold also announces that it has drawn US$7.5 of the US$15-million second tranche ("Tranche 2") of its previously announced US$35 million credit facility (the "Credit Facility"), with Nebari Natural Resources Credit Fund II LP ("Nebari").

The Credit Facility was entered into on December 31, 2024 and announced on January 2, 2025 [see https://westredlakegold.com/west-red-lake-gold-closes-us35-million-credit-facility-with-nebari-and-announces-drawdown-of-us15-million/], with the first drawdown of US$15 million received on December 31, 2024 ("Tranche 1"). The Credit Facility also provides for the remaining up to US$7.5 million under Tranche 2 and a third tranche of up to US$5 million, at the election of the Company, subject to satisfaction of certain conditions precedent.

The proceeds from Tranche 2 of the Credit Facility will be used for: 1) completing the remaining capital costs to restart the Madsen Mine, and 2) other corporate, exploration and working capital expenses.

Repayment of 50% of principal outstanding via fixed straight-line amortization commences on the 15th month following the draw-down of Tranche 1. The remaining 50% of borrowed funds are due on the maturity date. The Credit Facility may be repaid prior to maturity at any time subject to the additional payment of a make-whole threshold.

Interest will accrue on the advanced outstanding principal amount of the loan based on a floating rate per annum equal to the sum of: (i) the three-month term SOFR reference rate administered by CME Loan Party Benchmark Administration Limited (CBA) (the "Term SOFR"), as determined on the first date of each calendar month; and (ii) 8.0% per annum, provided that, if the Term SOFR is less than 4.0%, it shall be deemed to be 4.0%.

In addition, the Company is paying to Nebari an administration fee of US$30,000 per annum and an arrangement fee in the amount of 1.5% of the funded amount for each tranche, further details set out in the Loan Agreement.

No finder's fees are payable in connection with the Credit Facility.

The maturity date of the Credit Facility will be June 30, 2028.

In connection with drawing this portion of Tranche 2, the Company issued 2,691,934 non-transferable common share purchase warrants (the "Tranche 2 Loan Bonus Warrants") at an exercise price of CAD$0.7969 (using a USD/CAD exchange rate of 1.4301) per common share, which expire on June 30, 2028, subject to a pro-rata reduction if the funded amount is prepaid in whole or in part, then a pro rata number of the total Tranche 2 Loan Bonus Warrants issued in relation to Tranche 2 will have their term reduced to the later of one year from the date of issuance of the Warrants and 30 days from the reduction, in accordance with TSXV policies. The Lender will receive cash compensation for any pro-rata reduction.

The Tranche 2 Loan Bonus Warrants are subject to a statutory hold period of four months and one day under applicable securities laws. The Tranche 2 Loan Bonus Warrants represent the Canadian equivalent of 20% of the loan amount being drawn in respect of Tranche 2 divided by a Canadian dollar amount equal to a 30% premium to the lower of: (A) the lowest 20-day VWAP of the Company's share price prior to: (i) the date which the Company issues its request for the advance in respect of each Tranche; (ii) the date of this press release; and (iii) the closing date of the advance of Tranche 2, and (B) the common share price of the most recent equity raise, subject to compliance with TSXV policies.

Nebari is at arms-length to the Company and currently owns 8,559,310 common share purchase warrants issued in connection with the Tranche 1 and Tranche 2 Loan Bonus Warrants. Nebari does not own any other securities of the Company.

QUALIFIED PERSON

The technical information presented in this news release has been reviewed and approved by Maurice Mostert, P.Eng., Vice President of Technical Services for West Red Lake Gold and the Qualified Person for technical services at the West Red Lake Project, as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT WEST RED LAKE GOLD MINES

