Chinese technology giant Tencent reported impressive fourth-quarter financial results that significantly exceeded market expectations, with revenue climbing 11% to 172.4 billion yuan ($23.9 billion). The company's shareholder profit soared an remarkable 90% year-over-year to 51.3 billion yuan ($7.1 billion). This strong performance was primarily driven by Tencent's resurgent gaming division, which saw domestic gaming revenue increase by 23% to 33.2 billion yuan, while international gaming revenue grew 15% to 16 billion yuan. The company appears to be successfully navigating regulatory challenges in China's tech sector, leveraging its diverse business portfolio that includes the ubiquitous WeChat messaging platform and its position as the world's largest video game company.

Accelerating AI Investments Boost Market Confidence

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei Tencent?

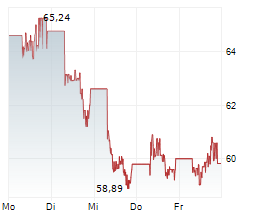

Tencent announced plans to substantially increase capital expenditure for 2025, focusing heavily on artificial intelligence as a strategic priority. The company intends to allocate investments in the "low double-digit" percentage range of total revenue, continuing the trend that saw capital expenditure rise to $10.7 billion in 2024 (12% of annual revenue). Fourth-quarter AI-related projects alone received 39 billion yuan ($5.4 billion) in funding. This strategic emphasis on AI technology, including enhancements to Tencent's proprietary Hunyuan model, has resonated positively with investors. The stock responded favorably, rising 1.4% to €64.19 in Frankfurt trading and reaching a 52-week high of €66.25 - representing a remarkable recovery of over 48% from its March 2024 low.

Ad

Tencent Stock: New Analysis - 20 MarchFresh Tencent information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated Tencent analysis...