- Return to more favorable dynamics in all addressed markets

- Slight growth in current operating income

- Net income impacted by non-recurring items and full effect of the Transform plan measures expected in the 2025 financial year

- Improvement in operating cash flow

Regulatory News:

SergeFerrari Group (FR0011950682 SEFER), a leading global supplier of innovative flexible composite materials, listed on Euronext Paris Compartment C, today announced its consolidated full-year results for the year ended December 31st, 2024, as approved by the Supervisory Board on March 26th, 2025. These consolidated financial statements have been audited by the Statutory Auditors, whose report is currently being prepared.

Sébastien Baril, SergeFerrari Group's Chairman of the Executive Board, stated:" SergeFerrari Group made significant efforts to optimize operations in the 2024 financial year to adapt as best as possible to shortened economic cycles and a complicated geopolitical environment. The Transform 2025 plan is now fully deployed and its implementation should result in increased operational efficiency in the medium term. The Group continued its efforts to optimize its working capital requirements. By relying on the measures put in place and counting on the continuation of the activity, SergeFerrari Group aims to quickly return to increased profitability."

2024 Revenue and profitability

Revenue (in €m) | 2024 | 2023 | Change at current scope and currency | Change at constant scope and currency | |

1st quarter | 73.5 | 84.8 | -13.4% | -14.1% | |

2nd quarter | 88.4 | 90.7 | -2.5% | -2.5% | |

3rd quarter | 72.2 | 73.0 | -1.1% | -0.6% | |

4th quarter | 89.8 | 79.1 | +13.6% | +13.6% | |

Full Year Total | 323.6 | 327.6 | -1.2% | -1.0% |

The Group reported revenue of €323.6 million in 2024, i.e. a slight decrease of -1.2% at current scope and currency rates and -1.0% at constant scope and currency rates. The level of activity recorded in the latter part of the year confirms the gradual recovery in volumes observed in all geographical areas since the end of the first half of 2024, with sales up 6.5% at constant scope and currency rates in the second half of the year.

Audited consolidated financial statements (report being prepared)

in €m | Dec 31, 2024 | Déc 31, 2023 | Change | |

Revenue | 323.6 | 327.6 | -1.2% | |

Adjusted EBIT1 | 12.3 | 11.3 | +11.5% | |

Current Operating Income | 10.6 | 10.4 | +1.9% | |

Net Income, Group Share | -15.2 | 4.7 | n.a |

The margin rate on purchases consumed observed over the period remains stable, a development mainly determined by the offsetting of a positive volume effect on sales by the resumption of a rising trend in the price of certain raw materials and the continued reduction of inventories.

The Group's adjusted EBIT stands at €12.6 million, an increase compared to the previous financial year.

The Group's share of net income amounted to -€15.2 million, compared with €4.7 million in 2023. It was impacted by exceptional expenses of nearly €11 million mainly generated by the restructuring costs of Verseidag-Indutex and the transfer of part of its activities to the Tour du Pin site, by a tax expense of €5. 5 million following the depreciation of deferred tax assets on Verseidag and the cost of financial debt.

Financial Structure

in €m | Dec 31, 2024 | Dec 31, 2023 | |

Net debt | 125.2 | 128.2 | |

Net debt excl. IFRS 16 | 77.6 | 78.6 | |

Shareholders' equity, Group share | 103.0 | 118.5 |

The operational working capital requirement (WCR) thus decreases to €122.0 million, representing 37.7% of revenue in 2024, compared with €130.1 million and 39.7% of revenue in 2023.

Outlook

The Group intends to capitalize on the resumption of activity in the second half of the year and will continue to work on its operational efficiency during the 2025 financial year. Despite the geopolitical context, the effects of this plan on a full-year basis and the favorable economic situation in all the markets addressed allow the Group to maintain its ambitions. Inflation on certain raw materials is leading the Group to adapt its pricing policy.

Financial calendar

- Publication of 2025 Q1 revenue, on Thursday, April 24th, 2025, after market close

- Annual General Meeting: Thursday, May 15th, 2025, at 10:00 am

ABOUT SERGEFERRARI GROUP

The Serge Ferrari Group is a leading global supplier of composite materials for Tensile Architecture, Modular Structures, Solar Protection and Furniture/Marine, in a global market estimated by the Company at around €6 billion. The unique characteristics of these products enable applications that meet the major technical and societal challenges: energy-efficient buildings, energy management, performance and durability of materials, concern for comfort and safety together, opening up of interior living spaces etc. Its main competitive advantage is based on the implementation of differentiating proprietary technologies and know-how. The Group has manufacturing facilities in France, Switzerland, Germany, Italy and Asia. Serge Ferrari operates in 80 countries via subsidiaries, sales offices and a worldwide network of over 100 independent distributors.

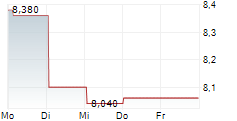

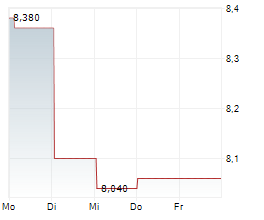

In 2024, Serge Ferrari posted consolidated revenues of €323.6 million, over 80% of which was generated outside France. The SergeFerrari Group share is listed on Euronext Paris Compartment C (ISIN: FR0011950682). SergeFerrari Group shares are eligible for the French PEA-PME and FCPI investment schemes. www.sergeferrari.com

____________________________________

1 Adjusted EBIT Operating income +/- restructuring costs +/- balance sheet effect of acquired companies' purchase price allocation operations

View source version on businesswire.com: https://www.businesswire.com/news/home/20250326955245/en/

Contacts:

SergeFerrari GROUP

Valentin Chefson

Head of Investor Relations

investor@sergeferrari.com

NewCap

Investor Relations Financial Communication

Théo Martin Nicolas Fossiez

Tél.: 01 44 71 94 94

sferrari@newcap.eu