Unaudited Interim Results for the Six Months ended 31 December 2024

LONDON, GB / ACCESS Newswire / March 21, 2025 / Helium One Global Limited (AIM:HE1), the primary helium explorer, is pleased to announce its unaudited condensed and consolidated results for the six months ended 31 December 2024, in addition to providing an update on progress across the Company's projects in Tanzania and the USA.

Highlights

Successful completion of the extended well test on Itumbula West-1 which successfully flowed up to 7.9% helium to surface.

Submission of a comprehensive Mining License ("ML") application on the southern Rukwa Helium Project to the Ministry of Minerals ("MoM").

Purchase of a 50% legal and beneficial interest in ASX-listed Blue Star Helium's Galactica-Pegasus project in Colorado, USA.

Net cash balance at 31 December 2024 of $10,021,699

Post half year-end

Commencement of the initial six well development drilling programme at the Galactica-Pegasus helium project in Las Animas County, Colorado.

On 28 February 2025, theCompany received an offer letter for the requested ML from the Mining Commission in Tanzania for the grant of an ML for the southern Rukwa Helium Project.

Jackson-4 development well at the Galactica Pegasus Project spudded and operations ongoing.

James Smith, Chairman of Helium One commented:

"This has been a very exciting and significant period for the Company. In Tanzania, we undertook a successful extended well test after our Phase II drilling campaign, completed a feasibility study and subsequently submitted a Mining Licence application, for which we have now received an offer letter from the Mining Commission. We also successfully acquired a 50% interest in a helium development project in Colorado USA.

We now have a portfolio containing two development opportunities in two jurisdictions which diversifies the risk profile of the Company and provides us with the opportunity, in Colorado, to realise near term revenue streams which will support our future investment requirements across the portfolio.

We would like to thank all our shareholders as well as all our stakeholders in Tanzania and elsewhere for their continued support and look forward to the year ahead as we progress both of our exciting projects."

For further information please visit the Company's website: www.helium-one.com

Contact

Helium One Global Ltd | +44 20 7920 3150 |

|

|

Panmure LiberumLimited (Nominated Adviser and Joint Broker) | +44 20 3100 2000 |

|

|

Zeus Capital Limited (Joint Broker) | +44 20 3829 5000 |

|

|

Tavistock(Financial PR) | +44 20 7920 3150 |

Notes to Editors

Helium One Global, the AIM-listed Tanzanian explorer, holds prospecting licences across two distinct project areas, with the potential to become a strategic player in resolving a supply-constrained helium market.

The Rukwa and Eyasi projects are located within rift basins on the margin of the Tanzanian Craton in the north and southwest of the country. These assets lie near surface seeps with helium concentrations ranging up to 10.4% helium by volume. All Helium One's licences are held on a 100% equity basis.

The Company's flagship southern Rukwa Project is located within the southern Rukwa Rift Basin covering 1,664km2 in south-west Tanzania. This project is considered to be entering an appraisal stage following the success of the 2023/24 exploration drilling campaign, which proved a helium discovery at Itumbula West-1 and, following an extended well test, successfully flowed 5.5% helium continually to surface in Q3 2024.

Following the success of the extended well test, the Company has now flowed significant quantities of helium to surface and has filed a Mining Licence application with the Mining Commission of the Tanzanian Government. Subsequent to the filing of the ML Application, the Company has now received the offer of an ML for the southern Rukwa Helium Project.

The Company also owns a 50% working interest in the Galactica-Pegasus helium development project in Las Animas County, Colorado, USA. This project is operated by Blue Star Helium Ltd (ASX: BNL).

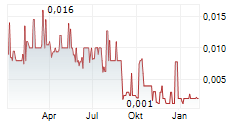

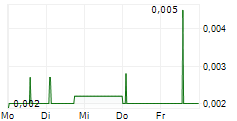

Helium One is listed on the AIM segment of the London Stock Exchange with the ticker of HE1 and on the OTCQB in the United States with the ticker HLOGF.

