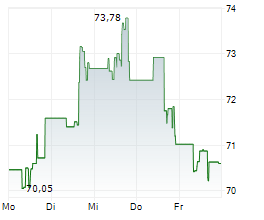

General Motors shares experienced a dramatic 7% decline on Thursday following President Trump's announcement of new tariffs on imported vehicles and auto parts. The planned 25% tariff on imported cars and light trucks will take effect April 3, while auto parts tariffs begin May 3. These measures pose significant challenges for GM despite its status as an American company, as it imports approximately 48% of vehicles sold in the US, with substantial sourcing from Mexico and Canada. The automaker's highly integrated production chains with neighboring countries make it particularly vulnerable to these trade restrictions. The news triggered a broader automotive sector selloff, with Ford falling nearly 4% and auto suppliers like Aptiv and BorgWarner each dropping around 5%.

Market Impact and Competitor Contrast

Sollten Anleger sofort verkaufen? Oder lohnt sich doch der Einstieg bei General Motors?

Unlike traditional automakers, Tesla managed a slight 0.4% gain as investors believe electric vehicle manufacturers with predominantly domestic production will suffer less from the tariffs. Analysts suggest vehicle prices could increase by $5,000 to $15,000 if the 25% import tariff remains in place, further weakening GM's competitive position. The S&P 500 also reflected investor concerns, falling 0.33% to 5,693.31 points. Portfolio managers note that beyond the policy itself, investors are particularly wary of the unpredictable shifts in trade policy, which complicate long-term investment decisions for both companies and market participants.

Ad

General Motors Stock: New Analysis - 28 MarchFresh General Motors information released. What's the impact for investors? Our latest independent report examines recent figures and market trends.

Read our updated General Motors analysis...