Driven by its Pharmaceutical Activities, Roquette's 2024 Results Demonstrate the Resilience of its Integrated Business Model

- Commercial performance in line with a market which remains below historical levels. 2024 turnover of €4,495 million (-10% vs. 2023).

- Rigorous cost management has allowed the Group to maintain margin levels (11.8% in 2024 compared with 12.2% in 2023), with a consolidated EBITDA of €529 million (-13% vs. 2023).

- A significant improvement in Free Cash-Flow, at €275 million, mainly driven by Roquette's financial discipline and easing inflationary pressure on working capital requirement.

- The acquisition of IFF Pharma Solutions, expected to be completed in Q2 2025, will strengthen the Pharma Solutions activities.

- Successful inaugural dual tranche bond issue raising €1.2 billion to finance part of the IFF Pharma Solutions acquisition.

Lille - March 21st, 2025 - Roquette announces today its 2024 full year results following the approval of its financial statements by the Board of Directors on March 20th, 2025.

On this occasion, Pierre Courduroux, Roquette's CEO, commented: "Roquette delivered a resilient financial performance in 2024. Our Pharma Solutions business continued its development, with a strong growth that confirms our strategy to reinforce our leadership in this market.Despite a challenging environment, our Core Ingredients activities are in line with a market which remains below historical levels."

2024 was marked by a strong Free Cash-Flow, supported by Roquette's operational excellence, its financial discipline, and the easing of inflationary pressures. The reduction in net debt places the group in a strong position to execute its ambitious investment strategy. "The ongoing acquisition of IFF Pharma Solutions marks a strategic milestone for the Group. It will enable us to better balance our portfolio between health and nutrition, reducing our exposure to commodity price fluctuations while strengthening our global presence in high-value markets, and particularly with a larger industrial footprint in the USA. In addition, the success of our first dual tranche bond issue demonstrates investor confidence and marks the beginning of a new phase of sustainable value creation for all our stakeholders," emphasized Pierre Courduroux.

Despite an uncertain economic environment, Roquette enters 2025 with confidence in its strategy, supported by the resilience of its integrated model, the diversity of its portfolio, and its global presence. Rigorous cost management and the continued growth of the Pharma Solutions business reinforce this momentum. Like other industries, visibility for the year remains limited, and Roquette stays fully focused on its strategic priorities. "In 2025, our priority will be to successfully integrate IFF Pharma Solutions, while maintaining the performance of our activities. We will also continue to strengthen our competitiveness and focus on deleveraging. The acquisition of IFF Pharma Solutions, scheduled for the second quarter of 2025, is unique due to the complementary nature of our portfolios and our industrial footprints. It will significantly strengthen Roquette's position as a key partner for global pharmaceutical companies, with a broad range of drug delivery solutions featuring diverse excipient technologies. This transformative step will pave the way for sustainable growth and long-term success for Roquette," concluded Pierre Courduroux.

FULL YEAR 2024 CONSOLIDATED KEY FIGURES1

| (in millions of euros) | 2023 | 2024 | Var. % | Var. at constant exchange rates (%) |

| Turnover | 4,992 | 4,495 | -10 % | -10 % |

| EBITDA | 609 | 529 | -13 % | -12 % |

| EBITDA margin | 12.2 % | 11.8 % | -43 bp | -36 bp |

| Net result | 204 | 61 | -70 % | - |

| Free Cash-Flow IFRS | (364)(a) | 275 | - | - |

| Net debt IFRS | 1,033 | 237(b) | -77 % | - |

| Leverage ratio (Net debt IFRS/EBITDA) | 1.70x | 0.45x | - | - |

(a) Free Cash-Flow IFRS amounts to + €83 million, excluding acquisition cost of Qualicaps completed in October 2023.

(b) Including €1.2 billion in short-term placements from the Eurobond issuances in November 2024, of which €600 million in hybrid bonds accounted as equity, in accordance with IFRS standards.

