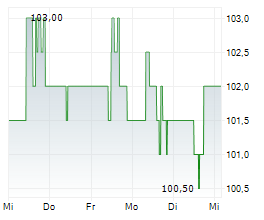

COLUMBUS (dpa-AFX) - American Electric Power (AEP) announced the pricing of a registered underwritten offering of about 19.61 million shares of its common stock at a price to the public of $102.00 per share.

AEP entered into forward sale agreements with each of Citibank, N.A. and Barclays Bank PLC or the 'forward counterparties' under which AEP agreed to issue and sell to the forward counterparties an aggregate of 19.61 million shares of its common stock.

In addition, the underwriters of the offering have been granted a 30-day option to purchase up to an additional 2.94 million shares of AEP's common stock upon the same terms. If the underwriters exercise their option to purchase additional shares, AEP expects to enter into additional forward sale agreements with the forward counterparties with respect to the additional shares.

Settlement of the forward sale agreements is expected to occur on or prior to December 31, 2026. AEP may, subject to certain conditions, elect cash settlement or net share settlement for all or a portion of its rights or obligations under the forward sale agreements.

If AEP elects physical settlement of the forward sale agreements, it expects to use the net proceeds for general corporate purposes, which may include capital contributions to its utility subsidiaries, acquisitions and/or repayment of debt.

Copyright(c) 2025 RTTNews.com. All Rights Reserved

Copyright RTT News/dpa-AFX

© 2025 AFX News