Revenue increased 1% to $5.8M

Adjusted EBITDA increased $900,000 to $871,000 in Q4 2024

Cash flow from operations increased to $353,000 from $(236,000) in Q4 2023

Rebranded to ACCESS Newswire Inc, effective January 27, 2025

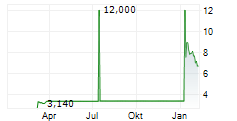

Compliance business was sold for $12.5M on February 28, 2025

Subscriptions increased to 1,124 from 1,053 in Q4 2023

RALEIGH, NC / ACCESS Newswire / March 25, 2025 / ACCESS Newswire Inc. (NYSE American:ACCS) (the "Company"), a leading communications company, today reported its operating results for the three months and full year ended December 31, 2024.

"Our core business grew modestly in the fourth quarter. During the quarter we executed on several key initiatives, including completion of our rebrand, advancing the strategic sale of our compliance business, which was completed at the end of February, and expanding our subscription business," said Brian R. Balbirnie, ACCESS Newswire's Founder and Chief Executive Officer.

"Looking ahead, we now have a singular focus on our communications business, and we believe a defined path toward improving gross margins and EBITDA margins through operational efficiency and subscription growth. Similar to the fourth quarter, our first quarter will include transaction adjustments-both on the balance sheet, with debt repayment, and on the statement of operations, reflecting the discontinued operations of the compliance business. Additionally, as we move beyond the first quarter, we remain committed to optimizing our capital allocation strategy and increasing our customer counts and market share," added Mr. Balbirnie.

Fourth Quarter 2024 Highlights:

Revenue - Total revenue was $5,826,000, a 1% increase from $5,762,000 in Q4 2023 and a 3% increase from $5,638,000 in Q3 2024. The increase is primarily due to an increase in revenue from our previously branded ACCESSWIRE platform due to an increase in average revenue per release, partially offset by a decrease in revenue from our previously branded Newswire distribution platform.

Gross Margin - Gross margin for Q4 2024 was $4,381,000, or 75% of revenue, compared to $4,318,000, also 75% of revenue, during Q4 2023 and $4,228,000, or 75% of revenue, in Q3 2024.

Operating Loss - Primarily due to an impairment loss of $14,150,000 related to the tradename associated with Newswire, operating loss was $(14,322,000) for Q4 2024, as compared to operating loss of $(1,131,000) during Q4 2023. Absent the impairment loss, operating expenses were $4,553,000 in Q4 2024 compared to $5,449,000 in Q4 2023. The impairment is associated with our rebrand, in which management determined the appropriate useful life of the tradename was 5 years as opposed to the 15 years originally estimated as part of the original valuation. The decrease in operating expenses is due to lower general and administrative expenses due to lower headcount and stock compensation expense as well as lower sales and marketing expenses due to lower headcount and advertising expense.

Net Loss from continuing operations - On a GAAP basis, net loss from continuing operations was $(10,945,000), or $(2.85) per diluted share during Q4 2024, compared to net loss from continuing operations of $(1,512,000), or $(0.40) per diluted share during Q4 2023.

Income from discontinued operations, net of taxes - On a GAAP basis, we recorded income from discontinued operations, net of taxes of $750,000, or $0.19 per diluted share, for Q4 2024, compared to $786,000, or $0.21 per diluted share, in Q4 2023.

Operating Cash Flows - Cash flows from continuing operations for Q4 2024 were $353,000 compared to cash flows used in continuing operations of $(236,000) in Q4 2023. The increase is due to operational efficiencies which in turn reduced expenses.

Non-GAAP Measures from continuing operations - Q4 2024 EBITDA was $770,000, or 13% of revenue, compared to $(834,000), or (14)% of revenue, during Q4 2023. Adjusted EBITDA was $871,000, or 15% of revenue, for Q4 2024 compared to $(27,000), or less than negative 1% of revenue, for Q4 2023. Non-GAAP net income for Q4 2024 was $819,000, or $0.21 per diluted share, compared to a non-GAAP net loss of $(275,000), or $(0.07) per diluted share, during Q4 2023. Adjusted free-cash flow was $413,000 for Q4 2024 compared to $(319,000) for Q4 2023.

