TORONTO, March 27, 2025 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. ("Hudbay" or the "company") (TSX, NYSE: HBM) today released its annual mineral reserve and resource update and issued new three-year production guidance. All amounts are in U.S. dollars, unless otherwise noted.

- Affirmed 2025 production guidance and issued new 2026 and 2027 production guidance, demonstrating strong copper and gold production from Hudbay's stable operating platform with three long-life operations in tier-one mining jurisdictions in the Americas.

- Consolidated copper production is expected to average 144,000i tonnes per year over the next three years, maintaining stable production levels from 2024. Consolidated copper production of 161,000i tonnes is expected in 2027, representing a 17% increase from 2024 and reflects the benefits from the completion of the optimization efforts at Copper Mountain.

- Strong complementary gold exposure with consolidated gold production expected to average 253,000i ounces per year over the next three years, reflecting continued strong production in Manitoba and a contribution from Pampacancha high grade gold zones in Peru in 2025.

- Constancia's expected mine life maintained until 2041 with stable average annual copper production of over 88,000i tonnes expected over the next three years, in spite of the depletion of Pampacancha in late 2025.

- Snow Lake's expected mine life optimized to 2037 with average annual gold production of over 193,000i ounces expected over the next three years and higher mill throughput rates at New Britannia driving higher life-of-mine gold production.

- Copper Mountain's expected mine life maintained until 2043 with average annual copper production of 44,000i tonnes expected over the next three years, including 60,000i tonnes in 2027, a 127% increase from 2024.

- Announcing accretive transaction to consolidate a 100% interest in Copper Mountain, further increasing Hudbay's exposure to a long-life, high-quality copper asset in a tier-1 mining jurisdiction, and results in a 200% increase in attributable copper production from Copper Mountain in 2027 compared to 2024.

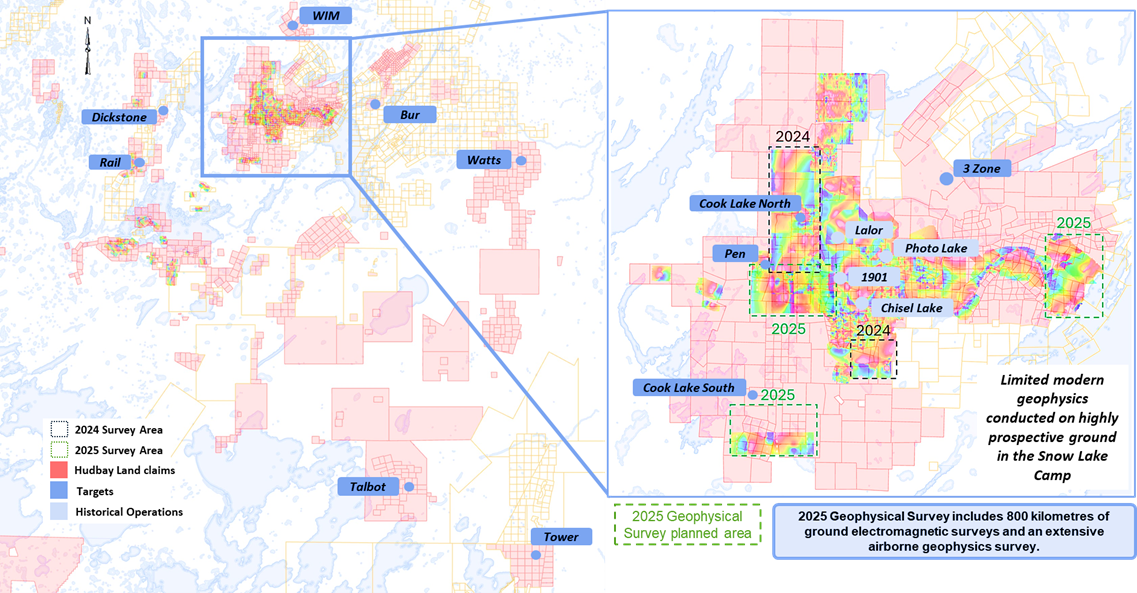

- Large exploration program in Snow Lake continues to execute threefold strategy focused on near-mine exploration to increase near-term production and mineral reserves, testing regional satellite deposits for additional ore feed to utilize available capacity at the Stall mill, and exploring the large land package for a potential new anchor deposit to meaningfully extend mine life.

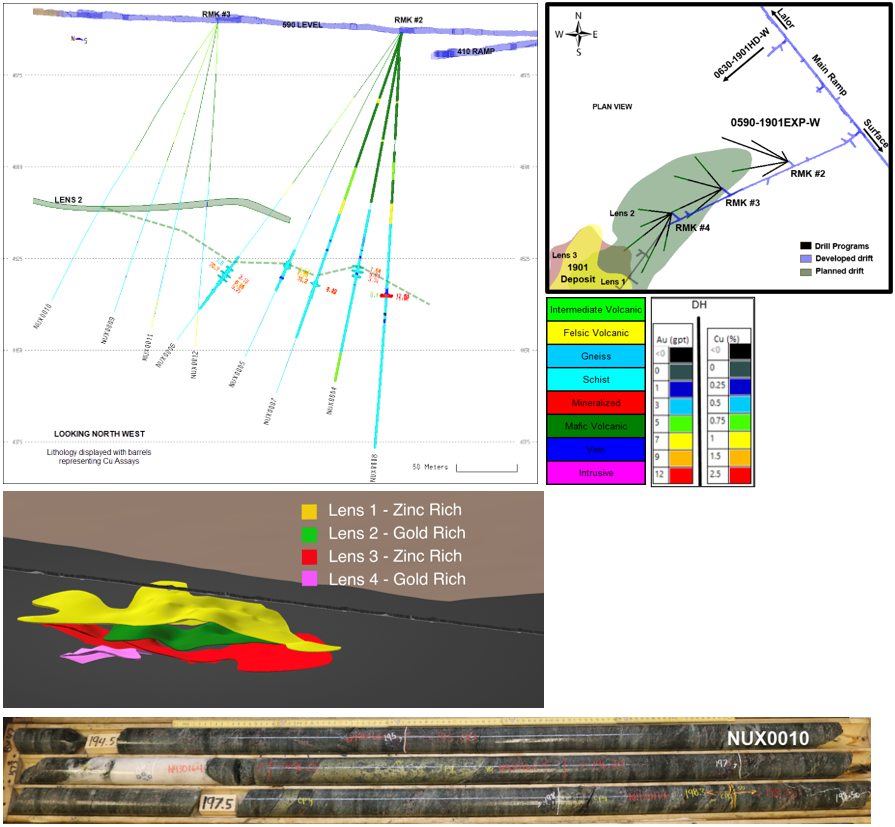

- Positive initial step out drilling from the exploration drift at the 1901 deposit intersected significant copper-gold mineralization, including 14.3% copper over 2.5 metres and 8.3 grams per tonne gold over 3.2 metres.

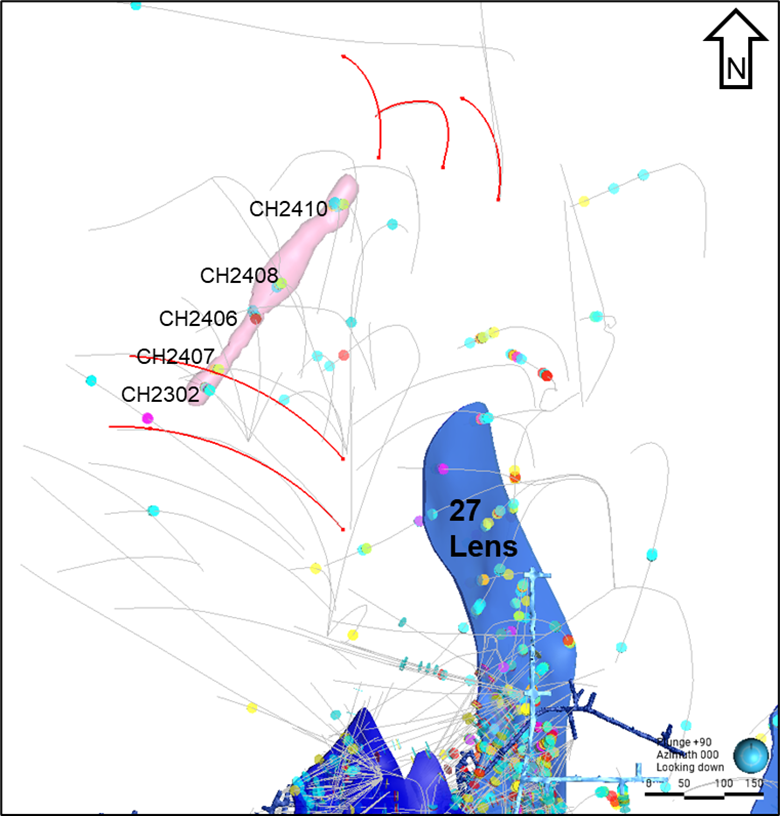

- Follow up drilling at Lalor Northwest continued to intersect copper-gold mineralization, including 16.4 grams per tonne gold over 3.7 metres and 2.6% copper over 3.5 metres.