FINANCIAL PERFORMANCE

PERFORMANCE SLOWED DOWN AFTER TWO VERY STRONG YEARS

2022 and 2023 were marked by market imbalances caused by the pandemic and intensified inflationary pressures due to the exogenous shock of the war in the Ukraine. In 2024, market conditions started to normalize, with reducing costs and a gradual recovery in demand, particularly in the health and nutrition sectors.

In a context of recovering demand and increased competition, Roquette adopted a market share protection strategy, particularly in its Core Ingredients business in Europe. This commercial policy adjustment, combined with the recovery in demand, led to an increase in the Group's volumes. In addition, to preserve its performance, the group maintained strict control over operational costs and benefited from the positive results of its ambitious competitiveness program launched in 2022.

As a result, the Group reported a turnover of €4,495 million, or 10% below 2023, and an EBITDA of €529 million (-13%) for the financial year, representing a margin of 11.8%. Growth in specialty products, particularly in the Pharma Solutions activities, partially offsets the pressure from declining selling prices.

Reported net income stood at €61 million, impacted by non-recurring items (before income tax effects) amounting to €68 million, mainly related to the ongoing acquisition of IFF Pharma Solutions and the Qualicaps integration costs.

STRONG IMPROVEMENT IN FREE CASH-FLOW GENERATION

| Consolidated figures - full year (in millions of euros) | 2023 | 2024 |

| Operating Cash-Flow | 462 | 352 |

| Variation in working capital requirement | (104) | 157 |

| Investments paid(c) | (722) | (234) |

| Free Cash-Flow IFRS | (364) | 275 |

(c) Including Qualicaps acquisition.

Working capital requirement improved, decreasing from 20.4% of turnover in 2023 to 18.9% in 2024. This was driven primarily by a reduction in inventory value and accounts receivable in a context of slowing inflation.

Moreover, a strict operational discipline, combined with easing inflationary pressures, allowed the Group to record a significant improvement in Free Cash-Flow, reaching €275 million in 2024 vs. -€364 million in 2023. Excluding the Qualicaps acquisition, the Group would have generated a positive Free Cash-Flow of €83 million in 2023.

OPERATIONAL AND COMMERCIAL PERFORMANCE

PHARMA SOLUTIONS - GROWTH AND TRANSFORMATIONAL ACQUISITION UNDERWAY

| Consolidated figures - full year (in millions of euros) | 2023 | 2024 | Var. | Var. % | |||||

| Sales | 680 | 818 | 138 | 20 % | |||||

| % of Group's sales | 14 % | 19 % | - | - | |||||

| EBITDA | 225 | 272 | 47 | 21 % | |||||

| % of Group's EBITDA | 37 % | 51 % | - | - | |||||

In 2024, the sales of the Pharma Solutions business reached €818 million, up 20% from 2023, reinforced by the capsules and equipment sales of Qualicaps, acquired by the Group in October 20232. Growth was also supported by the consolidation of margin levels in this market. EBITDA increased by 21% to reach €272 million, representing a margin of 33.3%, a slight increase compared to 2023.

In 2024, Roquette made a major strategic move by signing an agreement to acquire IFF Pharma Solutions3, with an expected completion date in the second quarter of 2025, which will strengthen its position as a key partner for the pharmaceutical industry.

CORE INGREDIENTS - TOWARDS MARKET NORMALIZATION AFTER TWO ATYPICAL YEARS

| Consolidated figures - full year (in millions of euros) | 2023 | 2024 | Var. | Var. % |

| Sales | 4,108 | 3,562 | (546) | -13 % |

| % of Group's sales | 86 % | 81 % | - | - |

| EBITDA | 385 | 258 | (127) | -33 % |

| % of Group's EBITDA | 63 % | 49 % | - | - |

In 2024, market dynamics contrasted with those of 2023. 2023 featured historically high sales price levels and a sharp decline in volumes, particularly for commodity products in Europe. In 2024, Core Ingredients recorded an 8% increase in volumes driven by market recovery and a strategy to maintain leadership in the region. At the same time, the fall in sugar prices and intensifying competition continued to put pressure on selling prices, particularly for commodities in Europe.