Full year 2024 Highlights:

Revenue - Total revenue was $23,057,000, a 6% decrease from $24,522,000 in 2023. The decrease is primarily related to a decrease in volume from our previously branded Newswire news distribution brand.

Gross Margin - Gross margin was $17,440,000, or 76% of revenue, compared to $18,915,000, or 77% of revenue, during 2023.

Operating Loss - Operating loss was $(16,319,000) compared to $(2,739,000) in 2023. The increase in operating loss is primarily due to the aforementioned impairment loss of $14,150,000 related to the tradename associated with Newswire. Absent the impairment, total operating expenses decreased $2,045,000 due to lower general and administrative expenses, lower headcount and stock compensation expense as well as lower sales and marketing expenses.

Net Loss from continuing operations - On a GAAP basis, net loss from continuing operations was $(13,281,000), or $(3.47) per diluted share during 2024, compared to net loss from continuing operations of $(3,441,000), or $(0.90) per diluted share during 2023. The increase in net loss from continuing operations is primarily related to the impairment loss on the Newswire tradenames noted earlier.

Income from discontinued operations, net of taxes - On a GAAP basis, we recorded income from discontinued operations, net of taxes, of $2,488,000, or $0.65 per diluted share, compared to $4,207,000, or $1.10 per diluted share, in 2023. The decrease is due primarily to two significant print and proxy fulfilment jobs that occurred in the prior year but did not reoccur in 2024.

Operating Cash Flows - Net operating cash flows provided by continuing operations was $400,000 in 2024 compared to net operating cash flows used in operating activities of $(741,000) in 2023.

Non-GAAP Measures from continuing operations - EBITDA for 2024 was $840,000, or 4% of revenue, compared to $(342,000), or (1)% of revenue, during 2023. Adjusted EBITDA for 2024 was $1,895,000, or 8% of revenue, compared to $2,005,000, also 8% of revenue, for 2023. Non-GAAP net income for 2024 was $791,000, or $0.21 per diluted share, compared to non-GAAP net income of $538,000, or $0.14 per diluted share, during 2023. Adjusted free-cash flow was $26,000 for 2024 compared to $(476,000) for 2023.

Key Performance Indicators:

As of December 31, 2024, we had 12,349 customers who had an active contract during the past twelve months, compared to 11,924 as of December 31, 2023.

Subscription customers increased by 71 to 1,124.

ARR for subscriptions for quarter was $10,735, up from $9,489 at the end of 2023.

Non-GAAP Information

Certain Non-GAAP financial measures are included in this press release. In the calculation of these measures, the Company excludes certain items, such as amortization of intangible assets, stock-based compensation, tax impact of adjustments, other unusual items and discrete items impacting income tax expense. The Company believes that excluding such items provides investors and management with a representation of the Company's core operating performance and with information useful in assessing its prospects for the future and underlying trends in the Company's operating expenditures and continuing operations. Management uses such Non-GAAP measures to evaluate financial results and manage operations. The release and the attachments to this release provide a reconciliation of each of the Non-GAAP measures referred to in this release to the most directly comparable GAAP measure. The Non-GAAP financial measures are not meant to be considered a substitute for the corresponding GAAP financial statements and investors should evaluate them carefully. These Non-GAAP financial measures may differ materially from the Non-GAAP financial measures used by other companies.

