"The Critical Minerals and ZEO Company"

Revenues Up 72% YOY

Cost of Sales Down 5% YOY

Gross Profit Up 204% YOY

DALLAS, TX / ACCESS Newswire / March 20, 2025 / United States Antimony Corporation ("USAC," the "Company" or "U.S. Antimony Corporation"), (NYSE American:UAMY) reported today its fiscal year 2024 financial and operational results.

Revenues for the full year of 2024 increased 72% to $14.9 million, an increase of $6.2 million compared to revenues reported in calendar year 2023 of $8.7 million. Cost of sales decreased 5%, or $567K, during the same period. This in-turn allowed gross profit to increase 204%, or $6.8 million. Operating expenses increased $2.1 million to $5.9 million for the full year of 2024 compared to 2023. $1.7 million of this increase is related to expenses associated with existing and new personnel being added at our operating facilities as well as in administrative functions necessary due to the significant growth in the Company. Approximately $569K of this expense was non-cash stock compensation. Additionally, $889K was costs associated with new project development in a number of different divisions of USAC that will not be realized until the future. These projects and initiatives are directly related to the Company's expanded scope of operations. The Company reported a net loss from operations of $1.7 million for the fiscal year of 2024, compared to a loss of $6.3 million in fiscal 2023, an improvement of $4.6 million.

The Company ended 2024 with another strong balance sheet with $18.2 million in cash and cash equivalents and only $328K in debt associated with one piece of mining equipment. During 2024, the Company received approximately $1.5 million in proceeds from the exercise of existing warrants outstanding. This resulted in 2,204,000 common shares being issued.

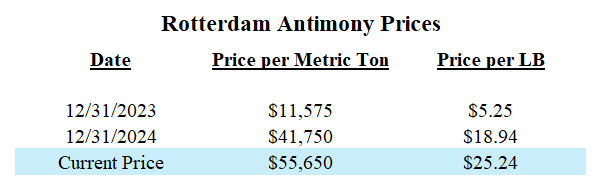

Antimony continues to be a scarce commodity worldwide due to a combination of supply issues and trade restrictions imposed on and by certain countries. The result has been the best performing price of any critical mineral as indicated below:

With almost a five times increase in price of antimony in just over a year, and being the only antimony smelter in the United States as well as the only antimony smelter in Mexico, USAC is well positioned to capitalize on the opportunity at hand.

Our zeolite division in 2024 was a turn around year for USAC. We completed a substantial number of repairs that was a result of prior management negligence. We went from under a 50% availability run time at the beginning of the year to 98.4% run time in the fourth quarter. Our operating personnel were successful at increasing the granule production capacity at our Preston, Idaho facility from around four tons per hour to over twelve tons per hour. These efficiencies allowed for a 9% increase in sales volume of zeolite sold. Additionally, we recently extended our ground mining lease to 10 additional years with improved economics. Improved safety compliance has been an overriding mission in 2024 with more training, an improved work culture along with plant improvements that provide a safer work environment for our dedicated employees. Two new salespeople, one in water filtration and one in the cattle market, have been hired in early 2025. The Company has previously had no sales personnel working for Bear River Zeolite. We are continuing to experience overall sales improvements because we can now deliver the highest quality zeolite in the world on a timely basis to meet our customer requirements.

Commenting on the Fiscal Year 2024 financial and operational results, Mr. Gary C. Evans, Chairman and CEO of U.S. Antimony Corporation stated, "This past year was a significant turning point for USAC. While we are proud to report the markedly improved operating and financial performance of the Company, the real meaningful changes are just now occurring. Once we are able to report our quarterly results in 2025, these overall financial improvements we are experiencing will become most evident. Since the beginning of last year, we have added a Controller, five Vice Presidents, one Senior Vice President, one Executive Vice President, and two sales personnel. These new hires are crucial to our expanded business operations and growth initiatives.

All divisions of the Company are improving on a monthly, and many times, weekly basis. This is a result of higher volumes through our facilities, improved pricing of our products and unprecedented demand. As we announced late last year, we are firing up our Madero Smelter in Mexico this month with new international antimony material arriving today at a key port in Mexico. Additional raw antimony inventory is on the water being shipped to Mexico. All necessary improvements to furnaces at Madero have been completed on time and below budget. We see this business becoming a key contributor to our financial results in the remaining three quarters of 2025.

