Topic: DEMIRE released FY24 results, showing rental income in line with our estimates but FFO weaker than expected. Further, the new outlook also reflects softening profitability. In detail:

FY24 rental income decreased by 16.9% yoy to € 65.3m (eNuW: € 66.1m). The decline was mainly driven by the disposals of the "LogPark Leipzig" (€ 7.8m effect on annualized rent) as well as the deconsolidation of the "LIMES" portfolio (€ 9.7m effect). Overall, the company was able to achieve record high asset disposals to the tune of € 110m (6% below BV).

FY24 FFO came in at € 23.8m, down 36.4% yoy and also clearly behind our estimate of € 28.4m. The gap to our estimate is mainly explained by a weaker than expected NOI margin (-5.1pp yoy) as well as higher admin and other operating expenses. The latter were mainly affected by legal and advisory fees connected to the bond restructuring while regular other OpEx remained stable.

Vacancy levels remain an issue at DEMIRE, as the vacancy rate increased bei 2pp to 15.1%, mainly driven by the insolvency of meinReal and Deutsche Telekom partly vacating an asset in Darmstadt. Going forward, management reiterated that improving the vacancy levels is on of the key strategic targets, while not providing a specifc target for FY25. In our view, a reduction to 12-13% should be seen as a success, while in the mid-term levels of <10% should be the target.

On a positive note, the company was able to improve its LTV ratio by 6.3pp to 51.0% following the successful refinancing of the corporate bond, partly below par, as well as several asset disposals. Going forward, we expect further improvement given continued deleveraging in accordance with the refinancing agreement.

FY25 outlook. With the release, management also provided a guidance for FY25, targeting rental income of € 51-53m (eNuW new: € 54.1m) and an FFO of € 3.5-5.5m (eNuW new: € 4.5m). The new guidance appears sensible in our view, given annualized contracted rent of € 56.4m as of FY24.

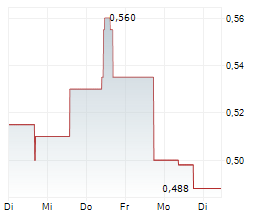

Despite the mixed release and muted outlook, the stock remains undervalued, in our view, given a current NAV discount of 65%. We hence reiterate our BUY recommendation but reduce our PT to € 1.30 (old: € 1.50) based on our NAV model.

ISIN: DE000A0XFSF0