RECONCILIATION OF SELECTED GAAP MEASURES TO NON-GAAP MEASURES

(in thousands, except per share amounts)

CALCULATION OF EBITDA & ADJUSTED EBITDA

| Three Months Ended December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

| Amount |

|

| Amount |

| |||

|

|

|

|

|

|

| ||

Net loss from continuing operations: |

| $ | (10,945 | ) |

| $ | (1,512 | ) |

Adjustments: |

|

|

|

|

|

|

|

|

Impairment loss on intangible assets |

|

| 14,150 |

|

|

| - |

|

Depreciation and amortization |

|

| 737 |

|

|

| 697 |

|

Interest expense, net |

|

| 250 |

|

|

| 309 |

|

Income tax benefit |

|

| (3,422 | ) |

|

| (328 | ) |

EBITDA |

|

| 770 |

|

|

| (834 | ) |

Acquisition and/or integration costs(1) |

|

| 39 |

|

|

| 116 |

|

Other non-recurring expenses(2) |

|

| (198 | ) |

|

| 400 |

|

Stock-based compensation expense(3) |

|

| 260 |

|

|

| 291 |

|

Adjusted EBITDA: |

| $ | 871 |

|

| $ | (27 | ) |

| Full Year Ended December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

| Amount |

|

| Amount |

| |||

|

|

|

|

|

|

| ||

Net loss from continuing operations: |

| $ | (13,281 | ) |

| $ | (3,441 | ) |

Adjustments: |

|

|

|

|

|

|

|

|

Impairment loss on intangible assets |

|

| 14,150 |

|

|

| - |

|

Depreciation and amortization |

|

| 2,928 |

|

|

| 2,788 |

|

Interest expense, net |

|

| 1,107 |

|

|

| 1,249 |

|

Income tax benefit |

|

| (4,064 | ) |

|

| (938 | ) |

EBITDA |

|

| 840 |

|

|

| (342 | ) |

Acquisition and/or integration costs(1) |

|

| 189 |

|

|

| 546 |

|

Other non-recurring expenses(2) |

|

| 138 |

|

|

| 436 |

|

Stock-based compensation expense(3) |

|

| 728 |

|

|

| 1,365 |

|

Adjusted EBITDA: |

| $ | 1,895 |

|

| $ | 2,005 |

|

(1) This adjustment gives effect to one-time corporate projects, including acquisition and/or integration related expenses, incurred during the periods.

(2) For the three months ended December, 31, 2024 and 2023, this adjustment primarily gives effect to a gain or loss recorded on the change in fair value of our interest rate swap. For the year ended December 31, 2024, this adjustment gives effect to a gain recorded on the change in fair value of our interest rate swap of $81,000, as well as, one-time accounting fees, termination benefits and other non-recurring or unusual expenses of $219,000. For the year ended December 31, 2023, this adjustment gives effect to $370,000 payment related to early extinguishment of our Seller Note and one-time non-recurring expenses of $45,000 and a loss on the change in fair value of our interest rate swap of $21,000.

(3) The adjustments represent stock-based compensation expense related to awards of stock options, restricted stock units, or common stock in exchange for services. Although we expect to continue to award stock in exchange for services, the amount of stock-based compensation is excluded as it is subject to change as a result of one-time or non-recurring projects.

CALCULATION OF NON-GAAP NET INCOME

| Three Months Ended December 31, |

| ||||||||||||||

| 2024 |

|

| 2023 |

| |||||||||||

| Amount |

|

| Per diluted share |

|

| Amount |

|

| Per diluted share |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net loss from continuing operations: |

| $ | (10,945 | ) |

| $ | (2.85 | ) |

| $ | (1,512 | ) |

| $ | (0.40 | ) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment loss on intangible assets(1) |