Our previously announced plan to bring antimony ore from our own mining claims located in Alaska to Montana, are on track for the third quarter of this year. Additionally, when we begin trucking this antimony material to Thompson Falls, an improvement to our operating margins at our smelter located there should occur. This also will greatly reduce our dependence on foreign buying and sourcing of antimony ore. We will be the first company in the United States to begin mining antimony again in a material way. No other North American company has the capability to mine, float, and smelter antimony under one roof, as we will soon be doing. The next step in our plan is to further expand our capabilities by improving our overall in-take volumes. That will occur from a combination of efficiency improvements and expansion plans underway. This will likely occur at both our U.S. and Mexican smelters and will continue throughout 2025.

This is an extremely exciting time for our Company. Our Board of Directors and Management Team are very proud of the fact we are assisting our industrial customers and our government in bringing supply certainty into the antimony sector. Not three to five years down the road but today. We fully recognize we have a window of opportunity, and we are doing everything in our control to capture and seize on it as much as possible now, for the combined benefit of not only our customers but our shareholders as well."

USAC has historically not provided any financial guidance. While there exists many moving parts within the organization related to its operating assets, 2025 consolidated revenues are being currently estimated as follows:

United States Antimony Corporation and Subsidiaries

Consolidated Statements of Operations

| For the years ended |

| ||||||

| December 31, 2024 |

|

| December 31, 2023 |

| |||

REVENUES |

| $ | 14,937,962 |

|

| $ | 8,693,155 |

|

COST OF REVENUES |

|

| 11,471,044 |

|

|

| 12,037,939 |

|

GROSS PROFIT (LOSS) |

|

| 3,466,918 |

|

|

| (3,344,784 | ) |

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

General and administrative |

|

| 2,052,852 |

|

|

| 1,642,269 |

|

Salaries and benefits |

|

| 2,350,021 |

|

|

| 639,172 |

|

Professional fees |

|

| 968,750 |

|

|

| 643,208 |

|

Loss on sale or disposal of property, plant and equipment, net |

|

| 11,097 |

|

|

| 217,921 |

|

Other operating expenses |

|

| 475,010 |

|

|

| 581,647 |

|

TOTAL OPERATING EXPENSES |

|

| 5,857,730 |

|

|

| 3,724,217 |

|

LOSS FROM OPERATIONS |

|

| (2,390,812 | ) |

|

| (7,069,001 | ) |

OTHER INCOME (EXPENSE): |

|

|

|

|

|

|

|

|

Interest and investment income |

|

| 668,543 |

|

|

| 618,762 |

|

Trademark and licensing income |

|

| 27,987 |

|

|

| 32,007 |

|

Other miscellaneous income (expense) |

|

| (36,122 | ) |

|

| 69,945 |

|

TOTAL OTHER INCOME |

|

| 660,408 |

|

|

| 720,714 |

|

LOSS BEFORE INCOME TAXES |

|

| (1,730,404 | ) |

|

| (6,348,287 | ) |

Income tax expense |

|

| - |

|

|

| - |

|

Net loss |

|

| (1,730,404 | ) |

|

| (6,348,287 | ) |

Preferred dividends |

|

| (7,500 | ) |

|

| (7,500 | ) |

Net loss available to common stockholders |

| $ | (1,737,904 | ) |

| $ | (6,355,787 | ) |

|

|

|

|

|

|

|

| |

Net loss per share of common stock: |

|

|

|

|

|

|

|

|

Basic |

| $ | (0.02 | ) |

| $ | (0.06 | ) |

Diluted |

| $ | (0.02 | ) |

| $ | (0.06 | ) |

|

|

|

|

|

|

|

| |

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

| 108,591,429 |

|

|

| 107,551,931 |

|

Diluted |

|

| 108,591,429 |

|

|

| 107,551,931 |

|

United States Antimony Corporation and Subsidiaries

Consolidated Balance Sheets

| December 31, 2024 |

|

| December 31, 2023 |

| |||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 18,172,120 |

|

| $ | 11,899,574 |

|

Certificates of deposit |

|

| - |

|

|

| 72,898 |

|

Accounts receivable, net |

|

| 1,156,564 |

|

|

| 625,256 |

|

Inventories |

|

| 1,245,724 |

|

|

| 1,386,109 |

|

Prepaid expenses and other current assets |

|

| 104,161 |

|

|

| 92,369 |

|

Total current assets |

|

| 20,678,569 |

|

|

| 14,076,206 |

|

Properties, plants and equipment, net |

|

| 12,891,447 |

|

|

| 13,454,491 |

|

Operating lease right-of-use asset |

|

| 565,289 |

|

|

| - |

|

Restricted cash for reclamation bonds |

|

| 98,778 |

|

|

| 55,061 |

|

IVA receivable and other assets, net |

|

| 408,519 |

|

|

| 509,237 |

|

Total assets |

| $ | 34,642,602 |

|

| $ | 28,094,995 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 1,545,708 |