Thus, Core Ingredient's performance is in line with a market which remains below historical levels, with sales of €3,562 million, down 13% compared to 2023. EBITDA stands at €258 million, down 33% compared to the 2023 financial year.

BALANCE SHEET

LOWER LEVERAGE AHEAD OF IFF PHARMA SOLUTIONS ACQUISITION

| Consolidated figures - full year (in millions of euros) | 2023 | 2024 |

| Gross debt IFRS | 1,250 | 1,791 |

| Cash & cash equivalents and financial investments | 217 | 1,554 |

| Net debt IFRS | 1,033 | 237(d) |

| Leverage ratio (Net debt IFRS/EBITDA) | 1.70x | 0.45x |

| Gross debt towards financial institutions (cf. Appendix 5) | 1,067 | 1,651 |

(d) Including €1.2 billion in short-term placements from the Eurobond issuances in November 2024, of which €600 million in hybrid bonds accounted as equity, in accordance with IFRS standards.

Dynamic balance sheet management in 2024

In 2024, the Group reduced its net financial debt to €237 million, compared with €1,033 million at the end of 2023. This change takes into consideration the benefits of the hybrid bond issue of €600 million classified as equity in accordance with IFRS standards. The bonds issued in 2024 are intended to finance the ongoing acquisition of IFF Pharma Solutions. To date, the funds have been deposited pending the acquisition.

All information relating to euro bond issues is available on Roquette's website: Roquette Financial Information.

The gross financial debt (IFRS), excluding cash and cash equivalents, amounted to €1 791 million in 2024, up €541 million compared to 2023, mainly due to the €600 million bond issue. Excluding the senior issue, financial debt is down slightly by €60 million compared to 2023. The cost of servicing the debt amounts to €52 million in 2024, compared to €33 million in 2023, and was impacted by the rise in interest rates, the financing of Qualicaps (acquired at the end of 2023) and the costs of the acquisition bridge financing. Despite these factors, the average cost of debt has decreased from 4.42% in 2023 to 3.81% in 2024.

A balanced debt profile, strong liquidity

The Group has also strengthened its debt structure, with 80% of debt now at a fixed rate, up from just a third in 2023. Its maturity profile is balanced, with no major repayments before 2028 and an average maturity of 5.4 years.

As of December 31st, 2024, the Group maintained liquidity exceeding €1 billion, including €798 million in confirmed credit lines, of which €614 million remains undrawn. Its €300 million commercial paper program, of which €90 million has been used, further reinforces this strong financial position. The Group's short-term rating is maintained at A-2 by S&P Global Ratings.

Rated BBB by S&P Global Ratings with a negative outlook, the Group continues to actively manage its balance sheet and is targeting an IFRS leverage ratio of between 2.3x and 2.7x by 2027, underscoring its commitment to maintaining a robust investment grade rating.

Secured financing in view of the planned acquisition of IFF Pharma Solutions

The acquisition of IFF Pharma Solutions, for 2.6 billion USD4, is fully secured via an acquisition bridge financing signed in March 2024 with leading pan-European banks.

The press release can be viewed on the Group's website www.roquette.com.

Status of the accounts:

The audit procedures on the consolidated accounts have been completed. The certification report is currently being issued and is scheduled for March 28th, 2025.

About Roquette

Roquette is a family-owned global leader in plant-based ingredients and a leading provider of pharmaceutical excipients. Founded in 1933, the company currently operates in more than 100 countries, through more than 30 manufacturing sites, has a turnover of around 4.5 billion euros in 2024, and employs almost 10,000 people worldwide.