|

| 14,150 |

|

|

| 3.69 |

|

|

| - |

|

|

| - |

|

Amortization of intangible assets(2) |

|

| 640 |

|

|

| 0.17 |

|

|

| 629 |

|

|

| 0.16 |

|

Stock-based compensation expense(3) |

|

| 260 |

|

|

| 0.06 |

|

|

| 291 |

|

|

| 0.08 |

|

Other unusual items(4) |

|

| (159 | ) |

|

| (0.04 | ) |

|

| 516 |

|

|

| 0.14 |

|

Discrete items impacting income tax(5) |

|

| - |

|

|

| - |

|

|

| 103 |

|

|

| 0.03 |

|

Tax impact of adjustments(6) |

|

| (3,127 | ) |

|

| (0.82 | ) |

|

| (302 | ) |

|

| (0.08 | ) |

Non-GAAP net income (loss): |

| $ | 819 |

|

| $ | 0.21 |

|

| $ | (275 | ) |

| $ | (0.07 | ) |

Weighted average number of common shares outstanding - diluted |

|

| 3,838 |

|

|

|

|

|

|

| 3,826 |

|

|

|

|

|

| Full Year Ended December 31, |

| ||||||||||||||

| 2024 |

|

| 2023 |

| |||||||||||

| Amount |

|

| Per diluted share |

|

| Amount |

|

| Per diluted share |

| |||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Net loss from continuing operations: |

| $ | (13,281 | ) |

| $ | (3.47 | ) |

| $ | (3,441 | ) |

| $ | (0.90 | ) |

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment loss on intangible assets(1) |

|

| 14,150 |

|

|

| 3.70 |

|

|

| - |

|

|

| - |

|

Amortization of intangible assets(2) |

|

| 2,559 |

|

|

| 0.67 |

|

|

| 2,559 |

|

|

| 0.67 |

|

Stock-based compensation expense(3) |

|

| 728 |

|

|

| 0.19 |

|

|

| 1,365 |

|

|

| 0.35 |

|

Other unusual items(4) |

|

| 327 |

|

|

| 0.08 |

|

|

| 982 |

|

|

| 0.26 |

|

Discrete items impacting income tax expense(5) |

|

| 38 |

|

|

| 0.01 |

|

|

| 103 |

|

|

| 0.03 |

|

Tax impact of adjustments(6) |

|

| (3,730 | ) |

|

| (0.97 | ) |

|

| (1,030 | ) |

|

| (0.27 | ) |

Non-GAAP net income: |

| $ | 791 |

|

| $ | 0.21 |

|

| $ | 538 |

|

| $ | 0.14 |

|

Weighted average number of common shares outstanding - diluted |

|

| 3,829 |

|

|

|

|

|

|

| 3,816 |

|

|

|

|

|

(1) This adjustment represents the impairment loss on intangible assets that was recognized for the year ended December 31, 2024.

(2) The adjustments represent the amortization of intangible assets related to acquired assets and companies.

(3) The adjustments represent stock-based compensation expense related to awards of stock options, restricted stock units, or common stock in exchange for services. Although we expect to continue to award stock in exchange for services, the amount of stock-based compensation is excluded as it is subject to change as a result of one-time or non-recurring projects.

(4) For the three months and full year ended December 31, 2024, this adjustment gives effect to a gain recorded on the change in fair value of our interest rate swap of $205,000 and $81,000, respectively, as well as, one-time accounting fees, termination benefits and other non-recurring or unusual expenses, including acquisition and/or integration expenses of $47,000 and $408,000, respectively. For the three months ended December 31, 2023, this adjustment give effect for the loss on the change in fair value of our interest rate swap of $400,000 and one-time corporate projects, including acquisition and/or integration related expenses of $116,000 incurred during the period. For the year ended December 31, 2023, this adjustment gives effect to $370,000 payment related to early extinguishment of our Seller Note and one-time non-recurring expenses, including acquisition and/or integration expenses of $591,000 and a loss on the change in fair value of our interest rate swap of $21,000.

(5) This adjustment eliminates discrete items impacting income tax expense. For the year ended December 31, 2024 and 2023, discrete items relate to additional income tax expense recorded during the period related to the exercise of stock compensation.

(6) This adjustment gives effect to the tax impact of all non-GAAP adjustments at the current Federal tax rate of 21%.

