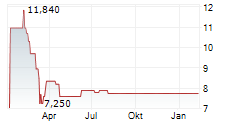

WASHINGTON (dpa-AFX) - Clearlake Capital Group, L.P. has entered into a definitive agreement to acquire Dun & Bradstreet Holdings, Inc. (DNB) in a deal valued at $7.7 billion, including outstanding debt / with an equity value of $4.1 billion. Upon completion, Dun & Bradstreet will become a privately held company and shares of Dun & Bradstreet common stock will no longer be listed on any public market. The transaction is expected to close in the third quarter of 2025.

The Dun & Bradstreet Board unanimously recommended that shareholders vote to approve the merger at an upcoming special meeting. The agreement provides for a go-shop period, during which Dun & Bradstreet, with the assistance of BofA Securities, will actively solicit, evaluate and potentially enter into negotiations with and provide due diligence access to parties that submit alternative proposals. The go-shop period is 30 days.

Shares of Dun & Bradstreet are up 3% in pre-market trade on Monday.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News