|

| $ | 456,935 |

|

Accrued liabilities |

|

| 1,427,146 |

|

|

| 133,841 |

|

Accrued liabilities - directors |

|

| 141,287 |

|

|

| 124,810 |

|

Royalties payable |

|

| 133,434 |

|

|

| 153,429 |

|

Current portion of operating lease liability |

|

| 626,562 |

|

|

| - |

|

Long-term debt, current portion |

|

| 132,252 |

|

|

| 28,443 |

|

Total current liabilities |

|

| 4,006,389 |

|

|

| 897,458 |

|

Noncurrent liabilities: |

|

|

|

|

|

|

|

|

Noncurrent operating lease liability |

|

| 129,007 |

|

|

| - |

|

Long-term debt, net of current portion |

|

| 195,425 |

|

|

| - |

|

Stock payable to directors |

|

| - |

|

|

| 38,542 |

|

Asset retirement obligations |

|

| 1,711,108 |

|

|

| 1,638,027 |

|

Total liabilities |

|

| 6,041,929 |

|

|

| 2,574,027 |

|

COMMITMENTS AND CONTINGENCIES (Note 11) |

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Preferred stock $0.01 par value, 10,000,000 shares authorized: |

|

|

|

|

|

|

|

|

Series A: 0 shares issued and outstanding |

|

| - |

|

|

| - |

|

Series B: 750,000 shares issued and outstanding (liquidation preference $975,000 and $967,500, respectively) |

|

| 7,500 |

|

|

| 7,500 |

|

Series C: 177,904 shares issued and outstanding (liquidation preference $97,847 both years) |

|

| 1,779 |

|

|

| 1,779 |

|

Series D: 0 shares issued and outstanding |

|

| - |

|

|

| - |

|

Common stock, $0.01 par value, 150,000,000 shares authorized; 112,951,317 and 107,647,317 shares issued and outstanding, respectively |

|

| 1,129,512 |

|

|

| 1,076,472 |

|

Additional paid-in capital |

|

| 68,610,905 |

|

|

| 63,853,836 |

|

Accumulated deficit |

|

| (41,149,023 | ) |

|

| (39,418,619 | ) |

Total stockholders' equity |

|

| 28,600,673 |

|

|

| 25,520,968 |

|

Total liabilities and stockholders' equity |

| $ | 34,642,602 |

|

| $ | 28,094,995 |

|

United States Antimony Corporation and Subsidiaries

Consolidated Statements of Cash Flows

| For the years ended |

| ||||||

| December 31, 2024 |

|

| December 31, 2023 |

| |||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net loss |

| $ | (1,730,404 | ) |

| $ | (6,348,287 | ) |

Adjustments to reconcile net loss to |

|

|

|

|

|

|

|

|

net cash provided (used) by operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

| 1,085,747 |

|

|

| 959,445 |

|

Accretion of asset retirement obligation |

|

| 73,081 |

|

|

| 13,471 |

|

Changes in asset retirement obligation estimates |

|

| - |

|

|

| 324,984 |

|

Noncash operating lease expense |

|

| 222,188 |

|

|

| - |

|

Share-based compensation |

|

| 568,588 |

|

|

| - |

|

Loss on sale or disposal of property, plant and equipment, net |

|

| 11,097 |

|

|

| 217,921 |

|

Write-down of inventory to net realizable value |

|

| 65,647 |

|

|

| 2,073,404 |

|

Change in allowance for doubtful accounts on accounts receivable |

|

| (261,047 | ) |

|

| 239,772 |

|

Change in IVA receivable and other assets, net |

|

| 100,718 |

|

|

| 388,442 |

|

Other noncash items |

|

| (16,107 | ) |

|

| (7,500 | ) |

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

| (270,261 | ) |

|

| (80,571 | ) |

Inventories |

|

| 74,738 |

|

|

| (2,084,445 | ) |

Prepaid expenses and other current assets |

|

| (11,792 | ) |

|

| 45,230 |

|

Accounts payable |

|

| 1,088,773 |

|

|

| (171,868 | ) |

Accrued liabilities |

|

| 1,293,305 |

|

|

| (67,308 | ) |

Accrued liabilities - directors |

|

| 16,477 |

|

|

| 51,847 |

|

Stock payable to directors |

|

| (38,542 | ) |

|

| (22,917 | ) |

Change in operating lease liability |

|

| (31,908 | ) |

|

| - |

|

Royalties payable |

|

| (19,995 | ) |

|

| (281,646 | ) |

Net cash provided (used) by operating activities |

|

| 2,220,303 |

|

|

| (4,750,026 | ) |

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from redemption of certificates of deposit |