CALCULATION OF FREE CASH FLOW AND ADJUSTED FREE CASH FLOW

| Three Months Ended December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

|

|

|

|

|

|

| ||

Net cash provided by (used in) operating activities (US GAAP) |

| $ | 353 |

|

| $ | (236 | ) |

Payments for purchase of fixed assets and capitalized software |

|

| (60 | ) |

|

| (158 | ) |

Free cash flow (Non-GAAP) |

|

| 293 |

|

|

| (394 | ) |

Cash paid for acquisition and/or integration related items (1) |

|

| - |

|

|

| 75 |

|

Cash paid for other unusual items (2) |

|

| 120 |

|

|

| - |

|

Adjusted free cash flow (Non-GAAP) |

| $ | 413 |

|

| $ | (319 | ) |

| Full Year Ended December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

|

|

|

|

|

|

| ||

Net cash provided by (used in) operating activities from continuing operations (US GAAP) |

| $ | 400 |

|

| $ | (741 | ) |

Payments for purchase of fixed assets and capitalized software |

|

| (616 | ) |

|

| (503 | ) |

Free cash flow (Non-GAAP) |

|

| (216 | ) |

|

| (1,244 | ) |

Cash paid for acquisition and/or integration related items (1) |

|

| 23 |

|

|

| 373 |

|

Cash paid for other unusual items (2) |

|

| 219 |

|

|

| 395 |

|

Adjusted free cash flow (Non-GAAP) |

| $ | 26 |

|

| $ | (476 | ) |

(1) This adjustment gives effect to one-time corporate projects, including acquisition and/or integration related expenses, paid during the periods.

(2) For the year ended December 31, 2024, this adjustment gives effect to payments for one-time accounting fees, termination benefits and other non-recurring or unusual expenses. During the year ended December 31, 2023, this adjustment is primarily related to a one-time payment of $370,000 related to the early termination of the note payable associated with the Newswire acquisition.

Conference Call Information

To participate in this event, dial approximately 5 to 10 minutes before the beginning of the call.

Date: | March 25, 2025 |

Time: | 9:00 a.m. eastern time |

Toll & Toll Free: | 973-528-0011 | 888-506-0062 |

Access Code: | 292516 |

Live Webcast: | https://www.webcaster4.com/Webcast/Page/1/52150 |

Conference Call Replay Information

The replay will be available beginning approximately 1 hour after the completion of the live event.

Toll & Toll Free: | 919-882-2331| 877-481-4010 |

Passcode: | 52150 |

Webcast Replay & Transcript | https://investors.accessnewswire.com/events-presentations |

About ACCESS Newswire Inc.

We are ACCESS Newswire, a globally trusted Public Relations (PR) and Investor Relations (IR) solutions provider. With a focus on innovation, customer service, and value-driven offerings, ACCESS Newswire empowers brands to connect with their audiences where it matters most. From startups and scale-ups to multi-billion-dollar global brands, we ensure your most important moments make an impact and resonate with your audiences. To learn more visit www.accessnewsire.com.

Forward-Looking Statements

This press release contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act") (which Sections were adopted as part of the Private Securities Litigation Reform Act of 1995). Statements preceded by, followed by or that otherwise include the words "believe," "anticipate," "estimate," "expect," "goal," "intend," "plan," "project," "prospects," "outlook," "target" and similar words or expressions, or future or conditional verbs, such as "will," "should," "would," "may," and "could," are generally forward-looking in nature and not historical facts. These forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the Company's actual results, performance, or achievements to be materially different from any anticipated results, performance, or achievements for many reasons. The Company disclaims any intention to, and undertakes no obligation to, revise any forward-looking statements, whether as a result of new information, a future event, or otherwise. For additional risks and uncertainties that could impact the Company's forward-looking statements, please see the Company's Annual Report on Form 10-K for the year ended December 31, 2024, including but not limited to the discussion under "Risk Factors" therein, which the Company filed with the SEC and which may be viewed at http://www.sec.gov/.

For Further Information:

ACCESS Newswire Inc.

