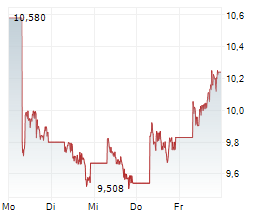

After an impressive start to 2025 with nearly 40% gains, Chinese electric vehicle manufacturer BYD has experienced a significant setback, with shares plunging over 8% in Asian trading on Friday. This dramatic decline comes amid a new European Commission investigation into potential subsidies for BYD's planned manufacturing facility in Hungary. The sell-off has overshadowed the company's strong operational performance, including February's remarkable 165.2% year-over-year increase in New Energy Vehicle (NEV) deliveries, which reached 322,846 units. Market observers attribute the correction to both profit-taking following the stock's substantial gains and growing analyst scrutiny. The downturn occurs within a generally cautious market environment, with major indices like the Dow Jones and Nasdaq Composite also recording modest losses.

Institutional Support Signals Long-Term Confidence

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei BYD?

Despite current volatility, there are encouraging signs for investors with longer time horizons. Prominent financial institutions maintain significant interest in BYD, with US investment giant BlackRock recently increasing its stake in the Chinese technology company. JP Morgan also remains a key anchor investor, demonstrating continued institutional confidence in BYD's future prospects. Market analysts suggest the negative impact of the EU investigation might be short-lived, potentially fading as early as next week if positive factors regain focus. The company's technological advancements in charging and battery technology, coupled with its European market expansion strategy, could provide renewed momentum for the stock in the medium term.

Ad

BYD Stock: New Analysis - 22 MarchFresh BYD information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated BYD analysis...