Life and nature have been our sources of inspiration for decades. All our raw materials are of natural origin. From them, we enable a whole new plant-based cuisine; we offer pharmaceutical solutions that play a key role in medical treatments; and we develop innovative ingredients for food, nutrition and health markets. We truly unlock the potential of nature to improve, cure and save lives.

Thanks to a constant drive for innovation and a long-term vision, we are committed to improving the well-being of people all over the world. We put sustainable development at the heart of our concerns, while taking care of resources and territories. We are determined to create a better and healthier future for all generations.

Discover more about Roquette at this link.

Press contacts:

Brunswick

Antoine Parison

+33

Roquette

Corporate Communications

Susannah Duquesne

Susannah.duquesne@roquette.com

Financial Communications

Eloïse de la Chaux

eloise.de-la-chaux@roquette.com

DISCLAIMER -Certain statements contained in this press release may contain forecasts that specifically relate to future events, trends, plans or objectives. By nature, these forecasts involve identified and unidentified risks and uncertainties and may be affected by many factors likely to give rise to a significant discrepancy between the actual results and those indicated in these statements.The group does not undertake to publish an update or revision of these forecasts, or to communicate on new information, future events or any other special circumstance. The amounts presented in this presentation have been rounded to the nearest hundred/unit, which may result in slight discrepancies in totals. Thus, the financial data is provided for informational purposes only and may not exactly match the figures in the consolidated financial statements.

FINANCIAL INFORMATION -This press release and Roquette's full regulated information are available on the Group's website: Roquette website

GLOSSARY

To measure its performance, the Group uses certain financial indicators that are not defined by IFRS standards. These indicators are used in the operational monitoring of the Group's activities and its financial communication (press releases, financial presentations, etc.).

| Alternative performance indicators | Definitions and reconciliation with IFRS indicators |

| EBITDA | EBITDA corresponds to the consolidated current or recurring operating income of the Group for that period, after adding back all amounts deducted from consolidated current or recurring operating income for depreciation, amortization, impairment on fixed assets, net amounts related of fixed assets write-offs, insurances and investment subsidies, non-core business or non-business-related incomes or charges. |

| Operating Cash-Flow | Operating cash flow corresponds to the Cash-Flow generated by operating activities (from the consolidated cash flow statement), plus the change in net working capital, the unrealized financial result on operating receivables and payables, the "net impairment of current assets" (impacts the operating cash flow) and "other reconciling items". |

| Free Cash-Flow | Free Cash-Flow corresponds to cash flow after investments (from the cash flow statement derived from the consolidated accounts), to which is added the Change in other current assets (for Short-term investments mentioned in Note 16 "Current and non-current financial assets", which are included in the aggregate "Net debt"), the change in other non-current assets (for long-term investments and receivables related to equity interests and loans mentioned in Note 16 "Current and non-current financial assets", which are included in the aggregate "Net debt"), the change in the scope of the Qualicaps debt mentioned in Note 22. 2a for the 2023 financial year and "Other reconciliation items". |

| Net debt | Net debt corresponds, on the basis of the consolidated accounts, to non-current financial liabilities, current financial liabilities, minus cash and cash equivalents, as well as Other current assets (for Short-term investments mentioned in Note 16 "Current and non-current financial assets", which are included in the aggregate "Net debt") and Other non-current assets (for Long-term investments and Receivables related to investments and loans mentioned in Note 16 "Current and non-current financial assets", which are included in the aggregate "Net debt"). |