- Exploration activities in Peru in 2025 focused on advancing drill permitting for highly prospective satellite properties near Constancia.

- Feasibility studies are underway at the fully permitted Copper World project in Arizona and minority joint venture partnership process commenced.

"Our updated mineral reserve estimates and three-year production outlook demonstrate Hudbay's stable copper and gold production profile from our high-quality asset base of long-life mines located in attractive mining regions in the Americas," said Peter Kukielski, Hudbay's President and Chief Executive Officer. "This solid foundation is further enhanced by robust exploration efforts at all our assets to drive production growth and significant mine life extension. We will continue to deliver meaningful free cash flow generation from our diversified operating platform, which together with our strengthened balance sheet, will allow us to advance our unique copper growth pipeline and unlock significant value for stakeholders."

Constancia Operations

Constancia is Hudbay's 100% owned copper operation located in the province of Chumbivilcas in southern Peru and consists of the Constancia and Pampacancha deposits. Current mineral reserve estimates total 517 million tonnes at 0.25% copper containing approximately 1.3 million tonnes of copper. In 2024, the company increased mineral reserve estimates at Constancia to include the addition of a tenth mining phase in the Constancia pit after conducting positive geotechnical drilling and studies in 2023. This extended the expected mine life at Constancia by three years to 2041.

Hudbay continues to mine the high-grade Pampacancha satellite deposit, located approximately six kilometres from the Constancia processing plant. Mining at the Pampacancha pit commenced in 2021 and is expected to extend until early December 2025. The mine plan has smoothed Pampacancha production throughout the year, resulting in total mill ore feed for 2025 from Pampacancha to be ~25%, lower than the typical one-third in prior years. Annual production at the Constancia operations is expected to average approximately 88,000i tonnes of copper and 31,000i ounces of gold over the next three years. This reflects steady copper production levels as higher mill throughput is expected to offset lower grades starting in 2026 after the completion of Pampacancha in late 2025.

Current mineral reserves and resources (exclusive of reserves) for Constancia and Pampacancha as of January 1, 2025 are summarized below.

| Constancia Operations Mineral Reserve and Resource Estimates1,2,3,4,5 | Tonnes | Cu Grade (%) | Mo Grade (g/t) | Au Grade (g/t) | Ag Grade (g/t) | |

| Constancia Reserves | ||||||

| Proven | 443,200,000 | 0.252 | 80 | 0.037 | 2.59 | |

| Probable | 64,800,000 | 0.205 | 73 | 0.036 | 1.78 | |

| Total Proven and Probable - Constancia | 508,000,000 | 0.246 | 79 | 0.037 | 2.49 | |

| Pampacancha Reserves | ||||||

| Proven | 8,700,000 | 0.452 | 110 | 0.272 | 5.38 | |

| Probable | 200,000 | 0.284 | 117 | 0.167 | 2.81 | |

| Total Proven and Probable - Pampacancha | 9,000,000 | 0.448 | 110 | 0.269 | 5.32 | |

| Total Proven and Probable | 517,000,000 | 0.249 | 79 | 0.041 | 2.54 | |

| Constancia Resources | ||||||

| Measured | 92,700,000 | 0.211 | 57 | 0.039 | 2.24 | |

| Indicated | 86,900,000 | 0.222 | 83 | 0.039 | 2.24 | |

| Inferred - Open Pit | 33,700,000 | 0.247 | 69 | 0.056 | 2.75 | |

| Inferred - Underground | 6,500,000 | 1.200 | 69 | 0.140 | 8.62 | |

| Pampacancha Resources | ||||||

| Inferred | 700,000 | 0.144 | 54 | 0.083 | 2.46 | |

| Total Measured and Indicated | 179,700,000 | 0.216 | 69 | 0.039 | 2.24 | |

| Total Inferred | 40,900,000 | 0.397 | 69 | 0.069 | 3.68 | |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral reserves are estimated using a minimum NSR cut-off of $6.40 per tonne at Pampacancha, $7.30 per tonne at Constancia and assuming metallurgical recoveries (applied by ore type) of 86% for copper on average for the life of mine.

3 Mineral resource estimates are based on resource pit design and do not include factors for mining recovery or dilution.

4 The open pit mineral resources are estimated using a minimum NSR cut-off of $6.40 per tonne and assuming metallurgical recoveries (applied by ore type) of 86% for copper on average for the life of mine, while the underground inferred resources at Constancia Norte are based on a 0.65% copper cut-off grade.

5 Long-term metal prices of $4.15 per pound copper, $15.00 per pound molybdenum, $1,900 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates and to estimate mineral resources.

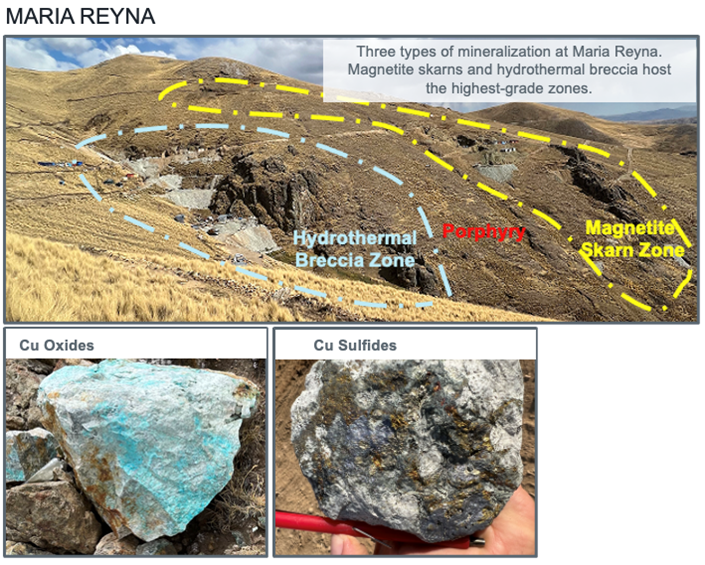

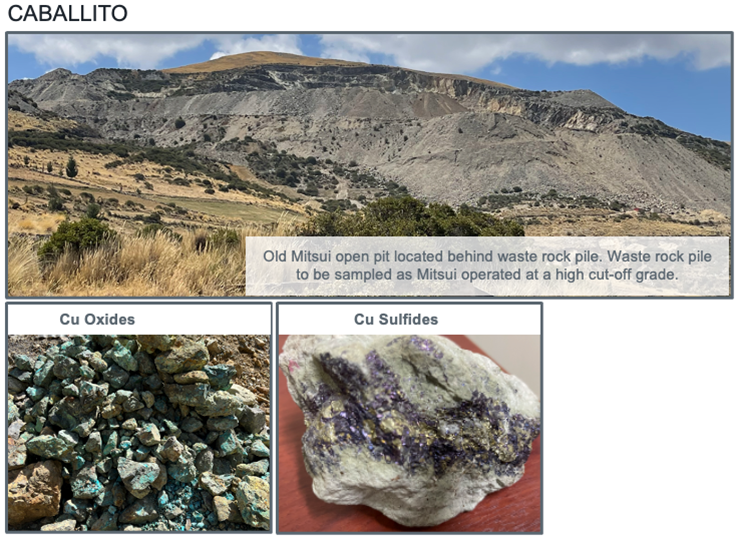

Maria Reyna and Caballito Exploration

Hudbay controls a large, contiguous block of mineral rights with the potential to host satellite mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. The company commenced early exploration activities at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. As part of the drill permitting process, environmental impact assessment (EIA) applications were submitted for the Maria Reyna property in November 2023 and for the Caballito property in April 2024. The EIA for Maria Reyna was approved by the government in June 2024 and the Caballito EIA was approved in September 2024. This represents one of several steps in the drill permitting process, which is expected to be completed in 2025. Surface mapping and geochemical sampling confirm that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies, as shown in Figure 1.

Snow Lake Operations

Hudbay's 100% owned Snow Lake operations in Manitoba include the Lalor gold-copper-zinc mine, the New Britannia gold mill, the Stall base metals concentrator, the 1901 zinc-gold deposit and several satellite deposits. The Lalor mine achieved commercial production in 2014 and reached a significant milestone in December 2024 with the recovery of a total of one million ounces of gold from the mine. Current mineral reserve estimates in Snow Lake total approximately 16 million tonnes with approximately 1.7 million ounces in contained gold and an expected mine life of to 2037. Snow Lake's life-of-mine production schedule has been optimized for higher mill throughput rates at New Britannia, maximizing gold production and cash flows.

In 2024, record annual gold production of 214,225 ounces was achieved in Snow Lake through a combination of higher metallurgical recoveries at the New Britannia and Stall mills, despite processing lower gold grades year-over-year, and the strategic allocation of more gold ore feed to the New Britannia mill. Annual gold production from Snow Lake is expected to average more than 193,000i ounces over the next three years.

Infill drilling at Lalor in 2024 resulted in the successful conversion of inferred gold resources to mineral reserves, offsetting half of the 2024 mining depletion. There remains another 1.3 million ounces of gold contained in inferred resources in Snow Lake that have the potential to maintain strong annual gold production levels beyond 2030 and further extend the mine life in Snow Lake beyond 2038.