Chairman's Statement

Operations

Following on the success of the Phase II drilling programme on our southern Rukwa helium project in FY2024, and the announcement of a confirmed helium discovery, the six-month period ended 31 December 2024 saw the completion of the extended well test at Itumbula West-1 which successfully flowed up to 7.9% helium to surface.

After extensive analysis of all of the data from the operations during the year, the team submitted an application for a Mining Licence ("ML") on the southern Rukwa Helium Project in September 2024. Subsequently, the Company continued to engage with the Ministry of Minerals and the Mining Commission in Tanzania whist awaiting the award of the ML and on 3 March 2025, the Company then announced that it had received an offer letter for the ML from the Mining Commission.

On 31 October 2024, the Company executed definitive agreements to acquire a 50% legal and beneficial interest in Blue Star's Galactica-Pegasus project in Colorado, USA as well as a similar interest in the leases associated with 246 km2 (61,000 gross acres) of acreage in the proven helium fairway of Las Animas County, southern Colorado.

The full development programme for the Galactica project will require the drilling and tie-back of 15 wells, as well as commissioning of the relevant helium and CO2 processing facilities. The initial programme will require the drilling of six development wells, which commenced with the spud of the Jackson-31 SENW 3054 development well in February 2025. Once the drilling and development programme is complete, it is forecast that the sale of helium and CO2 from these initial wells will generate sufficient cash to fund the drilling and tie-back of the remaining nine wells given the project's desirable location.

The initial wells are expected to be on stream and producing by the end of H1 2025 and an independent third-party competent person's report indicates that an average of approximately US$2 million per annum will accrue to the Company over a period of five years. However, these estimates represent only sales from the production of helium. The Company believes that the sale of associated CO2 into the local market could also increase this by up to 50%.

We are very pleased to have entered into this partnership with Blue Star, enabling the Company to build an expanding global footprint in the helium sector at such a pivotal time and this development opportunity enables the Company to potentially secure near-term cash flow to aid with progressing our Tanzanian asset. We now have a portfolio of two potential near term revenue projects in our portfolio.

Financing

In August 2024, the Company raised gross proceeds of £6.4 million (approximately US$8.2 million) through the issue of 590,000,000 new ordinary shares at a price of 1.09 pence per share to fund the acquisition of the 50% interest in the Galactica-Pegasus project.

Financials

For the six-month period ended 31 December 2024, the Group reported an unaudited pre-tax loss of $1,927,896 (six months ended 31 December 2023, unaudited $1,064,747). The Company continues to be well funded and as at 31 December 2024 the Company had cash balances totalling $10.02 million (31 December 2023 $8.74 million).

Outlook

Helium remains an irreplaceable technology commodity in a very dynamic market, sensitive to demand supply and geopolitics. The Board believes Helium One has a portfolio that has the potential to assist in helping meet the increasing demand for helium. The year ahead promises to be another busy and very significant period for the Company, as we look to progress our ML across the southern Rukwa Helium Project in Tanzania and work towards first production, and associated revenue in the USA.

I would like to take this opportunity to thank all our stakeholders for their continued support and look forward to providing further updates in due course.

James Smith

Chairman

20 March 2025

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

| Notes | 6 months to 31 December 2024 Unaudited | 6 months to 31 December 2023 Unaudited |

$ | $ | ||

Continuing operations |

|

|

|

Revenue |

| - | - |

Administration expenses | 4 | (1,971,822) | (1,066,187) |

Operating loss |

| (1,971,822) | (1,066,187) |

Finance income |

| 43,926 | 1,440 |

Loss for the period before taxation |

| (1,927,896) | (1,064,747) |

Taxation |

| - | - |

Loss for the period from continuing operations (attributable to the equity holders of the parent) |

| (1,927,896) | (1,064,747) |

|

|

|

|

Items that may be reclassified subsequently to profit or loss: |

|

|

|

Exchange differences on translation of foreign operations |

| 112,150 | (314,379) |

Total comprehensive loss for the period (attributable to the equity holders of the parent) |