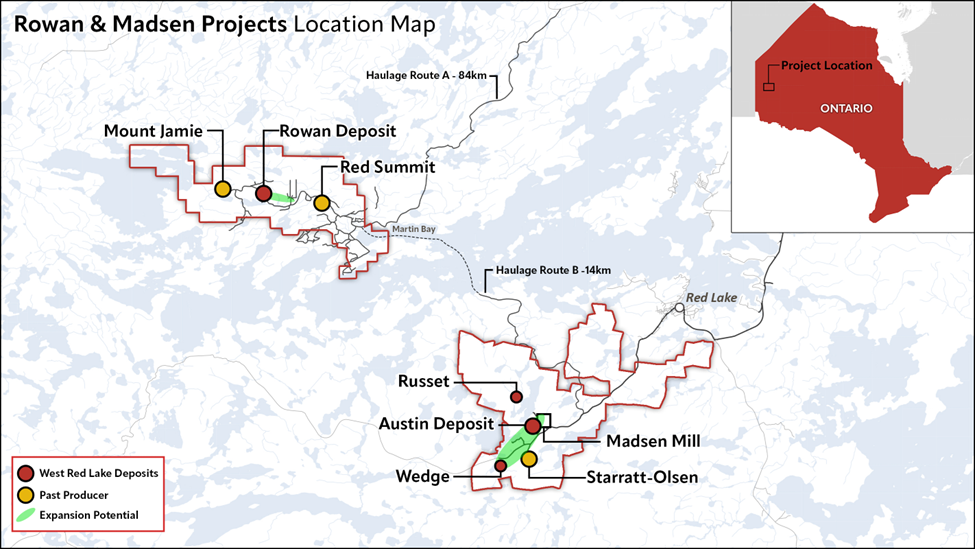

West Red Lake Gold Mines Ltd. is a mineral exploration company that is publicly traded and focused on advancing and developing its flagship Madsen Gold Mine and the associated 47 km2 highly prospective land package in the Red Lake district of Ontario. The highly productive Red Lake Gold District of Northwest Ontario, Canada has yielded over 30 million ounces of gold from high-grade zones and hosts some of the world's richest gold deposits. WRLG also holds the wholly owned Rowan Property in Red Lake, with an expansive property position covering 31 km2 including three past producing gold mines - Rowan, Mount Jamie, and Red Summit.

ON BEHALF OF WEST RED LAKE GOLD MINES LTD.

"Shane Williams"

Shane Williams

President & Chief Executive Officer

FOR FURTHER INFORMATION, PLEASE CONTACT:

Gwen Preston

Vice President Communications

Tel: (604) 609-6132

Email: investors@wrlgold.com or visit the Company's website at https://www.westredlakegold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

CAUTIONARY STATEMENT AND FORWARD-LOOKING INFORMATION

Certain statements contained in this news release may constitute "forward-looking information" within the meaning of applicable securities laws. Forward-looking information generally can be identified by words such as "anticipate", "expect", "estimate", "forecast", "planned", and similar expressions suggesting future outcomes or events. Forward-looking information is based on current expectations of management; however, it is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from the forward-looking information in this news release and include without limitation, statements relating to the Company's intended use of proceeds from the Credit Facility; final approval of the Loan Bonus Warrants by the TSXV, statements relating to the plans and timing for the potential restart of mining operations at the Madsen Mine, the potential (including the amount of tonnes of material from the bulk sample program) of the Madsen Mine; the benefits of test mining; the timing for the completion of the Connection Drift; the timing of completion of the Madsen Mine Camp; any untapped growth potential in the Madsen deposit or Rowan deposit; and the Company's future objectives and plans. Readers are cautioned not to place undue reliance on forward-looking information.

Forward-looking information involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking information. These risks and uncertainties include, among other things, market volatility; the state of the financial markets for the Company's securities; fluctuations in commodity prices; timing and results of the cleanup and recovery at the Madsen Mine; and changes in the Company's business plans. Forward-looking information is based on a number of key expectations and assumptions, including without limitation, that the Company will continue with its stated business objectives and its ability to raise additional capital to proceed. Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information. Accordingly, readers should not place undue reliance on forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Additional information about risks and uncertainties is contained in the Company's management's discussion and analysis for the year ended November 30, 2023, and the Company's annual information form for the year ended November 30, 2023, copies of which are available on SEDAR+ at www.sedarplus.ca.

The forward-looking information contained herein is expressly qualified in its entirety by this cautionary statement. Forward-looking information reflects management's current beliefs and is based on information currently available to the Company. The forward-looking information is made as of the date of this news release and the Company assumes no obligation to update or revise such information to reflect new events or circumstances, except as may be required by applicable law.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available on SEDAR+ at www.sedarplus.ca.

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/94295cbc-6c7b-4111-9dcb-e82a52d3666b

https://www.globenewswire.com/NewsRoom/AttachmentNg/8e5a11f3-9685-4fed-9d84-ff1b983575a3

https://www.globenewswire.com/NewsRoom/AttachmentNg/9c580c8a-229a-4ef7-a5df-b22d57a81cb7

https://www.globenewswire.com/NewsRoom/AttachmentNg/c41a28f5-4f67-4365-8661-65189afffd76

https://www.globenewswire.com/NewsRoom/AttachmentNg/89f86726-f015-4cb5-92a6-cbc393643d46

https://www.globenewswire.com/NewsRoom/AttachmentNg/149dafc5-c887-49b5-afca-93351574213a

https://www.globenewswire.com/NewsRoom/AttachmentNg/24e71451-b70d-411b-aeb4-4ba2dcf542da