The Snow Lake mineral reserve and resource estimates include the copper-gold WIM deposit, the gold-rich 3 Zone and the zinc-rich Watts, Pen II and Talbot deposits, which have the potential to provide feed for the Stall and New Britannia processing facilities and further extend the life of the Snow Lake operations. Hudbay continues to conduct geophysical and drilling programs on the Snow Lake land package, including the Cook Lake claims and other promising regional targets, as discussed further below.

Current mineral reserves and resources (exclusive of reserves) for Lalor, 1901 and other Snow Lake satellite deposits as of January 1, 2025 are summarized below.

| Lalor Mine and 1901 Deposit Mineral Reserve and Resource Estimates1,2,3,4,5,6,7 | Tonnes | Au Grade (g/t) | Zn Grade (%) | Cu Grade (%) | Ag Grade (g/t) | |

| Gold Zone Reserves | ||||||

| Proven - Lalor | 3,250,000 | 5.3 | 0.72 | 0.62 | 32.6 | |

| Proven - 1901 | 102,000 | 2.8 | 1.33 | 1.00 | 19.2 | |

| Probable - Lalor | 3,701,000 | 4.3 | 0.32 | 1.02 | 24.5 | |

| Probable - 1901 | 51,000 | 1.6 | 0.45 | 1.84 | 5.2 | |

| Total Proven and Probable - Gold | 7,103,000 | 4.7 | 0.52 | 0.84 | 28.0 | |

| Base Metal Zone Reserves | ||||||

| Proven - Lalor | 3,631,000 | 2.7 | 5.17 | 0.38 | 30.7 | |

| Proven - 1901 | 1,157,000 | 2.3 | 8.31 | 0.31 | 25.4 | |

| Probable - Lalor | 574,000 | 1.6 | 5.05 | 0.28 | 34.4 | |

| Probable - 1901 | 274,000 | 0.8 | 11.31 | 0.30 | 28.3 | |

| Total Proven and Probable - Base Metal | 5,636,000 | 2.4 | 6.10 | 0.35 | 29.9 | |

| Total Gold and Base Metal Zone Reserves | ||||||

| Proven and Probable - Lalor | 11,156,000 | 3.9 | 2.26 | 0.66 | 29.4 | |

| Proven and Probable - 1901 | 1,584,000 | 2.1 | 8.13 | 0.40 | 24.8 | |

| Total Proven and Probable (Gold and Base Metal) | 12,740,000 | 3.7 | 2.99 | 0.62 | 28.8 | |

| Gold Zone Resources | ||||||

| Inferred - Lalor | 1,953,000 | 4.3 | 0.26 | 2.36 | 14.8 | |

| Inferred - 1901 | 1,587,000 | 5.5 | 0.30 | 0.85 | 16.6 | |

| Total Inferred - Gold | 3,540,000 | 4.8 | 0.28 | 1.68 | 15.6 | |

| Base Metal Zone Resources | ||||||

| Inferred - Lalor | 560,000 | 1.7 | 5.45 | 0.39 | 31.7 | |

| Inferred - 1901 | 312,000 | 1.6 | 5.87 | 0.19 | 32.2 | |

| Total Inferred - Base Metal | 873,000 | 1.7 | 5.60 | 0.32 | 31.9 | |

| Total Gold and Base Metal Zone Resources | ||||||

| Inferred - Lalor | 2,513,000 | 3.7 | 1.42 | 1.92 | 18.6 | |

| Inferred - 1901 | 1,900,000 | 4.8 | 1.22 | 0.74 | 19.1 | |

| Total Inferred (Gold and Base Metal) | 4,413,000 | 4.2 | 1.33 | 1.41 | 18.8 | |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Lalor mineral reserves and resources are estimated using a NSR cut-off ranging from C$154 to C$182 per tonne, assuming a long hole mining method and depending on mill destination.

3 Individual stope gold grades at Lalor and 1901 were capped at 10 grams per tonne. This capping method resulted in an approximate 3% reduction in the overall gold reserve grade.

4 1901 mineral reserves and resources are estimated using a minimum NSR cut-off of C$166 per tonne.

5 Mineral resources do not include factors for mining recovery or dilution.

6 Base metal mineral resources are estimated based on the assumption that they would be processed at the Stall concentrator while gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator.

7 Long-term metal prices of $2,090 per ounce gold, $1.25 per pound zinc, $4.30 per pound copper and $24.30 per ounce silver with an exchange rate of 1.33 C$/US$ were used to confirm the economic viability of the mineral reserve estimates and to estimate mineral resources.

| Snow Lake Regional Deposits - Gold Mineral Reserve and Resource Estimates1,2,3,4,5,6,7 | Tonnes | Au Grade (g/t) | Zn Grade (%) | Cu Grade (%) | Ag Grade (g/t) | |

| Probable Reserves | ||||||

| WIM | 2,450,000 | 1.6 | 0.25 | 1.63 | 6.3 | |

| 3 Zone | 660,000 | 4.2 | - | - | - | |

| Total Probable (Gold) | 3,110,000 | 2.2 | 0.20 | 1.28 | 5.0 | |

| Inferred Resources | ||||||

| New Britannia | 2,750,000 | 4.5 | - | - | - | |

| Birch | 570,000 | 4.4 | - | - | - | |

| Total Inferred (Gold) | 3,320,000 | 4.5 | - | - | - | |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 WIM mineral reserves assume processing recoveries of 98% for copper, 88% for gold, and 70% for silver based on processing through New Britannia's flotation and tails leach circuits.

3 3 Zone mineral reserves assume processing recoveries of 85% for gold based on processing through New Britannia's leach circuit.

4 Long-term metal prices of $1,700 per ounce gold, $1.25 per pound zinc, $4.00 per pound copper and $23.00 per ounce silver with an exchange rate of 1.33 C$/US$ were used to confirm the economic viability of the mineral reserve estimates.

4 Mineral resources do not include factors for mining recovery or dilution.

6 Gold mineral resources are estimated based on the assumption that they would be processed at the New Britannia concentrator.

7 New Britannia mineral resource estimates have been reported at a minimum true width of 1.5 metres and with a cut-off grade varying from 2 grams per tonne (at the lower part of New Britannia) to 3.5 grams per tonne (at the upper part of New Britannia).

| Snow Lake Regional Deposits - Base Metal Mineral Reserve and Resource Estimates1,2,3,4,5,6,7 | Tonnes | Au Grade (g/t) | Zn Grade (%) | Cu Grade (%) | Ag Grade (g/t) | |

| Indicated Resources | ||||||

| Pen II | 470,000 | 0.3 | 8.89 | 0.49 | 6.8 | |

| Talbot | 2,190,000 | 2.1 | 1.79 | 2.33 | 36.0 | |

| Total Indicated (Base Metals) | 2,660,000 | 1.8 | 3.04 | 2.01 | 30.9 | |

| Inferred Resources | ||||||

| Watts | 3,150,000 | 1.0 | 2.58 | 2.34 | 31.0 | |

| Pen II | 130,000 | 0.3 | 9.81 | 0.37 | 6.8 | |

| Talbot | 2,450,000 | 1.9 | 1.74 | 1.13 | 25.8 | |

| Total Inferred (Base Metals) | 5,730,000 | 1.3 | 2.39 | 1.78 | 28.3 | |

Note: totals may not add up correctly due to rounding.

1 Mineral resources are exclusive of mineral reserves and do not have demonstrated economic viability.

2 Mineral resources do not include factors for mining recovery or dilution.

3 Base metal mineral resources are estimated based on the assumption that they would be processed at the Stall concentrator.

4 Watts and Pen II mineral resources were initially estimated using metal price assumptions that vary marginally over the assumptions used to estimate mineral resources at Lalor. In the Qualified Person's opinion, the combined impact of these small variations does not have any impact on the mineral resource estimates.

5 Watts mineral resources are estimated using a minimum NSR cut-off of C$150 per tonne, assuming processing recoveries of 90% for copper, 80% for zinc, 70% for gold and 70% for silver.

6 Pen II mineral resources are estimated using a minimum NSR cut-off of C$75 per tonne.

7 The above resource estimates table includes 100% of the Talbot mineral resources reported by Rockcliff Metals Corp. in its 2020 NI 43-101 technical report published on SEDAR+.

Snow Lake Exploration Program - Executing Threefold Strategy

Hudbay continues to execute the largest exploration program in Snow Lake in the company's history through extensive geophysical surveying and multi-phased drilling campaigns as part of its threefold exploration strategy.

1)Near-Mine Exploration to Further Increase Near-term Production and Extend Mine Life

The company is testing mineralized extensions of the Lalor and 1901 deposits to increase mineral reserves and resources, providing near-term production growth and long-term mine life extension potential.