Brian R. Balbirnie

(919)-481-4000

brianb@accessnewswire.com

Hayden IR

Brett Maas

(646)-536-7331

brett@haydenir.com

Hayden IR

James Carbonara

(646)-755-7412

james@haydenir.com

ACCESS NEWSWIRE INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share amounts)

| As of December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

ASSETS |

|

|

|

|

|

| ||

Current assets: |

|

|

|

|

|

| ||

Cash and cash equivalents |

| $ | 4,103 |

|

| $ | 5,714 |

|

Accounts receivable (net of allowance for credit losses of $1,059 and $721, respectively) |

|

| 3,351 |

|

|

| 3,005 |

|

Income tax receivable |

|

| - |

|

|

| 232 |

|

Other current assets |

|

| 1,234 |

|

|

| 1,134 |

|

Current assets held for sale |

|

| 1,338 |

|

|

| 1,419 |

|

Total current assets |

|

| 10,026 |

|

|

| 11,504 |

|

Capitalized software (net of accumulated amortization of $3,644 and $3,424, respectively) |

|

| 934 |

|

|

| 556 |

|

Fixed assets (net of accumulated depreciation of $914 and $765, respectively) |

|

| 365 |

|

|

| 495 |

|

Right-of-use asset - leases (See Note 10) |

|

| 766 |

|

|

| 1,022 |

|

Other long-term assets |

|

| 158 |

|

|

| 101 |

|

Goodwill |

|

| 19,043 |

|

|

| 19,043 |

|

Intangible assets (net of accumulated amortization of $7,024 and $4,465, respectively) |

|

| 11,976 |

|

|

| 28,685 |

|

Deferred tax asset |

|

| 3,793 |

|

|

| - |

|

Non-current assets held for sale |

|

| 3,577 |

|

|

| 3,746 |

|

Total assets |

| $ | 50,638 |

|

| $ | 65,152 |

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

| $ | 1,423 |

|

| $ | 1,180 |

|

Accrued expenses |

|

| 1,699 |

|

|

| 1,838 |

|

Income taxes payable |

|

| 56 |

|

|

| 11 |

|

Current portion of long-term debt |

|

| 4,000 |

|

|

| 4,000 |

|

Deferred revenue |

|

| 4,743 |

|

|

| 4,750 |

|

Current liabilities held for sale |

|

| 893 |

|

|

| 871 |

|

Total current liabilities |

|

| 12,814 |

|

|

| 12,650 |

|

Long-term debt (net of debt discount of $70 and $87, respectively) (see Note 6) |

|

| 11,930 |

|

|

| 15,913 |

|

Deferred income tax liability |

|

| - |

|

|

| 139 |

|

Lease liabilities - long-term (See Note 10) |

|

| 668 |

|

|

| 1,009 |

|

Other long-term liabilities |

|

| - |

|

|

| 21 |

|

Total liabilities |

|

| 25,412 |

|

|

| 29,732 |

|

|

|

|

|

|

|

|

| |

Stockholders' equity: |

|

|

|

|

|

|

|

|

Preferred stock, $0.001 par value, 1,000,000 shares authorized, no shares issued and outstanding as of December 31, 2024 and 2023, respectively. |

|

| - |

|

|

| - |

|

Common stock $0.001 par value, 20,000,000 shares authorized, 3,838,743 and 3,815,212 shares issued and outstanding as of December 31, 2024 and 2023, respectively. |

