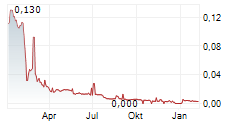

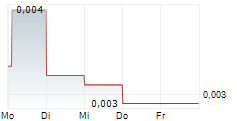

PARIS, FR / ACCESS Newswire / March 21, 2025 / METAVISIO - THOMSON Computing (Euronext Paris - ticker:ALTHO), a recognized French and European player in technological and IT solutions, is taking a major step forward in its plan to list on the U.S. stock markets.

Following the signing of a strategic agreement with ARC Group Limited at CES in Las Vegas in January 2025, the structuring of the dossier and an in-depth financial analysis have validated the transition to Phase 2 of the IPO process on NASDAQ or NYSE. The process now moves into its operational phase, fully aligned with the agreed timeline and financing plan.

A Structured Preparatory Phase: A Key Step Towards U.S. Listing

Over the past months, teams have been working on several strategic areas, including:

Analysis of listing options and structuring of the project, with an in-depth study of the most relevant listing vehicle (De-SPAC, IPO, RTO).

Transfer (delisting) or dual listing, depending on the company's considerations.

Optimization of financial and accounting elements, including preliminary audit preparations and transitioning accounts to international IFRS standards.

Preparation of regulatory filings and SEC requirements in collaboration with specialized legal and financial partners.

Identification of pre-IPO investors and development of a valuation strategy aligned with U.S. market expectations.

A Gradual and Controlled Structuring of the Listing Process

The partnership with ARC Group Limited is based on a multi-phase methodology, with each phase triggering the implementation of key financial and structural milestones:

Initial phase: Structuring and preparation, representing approximately 20% of the total engagement. This includes corporate restructuring and alignment of financial statements with IFRS and SEC requirements.

Listing initiation phase: Covering around 30% of the project, including finalization of audits, submission of filings to authorities, and initial discussions with U.S. investors.

Validation and official submission phase: Representing another 30%, this stage includes roadshows and final compliance before listing.

Final phase: Accounting for the remaining 20%, this stage involves pricing and the official market launch, including setting the IPO price if applicable.

"The work carried out with ARC Group has fully convinced us of the strategic opportunity that this U.S. listing represents. With this thorough analysis, we are now fully committed to this project, making it our top priority. This listing is a key driver for accelerating our growth and creating value. I am also extremely proud that METAVISIO is among the select companies chosen by ARC Group to be supported in this rigorous process. This validation highlights the interest and potential our company holds in the U.S. market." - Stephan Français, President of METAVISIO

"Our mission with METAVISIO is to structure the entire IPO process, aligning financial strategy with U.S. market regulations. Since January, our teams have been assisting METAVISIO in preparing its financial statements under IFRS standards and conducting the initial analyses necessary for structuring the operation and valuation. We will now accelerate audits and coordinate due diligence." - Jesus Hoyos, Senior Partner at ARC Group

A Transformational Project for METAVISIO's International Ambitions

A U.S. listing will allow METAVISIO to:

Increase its visibility among U.S. investors.

Strengthen its financial capabilities to accelerate growth.

Join the ranks of major technology companies listed in the United States.

About ARC Group

ARC Group is a Global Investment Bank and Management Consultancy Firm with deep roots in Asia, specializing in bridging markets across Asia, the US, and Europe. Since 2015, we have become a global leader in IPO and SPAC advisory, earning accolades such as Best Global Mid-Market Investment Bank (2020) and Deal of the Year (2024). Combining investment banking and management consulting expertise, Arc Group delivers tailored solutions in IPOs, SPACs, M&A, strategic consulting, and asset management, in 12 countries across 3 continents, united by a shared vision:

Your achievement is the reason for our existence, and your growth is our passion.

As part of its advisory role for METAVISIO, ARC Group is leveraging its international network of institutional investors and strategic partners to maximize funding opportunities and ensure a successful IPO on NASDAQ or NYSE.

For more information: www.arc-group.com

About METAVISIO-THOMSON Computing

METAVISIO - THOMSON Computing (FR00140066X4; ticker symbol: ALTHO) is a French company specializing in the research and development of IT, hardware, and software solutions under the THOMSON brand. Founded in 2013, METAVISIO - THOMSON Computing offers a range of products featuring "the latest technologies at the best price."

For more information: www.metavisio.eu

Press & Investor Relations Contact: Gabriel Rafaty - metavisio@aimpact.net

SOURCE: METAVISIO (THOMSON COMPUTING)

View the original press release on ACCESS Newswire