| (1,815,746) | (1,379,126) |

|

|

|

|

Loss per share: |

|

|

|

Basic and diluted earnings per share (cents) | 5 | (0.03)c | (0.12)c |

CONDENSED CONSOLIDATED BALANCE SHEET

|

| As at | As at | As at |

| 31 December 2024 Unaudited | 30 June 2024 Audited | 31 December 2023 Unaudited | |

| $ | $ | $ | |

Notes |

|

|

| |

ASSETS |

|

|

|

|

Non-current assets |

|

|

|

|

Intangible assets | 7 | 39,192,682 | 31,729,689 | 32,385,522 |

Property, plant & equipment |

| 3,037,838 | 2,966,713 | 2,378,097 |

Other receivables |

| 1,524,136 | 1,083,797 | 2,082,010 |

Total non-current assets |

| 43,754,656 | 35,780,199 | 36,845,629 |

Current assets |

|

|

|

|

Inventories |

| - | - | 345,967 |

Trade and other receivables |

| 1,198,997 | 1,627,741 | 354,840 |

Cash and cash equivalents |

| 10,021,699 | 11,647,723 | 8,744,705 |

Total current assets |

| 11,220,696 | 13,275,464 | 9,445,512 |

Total assets |

| 54,975,352 | 49,055,663 | 46,291,141 |

|

|

|

|

|

LIABILITIES |

|

|

|

|

Current liabilities |

|

|

|

|

Trade and other payables |

| 371,807 | 1,584,566 | 4,494,986 |

Total liabilities |

| 371,807 | 1,584,566 | 4,494,986 |

Net assets |

| 54,603,545 | 47,471,097 | 41,796,155 |

|

|

|

|

|

EQUITY | ||||

Share premium | 8 | 93,305,620 | 85,130,910 | 70,372,410 |

Other reserves |

| 1,985,432 | 1,099,798 | 3,994,406 |

Retained earnings |

| (40,687,507) | (38,759,611) | (32,570,661) |

Total equity |

| 54,603,545 | 47,471,097 | 41,796,155 |

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS' EQUITY

| Note | Share premium | Other reserves | Retained earnings | Total equity |

$ | $ | $ | $ | ||

Balance as at 1 July 2023 |

| 54,468,236 | 4,242,482 | (31,505,914) | 27,204,804 |

Comprehensive income |

|

|

|

|

|

Loss for the period |

| - | - | (1,064,747) | (1,064,747) |

Currency translation differences |

| - | (314,379) | - | (314,379) |

Total comprehensive loss for the period |

| - | (314,379) | (1,064,747) | (1,379,126) |

Transactions with owners recognised directly in equity |

|

|

|

|

|

Share based payments |

| - | 66,303 |

| 66,303 |

Shares issued for services |

| 49,845 | - | - | 49,846 |

Issue of shares |

| 8,472,586 | - | - | 8,472,586 |

Cost of share issue |

| (448,150) | - | - | (448,150) |

Warrants and options exercised during the year |

| 751,988 | - | - | 751,988 |

Issue of shares |

| 7,764,558 | - | - | 7,764,557 |

Cost of share issue |

| (686,653) | - | - | (686,653) |

Total transactions with owners |

| 15,904,174 | 66,303 | - | 15,970,477 |

Balance as at 31 December 2023 (unaudited) |

| 70,372,411 | 3,994,406 | (32,570,661) | 41,796,155 |

|

| - | - | - | - |

Comprehensive income |

|

|

|

|

|

Loss for the period |

| - | - | (7,624,874) | (7,624,874) |

Currency translation differences |

| - | (2,008,204) | - | (2,008,204) |

Total comprehensive income for the period |

| - | (2,008,204) | (7,624,874) | (9,633,078) |

Transactions with owners recognised directly in equity |

|

|

|

|

|

Adjustment in respect of prior year unrealised losses |

| - | (927,627) | 927,627 | - |

Issue of ordinary shares |

| 15,587,799 | - | - | 15,587,799 |

Expiry of options during the period |

| - | (123,721) | 123,721 | - |

Warrant options exercised during the period |

| - | (384,576) | 384,576 | - |

Share based payments |

| - | 549,519 | - | 549,519 |

Cost of share issue |

| (829,298) | - |

| (829,298) |

Total transactions with owners |

| 14,758,500 | (886,405) | 1,435,924 | 15,308,019 |

Balance as at 30 June 2024 (audited) |

| 85,130,911 | 1,099,797 | (38,759,611) | 47,471,097 |

|

|

|

|

|

|

Comprehensive income |

|

|

|

|

|

Loss for the period |

| - | - | (1,927,896) | (1,927,896) |

Currency translation differences |

| - | 112,150 | - | 112,150 |