|

| 4 |

|

|

| 4 |

|

Additional paid-in capital |

|

| 24,259 |

|

|

| 23,531 |

|

Other accumulated comprehensive loss |

|

| (178 | ) |

|

| (49 | ) |

Retained earnings |

|

| 1,141 |

|

|

| 11,934 |

|

Total stockholders' equity |

|

| 25,226 |

|

|

| 35,420 |

|

Total liabilities and stockholders' equity |

| $ | 50,638 |

|

| $ | 65,152 |

|

ACCESS NEWSWIRE INC AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

| For the Three Months Ended |

|

| For the Year Ended |

| |||||||||||

| December 31, |

|

| December 31, |

|

| December 31, |

|

| December 31, |

| |||||

| 2024 |

|

| 2023 |

|

| 2024 |

|

| 2023 |

| |||||

| (unaudited) |

|

| (unaudited) |

|

|

|

|

|

|

| |||||

Revenues |

| $ | 5,826 |

|

| $ | 5,762 |

|

| $ | 23,057 |

|

| $ | 24,522 |

|

Cost of revenues |

|

| 1,445 |

|

|

| 1,444 |

|

|

| 5,617 |

|

|

| 5,607 |

|

Gross profit |

|

| 4,381 |

|

|

| 4,318 |

|

|

| 17,440 |

|

|

| 18,915 |

|

Operating costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative |

|

| 1,626 |

|

|

| 2,154 |

|

|

| 7,000 |

|

|

| 8,354 |

|

Sales and marketing expenses |

|

| 1,474 |

|

|

| 1,952 |

|

|

| 7,080 |

|

|

| 8,028 |

|

Product development |

|

| 777 |

|

|

| 661 |

|

|

| 2,821 |

|

|

| 2,544 |

|

Depreciation and amortization |

|

| 676 |

|

|

| 682 |

|

|

| 2,708 |

|

|

| 2,728 |

|

Impairment loss on intangible assets |

|

| 14,150 |

|

|

| - |

|

|

| 14,150 |

|

|

| - |

|

Total operating costs and expenses |

|

| 18,703 |

|

|

| 5,449 |

|

|

| 33,759 |

|

|

| 21,654 |

|

Operating loss |

|

| (14,322 | ) |

|

| (1,131 | ) |

|

| (16,319 | ) |

|

| (2,739 | ) |

Interest expense, net |

|

| (250 | ) |

|

| (309 | ) |

|

| (1,107 | ) |

|

| (1,249 | ) |

Other expense |

|

| 205 |

|

|

| (400 | ) |

|

| 81 |

|

|

| (391 | ) |

Loss before taxes |

|

| (14,367 | ) |

|

| (1,840 | ) |

|

| (17,345 | ) |

|

| (4,379 | ) |

Income tax expense (benefit) |

|

| (3,422 | ) |

|

| (328 | ) |

|

| (4,064 | ) |

|

| (938 | ) |

Net loss from continuing operations |

|

| (10,945 | ) |

|

| (1,512 | ) |

|

| (13,281 | ) |

|

| (3,441 | ) |

Income from discontinued operations, net of taxes |

|

| 750 |

|

|

| 786 |

|

|

| 2,488 |

|

|

| 4,207 |

|

Net income (loss) |

| $ | (10,195 | ) |

| $ | (726 | ) |

| $ | (10,793 | ) |

| $ | 766 |

|

Loss from continuing operations - basic |

| $ | (2.85 | ) |

| $ | (0.40 | ) |

| $ | (3.47 | ) |

| $ | (0.90 | ) |

Loss from continuing operations - diluted |

| $ | (2.85 | ) |

| $ | (0.40 | ) |

| $ | (3.47 | ) |

| $ | (0.90 | ) |

Income from discontinued operations - basic |

| $ | 0.19 |

|

| $ | 0.21 |

|

| $ | 0.65 |

|

| $ | 1.10 |

|

Income from discontinued operations - diluted |

| $ | 0.19 |

|

| $ | 0.21 |

|

| $ | 0.65 |

|

| $ | 1.10 |

|

Income (loss) per share - basic |

| $ | (2.66 | ) |

| $ | (0.19 | ) |

| $ | (2.82 | ) |

| $ | 0.20 |

|

Income (loss) per share - fully diluted |

| $ | (2.66 | ) |

| $ | (0.19 | ) |

| $ | (2.82 | ) |

| $ | 0.20 |

|

Weighted average number of common shares outstanding - basic |

|

| 3,837 |

|

|

| 3,813 |

|

|

| 3,827 |

|

|

| 3,802 |

|

Weighted average number of common shares outstanding - fully diluted |

|

| 3,838 |

|

|

| 3,826 |

|

|

| 3,829 |

|

|

| 3,816 |

|

ACCESS NEWSWIRE INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, except share and per share amounts)

| Years Ended December 31, |

| ||||||

| 2024 |

|

| 2023 |

| |||

Cash flows from operating activities |

|

|

|

|

|

| ||

Net (loss)income |

| $ | (10,793 | ) |

| $ | 766 |

|

Adjustments to reconcile net (loss) income to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