1901 Deposit Step-out Drilling Confirms Down Plunge Copper-Gold Extensions

The 2024 drilling activities at the 1901 deposit targeted down plunge extensions of the ore body with five step-out holes drilled beyond the known extent of the mineralization, as shown in the images provided in Figure 2. All five of the step-out holes intersected copper-gold mineralization, including:

- Hole NUX0006 intersected 8.6 metres at 2.6 grams per tonne gold and 1.5% copper

- Hole NUX0007 intersected 3.2 metres at 8.3 grams per tonne gold and 1.8% copper

- Hole NUX0008 intersected 2.5 metres at 4.4 grams per tonne gold and 14.3% copper

In addition to the copper-gold extensions, a recent drill hole on the face of the 1901 exploration drift, directed towards the planned drift extension, intersected zinc-rich massive sulphides 20 metres earlier than expected. This positive outcome further reinforces the company's target of achieving first ore from the 1901 deposit in the second quarter of 2025.

Additional exploration drilling is planned for 2025 targeting additional step-out drill holes to potentially extend the ore body and infill drilling to convert inferred mineral resources in the gold lenses to mineral reserves.

Lalor Northwest Drilling Confirms Copper-Gold Mineralized Zones

At Lalor Northwest, follow-up drilling in the second half of 2024 confirmed the potential for a new gold-copper discovery located approximately 400 metres from the existing Lalor underground infrastructure. Several 2024 intersections have helped establish the geometry of this new discovery, including:

- Hole CH2406 intersected 9.3 metres at 3.0% copper and 6.2 grams per tonne gold

- Hole CH2408 intersected 3.5 metres at 2.6% copper and 3.8 grams per tonne gold

- Hole CH2410 intersected 9.9 metres at 1.4% copper and 1.4 grams per tonne gold

- Hole CH2411 intersected 3.7 metres at 1.3% copper and 16.4 grams per tonne gold

The company plans to continue to drill Lalor Northwest in 2025 through a surface drill program that is focused on testing the extent of the mineralization, as shown in Figure 3.

2)Testing Regional Satellite Deposits to Utilize Available Processing Capacity and Increase Production

Hudbay increased its land package by more than 250% in 2023 through the acquisition of Rockcliff Metals Corp. ("Rockcliff"), which included the addition of several known deposits located within trucking distance of the Snow Lake processing infrastructure. These newly acquired deposits, together with several deposits already owned by Hudbay in Snow Lake, have created an attractive portfolio of regional deposits in Snow Lake, as shown in Figure 4, including:

- Talbot - Consolidated 100% ownership of this copper-zinc-gold rich deposit through the Rockcliff acquisition. Rockcliff estimated indicated mineral resources of 2.2 million tonnes at 2.3% copper, 1.8% zinc and 2.1 grams per tonne gold.

- Rail - Acquired through Rockcliff, Hudbay's 2024 drill program yielded new intersections of high-grade copper-gold mineralization. These results will be combined with historical drilling results on the property to update the geological model and assess its economic potential.

- Pen II - Hudbay consolidated land adjacent to this low tonnage, near surface, high-grade zinc deposit through the Rockcliff acquisition. Rockcliff intersected mineralization down-dip from Hudbay's deposit and identified a deep geophysical conductive plate.

- Watts - A copper-zinc-rich deposit located near existing powerlines and 100 kilometres by road from the Stall mill. Drilling by Hudbay in 2019 successfully extended the known high-grade copper mineralization.

- 3 Zone - Acquired by Hudbay in 2015, this gold-rich deposit is located three kilometres from the New Britannia mill and is expected come into production after the Lalor deposit is depleted.

- WIM - Acquired by Hudbay in 2018, this copper-gold deposit is located 15 kilometres from the New Britannia mill and is expected to come into production after the Lalor deposit is depleted.

With the recent strong performance from the New Britannia mill operating at above 2,000 tonnes per day, the company has been increasing the amount of Lalor ore sent to New Britannia which has freed up processing capacity at the Stall mill. There is approximately 1,500 tonnes per day of available capacity at the Stall mill which can be utilized by the regional satellite deposits to increase production. The regional satellite deposits also have the potential to extend the life of the Snow Lake operations beyond 2038.

3)Exploring Large Land Package for New Anchor Deposit to Significantly Extend Mine Life

Large Modern Geophysics Program

A majority of the newly acquired Cook Lake and former Rockcliff claims have been untested by modern deep geophysics, which was the discovery method for the Lalor deposit. A large geophysics program is currently underway consisting of surface electromagnetic surveys using cutting-edge techniques that enable the team to detect targets at depths of almost 1,000 metres below surface. Figure 4 outlines the regional geophysics that have been completed to date. The planned geophysics program in 2025 is the largest geophysics program in Hudbay's history and includes 800 kilometres of ground electromagnetic surveys and an extensive airborne geophysics survey.

Copper Mountain Mine

Hudbay's 75% owned Copper Mountain mine is an open pit copper mine in southern British Columbia, which also produces gold and silver as by-product metals. Hudbay acquired Copper Mountain as part of its acquisition of Copper Mountain Mining Corporation in June 2023 and Mitsubishi Materials Corporation ("MMC") holds the remaining 25% interest. On March 27, 2025, Hudbay announced that it entered into an agreement with MMC to acquire MMC's 25% minority interest in Copper Mountain for an upfront cash payment of $4.5 million and up to $39.75 million in deferred and contingent cash payments (the "MMC Transaction"). In addition, Hudbay will be solely responsible to settle any of Copper Mountain's outstanding obligations, including an intercompany loan owing to Hudbay, of which 25% represents approximately $104 million. The MMC Transaction is accretive to Hudbay's net asset value per share. Once completed, Hudbay will be the 100% owner of the Copper Mountain mine.

Current mineral reserve estimates at Copper Mountain total 346 million tonnes at 0.25% copper and 0.12 grams per tonne gold with approximately 850 thousand tonnes of contained copper and 1.3 million ounces of contained gold. The current mineral reserve estimates continue to support a mine life until 2043, with significant upside potential for future resource conversion and mine life extension beyond 19 years through an additional 125 million tonnes of measured and indicated resources at 0.21% copper and 0.10 grams per tonne gold and 372 million tonnes of inferred resources at 0.25% copper and 0.13 grams per tonne gold, in each case, exclusive of mineral reserves.

Since acquiring Copper Mountain in June 2023, Hudbay has been focused on advancing operational stabilization and optimization plans, including opening up the mine by re-activating the full mining fleet, adding additional haul trucks, adding additional mining faces, optimizing the ore feed to the plant and implementing plant improvement initiatives that mirror Hudbay's successful processes at Constancia. These investments have successfully increased the total tonnes moved and resulted in stronger mill performance as demonstrated by high mill availability of 92% and copper recoveries of 82% in 2024, compared to 85% and 80%, respectively, in 2023.

In 2025, the planned conversion of the third ball mill to a second SAG mill is anticipated to result in the ramp-up of mill throughput in the second half of the year. The mill throughput is anticipated to ramp up towards 50,000 tonnes per day in 2026. Annual production at the British Columbia operations is expected to average approximately 44,000i tonnes of copper and 28,600i ounces of gold over the next three years.

Current mineral reserves and resources (exclusive of reserves) for Copper Mountain as of January 1, 2025 are summarized below.

| Copper Mountain Mine Mineral Reserve and Resource Estimates1,2,3,4,5,6 | Tonnes | Cu Grade (%) | Au Grade (g/t) | Ag Grade (g/t) | |

| Reserves | |||||

| Proven | 172,900,000 | 0.269 | 0.124 | 0.72 | |

| Probable | 173,100,000 | 0.222 | 0.109 | 0.62 | |

| Total proven and probable | 346,000,000 | 0.245 | 0.116 | 0.67 | |

| Resources | |||||

| Measured | 31,900,000 | 0.213 | 0.092 | 0.72 | |

| Indicated | 92,800,000 | 0.209 | 0.109 | 0.66 | |

| Total measured and indicated | 124,700,000 | 0.210 | 0.105 | 0.68 | |

| Inferred | 372,200,000 | 0.250 | 0.128 | 0.60 | |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates are exclusive of mineral reserves. Mineral resources are not mineral reserves as they do not have demonstrated economic viability.

2 Mineral reserves are estimated using a 0.1% copper cut-off grade and assuming metallurgical recoveries (applied by ore type) of 86% for copper, and 68% for gold and silver on average for the life of mine.

3 Long term metal prices of $4.15 per pound copper, $1,900 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates and to estimate mineral resources.

4 Mineral resource estimate tonnes and grades constrained to a Lerch Grossman revenue factor 1 pit shell.

5 Mineral resources are estimated using 0.1% copper cut-off grade.

6 Mineral reserve and resource estimates presented on a 100% basis. Hudbay currently holds a 75% interest in the Copper Mountain mine and has recently entered into an agreement to acquire the remaining 25% interest.

3-Year Production Outlook

Hudbay has affirmed its 2025 production guidance as issued on February 19, 2025, and has issued new 2026 and 2027 production guidance in connection with updated life-of-mine models to support annual reserves and resource estimates. Consolidated copper production over the next three years is expected to average 144,000i tonnes, representing an increase of 4% from 2024 levels. The increase is due to higher expected copper production in British Columbia as a result of mill throughput ramp-up throughout 2025 and 2026 and higher grades in 2027 from the accelerated stripping schedule, which more than offsets the depletion of the high-grade Pampacancha deposit in Peru at the end of 2025. Consolidated gold production over the next three years is expected to average 253,000i ounces, reflecting higher-than-expected annual gold production levels in Manitoba, as compared to prior guidance, a result of continued strong operating performance in Snow Lake and a contribution from Pampacancha high grade gold zones in 2025.