Total comprehensive loss for the period |

| - | 112,150 | (1,927,896) | (1,815,746) |

Transactions with owners recognised directly in equity |

|

|

|

|

|

Share based payments |

| - | 773,485 | - | 773,485 |

Shares issued for services |

| 236,863 | - | - | 236,863 |

Issue of shares |

| 8,448,669 | - | - | 8,448,669 |

Cost of share issue |

| (510,822) | - | - | (510,822) |

Total transactions with owners |

| 8,174,710 | 773,485 | - | 8,948,195 |

Balance as at 31 December 2024 (unaudited) |

| 93,305,620 | 1,985,432 | (40,687,507) | 54,603,545 |

|

|

|

|

|

|

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

|

| 6 months to 31 December 2024 Unaudited | 6 months to 31 December 2023 Unaudited |

Notes | $ | $ | |

Cash flows from operating activities |

|

|

|

Loss before taxation |

| (1,927,896) | (1,064,747) |

Adjustments for: |

|

|

|

Depreciation & amortisation |

| 226,968 | 121,806 |

Shares issued for services |

| 236,863 | 49,846 |

Share based payments |

| 554,843 | 66,303 |

(Increase)/ decrease in trade and other receivables |

| (11,595) | 1,032,837 |

Decrease in inventories |

| - | 1,130,394 |

(Decrease)/ increase in trade and other payables |

| (1,212,760) | 1,637,829 |

Net cash (used in)/ generated from operating activities |

| (1,914,935) | 2,974,268 |

Cash flows from investing activities |

|

|

|

Purchase of Plant & Equipment |

| (298,092) | (2,494,291) |

Expenditure on intangible assets | 7 | (7,462,993) | (16,876,007) |

Net cash used in investing activities |

| (7,761,085) | (19,370,298) |

Cash flows from financing activities |

|

|

|

Proceeds from the issue of shares |

| 8,448,669 | 16,989,131 |

Cost of share issue |

| (510,822) | (1,134,803) |

Net cash generated from financing activities |

| 7,937,847 | 15,854,328 |

Net decrease in cash and cash equivalents |

| (5,082,649) | (541,702) |

Cash and cash equivalents at beginning of period |

| 11,647,723 | 9,600,786 |

Exchange movement on cash |

| 112,150 | (314,379) |

Cash and cash equivalents at end of period |

| 10,021,699 | 8,744,705 |

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

The principal activity of Helium One Global Limited (the 'Company') and its subsidiaries (together the 'Group') is the exploration and development of helium gas resources. The Company is incorporated and domiciled in the British Virgin Islands. The address of its registered office is 171 Main Street, PO Box 92, Road Town, Tortola, British Virgin Islands, VG110. The Company's shares are listed on the AIM Market of the London Stock Exchange ('AIM'), the Frankfurt Stock Exchange and the OTCQB exchange.

2. Basis of Preparation

The condensed consolidated interim financial statements have been prepared in accordance with the requirements of the AIM Rules for Companies. As an AIM listed Company, the company is entitled to exemption from adopting IAS 34 and this exemption has been taken to the effect that segment information is not disclosed. The condensed consolidated interim financial statements should be read in conjunction with the annual financial statements for the year ended 30 June 2024. The interim consolidated financial statements have been prepared in accordance International Financial Reporting Standards (IFRS) and IFRS Interpretations Committee (IFRS IC) interpretations as adopted by the European Union applicable to companies under IFRS and in accordance with AIM Rules, which have not differed from the previously EU-endorsed IFRS, and hence the previously reported accounting policies still apply. The financial statements are prepared on the historical cost basis or the fair value basis where the fair valuing of relevant assets or liabilities has been applied. The interim report has not been audited or reviewed by the Company's auditor.