Net income from discontinued operations, net of tax |

|

| (2,488 | ) |

|

| (4,207 | ) |

Loss on impairment of intangible assets |

|

| 14,150 |

|

|

| - |

|

Provision for credit losses |

|

| 1,083 |

|

|

| 538 |

|

Depreciation and amortization |

|

| 2,928 |

|

|

| 2,788 |

|

Deferred income taxes |

|

| (3,933 | ) |

|

| (433 | ) |

Stock-based compensation expense - employees and directors |

|

| 684 |

|

|

| 1,365 |

|

Stock-based compensation expense - consultants |

|

| 44 |

|

|

| - |

|

Change in fair value of interest rate swap |

|

| (81 | ) |

|

| 21 |

|

Amortization of debt issuance costs |

|

| 17 |

|

|

| 13 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Decrease (increase) in accounts receivable |

|

| (1,462 | ) |

|

| (1,150 | ) |

Decrease (increase) in other assets |

|

| 391 |

|

|

| 152 |

|

Increase (decrease) in accounts payable |

|

| 245 |

|

|

| (60 | ) |

Increase (decrease) in deferred revenue |

|

| 44 |

|

|

| 267 |

|

Increase (decrease) in accrued expenses and other liabilities |

|

| (429 | ) |

|

| (801 | ) |

Net cash provided by (used in) operating activities of continuing operations |

|

| 400 |

|

|

| (741 | ) |

Net cash provided by operating activities of discontinued operations |

|

| 2,760 |

|

|

| 3,801 |

|

Net cash provided by operating activities |

|

| 3,160 |

|

|

| 3,060 |

|

|

|

|

|

|

|

|

| |

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Purchase of fixed assets |

|

| (19 | ) |

|

| (25 | ) |

Capitalized software |

|

| (597 | ) |

|

| (478 | ) |

Purchase of acquired business, net of cash received (See note 4) |

|

| - |

|

|

| 350 |

|

Net cash used in investing activities |

|

| (616 | ) |

|

| (153 | ) |

|

|

|

|

|

|

|

| |

Cash flows from financing activities |

|

|

|

|

|

|

|

|

Payment of note payable (see Note 6) |

|

| (4,000 | ) |

|

| (22,000 | ) |

Proceeds from issuance of term loan (see Note 6) |

|

| - |

|

|

| 19,988 |

|

Payment for capitalized debt issuance costs |

|

| - |

|

|

| (88 | ) |

Proceeds from exercise of stock options, net of income taxes |

|

| - |

|

|

| 19 |

|

Net cash used in financing activities |

|

| (4,000 | ) |

|

| (2,081 | ) |

|

|

|

|

|

|

|

| |

Net change in cash and cash equivalents |

|

| (1,456 | ) |

|

| 826 |

|

Cash and cash equivalents - beginning |

|

| 5,714 |

|

|

| 4,832 |

|

Currency translation adjustment |

|

| (155 | ) |

|

| 56 |

|

Cash and cash equivalents - ending |

| $ | 4,103 |

|

| $ | 5,714 |

|

Supplemental disclosures: |

|

|

|

|

|

|

|

|

Cash paid for income taxes |

| $ | 342 |

|

| $ | 1,314 |

|

Cash paid for interest |

| $ | 1,387 |

|

| $ | 1,394 |

|

SOURCE: ACCESS Newswire Inc.