Landesbank Baden-Württemberg - Pre-Stabilisation Period Announcement

PR Newswire

LONDON, United Kingdom, March 21

21 March 2025

Not for distribution, directly or indirectly, in or into the United States or any jurisdiction in which such distribution would be unlawful.

Sparebanken Vest / ISIN []

Pre-stabilisation Period Announcement

Landesbank Baden-Württemberg (contact: Yannick Wiggert; telephone: +4971112778844) hereby gives notice, as Stabilisation Coordinator, that the Stabilisation Manager(s) named below may stabilise the offer of the following securities in accordance with Commission Delegated Regulation (EU) 2016/1052 under the Market Abuse Regulation (EU/596/2014).

Securities

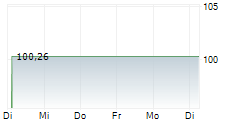

| Issuer | Sparebanken Vest Boligkreditt AS |

| Legal Entity Identifier | 5967007LIEEXZX6AO004 |

| Expected Issue Ratings | Aaa (Moody's) |

| Aggregate nominal amount: | EUR Benchmark |

| Launch Date | 21 March 2025 |

| Settlement Date | 28 March 2025 (T+5) |

| Maturity Date | 28 June 2030 (soft bullet) |

| Extended Final Maturity Date | 28 June 2031 |

| Offer price: | [XX.XXX] |

| Other offer terms: | NA |

Stabilisation:

| Stabilisation Manager(s): | BMO Capital Markets/DZ BANK/ Helaba/LBBW/Santander/SEB |

| Stabilisation period expected to start on: | 21 March 2025 |

| Stabilisation period expected to end no later than: | 30 days after the proposed issue date of the securities |

| Existence, maximum size and conditions of use of over-allotment facility: | The Stabilisation Manager(s) may over-allot the securities to the extent permitted in accordance with applicable law |

| Stabilisation trading venue(s): | Over the counter (OTC) |

Disclaimer

This document has been prepared by the Joint Bookrunners for information purposes only, is not intended to create any legally binding obligations on the Joint Lead Managers and should not be construed as an underwriting commitment or a recommendation to conclude any transaction. The terms set out herein are subject to the completion of final documentation, including any relevant underwriting or subscription agreement (and satisfaction of any conditions precedent therein) and any necessary disclosure documentation. Neither the Joint Bookrunners nor any of their respective employees or directors, accept any liability or responsibility in respect of the information herein and shall not be liable for any loss of any kind which may arise from reliance by the Issuer, or others, upon such information.

This document is confidential and is only for the information of the Issuer and the Joint Bookrunners. It has not been prepared for and should not be provided to or relied upon by any investor or any other person for any purpose. The Joint Lead Managers are not providing any financial, legal, tax or other advice to any recipient.

Each of the Joint Lead Managers may from time to time, as principal or agent, have positions in, or may buy or sell, or make a market in any securities, currencies, financial instruments or other assets underlying the transaction to which this document relates. The Joint Lead Managers trading and/or hedging activities related to the transaction to which this document relates may have an impact on the price of the securities to which this document relates.

PreStabilisation Announcement Sparebanken Vest long 5y EUR BMK | PreStabilisation Announcement Sparebanken Vest long 5y EUR BMK |