Critical accounting estimates

The preparation of condensed consolidated interim financial statements in conformity with IFRS requires management to make judgements, estimates and assumptions that affect the application of policies and reported amounts of assets and liabilities, income and expenses. The estimates and associated assumptions are based on historical experience and factors that are believed to be reasonable under the circumstances, the results of which form the basis of making judgements about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis. Changes in accounting estimates may be necessary if there are changes in the circumstances on which the estimate was based, or as a result of new information or more experience. Such changes are recognised in the period in which the estimate is revised. Significant items subject to such estimates are set out in Note 4 of the Company's 2024 Annual Report and Financial Statements. The nature and amounts of such estimates have not changed significantly during the interim period.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of the business. The key risks that could affect the Company's medium term performance and the factors that mitigate those risks have not substantially changed from those set out in the Company's 2024 Annual Report and Financial Statements, a copy of which is available on the Company's website: www.helium-one.com. The key financial risks are liquidity risk, credit risk, interest rate risk and fair value estimation.

The Condensed interim financial statements were approved by the Board of Directors on 20 March 2024.

3. Accounting Policies

The accounting policies adopted are consistent with those used in the preparation of the Company's 2024 Annual Report and Financial Statements and corresponding interim reporting period. There were no new or amended accounting standards that required the Group to change its accounting policies. The directors also considered the impact of standards issued but not yet applied by the Group and do not consider that there will be a material impact of transition on the financial statements.

Interest in Joint Arrangements

In October 2024, the Company concluded a Farm-in Agreement with Blue Star Helium ("Blue Star") whereby The Company earns a 50% interest in a helium development project ("the Galactica Project") in Colorado, USA in exchange for paying US$1.5 million to Blue Star in consideration for past costs and funding the drilling of six development wells (capped at US$450k per well). Blue Star, through its local operating entity, will continue to act as Operator of the Galactica Project.

This transaction will be recorded in the Company's Financial Statements as a joint operation whereby the parties of the arrangement have rights to the assets, and obligations for the liabilities, relating to the arrangement. When the Group undertakes its activities under the above-referenced joint operation, the Group does not act operator but recognises in relation to its interest in a joint operation:

Its assets, including its share of any assets held jointly

Its liabilities, including its share of any liabilities incurred jointly

Its revenue from the sale of its share of the output arising from the joint operation

Its share of the revenue from the sale of the output by the joint operation

Its expenses, including its share of any expenses incurred jointly

Costs incurred in connection with this transaction will be capitalised in accordance with IFRS 6, "Exploration for and Evaluation of Mineral Resources," and will be amortised upon commencement of helium production which is expected to commence during the first half of 2025.

4. Expenses by nature breakdown

| Notes | 6 months to 31 December 2023 Unaudited | 6 months to 31 December 2022 Unaudited |

$ | $ | ||

|

|

|

|

Depreciation |

| 226,968 | 121,806 |

Wages and salaries (including Directors' fees) |

| 257,733 | 234,968 |

Professional & Consulting fees |

| 462,438 | 395,960 |

Insurance |

| 50,993 | 100,356 |

Office expenses |

| 93,340 | 67,094 |

Share option expense |

| 773,485 | 66,303 |

Travel and subsistence expenses |

| 19,041 | 8,571 |

Foreign currency loss / (profit) |

| 60,673 | (107,747) |

Other (income)/ expenses |

| 27,150 | 178,876 |

|

| 1,971,822 | 1,066,187 |

5. Loss per share

The calculation for earnings per share (basic and diluted) is based on the consolidated loss attributable to the equity shareholders of the Company is as follows:

|

| 6 months to 31 December 2024 Unaudited | 6 months to 31 December 2023 Unaudited |

$ | $ | ||

|

|

|

|

Loss attributable to equity shareholders |

| (1,927,896) | (1,064,747) |

Weighted average number of Ordinary Shares |

| 5,420,713,539 | 925,281,778 |

Loss per Ordinary Share ($/cents) |

| (0.03) | (0.12) |

Earnings and diluted loss per share have been calculated by dividing the loss attributable to equity holders of the company after taxation by the weighted average number of shares in issue during the year. Diluted share loss per share has not been calculated as the options, warrants and loan notes have no dilutive effect given the loss arising in the period.