|

| 72,898 |

|

|

| 186,959 |

|

Proceeds from sale of properties, plants and equipment |

|

| 315,625 |

|

|

| - |

|

Purchases of properties, plant, and equipment |

|

| (430,596 | ) |

|

| (1,528,672 | ) |

Net cash used by investing activities |

|

| (42,073 | ) |

|

| (1,341,713 | ) |

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Payments on dividends payable |

|

| - |

|

|

| (787,730 | ) |

Principal payments on long-term debt |

|

| (103,488 | ) |

|

| (283,562 | ) |

Proceeds from issuance of common stock, net of issuance costs |

|

| 2,759,681 |

|

|

| - |

|

Proceeds from exercise of warrants |

|

| 1,481,840 |

|

|

| - |

|

Net cash provided (used) by financing activities |

|

| 4,138,033 |

|

|

| (1,071,292 | ) |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS AND RESTRICTED CASH |

|

| 6,316,263 |

|

|

| (7,163,031 | ) |

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD |

|

| 11,954,635 |

|

|

| 19,117,666 |

|

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD |

| $ | 18,270,898 |

|

| $ | 11,954,635 |

|

|

|

|

|

|

|

|

| |

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION |

|

|

|

|

|

|

|

|

Interest paid in cash |

| $ | 8,869 |

|

| $ | 10,521 |

|

NON-CASH FINANCING AND INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Equipment purchased with note payable |

| $ | 402,722 |

|

| $ | - |

|

Recognition of operating lease liability and right of use asset |

| $ | 787,477 |

|

| $ | - |

|

Common stock buyback and retirement |

| $ | - |

|

| $ | 202,980 |

|

Conversion of Preferred Series D to Common Stock |

| $ | - |

|

| $ | 16,926 |

|

About USAC:

United States Antimony Corporation and its subsidiaries in the U.S., Mexico, and Canada ("USAC," the "Company," "Our," "Us," or "We") sell antimony, zeolite, and precious metals primarily in the U.S. and Canada. The Company processes third party ore primarily into antimony oxide, antimony metal, antimony trisulfide, and precious metals at its facilities located in Montana and Mexico. Antimony oxide is used to form a flame-retardant system for plastics, rubber, fiberglass, textile goods, paints, coatings, and paper, as a color fastener in paint, and as a phosphorescent agent in fluorescent light bulbs. Antimony metal is used in bearings, storage batteries, and ordnance. Antimony trisulfide is used as a primer in ammunition. The Company also recovers precious metals, primarily gold and silver, at its Montana facility from third party ore. At its facility located in Idaho, the Company mines and processes zeolite, a group of industrial minerals used in water filtration, sewage treatment, nuclear waste and other environmental cleanup, odor control, gas separation, animal nutrition, soil amendment and fertilizer, and other miscellaneous applications. The Company acquired mining claims and leases located in Alaska and Ontario, Canada and leased a metals concentration facility in Montana in 2024 that could expand its operations as well as its product offerings.

Forward-Looking Statements:

Readers should note that, in addition to the historical information contained herein, this press release may contain forward-looking statements within the meaning of, and intended to be covered by, the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based upon current expectations and beliefs concerning future developments and their potential effects on the Company including matters related to the Company's operations, pending contracts and future revenues, financial performance and profitability, ability to execute on its increased production and installation schedules for planned capital expenditures, and the size of forecasted deposits. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-K and Form 10-Q with the Securities and Exchange Commission.

Forward-looking statements are typically identified by words such as "believe," "expect," "anticipate," "intend," "outlook," "estimate," "forecast," "project," "pro forma," and other similar words and expressions. Forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made. Because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in the forward-looking statements and future results could differ materially from historical performance.

Contact:

United States Antimony Corp.

4438 W. Lover's Lane, Unit 100

Dallas, TX 75209

Jonathan Miller, VP, Investor Relations

E-Mail: Jmiller@usantimony.com

Phone: 406-606-4117

SOURCE: United States Antimony Corp.