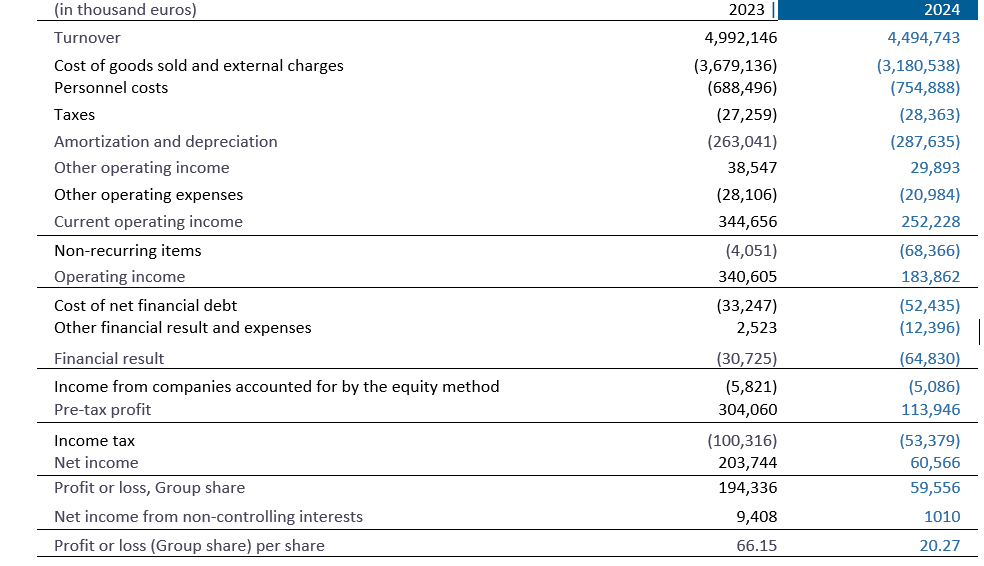

APPENDIX 1 - INCOME STATEMENT

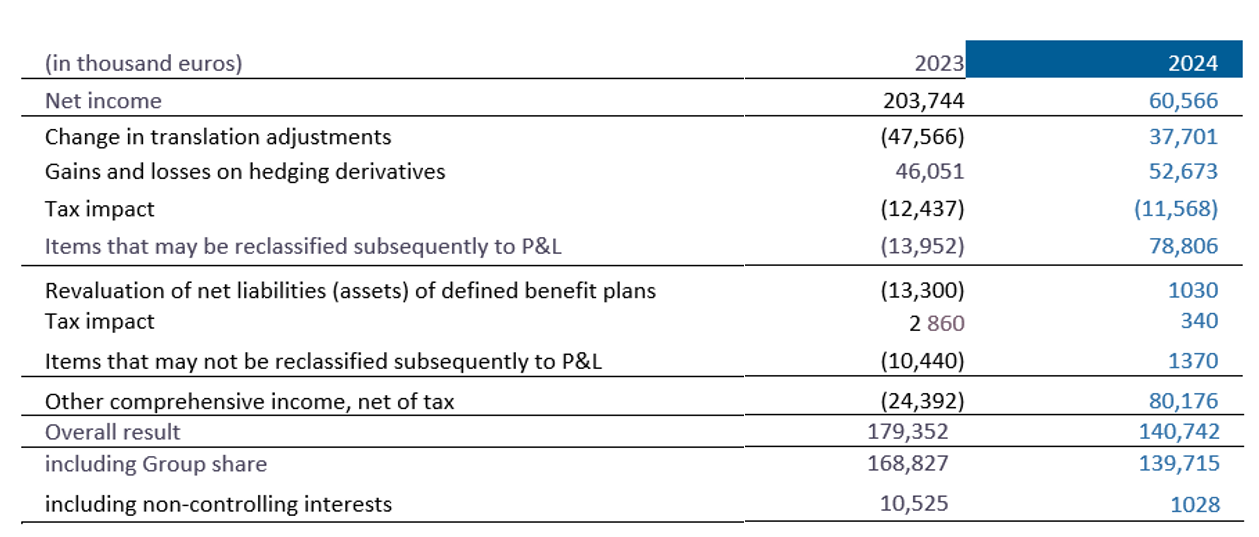

APPENDIX 2 - COMPREHENSIVE INCOME STATEMENT

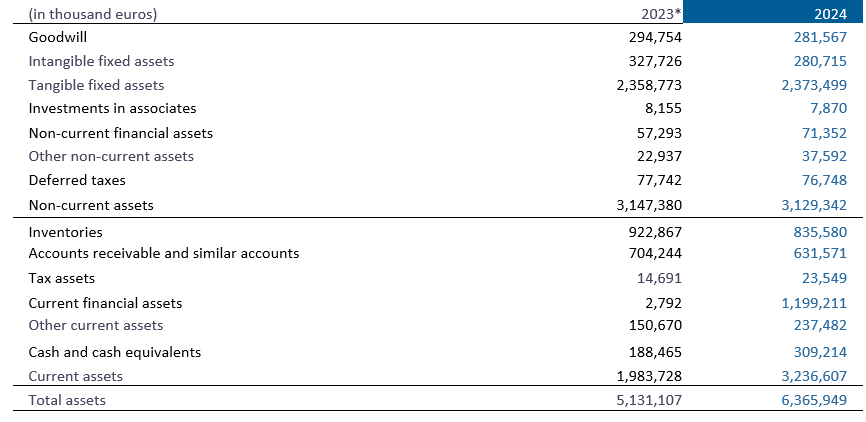

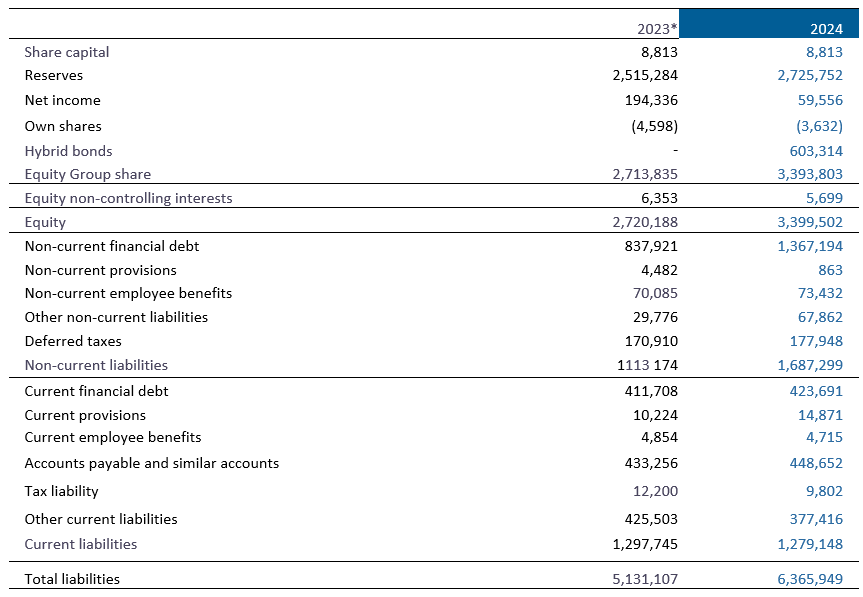

APPENDIX 3 - BALANCE SHEET

*Restated to reflect finalization of the Qualicaps purchase price allocation

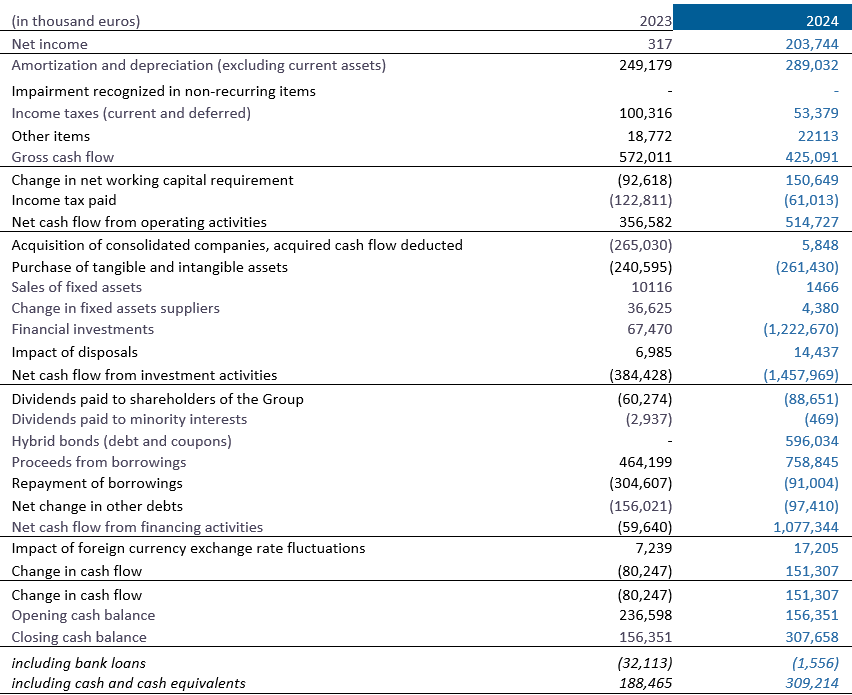