Peru's three-year production guidance reflects stable copper production of approximately 88,000i tonnes per year, as the depletion of higher copper grades from Pampacancha in 2025 is offset by higher expected throughput levels in 2026 and 2027 with mill improvement projects, including the installation of a pebble crusher. Total mill ore feed from Pampacancha is expected to be approximately 25% in 2025, lower than the typical one-third in prior years as Pampacancha approaches depletion. Gold production over the next three years is expected to average 31,000i ounces, lower than 2024 levels as additional high grade gold benches were mined at Pampacancha in late 2024, ahead of schedule, resulting in gold production exceeding 2024 guidance levels, as well as the depletion of the higher grade Pampacancha deposit in late 2025.

Manitoba's three-year production guidance reflects continued strong gold production levels averaging 193,000i ounces per year. The impressive operating performance has resulted in 2025 gold production guidance being 8% higher than the previous 2025 guidance of 185,000i ounces, and 2026 gold production guidance being 3% higher than the previous 2026 guidance of 185,000i ounces. Similarly, the midpoint of the 2027 gold production guidance is 17% higher than the production in the most recent technical report. The production guidance anticipates Lalor operating at 4,500 tonnes per day supplemented by 45,000 tonnes of ore feed from the 1901 deposit in 2025 as the company confirms the optimal mining method. New Britannia mill throughput is expected to continue to exceed initial expectations and operate at 2,000 tonnes per day starting in 2025, far exceeding its original design capacity of 1,500 tonnes per day. Zinc production is expected to decline over the next two years as the Lalor mine continues to prioritize higher grade gold and copper zones and then start to increase in 2027 with initial production from the zinc zones at the 1901 deposit.

British Columbia's three-year production guidance reflects sequentially higher annual copper production averaging 44,000i tonnes per year, a 67% increase from 2024 as a result of mill throughput ramp-up in the second half of the year from several mill initiatives, including the planned conversion of the third ball mill to a second SAG mill, and higher grades from the accelerated stripping program. The mill throughput ramp-up reflects the first half of 2025 at similar throughput levels seen in 2024 with improvements to throughput in the second half of 2025 concurrent with the completion of the SAG mill conversion project, ramping up towards 50,000 tonnes per day in 2026. The Copper Mountain production guidance ranges are wider than typical ranges and coincide with the operation ramp up activities over the three-year optimization period. Upon completion of Hudbay's optimization activities, 2027 copper production is expected to be 60,000i tonnes, representing a 127% increase from 2024. 2027 expected copper production is also 20% higher than the production in the most recent technical report as a result of the deferral of higher grades from 2026 to 2027 in connection with the current accelerated stripping schedule.

| 3-Year Production Outlook Contained Metal in Concentrate and Doré1 | 2025 Guidance | 2026 Guidance | 2027 Guidance | |

| Peru | ||||

| Copper | tonnes | 80,000 - 97,000 | 76,000 - 100,000 | 76,000 - 100,000 |

| Gold | ounces | 49,000 - 60,000 | 16,000 - 21,000 | 17,000 - 23,000 |

| Silver | ounces | 2,475,000 - 3,025,000 | 1,610,000 - 2,070,000 | 1,415,000 - 1,915,000 |

| Molybdenum | tonnes | 1,300 - 1,500 | 1,300 - 1,500 | 1,400 - 1,800 |

| Manitoba | ||||

| Gold | ounces | 180,000 - 220,000 | 170,000 - 210,000 | 170,000 - 210,000 |

| Zinc | tonnes | 21,000 - 27,000 | 21,000 - 25,000 | 21,000 - 27,500 |

| Copper | tonnes | 9,000 - 11,000 | 11,000 - 13,000 | 12,000 - 14,000 |

| Silver | ounces | 800,000 - 1,000,000 | 750,000 - 950,000 | 1,000,000 - 1,200,000 |

| British Columbia2 | ||||

| Copper | tonnes | 28,000 - 41,000 | 30,000 - 45,000 | 50,000 - 70,000 |

| Gold | ounces | 18,500 - 28,000 | 20,000 - 30,000 | 30,000 - 45,000 |

| Silver | ounces | 245,000 - 365,000 | 230,000 - 345,000 | 455,000 - 680,000 |

| Total | ||||

| Copper | tonnes | 117,000 - 149,000 | 117,000 - 158,000 | 138,000 - 184,000 |

| Gold | ounces | 247,500 - 308,000 | 206,000 - 261,000 | 217,000 - 278,000 |

| Zinc | tonnes | 21,000 - 27,000 | 21,000 - 25,000 | 21,000 - 27,500 |

| Silver | ounces | 3,520,000 - 4,390,000 | 2,590,000 - 3,365,000 | 2,870,000 - 3,795,000 |

| Molybdenum | tonnes | 1,300 - 1,500 | 1,300 - 1,500 | 1,400 - 1,800 |

| 1 Metal reported in concentrate and doré is prior to smelting and refining losses or deductions associated with smelter terms. 2 Represents 100% of the production from the Copper Mountain mine. Hudbay currently holds a 75% interest in the Copper Mountain mine and recently entered into an agreement to acquire the remaining 25% interest. | ||||

Copper World Project

The 100% owned Copper World project is located in Pima County, Arizona, approximately 50 kilometres southeast of Tucson. The Copper World project includes the large East deposit (formerly known as the Rosemont deposit) together with new deposits that were defined after the completion of an expanded drill program following a successful initial drill program in 2020. A new resource model was completed for the preliminary economic assessment ("PEA") of Copper World in 2022, which contemplated a two-phased mine plan with Phase I as a standalone operation requiring state and local permits only and Phase II expanding onto federal lands requiring federal permits.

In September 2023, Hudbay released its enhanced pre-feasibility study ("PFS") for Copper World reflecting the results of further technical work on Phase I of the project. Phase I has a mine life of 20 years, which is four years longer than the Phase I mine life that was presented in the PEA, largely due to an increase in the capacity for tailings and waste deposition as a result of optimizing the site layout. Phase II is expected to involve an expansion on to federal lands with a significantly longer mine life and enhanced project economics. Phase II would be subject to the federal permitting process and was not included in the PFS results.

Hudbay has received all three key state permits required for Copper World development and operation:

- Mined Land Reclamation Plan - Completed - the Mined Land Reclamation Plan was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended and approved to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023.

- Aquifer Protection Permit - Completed - the Aquifer Protection Permit was received on August 29, 2024 from the ADEQ following a robust process that included detailed analysis by the agency and Hudbay, along with a public comment period that was completed in the second quarter of 2024.

- Air Quality Permit - Completed - the Air Quality Permit was received on January 2, 2025 from the ADEQ following a similarly robust process, including a public comment period that concluded in the third quarter of 2024. An administrative appeal was filed by certain opponents in late January, as expected, and the company is confident the permit will be upheld, similar to the project's other state-level permits.

Based on the PFS, Phase I contemplates average annual copper production of 85,000 tonnes over a 20-year mine life, at average cash costsii and sustaining cash costsii of $1.47 and $1.81 per pound of copper, respectively. A variable cut-off grade strategy allows for higher mill head grades in the first ten years, which increases annual production to approximately 92,000 tonnes of copper at average cash costsii and sustaining cash costsii of $1.53 and $1.95 per pound of copper, respectively.

At a copper price of $3.75 per pound, the after-tax net present value ("NPV") of Phase I using an 8% discount rate is $1.1 billion and the internal rate of return ("IRR") is 19%. The valuation metrics are leveraged to higher copper prices and at a price of $4.25 per pound, the after-tax NPV (8%) of Phase I increases to $1.7 billion, and the IRR increases to 25.5%.

Copper World is one of the highest-grade open pit copper projects in the Americas with proven and probable mineral reserves of 385 million tonnes at 0.54% copper. There remains approximately 60% of the total copper contained in measured and indicated mineral resources (exclusive of mineral reserves), providing significant potential for Phase II expansion and mine life extension. In addition, the inferred mineral resource estimates are at a comparable copper grade and provide significant upside potential.