6. Dividends

No dividend has been declared or paid by the Company during the six months ended 31 December 2024 (2023: $nil).

7. Intangible assets

Exploration & Evaluation at Cost and Net Book Value |

|

| $ |

Balance as at 1 July 2023 |

|

| 15,509,515 |

Additions to exploration assets |

|

| 16,277,827 |

Capitalised Directors' fees and employee wages |

|

| 605,329 |

Capitalised other expenses |

|

| (7,149) |

As at 31 December 2023 (Unaudited) |

|

| 32,385,522 |

|

|

|

|

Additions to exploration assets |

|

| 4,653,632 |

Capitalised Directors' fees and employee wages |

|

| (159,168) |

Capitalised other expenses |

|

| 571,525 |

Additions - equity settled |

|

| 49,846 |

Exchange rate variances |

|

| - |

Total additions |

|

| 5,115,835 |

Impairments |

|

| (5,771,668) |

As at 30 June 2024 (Audited) |

|

| 31,729,689 |

|

|

|

|

Additions to exploration assets |

|

| 6,452,543 |

Capitalised Directors' fees and employee wages |

|

| 444,229 |

Capitalised other expenses |

|

| 329,358 |

Additions - equity settled |

|

| 236,863 |

Exchange rate variances |

|

| 3,344,476 |

As at 31 December 2024 (Unaudited) |

|

| 39,192,682 |

Intangible assets comprise exploration and evaluation costs which arise from both acquired and internally generated assets.

Following the assessment in accordance IFRS 6 at year end, impairments of $5,771,668 incurred in the financial year end 30 June 2023, the Directors reached a decision to impair all costs associated with the Eyasi and Balangida areas. This reflects that the Group's focus us currently on the southern Rukwa Helium Project area which, subsequently to the date of this interim report, the offer of the Mining License has been received.

8. Share premium

| Number of shares | Ordinary shares | Total |

|

| $ | $ |

As at 31 December 2023 | 3,402,377,430 | 73,609,171 | 73,609,171 |

Share Issue costs | - | (3,236,761) | (3,236,761) |

| 3,402,377,430 | 70,372,411 | 70,372,411 |

|

|

|

|

Issue of new shares | 1,913,333,333 | 15,587,798 | 15,587,798 |

Share issue costs | - | (829,298) | (829,298) |

|

|

|

|

As at 30 June 2024 | 5,315,710,763 | 89,196,969 | 89,196,969 |

Share Issue costs | - | (4,066,059) | (4,066,059) |

| 5,315,710,763 | 85,130,910 | 85,130,910 |

|

|

|

|

|

|

|

|

Issue of new shares - 30 August 2024 | 590,000,000 | 8,448,669 | 8,448,669 |

Share issue costs | - | (510,822) | (510,822) |

Issue of new shares - 10 December 2024 | 15,716,133 | 236,863 | 236,863 |

Share issue costs | - | - | - |

|

|

|

|

As at 31 December 2024 | 5,921,426,896 | 97,882,501 | 97,882,501 |

Share Issue costs | - | (4,576,881) | (4,576,881) |

| 5,921,426,896 | 93,305,620 | 93,305,620 |

This information is provided by RNS, the news service of the London Stock Exchange. RNS is approved by the Financial Conduct Authority to act as a Primary Information Provider in the United Kingdom. Terms and conditions relating to the use and distribution of this information may apply. For further information, please contact rns@lseg.com or visit www.rns.com.

SOURCE: Helium One Global Ltd

View the original press release on ACCESS Newswire