APPENDIX 4 - CASH FLOW STATEMENT

* Including an advance payment of €29,2 million on 2024 dividends, decided by the Board of Directors on September 25th, 2024, prior to the creation of the family holding company.

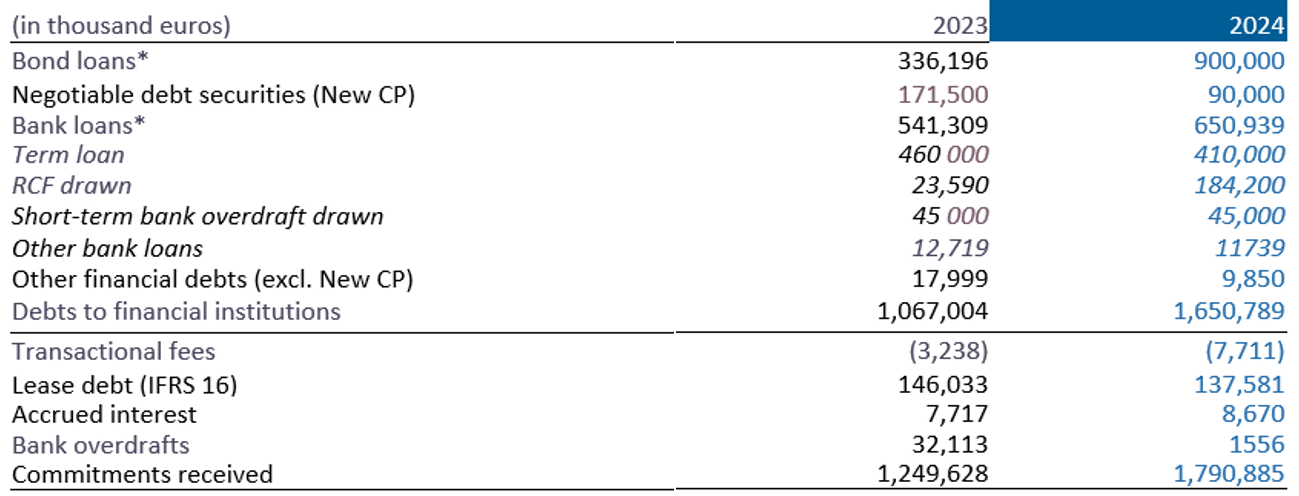

APPENDIX 5 - GROSS DEBT TOWARDS FINANCIAL INSTITUTIONS

This aggregate excludes bank loans, loan issue fees, lease debts and accrued interest, and therefore reflects nominal amounts of indebtedness to financial institutions (banks and investors).

*excluding issuance fees

1 The definition of the alternative performance indicators is provided in the appendices of this press release.

2 Refer to the press releasein the Roquette websitein the Roquette website (IFF Pharma Solutions).

4 Excluding earnouts, which are secured by the acquisition bridge.