Current mineral reserves and resources (exclusive of reserves) for the Copper World project as of January 1, 2025 are summarized below.

| Copper World Project Mineral Reserve and Resource Estimates1,2,3,4,5,6,7 | Tonnes | Cu Grade (%) | Soluble Cu Grade (%) | Mo Grade (g/t) | Au Grade (g/t) | Ag Grade (g/t) |

| Reserves | ||||||

| Proven | 319,400,000 | 0.54 | 0.11 | 110 | 0.03 | 5.7 |

| Probable | 65,700,000 | 0.52 | 0.14 | 96 | 0.02 | 4.3 |

| Total Proven and Probable Reserves | 385,100,000 | 0.54 | 0.12 | 108 | 0.02 | 5.4 |

| Resources - Flotation | ||||||

| Measured | 424,000,000 | 0.39 | 0.04 | 150 | 0.02 | 4.1 |

| Indicated | 191,000,000 | 0.36 | 0.06 | 125 | 0.02 | 3.5 |

| Total Measured and Indicated (Flotation) | 615,000,000 | 0.38 | 0.05 | 142 | 0.02 | 3.9 |

| Inferred | 192,000,000 | 0.35 | 0.07 | 117 | 0.01 | 3.1 |

| Resources - Leach | ||||||

| Measured | 159,000,000 | 0.28 | 0.20 | - | - | - |

| Indicated | 70,000,000 | 0.26 | 0.20 | - | - | - |

| Total Measured and Indicated (Leach) | 229,000,000 | 0.27 | 0.20 | - | - | - |

| Inferred | 83,000,000 | 0.26 | 0.19 | - | - | - |

| Total Measured and Indicated | 844,000,000 | 0.35 | 0.09 | 104 | 0.01 | 2.9 |

| Total Inferred | 275,000,000 | 0.32 | 0.11 | 82 | 0.01 | 2.2 |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates are exclusive of mineral reserves. CIM definitions were followed for the estimation of mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2 Long term metal prices of $4.00 per pound copper, $12.00 per pound molybdenum, $1,700 per ounce gold and $23.00 per ounce silver were used to confirm the economic viability of the mineral reserve estimates.

3 Mineral reserve estimates are limited to the portion of the measured and indicated resource estimates scheduled for milling and included in the financial model of the Copper World PFS.

4 Long-term metals prices of $3.75 per pound copper, $12.00 per pound molybdenum, $1,650 per ounce gold and $22.00 per ounce silver were used to estimate mineral resources.

5 Mineral resources are constrained within a computer-generated pit using the Lerchs-Grossman algorithm.

6 Mineral resource estimates were reported using a 0.1% copper cut-off grade and an oxidation ratio lower than 50% for flotation material and a 0.1% soluble copper cut-off grade and an oxidation ratio higher than 50% for leach material.

7 Estimate of the mineral reserve does not account for marginal amounts of historical small-scale operations in the area that occurred between 1870 and 1970 and is estimated to have extracted approximately 200,000 tonnes, which is within rounding approximations of the current reserve estimates.

Mason Project

The Mason project is a 100% owned greenfield copper deposit located in the historic Yerington District of Nevada and is one of the largest undeveloped copper porphyry deposits in North America. The Mason project's measured and indicated mineral resources are comparable in size to Constancia. Hudbay views the Mason project as a long-term future development asset as part of the company's pipeline of high-quality copper growth opportunities. Since acquiring Mason, Hudbay has consolidated a prospective package of patented and unpatented mining claims contiguous to the Mason project and has advanced a number of technical studies, including a revised resource model and the completion of a PEA on Mason.

The Mason PEA was completed in April 2021 and contemplates a 27-year mine life with average annual copper production of approximately 140,000 tonnes over the first ten years of full production. At a copper price of $4.00 per pound, the after-tax net present value using a 10% discount rate is $2.0 billion and the internal rate of return is 23%. For information regarding the limitations of a PEA, please refer to the Qualified Person and NI 43-101 statement at the end of this news release.

Since 2021, the company has completed exploration activities at Mason, while continuing to focus on local stakeholder engagement. The company is advancing additional metallurgical studies with the objective of further enhancing the project economics.

Current mineral resource estimates for Mason as of January 1, 2025 are summarized below.

| Mason Project Mineral Resource Estimates1,2,3,4,5 | Tonnes | Cu Grade (%) | Mo Grade (g/t) | Au Grade (g/t) | Ag Grade (g/t) | |

| Measured | 1,417,000,000 | 0.29 | 59 | 0.031 | 0.66 | |

| Indicated | 801,000,000 | 0.30 | 80 | 0.025 | 0.57 | |

| Total Measured and Indicated | 2,219,000,000 | 0.29 | 67 | 0.029 | 0.63 | |

| Inferred | 237,000,000 | 0.24 | 78 | 0.033 | 0.73 | |

Note: totals may not add up correctly due to rounding.

1 Mineral resource estimates that are not mineral reserves do not have demonstrated economic viability.

2 Mineral resource estimates do not include factors for mining recovery or dilution.

3 Metal prices of $3.10 per pound copper, $11.00 per pound molybdenum, $1,500 per ounce gold, and $18.00 per ounce silver were used to estimate mineral resources.

4 Mineral resources are estimated using a minimum NSR cut-off of $6.25 per tonne.

5 Mineral resources are based on resource pit designs containing measured, indicated, and inferred mineral resources.

Llaguen Project

The Llaguen project is a 100% owned copper-molybdenum porphyry deposit located near the city of Trujillo, the third largest city in Peru. Llaguen is at moderate altitude and in close proximity to existing infrastructure, water and power supply, including the port of Salaverry located 62 kilometres away and the Trujillo Nueva electric power substation located 40 kilometres away. Hudbay completed a 28-hole confirmatory drill program in 2021 and 2022, which confirmed and extended the footprint of the known mineralization and highlighted the existence of a high-grade zone in the center of the deposit.

After completing an initial mineral resource estimate in November 2022, Hudbay initiated preliminary technical studies, including metallurgical test work as well as geotechnical and hydrogeological studies, which are expected to be incorporated into a preliminary economic assessment for the Llaguen project. Additional exploration drilling is warranted on the Llaguen property to test the areas of the deposit that remain open and the several untested geophysical targets in the area to fully define the regional extent of the mineralization. The current mineral resource is also surrounded by a large halo of low grade hypogene copper mineralization, not currently included in the mineral resource estimate, but for which metallurgical test work could assess the potential for economic sulfide heap leaching via commercially available technologies.

Current mineral resource estimates for Llaguen as of January 1, 2025 are summarized below.

| Llaguen Mineral Resource Estimates1,2,3,4,5,6 | Metric Tonnes | Cu (%) | Mo (g/t) | Au (g/t) | Ag (g/t) | CuEq (%) |

| Indicated Global (>= 0.14% Cu) | 271,000,000 | 0.33 | 218 | 0.033 | 2.04 | 0.42 |

| Including Indicated High-grade (>= 0.30% Cu) | 113,000,000 | 0.49 | 261 | 0.046 | 2.73 | 0.60 |

| Inferred Global (>= 0.14% Cu) | 83,000,000 | 0.24 | 127 | 0.024 | 1.47 | 0.30 |

| Including Inferred High-grade (>= 0.30% Cu) | 16,000,000 | 0.45 | 141 | 0.038 | 2.60 | 0.52 |

Note: totals may not add up correctly due to rounding.

1 CIM definitions were followed for the estimation of mineral resources. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

2 Mineral resources are reported within an economic envelope defined by a pit shell optimization algorithm. This pit shell is defined by a revenue factor of 0.33 assuming operating costs adjusted from Hudbay's Constancia open pit operation.

3 Long-term metal prices of $3.60 per pound copper, $11.00 per pound molybdenum, $1,650 per ounce gold and $22.00 per ounce silver were used for the estimation of mineral resources.

4 Metal recovery estimates assume that this mineralization would be processed at a combination of facilities, including copper and molybdenum flotation.

5 Copper-equivalent ("CuEq") grade is calculated assuming 85% copper recovery, 80% molybdenum recovery, 60% gold recovery and 60% silver recovery.

6 Specific gravity measurements were estimated by industry standard laboratory measurements.

Flin Flon Opportunities

Unlocking Value Through Tailings Reprocessing

Hudbay is advancing studies to evaluate the opportunity to reprocess Flin Flon tailings where more than 100 million tonnes of tailings have been deposited for over 90 years from the mill and the zinc plant. The studies are evaluating the potential to use the existing Flin Flon concentrator, which is currently on care and maintenance after the closure of the 777 mine in 2022, with flow sheet modifications to reprocess tailings to recover critical minerals and precious metals while creating environmental and social benefits for the region. The company is completing metallurgical test work and an early economic study to evaluate the tailings reprocessing opportunity.

- Zinc plant tailings - Hudbay operated a hydrometallurgical zinc facility where high grade critical minerals and precious metals were deposited for more than 25 years. Metallurgical test work continues following positive results from the initial confirmatory drill program completed in 2024. The results confirmed the grades of precious metals and critical minerals previously estimated from historical zinc plant records. An early economic study to evaluate the opportunity to reprocess the zinc plant tailings has confirmed the potential for a technically viable reprocessing alternative, and further engineering work is underway.

- Mill tailings - Initial confirmatory drilling completed in 2022 indicated higher zinc, copper and silver grades than predicted from historical mill records while confirming the historical gold grade. The tailings reprocessing opportunity is expected to reduce acid-generating properties of the tailings, which would improve the environmental impacts through higher quality water in the tailings facility and reduce the need for long-term water treatment. In 2023, Hudbay advanced metallurgical test work and evaluated metallurgical technologies, including the signing of a test work co-operation agreement with Cobalt Blue Holdings ("COB") examining the use of COB technology to treat Flin Flon mill tailings. Initial results from preliminary roasting test work were encouraging in converting more than 90% of pyrite into pyrrhotite and low-carbon sulphur, and the project has been advanced to the next stage of testing.

Marubeni Flin Flon Exploration Partnership

In March 2024, Hudbay entered into an option agreement with Marubeni Corporation ("Marubeni"), pursuant to which Hudbay granted Marubeni an option to acquire a 20% interest in three projects located within trucking distance of Hudbay's processing facilities in the Flin Flon area by funding a minimum of C$12 million in exploration expenditures over a period of approximately five years. All three properties hold past producing mines that generated meaningful production with attractive grades of both base metals and precious metals. The properties remain highly prospective with potential for further discovery based on the attractive geological setting, limited historical deep drilling and promising geochemical and geophysical targets. Geochemical sampling, together with geological and structural mapping was conducted on the properties in 2024, which resulted in the identification of drill ready targets for 2025.

Qualified Person and NI 43-101

The technical and scientific information in this news release related to the Constancia mine, Snow Lake operations and Copper World project has been approved by Olivier Tavchandjian, P. Geo., Senior Vice President, Exploration and Technical Services. The technical and scientific information in this news release related to the Copper Mountain mine has been approved by Marc-Andre Brulotte, P. Geo., Director, Global Exploration and Resource Evaluation. Messrs. Tavchandjian and Brulotte are qualified persons pursuant to NI 43-101 (as defined below). Additional details on the company's material mineral properties, including a year-over-year reconciliation of reserves and resources, are included in Hudbay's Annual Information Form for the year ended December 31, 2024 (the "AIF"), which will be filed today on SEDAR+ at www.sedarplus.ca.

The Mason PEA is preliminary in nature, includes inferred resources that are considered too speculative to have the economic considerations applied to them that would enable them to be categorized as mineral reserves and there is no certainty the preliminary economic assessments will be realized.

Supplemental Information for 1901 Drill Holes

| 1901 Deposit 2024 Drill Hole ID1,2 | From (m) | To (m) | Intercept (m) | Estimated true width (m) | Cu (%) | Au (g/t) | Ag (g/t) |

| NX0004 | 196.0 | 206.0 | 10.0 | 9.7 | 1.76 | 0.67 | 5.49 |

| NX0005 | 211.3 | 217.0 | 5.7 | 5.1 | 1.82 | 1.38 | 6.37 |

| NX0006_top | 213.5 | 217.0 | 3.5 | 2.8 | nil | 11.26 | 3.74 |

| NX0006_bottom | 241.0 | 251.8 | 10.8 | 8.6 | 1.45 | 2.57 | 5.17 |

| NX0007 | 218.0 | 221.4 | 3.4 | 3.2 | 1.75 | 8.33 | 7.75 |

| NX0008 | 215.2 | 217.7 | 2.5 | 2.5 | 14.29 | 4.39 | 48.12 |

Notes:

1. True widths are estimated based on drill angle and intercept geometry of mineralization.

2. All copper, gold and silver values are uncut.

| 1901 Deposit 2024 Drill Hole ID | From | To | Azimuth at Intercept | Dip at Intercept | ||||

| Easting | Northing | Elevation | Easting | Northing | Elevation | |||

| NX0004 | 427,579 | 6,079,305 | -480 | 427,576 | 6,079,304 | -490 | 244.5 | -75.5 |

| NX0005 | 427,523 | 6,079,319 | -478 | 427,520 | 6,079,319 | -483 | 266.7 | -64.2 |

| NX0006_top | 427,504 | 6,079,381 | -463 | 427,503 | 6,079,382 | -466 | 295.1 | -53.1 |

| NX0006_bottom | 427,489 | 6,079,388 | -485 | 427,484 | 6,079,391 | -494 | 295.1 | -53.0 |

| NX0007 | 427,557 | 6,079,366 | -496 | 427,556 | 6,079,366 | -499 | 289.6 | -70.5 |

| NX0008 | 427,609 | 6,079,335 | -505 | 427,609 | 6,079,335 | -508 | 265.3 | -86.0 |

Supplemental Information for Lalor Northwest Drill Holes

| Lalor Northwest 2024 Drill Hole ID1,2 | From (m) | To (m) | Intercept (m) | Estimated True Width (m) | Cu (%) | Au (g/t) | Ag (g/t) |

| CH2406 Top | 1115.5 | 1124.8 | 9.3 | 9.3 | 2.96 | 6.2 | 88.5 |

| CH2407 Top | 1090.6 | 1095.0 | 4.4 | 4.3 | 1.26 | 0.9 | 17.1 |

| CH2408 Top | 1132.5 | 1134.5 | 2.0 | 1.9 | 1.72 | 1.2 | 16.1 |

| CH2410 Top | 1214.9 | 1224.8 | 10.0 | 9.9 | 1.41 | 1.4 | 16.4 |

| CH2411 Top | 1209.3 | 1213.0 | 3.8 | 3.7 | 1.34 | 16.4 | 13.9 |

| CH2416 Top | 1129.9 | 1137.8 | 7.9 | 7.6 | assays pending | ||

| CH2406 Bottom | 1165.0 | 1168.0 | 3.0 | 3.0 | 1.21 | 0.93 | 5.8 |

| CH2407 Bottom | 1133.2 | 1139.9 | 6.8 | 6.6 | 0.04 | 0.03 | 7.3 |

| CH2408 Bottom | 1190.7 | 1194.1 | 3.5 | 3.5 | 2.57 | 3.75 | 29.2 |

| CH2410 Bottom | 1267.4 | 1267.6 | 0.2 | 0.2 | 1.34 | 16.40 | 13.9 |

| CH2411 Bottom | 1256.6 | 1258.2 | 1.6 | 1.5 | 0.55 | 1.80 | 4.1 |

| CH2416 Bottom | 1176.8 | 1179.5 | 2.7 | 2.6 | assays pending | ||

Notes:

1. True widths are estimated based on drill angle and intercept geometry of mineralization.

2. All copper, gold and silver values are uncut.

| Lalor Northwest 2024 Drill Hole ID | From | To | Azimuth at Intercept | Dip at Intercept | ||||

| Easting | Northing | Elevation | Easting | Northing | Elevation | |||

| CH2406 Top | 426,467 | 6,082,069 | -802 | 426,467 | 6,082,069 | -811 | 347.1 | -85.0 |

| CH2407 Top | 426,421 | 6,082,005 | -762 | 426,420 | 6,082,005 | -767 | 265.3 | -79.1 |

| CH2408 Top | 426,500 | 6,082,114 | -824 | 426,500 | 6,082,114 | -826 | 267.9 | -86.8 |

| CH2410 Top | 426,578 | 6,082,213 | -893 | 426,577 | 6,082,213 | -902 | 265.4 | -86.5 |

| CH2411 Top | 426,567 | 6,082,215 | -895 | 426,567 | 6,082,215 | -898 | 280.5 | -88.4 |

| CH2416 Top | 426,460 | 6,082,076 | -806 | 426,458 | 6,082,076 | -814 | 256.0 | -75.8 |

| CH2406 Bottom | 426,466 | 6,082,073 | -851 | 426,466 | 6,082,073 | -854 | 343.0 | -85.5 |

| CH2407 Bottom | 426,413 | 6,082,005 | -804 | 426,412 | 6,082,004 | -811 | 261.6 | -78.9 |

| CH2408 Bottom | 426,497 | 6,082,113 | -882 | 426,497 | 6,082,113 | -885 | 228.9 | -86.5 |

| CH2410 Bottom | 426,575 | 6,082,213 | -945 | 426,575 | 6,082,213 | -945 | 250.1 | -86.6 |

| CH2411 Bottom | 426,566 | 6,082,214 | -942 | 426,566 | 6,082,214 | -944 | 230.6 | -88.1 |

| CH2416 Bottom | 426,448 | 6,082,073 | -852 | 426,448 | 6,082,073 | -854 | 253.4 | -75.6 |

Note to United States Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. Canadian reporting requirements for disclosure of mineral properties are governed by the Canadian Securities Administrators' National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

For this reason, information contained in this news release containing descriptions of the company's mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder. For further information on the differences between the disclosure requirements for mineral properties under the United States federal securities laws and NI 43-101, please refer to the company's AIF, a copy of which will be filed under Hudbay's profile on SEDAR+ at www.sedarplus.ca and the company's Form 40-F, a copy of which will be filed under Hudbay's profile on EDGAR at www.edgar.com.

Forward-Looking Information

This news release contains forward-looking information within the meaning of applicable Canadian and United States securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information includes, but is not limited to, statements with respect to the company's production, cost and capital and exploration expenditure guidance, expectations regarding reductions in discretionary spending and capital expenditures, Hudbay's ability to stabilize and optimize the Copper Mountain mine operation, the implementation of stripping strategies and the expected benefits therefrom, the estimated timelines and pre-requisites for sanctioning the Copper World project and the pursuit of a potential minority joint venture partner, the possibility of and expectations regarding the results of any challenges to the permits for the Copper World project, the expected benefits of the sanctioning of Copper World project, the expected benefits of Manitoba growth initiatives, including the use of the exploration drift at the 1901 deposit, the potential utilization of excess capacity at the Stall mill, and the advancement of Hudbay's exploration partnership with Marubeni, the anticipated use of proceeds from financing transactions, the company's future deleveraging strategies and its ability to deleverage and repay debt as needed, expectations with respect to the consummation and timing of the MMC Transaction, expectations regarding the company's cash balance and liquidity, expectations regarding the ability to conduct exploration work and execute on exploration programs on its properties and to advance related drill plans, including the advancement of the exploration program at Maria Reyna and Caballito and the status of the related drill permit application process, the ability to continue mining higher-grade ore in the Pampacancha pit and the company's expectations resulting therefrom, expectations regarding the company's ability to further reduce greenhouse gas emissions, Hudbay's evaluation and assessment of opportunities to reprocess tailings using various metallurgical technologies, expectations regarding the prospective nature of the Maria Reyna and Caballito properties, the anticipated impact of brownfield and greenfield growth projects on the company's performance, anticipated expansion opportunities and extension of mine life in Snow Lake and the company's ability to find a new anchor deposit near its Snow Lake operations, anticipated future drill programs and exploration activities and any results expected therefrom, anticipated mine plans, anticipated metals prices and the anticipated sensitivity of the company's financial performance to metals prices, events that may affect the company's operations and development projects, anticipated cash flows from operations and related liquidity requirements, the anticipated effect of external factors on revenue, such as commodity prices, estimation of mineral reserves and resources, mine life projections, reclamation costs, economic outlook, government regulation of mining operations, and business and acquisition strategies. Forward-looking information is not, and cannot be, a guarantee of future results or events. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by the company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information.

The material factors or assumptions that Hudbay has identified and were applied in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to:

- the ability to achieve production, cost and capital and exploration expenditure guidance;

- no significant interruptions to Hudbay's operations due to social or political unrest in the regions the company operates, including the navigation of the complex political and social environment in Peru;

- no interruptions to the company's plans for advancing the Copper World project, including with respect to any challenges to the Copper World permits and/or the pursuit of a potential minority joint venture partner;

- the company's ability to successfully complete the stabilization and optimization of the Copper Mountain operations, obtain required permits and develop and maintain good relations with key stakeholders;

- the ability to satisfy the conditions to close the MMC Transaction;

- the ability to execute on the company's exploration plans and to advance related drill plans;

- the ability to advance the exploration program at the Maria Reyna and Caballito properties;

- the success of mining, processing, exploration and development activities;

- the scheduled maintenance and availability of the company's processing facilities;

- the accuracy of geological, mining and metallurgical estimates;

- anticipated metals prices and the costs of production;

- the supply and demand for metals the company produce;

- the supply and availability of all forms of energy and fuels at reasonable prices;

- no significant unanticipated operational or technical difficulties;

- the execution of the company's business and growth strategies, including the success of its strategic investments and initiatives;

- the availability of additional financing, if needed;

- the ability to deleverage and repay debt, as needed;

- the ability to complete project targets on time and on budget and other events that may affect the company's ability to develop its projects;

- the timing and receipt of various regulatory and governmental approvals;

- the availability of personnel for the company's exploration, development and operational projects and ongoing employee relations;

- maintaining good relations with the employees at the company's operations;

- maintaining good relations with the labour unions that represent certain of the company's employees in Manitoba and Peru;

- maintaining good relations with the communities in which the company operates, including the neighbouring Indigenous communities and local governments;

- no significant unanticipated challenges with stakeholders at the company's various projects;

- no significant unanticipated events or changes relating to regulatory, environmental, health and safety matters;

- no contests over title to the company's properties, including as a result of rights or claimed rights of Indigenous peoples or challenges to the validity of the company's unpatented mining claims;

- the timing and possible outcome of pending litigation and no significant unanticipated litigation;

- certain tax matters, including, but not limited to current tax laws and regulations, changes in taxation policies and the refund of certain value added taxes from the Canadian and Peruvian governments; and

- no significant and continuing adverse changes in general economic conditions or conditions in the financial markets (including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks related to the failure to effectively complete the stabilization, optimization and expansion of the Copper Mountain mine operations, political and social risks in the regions the company operates, including the navigation of the complex political and social environment in Peru, risks generally associated with the mining industry and the current geopolitical environment, including future commodity prices, the potential implementation or expansion of tariffs, currency and interest rate fluctuations, energy and consumable prices, supply chain constraints and general cost escalation in the current inflationary environment, uncertainties related to the development and operation of the company's projects, the risk of an indicator of impairment or impairment reversal relating to a material mineral property, risks related to the Copper World project, including in relation to project delivery and financing risks, risks related to the Lalor mine plan, including the ability to convert inferred mineral resource estimates to higher confidence categories, dependence on key personnel and employee and union relations, risks related to political or social instability, unrest or change, risks in respect of Indigenous and community relations, rights and title claims, operational risks and hazards, including the cost of maintaining and upgrading the company's tailings management facilities and any unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, depletion of the company's reserves, volatile financial markets and interest rates that may affect the company's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, the company's ability to comply with its pension and other post-retirement obligations, the company's ability to abide by the covenants in its debt instruments and other material contracts, tax refunds, hedging transactions, as well as the risks discussed under the heading "Risk Factors" in the company's most recent Annual Information Form and under the heading "Financial Risk Management" in the company's management's discussion and analysis for the year ended December 31, 2024.

Should one or more risk, uncertainty, contingency or other factor materialize or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, you should not place undue reliance on forward-looking information. Hudbay does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is a copper-focused critical minerals company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining jurisdictions of Canada, Peru and the United States.

Hudbay's operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production and by-product zinc, silver and molybdenum. Hudbay's growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations.

The value Hudbay creates and the impact it has is embodied in its purpose statement: "We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities." Hudbay's mission is to create sustainable value and strong returns by leveraging its core strengths in community relations, focused exploration, mine development and efficient operations.

For further information, please contact:

Candace Bru^le´

Vice President, Investor Relations, Financial Analysis and External Communications

(416) 814-4387

investor.relations@hudbay.com

________________________________

i Calculated using the mid-point of the annual guidance range. All production estimates reflect the Copper Mountain mine on a 100% basis, with Hudbay currently holding a 75% interest in the mine and recently entering into an agreement to acquire the remaining 25% interest.

ii Cash costs and sustaining cash costs are non-GAAP financial performance measures with no standardized definition under IFRS. For further details on why Hudbay believes cash costs are a useful performance indicator, please refer to the company's most recent management's discussion and analysis for the period ended December 31, 2024.

Figure 1: Hudbay's Satellite Properties Near Constancia in Peru

The highly prospective Maria Reyna property and the past producing Caballito property are located within trucking distance of the Constancia processing infrastructure and have the potential to host satellite mineral deposits. Surface mapping and geochemical sampling confirm that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies. Drill permitting was initiated after a surface rights exploration agreement was signed in 2022, and Hudbay expects the drill permitting process to be completed in 2025.

Figure 2: 1901 Step-out Drilling from Exploration Drift Intersected Copper-gold Mineralization

The 1901 deposit is located within 1,000 metres of the existing underground ramp at the Lalor mine in Snow Lake. The deposit consists of a series of zinc and gold-rich lenses that were defined by drilling and pre-feasibility studies conducted over the 2019 to 2021 period. In early 2024, the company commenced the development of an access drift from the existing Lalor ramp and completed step-out drilling in the second half of 2024. All five step-out holes intersected copper-gold mineralization and follow-up drilling is underway in 2025. Infill drilling is also planned for 2025 to convert the gold inferred mineral resources to mineral reserves.

Figure 3: Lalor Northwest Drilling Continued to Intersect Copper-Gold Mineralization

Following up on promising results from 2023 and early 2024, additional drilling at the Lalor Northwest zone was completed in the second half of 2024 and continued to intersect copper-gold mineralization. A winter surface drill program is planned for 2025 with five holes testing the extent of the mineralization.

Figure 4: Regional Snow Lake Satellite Deposits

Hudbay increased its land package in Snow Lake by 250% in 2023, adding several regional satellite properties located within trucking distance of the company's processing infrastructure. The company launched a significant geophysics program in 2024 that included surface electromagnetic surveys using modern technology to target depths up to 1,000 metres. These efforts will continue in 2025 with the largest geophysics program in Hudbay's history, including 800 kilometres of ground electromagnetic surveys and an extensive airborne geophysics survey.

Figures accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/93b604b5-7dfd-40e2-9ce0-6b6cfa2abbd2

ttps://www.globenewswire.com/NewsRoom/AttachmentNg/bd3f168d-a3d7-4584-97b8-49c418847d40

https://www.globenewswire.com/NewsRoom/AttachmentNg/2b6b1fa1-80bb-4b75-8213-aad533935cf3

https://www.globenewswire.com/NewsRoom/AttachmentNg/4235d42d-9907-4566-9357-3c35090bca49

https://www.globenewswire.com/NewsRoom/AttachmentNg/0efdff1c-b0b1-4e81-a85d-a977ba41db82